Trending Assets

Top investors this month

Trending Assets

Top investors this month

$AMD is likely to remain a fundamental winner.

"Semiconductors" and "Semi Equipment" consist of peculiar and highly technical industries. They often require high capital expenditures, complex supply chains, massive barriers to entry, and superior R&D leadership - and over all that, they tend to have elements of macro cyclicality as well as secular growth.

Advanced Micro Devices (or $AMD) has had a renaissance over the past few years, primarily from closing the deep performance gap of their CPUs (Central Processing Units) vs. the stewards of the category, Intel ($INTC). Since 2020, it became apparent that pound for pound, or watt for watt, AMD chips were offering better performance than their Intel counterparts, and have since pushed forward widening their lead. The inflexion of wider adoption of AMD, as opposed to Intel, began interestingly in the PC markets, where enthusiasts noticed the advantages and swapped out their old Intel chips for AMD. The following year in 2021, enterprise and data-centre use cases followed, along with big contracts from gaming consoles. Now "Enterprise, Embedded, and Semi-Custom" makes for the majority of their revenues, and most compute use cases have recognised that AMD is the way to go, positioning their infrastructure and chipsets to adopt it.

Investors such as myself would like answers to the following questions at this point in time:

- How much more can AMD actually grow long term?

- How will macro, supply constraints, and a potential recession impact AMD?

On Growth

Source: AMD Presentation, May 2022

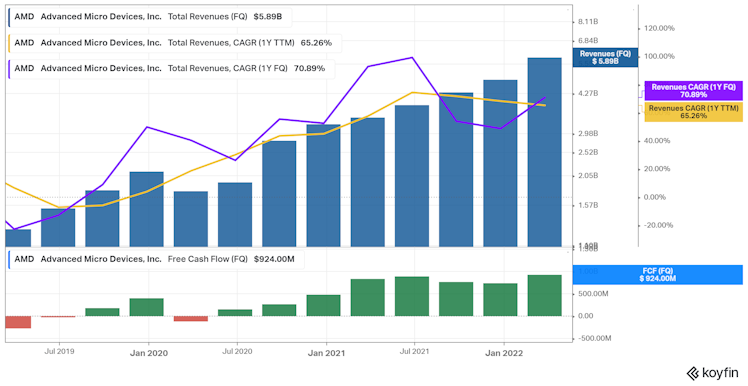

The company itself has posted some lofty estimates. The TAM, or the total annual sales opportunity, is several multiples bigger than the current $18.9B in sales (last twelve months) that grew at ~65% YoY. The growth is somewhat murked up by Xilinx's acquisition addition, but excluding it, AMD's Q1 still grew 53% YoY organically. Intel for instance, despite its many performance troubles still did $77.7B in sales, growing at ~0% YoY. Theoretically, if AMD could scale elastically, a 100B TAM isn't really out of the question. That's a big IF though. In the GPU space, for instance, Nvidia simply owns most of the market. Could that be AMD in a few years? Perhaps.

The notable performance advantage on hand has led to the rapid growth of AMD's sales, as well as Free Cash Flow generation at a 20% margin. One might argue, that Intel has held their existing sales because manufacturers like TSMC, which make AMD chips, have been scale-constrained as the boom of compute, data, cloud, and auto have just kept on through the pandemic. One can infer this from more data points and the fact that Intel's FCF margin has been in decline to the low teens % last year from the 20%+ range before 2019.

AMD is therefore in serious market share taking mode vs Intel - in the x86 primary CPU market for PCs, data-centre, enterprise, embedded etc.; and they haven't been shy on exercising pricing power either. These serve to reinvest in development and hunt for new opportunities such as the Xilinx acquisition/integration and the FPGA market. There's a long runway if AMD's tech leadership sustains.

On Supply Chain Capacity.

Supply chain and growth rates are aspects that most of Wall Street try to predict, and often fail to do so accurately. As a long term investor, I like the bigger hunt to the 100B market, judging AMD carefully on their execution towards that goal. To figure out where their supply chain and capacity are heading, I simply go by CEO Dr Lisa Su's earnings call comments, and FY guide.

"For the full year 2022, AMD now expects revenue to be approximately $26.3 billion, an increase of approximately 60% over 2021, up from prior guidance of approximately 31%, driven by the addition of Xilinx and higher server and semi-custom revenue."

Ex Xilinx, which is a roughly $2.5B business, we're still looking at about ~45%+ growth. This is impressive stuff and puts it in high growth territory. Consider it high-quality territory too with an epic 20% FCF margin which is likely to sustain.

It's also worth noting that AMD beat sales guidance and earnings guidance for the past 8 quarters, after the March 2020 shock. In my experience, these trends hold through when a business is market share taking on secular growth.

Macro Headwinds - Why I think cyclicality won't be a big deal.

If we're heading into a recession, then what should we expect? It logically follows that there will be less than trend growth in computing power, upgrades, and so on by consumers and enterprises worldwide. Semiconductors have known to be cyclical industries. That said, AMD has not been demand constrained but supply constrained. All the tech and research points to superior chip offerings, and it's well established that AMD is eating Intel's market share. It's therefore my inference, that Intel is going to take most of the pain should this economy crunch on semis and the CPU market. Upcycle or down cycle, the best products continue to take market share. The discrepancy between $20B and $77B in sales is enough that it won't truly hurt the smaller, nimbler player here. There's beneficial financial leverage built into the performance of these AMD chips.

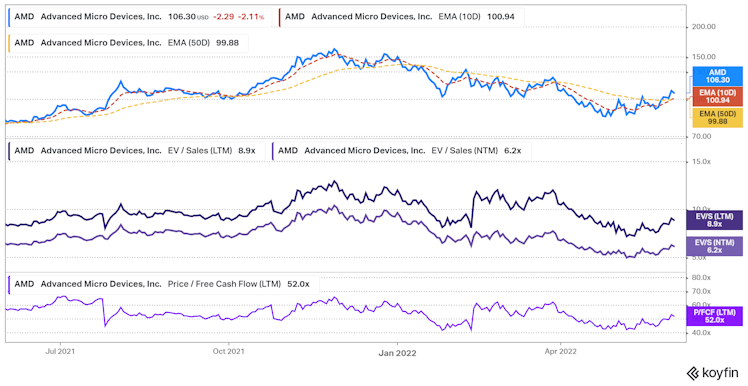

Of course, we've seen some drawdowns in semi stocks, as the cost of capital, and interest rates have inherently pushed valuations lower, with good reason. AMD saw a drawdown from the $150 range to about $100 too.

EV/S on an NTM (next-twelve-month) basis shows 6.2x; P/FCF should compress to 35x or so one year out with guided growth and sustained margin. AMD isn't going to lose its pricing power anytime soon given the state of its product portfolio, especially when the entire server market is trending towards its products. The potential for permanent loss of capital is relatively minor for prudent investors who keep track of risks in my opinion.

These are not "cheap" multiplies per se, even post drawdown. But with this exponential grower that could seemingly and logically scale sales a few times over, I see good compounding potential from these levels for the next few years. I'd ballpark about 15-20% IRR with some multiple compression baked in.

$AMD forms an anchor stock in my growth portfolio. I'm not expecting leaps and bounds of compounding, but with that cash cushion, secular growth trend, and growth/profit profile, it seems logical to hold onto this rather reliable company - with best in class tech, a solid balance sheet, moat, rockstar CEO in Lisa Su, and big growth potential. I'm long.

Already have an account?