Trending Assets

Top investors this month

Trending Assets

Top investors this month

"Buy The Dip" July Idea Competition: $MELI

I thought carefully about this post. Since I took its content from paid posts in my Substack, that would not be fair to distribute it for free while competing for a monetary prize.

At the same time, there was no chance I would be out of this fantastic event organized by @commonstock.

So, the best way I figured out was to donate any monetary compensation that may come from this post to a Brazilian non-profitable organization that would have good use of the resources. I hope you enjoy the reading. Cheers!

---

Outline

#When the Going Gets Tough, the Tough Get Going (Introduction)

# Winner corporate culture

# Business Model

## Marketplace

### Superior Economies of Scale

### Why will Meli outperform its peers?

### Marketplace Unit Economics

## Mercado Pago

### Payment Business

### Mercado Crédito

## Mercado Envio

## MercadoLibre Classified

## MercadoLibre Advertising

## MercadoShops

#How does Meli make money?

#Management compensation

#Valuation

###When the Going Gets Tough, the Tough Get Going

Meli's founder, Mr. Galperin, probably is one of the lowest-profile businessmen in LatAm. Many employees at Mercado Livre wouldn’t recognize his face. No glamorous annual showups to employees, nor motivational speaks.

> "I see many entrepreneurs who use their company as a platform to be famous.”

He was born in Buenos Aires, from a wealthy family, went to study finance at the University of Pennsylvania. Then, he returned to Argentina and spent three years working at YPF (the largest O&G company in Argentina).

In 1997, interested in technology, he applied to Stanford University in California’s Silicon Valley. After studying eBay, he developed his version for a company that would thrive in LatAm.

> "For us, it's exactly the opposite, we want the company to be famous. The lower our personal profile, the better."

Unlike e-commerces which were starting to thrive in developed countries, Mr. Galperin focused on simplifying the lives of LatAm users, adapting the service to their financial condition, infrastructure, internet access, and regulation.

In 1999, John Muse, a Private Equity owner (HM Capital,) made a speech to MBA students at Stanford, and Mr. Galperin volunteered to drive Mr. Muse back to the airport. On the way, he pitched his idea and got his seed money.

In November of 1999, Mercado Libre raised $7,6M in a Venture Round. Mercado Libre received $46,5M in a Series B in the following year, led by HM Capital, GS, GE Equity, Flatiron Partners, Chase Capital (JP Morgan), and Capital Riesgo. But, of course, the luck was there since the last deal was made right before the tech bubble burst.

The early days were challenging, with the company facing additional financing issues, hiring people in LatAm, and the competitive landscape evolving fast.

About the latter, DeRemate.com was offering pressure in Argentina, Lokau in Brazil, and a foreign competitor entrance was imminent (Yahoo! and eBay).

An ivy league educated founded Lokau. Knowing that the market was small for many players, their communication strategy was very aggressive. DeRemate.com was no different, receiving a $45m fund to invest in customer acquisition. By no means Mercado Libre was off the hook.

However, Mercado Libre differentiated from DeRemate.com in its operations. Meli offered an open forum where buyers and sellers could find each other, negotiate and make deals based on trust.

As more deals were made, the seller was considered more reliable inside the forum. What made the model of open space forum thrive was that, different from the offline world, the bigger the marketplace became, the easier it was to identify the best seller to make a deal with.

In 2001, eBay became the biggest shareholder of Mercado Libre, holding a 19,5% stake in the company. The deal also allowed Mercado Libre to incorporate iBazar Como, eBay’s subsidiary in Brazil, access capital, and eBay pledged not to enter LatAm for at least five years. Eventually, in 2016, eBay divested from its stake.

One of the most remarkable contributions from eBay to Meli was the “Feedback tool,” where customers were able to evaluate the seller, leaving comments about the purchase. It had a massive impact on the traction that Meli was growing.

Before, the only evidence the buyer had was the volume of deals. The Feedback enabled buyers to evaluate sellers using different qualitative metrics, such as shipping, quality of the product, contact with the seller, and so on.

Then, in 2004, Meli came up with Mercado Pago, offering a definitive solution for transaction problems in the marketplace.

If customers were skeptical about buying and negotiating the payment process with an online seller, Mercado Pago standardized the payment process internally, so clients would have to trust Meli, not the seller.

For instance, the seller receives the payment only after the buyer receives the order. If there is any problem, the buyer could open a dispute with Meli as the intermediary to get his money back.

In 2007, after a corporate round of $27,8M led by Tiger, Mercado Libre went to market, raising almost $50M in its IPO. eBay divested from Meli in 2016.

In 2011, the company transitioned its platform to open source technology. The transitions allowed APIs to expand the platform solutions. Two years later, they created the Meli Fund, private equity inside Mercado Libre focused on investing in disruptive companies that could boost the API platform solution.

### Winner corporate culture

Let’s go back to Meli Fund for a moment.

Let’s take a moment on Meli Fund. Just a sheer of investors notices, Meli Fund is such an entrepreneurial characteristic that resembles Mercado Libre.

After returning to Argentina, Mr. Galperin faced hardships looking for people with the right fit to work at Mercado Libre. He brought back from Stanford to Buenos Aires a few of his colleagues: Mr. Pedro Arnt, current CFO, Osvaldo Giménez, current Fintech President, and Mr. Hernan Kazah.

Also, it’s essential to highlight Mr. Nicolas Szekasy, CFO from 2000 to 2009. Mr. Szekasy and Mr. Kazah left Mercado Libre to found Kaszek in 2011, one of the most successful Venture Capital companies in Latin America.

In their unbelievable track record, they invested in Nubank ($NU) since the seed round, QuintoAndar (Series E), Nuvemshop (Series E), Konfio (Series E), Loggi (Series D), Warren (Series C), and so on.

More recently, in October of 2021, Mercado Libre and Kaszek created a SPAC called MEKA (MELI Kaszek Pioneer Corp), raising $287M to invest in innovative companies.

Kaszek’s and Mercado Libre’s track record teaches us their unique ability to find outstanding teams and understand the market’s demand for products. That is the most important competitive advantage Mercado Libre has: its culture.

Since it was founded, Mercado Libre invested and bought almost 50 companies (35 under Meli Funds). I’m not saying that those were successful acquisitions, but on both sides (bidder and offer), the probability of greater alignment was higher than in many other companies.

Also, it reflected in better recruiting and retention. Mercado Libre gives employees plenty of freedom to develop solutions they think would serve better clients, attracting people focused on developing the best solution into a company that offers fewer constraints as possible.

### Business Model

The company offers an ecosystem of six integrated e-commerce and digital payments services: Mercado Libre Marketplace, Mercado Pago Fintech, Mercado Envios (logistic service), Mercado Libre Ads, Mercado Libre Classifieds, and Mercado Shops (online storefront solution).

#### Marketplace

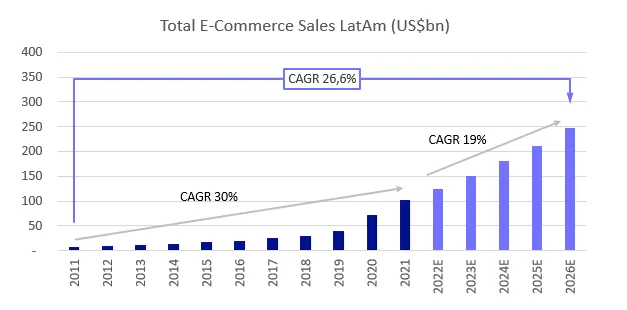

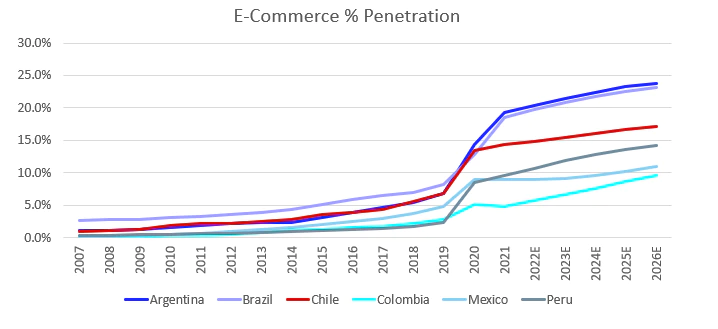

LatAm eCommerce is a US$102bn market; supported by our proprietary industry model, we forecast growth to US$250bn in 2026. In 2021, eCommerce volumes represented 13% of overall retail sales in LatAm (excluding autos, restaurants, and services).

While this was up notably from 5.9% in 2019, the secular shift toward online retail had been in place well before the Covid-driven acceleration.

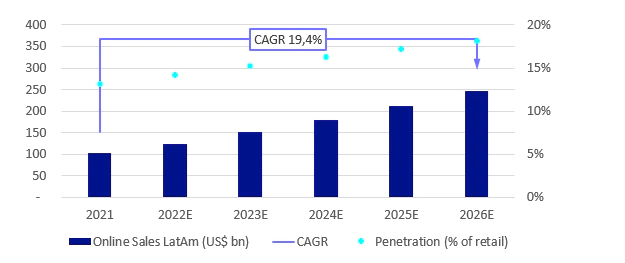

Supported by our bottom-up company estimates – and supported by the top-down consensus expectations, we build to a cumulative US$250bn market opportunity by 2026, representing a 19% 5-year CAGR and a US$145bn incremental GMV opportunity.

Source: Giro Lino, BCB, Bloomberg, Mercadolibre, Americanas, Via, Magalu, TIKR, FRED, MCC, Compre&Confie.

While stay-at-home trends were a driver of outsized growth in 2019-21, we see a stronger-for-longer setup of a double-digit CAGR through 2026; we believe the Covid-driven bump will not flatten the future eCommerce penetration curve.

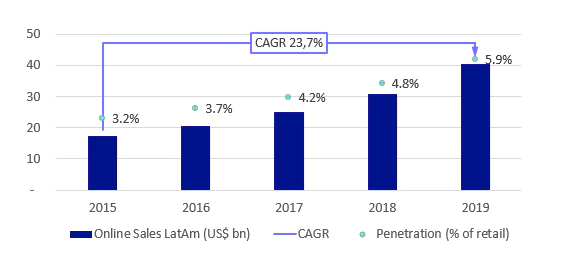

As shown in the image below, between 2015 and 2019, LatAm eCommerce volumes increased at an 18% CAGR, with ~68bps of average penetration gains annually.

Source: Giro Lino, BCB, Bloomberg, Mercadolibre, Americanas, Via, Magalu, TIKR, FRED, MCC, Compre&Confie.

Considering initial Covid impacts in 2020 and subsequent Covid-wave disruptions throughout 2021, growth accelerated to a 51% 2019-21 CAGR (69% in 2020, 35% in 2021); annual penetration gains were ~360bps over these two years.

Looking to 2021 figures, parts of the world had not fully normalized/reopened, likely benefiting the eCommerce channel. However, we also see structural and behavioral change, given the persistence of growth in 2021 on a historically tricky comparison.

Looking at 2021-26E, we forecast a 19% CAGR, with ~100bps of annual penetration gains, while the percentage growth rate is below pre-Covid levels, partly due to the more extensive base, penetration gains are more in-line with pre-2019 levels.

This is consistent with our view of a step-change in eCommerce demand, supporting the go-forward penetration curve.

Source: Giro Lino, BCB, Bloomberg, Mercadolibre, Americanas, Via, Magalu, TIKR, FRED, MCC, Compre&Confie.

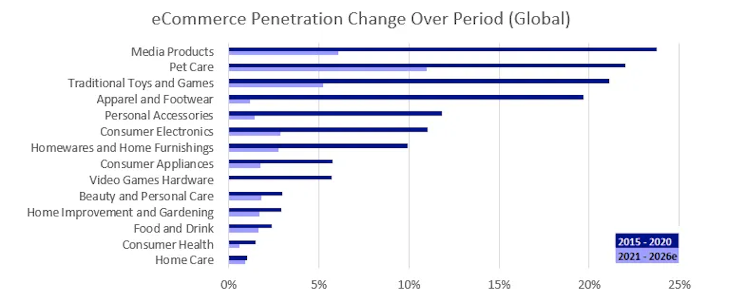

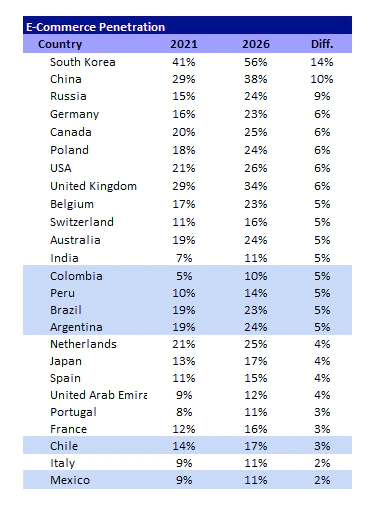

Further supporting our multiyear growth thesis, we highlight a trend of broad-based eCommerce gains even for the highest penetration countries and categories.

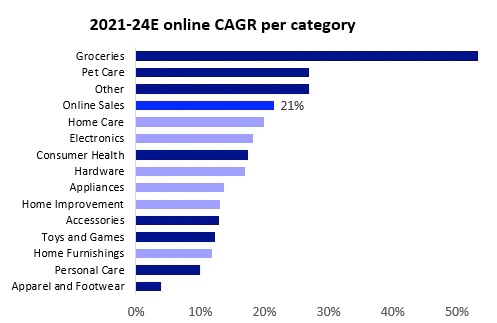

Comparative eCommerce penetration over sales by merchandise category is shown in the image below; these charts demonstrate the broad-based gains for online retail.

Source: Giro Lino, BCB, Bloomberg, Mercadolibre, Americanas, Via, Magalu, TIKR, FRED, MCC, Compre&Confie.

This depth and breadth support our conviction in a stronger-for-longer eCommerce growth outlook, even though we couldn’t estimate the penetration per category for LatAm.

Also, on a relative basis, forecast growth rates are higher for lower-penetrated regions (e.g., LatAm, ASEAN, Africa) and categories (e.g., grocery, personal care).

While there are headwinds (logistics and otherwise) in certain countries and verticals, we believe these barriers continue to come down; encouragingly, across the LatAm countries, we have yet to see a ceiling for eCommerce penetration.

At the country level, we estimate, on average, a five-year path from 12.5% to ~16.5% eCommerce penetration, supporting growth forecasts for markets in this phase of the eCommerce inflection.

The image below shows the eCommerce penetration curves for countries; we offer the overall penetration per country in LatAm.

Source: Giro Lino, BCB, Bloomberg, Mercadolibre, Americanas, Via, Magalu, TIKR, FRED, MCC, Compre&Confie.

We understand that countries like Mexico, Peru, and Chile offer a massive logistic headwind, lagging any substantial penetration gain.

We forecast a +7% CAGR for Mexico, with 12% penetration (10% today). Nevertheless, Mercadolibre (“Meli”) achieved +70% fulfillment penetration in the country as of 4Q21, and Walmex can reach ~90% of the population in ~10 minutes from its stores.

We highlight that Brazil and Argentina lead among LatAm countries for eCommerce penetration, even though the logistics headwinds were tremendous.

Also, we see a replicable path for increases across the region, primarily driven by logistics improvements; Therefore, we believe that the market is overly conservative in its growth assumptions on LatAm.

In Brazil, logistics improvements have unlocked new categories, with companies including Magazine Luiza (“Magalu,” “MGLU”), Americanas (“AMER”), and Via (“VIIA”) investing in omnichannel logistics. At the same time, Meli continues its marketplace fulfillment center roll-out.

For the other countries in the region, both omnichannel operators (such as Falabella) and marketplace operators (led by Meli) are increasing their focus on eCommerce.

For instance, Meli opened its first fulfillment centers in Chile and Colombia in 2021, supporting our view that company-driven service improvements can drive eCommerce growth above the conservative consensus expectation.

Source: Giro Lino, BCB, Bloomberg, Mercadolibre, Americanas, Via, Magalu, TIKR, FRED, MCC, Compre&Confie.

##### Superior Economies of Scale

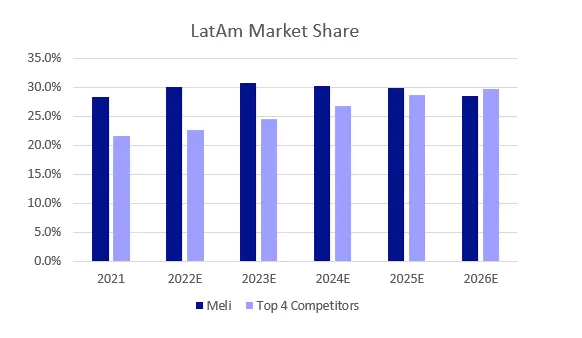

Our industry model illustrates Meli's leading share across LatAm eCommerce; the backdrop in Brazil is competitive, while other countries are more fragmented. As a result, we see Meli leading with ~30% eCommerce market share in Brazil.

Local operators Americanas, Magalu, and Via command a combined ~49%, and Shopee (owned by Sea Ltd) has been gaining ground (~6% 2021 share).

We see Meli and Shopee as best positioned to gain share in Brazil, supported by favorable category mixes, including fewer electronics exposure, as will show soon.

Brazil-based peers lead on first-party goods and omnichannel logistics, but Americanas/Magalu/Via marketplace build-outs remain relatively earlier.

Panning out to the broader region, our LatAm market share analysis illustrates a favorable position for Meli. For instance, we estimate that only by 2026 Meli’s top competitors will reach its market share.

Source: Giro Lino, BCB, Bloomberg, Mercadolibre, Americanas, Via, Magalu, TIKR, FRED, MCC, Compre&Confie.

Meli is the only major LatAm operator with a presence across all top markets, and the competitive backdrop ex-Brazil is more fragmented.

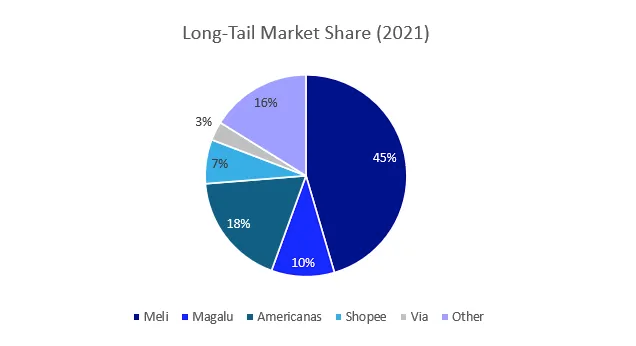

While individual countries remain competitive, we see scope for top platforms (led by Meli) to continue concentrating share from the long tail, as we’ll discuss in a few minutes.

Operations for eCommerce are primarily conducted on a country-level basis. Still, gains from platform scale, product development, and data analysis can be spread across the region, taking Meli to an entirely new level compared to its peers.

##### Why will Meli outperform its peers?

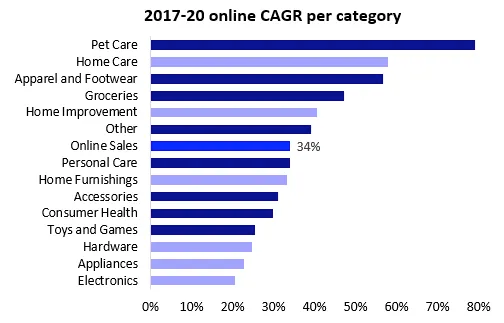

To deeply understand why we believe it will outperform its peers, we must assess the breakdown of electronics versus other (long-tail) categories to understand the implication for company-level in the eCommerce landscape.

Our channel checking process involves interviewing and talking to different market participants, asking for a mutual collaboration process, sharing resources, and building knowledge as a team.

While the companies themselves do not report category mixes for gross merchandise value (GMV), our forecasts leverage our industry views.

We cross-check the consensus bottom-up estimates versus our top-down category economic expectations, with a bias toward the macro approach, extrapolating the penetration curve-based digital tools adoption.

From a top-down perspective, we see headwinds for electronics eCommerce in 2022, while a broadening category base supports our +17% growth forecast for overall Brazil eCommerce.

From 2017 to 2020, Brazil went through an easing cycle and low inflation, boosting household indebtedness and durable consumption.

Amidst the Covid-19 outbreak, the government released an enormous fiscal stimulus through wealth distribution called Emergency Aid, boosting the growth in categories such as electronics, appliances, etc.

Source: Giro Lino, BCB, Bloomberg, Mercadolibre, Americanas, Via, Magalu, TIKR, FRED, MCC, Compre&Confie, IBGE.

As a consequence of such a fiscal stimulus package, we now see a combination of high inflation and difficult comparisons (lapping stimulus payments) contributing to the pressure.

From an eCommerce perspective, electronics/appliances/video games/media products account for ~15% of the Brazilian retail market but for ~50% of eCommerce GMV (versus 17%-25% in countries like the UK, China, and the US).

We see long-tail / other categories (including apparel, beauty care, and food) as the critical eCommerce drivers for the following years. Accordingly, we forecast a modest CAGR growth for these categories and an acceleration for long-tail categories.

Source: Giro Lino, BCB, Bloomberg, Mercadolibre, Americanas, Via, Magalu, TIKR, FRED, MCC, Compre&Confie, IBGE.

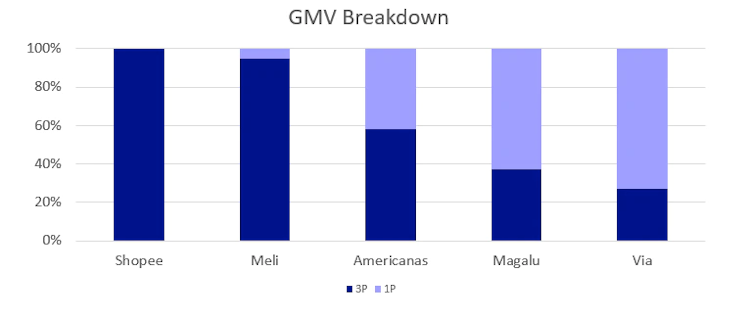

Our model points to a competitive market for electronics, with Magalu at ~25% 2021E share and each of Meli / Americanas / Via in the high-teens range.

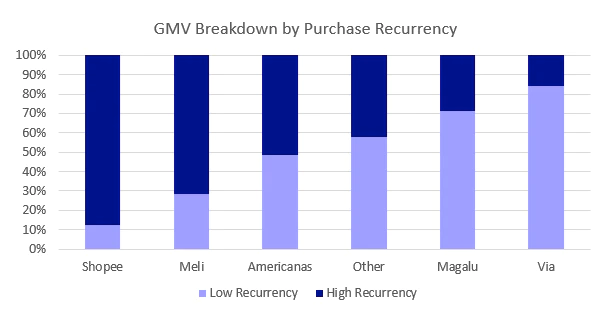

In 2021, according to our estimates, the low recurrency GMV mix (including appliances and accessories) at 84% for Via, 71% for Magalu, 49% for Americanas, and 29% for Meli.

Source: Giro Lino, BCB, Bloomberg, Mercadolibre, Americanas, Via, Magalu, TIKR, FRED, MCC, Compre&Confie, IBGE.

While Meli has been diversifying away from the category — a company fact sheet shows 33% electronics mix in 2021, down from 65% in 2009 – the broadening initiatives for other platforms are earlier-stage in comparison.

Disclosure in Magalu's earnings illustrates ~57% purchases in long-tail categories for the 2021 cohort versus 14% for the 2017 cohort. On the overall GMV, the long tail categories accounted for 45% of Magalu’s GMV in 2021.

While Magalu's marketplace has quickly ramped from a base of zero in 2016, first-party merchandise still represents 63% of MGLU 2021 online GMV; the 1P business over-indexes for electronics.

We see similar trends holding for Via, with 73% 1P penetration and an earlier-stage marketplace roll-out. Americanas, with 42% 1P penetration, have the lowest estimated electronics exposure of Brazil-based peers.

Source: Giro Lino, BCB, Bloomberg, Mercadolibre, Americanas, Via, Magalu, TIKR, FRED, MCC, Compre&Confie, IBGE.

While the category screens are competitive, we believe rationality is a bright spot. However, all players suggest more focus on margin for 1P operations, which will lead to lower growth, considering the incremental headwind from inflationary pressure.

On the other hand, our model shows Meli's wide-scale advantage and Shopee's recent gains for longer-tail categories.

Looking at the Brazil eCommerce high recurrence categories, we see Meli as the scale leader with a 45% share; MELI's presence in long-tail categories over-indexes versus the company's ~30% total Brazil eCommerce share for 2021.

Source: Giro Lino, BCB, Bloomberg, Mercadolibre, Americanas, Via, Magalu, TIKR, FRED, MCC, Compre&Confie, IBGE.

##### Marketplace Unit Economics

Most analysts use GMV and Gross Profit multiples to value marketplaces. We respectfully decline to use it.

There has been a widening charm between financial information and stock prices. Until the 70s, there was a strong correlation between earnings and stock return.

The 1980s saw the beginning of the growth and importance of intangible assets. However, even if extraordinary, revolutionary changes did not cause any change in accounting standards.

Entire industries, which are immensely dependent on intangibles (central industries, as Alan Greenspan called them), including software, biotech, and internet services, began to emerge between the 1980s and 1990s.

And for all other businesses, the main drivers of value have moved from property, land, machinery, and inventory to patents, brands, information technology, and people.

This group, which is not present in any balance sheet, is treated in accounting as an expense, generating distortion in both the balance sheet and financial statements.

These three factors — intangibles, the proliferation of managerial guidance, and delays in recognizing important corporate events — explain the distortion.

For its business nature, Meli acquires its customer through its marketing expense and, therefore, doesn’t capitalize it on its balance sheet.

Although we’ll not present our Earnings Power Value for Meli, capitalizing back its intangible, in this post, we believe it’s essential to understand the simple unit economics, as we did for Shopee previously.

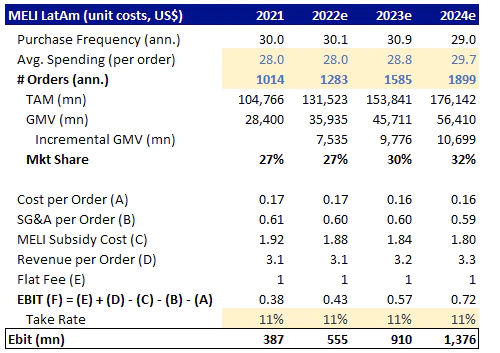

In that case, the image below illustrates the first evidence that Meli enjoys a superior competitive advantage versus its peers, generating a lot of cash for its marketplace business.

Source: Giro Lino, Mercadolibre

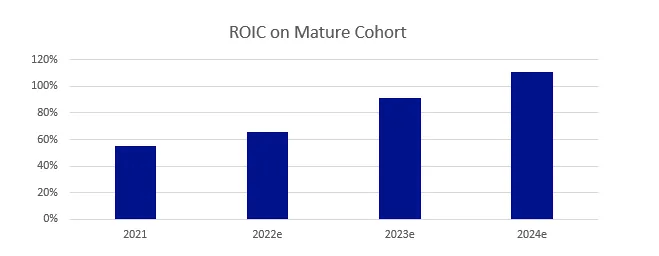

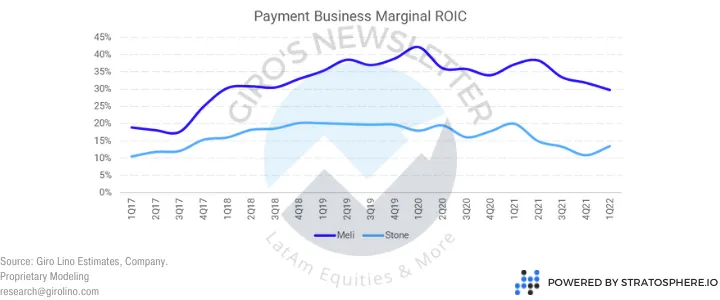

Second, after almost a dozen industry channel checks, we have enough confidence to estimate the marginal capital invested and, therefore, the ROIC for mature cohorts, as the image below shows.

Source: Giro Lino, Mercadolibre

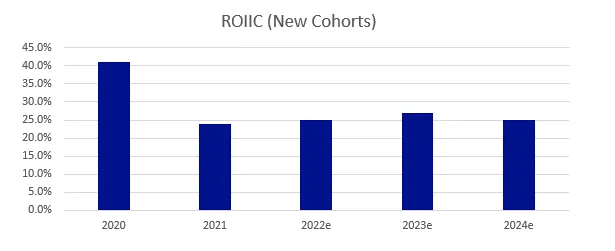

However, as we didn’t capitalize back the marketing expense, this figure is overestimated, taking us to the third metric, the return on incremental invested capital (ROIIC).

The ROIIC is a much better indicator of profitability since it considers the immediate return from new cohorts. Even though 2020 was an outlier due to mobility restrictions, the 2021 profitability for the new cohorts is outstanding.

Source: Giro Lino, Mercadolibre

Yet, it’s worth mentioning that Meli historically invested all its cash generated in the marketplace business to acquire customers and new ventures, leading unaware investors to believe that Meli operates an inferior business.

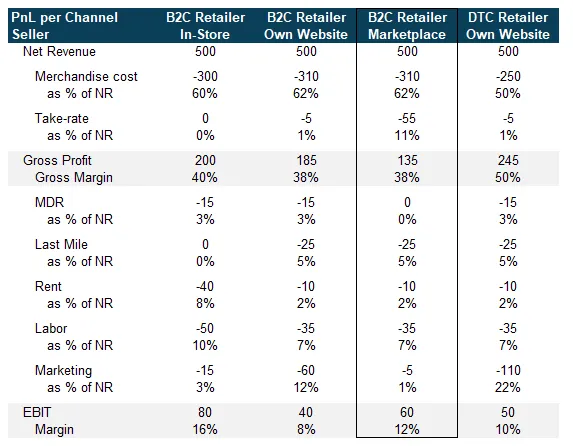

For the seller, the most significant advantage is access to more customers. Also, Meli offers delivery, funding, and inventory solutions. As a result, the service provides higher margins than different online channels from a profit and losses perspective.

Source: Neotrust, IBGE, Sequoia Logística, Iguatemi, Multiplan, Sonae, Stone, Mercado Pago, Mercado Libre and Giro Lino estimates.

The image above estimates retailers’ operational performance based on their selling channel. Marketplace offers a good value proposition when customers focus solely on volumes.

Furthermore, channel checks suggest that one of the most important advantages for sellers is not necessarily higher sales. Instead, more significant sales volumes are translated into better conditions for financing operations and suppliers, boosting cash flow.

Most sellers rely on Mercado Libre to access financial and operational conditions that enable better operational performances, taking us to the jewel of the crown, the payment/credit business.

#### Mercado Pago

The company created Mercado Pago in 2004 to offer online payments solutions designed to facilitate transactions both within and outside of the marketplace product.

Mercado Pago operated similar to Paypal when it was launched, offering a digital wallet. Customers could add their payments after linking a valid credit/debit card or depositing the fund in the account.

Mercado Pago was initially designed to facilitate transactions on Mercado Libre’s Marketplaces by providing a mechanism that allowed users to securely, quickly, and promptly send and receive payments.

Mercado Pago is a whole ecosystem of financial technology solutions in the digital and physical world, more significant than the Marketplace itself.

The digital payments solution enables any Mercado Libre registered user to securely and efficiently send and receive digital payments and pay for purchases made on any of Mercado Libre’s Marketplaces.

Beyond facilitating Marketplace transactions, MELI has expanded the array of Mercado Pago services to third parties outside Mercado Libre’s Marketplace over the years.

The company began first by satisfying the growing demand for online-based payment solutions by providing merchants with the necessary digital payment infrastructure for e-commerce to flourish in Latin America.

Today, Mercado Pago’s digital payments business not only allows merchants to facilitate checkout and payment processes on their websites through a branded or white label solution or software development kits.

It also enables users to simply transfer money to each other through the Mercado Pago website or the Mercado Pago app.

Through Mercado Pago, MELI brought trust to the merchant customer relationship, allowing online consumers to shop quickly and safely while giving them the confidence to share sensitive personal and financial data.

As MELI deployed their digitally-based payments solutions, they also observed that SME companies in the physical world were being underserved or overlooked by incumbent payment providers.

Mercado Pago is a powerful disruptive provider of end-to-end financial technology solutions that will generate financial inclusion for segments of the population that have been historically underserved and operate in the informal economy today.

- In-store physical payments by selling mobile point of sale (“MPOS”) devices and through quick response (“QR”) payment codes;

- Digital payment solutions for utilities, mobile phone top-up, peer-to-peer payments, and more through the mobile wallet;

- Pre-paid cards and debit cards for users to spend and withdraw their account balances from their Mercado Pago wallet;

- Merchant and consumer credits, both on and off the Mercado Libre Marketplace, and credit cards.

Mercado Credito, the credit solution, leverages the user base, which is not only loyal and engaged but has also been historically underserved or overlooked by financial institutions and suffers from a lack of access to needed credit.

Facilitating credit is a crucial service overlay that enables us to further strengthen the engagement and lock-in rate of Meli’s users while also generating additional touchpoints and incentives to use Mercado Pago as an end-to-end financial solution.

The distribution capabilities and in-depth understanding of merchants’ sales on the Mercado Libre Marketplace have also allowed MELI to develop their own proprietary credit risk models with unique data that differentiate the scoring from traditional financial institutions.

Meli offers credit lines to both online merchants and MPOS device users. Because online merchants’ business flows through Mercado Pago, MELI collects principal and interest payments from their existing sales on the Marketplace, meaningfully reducing the risk on the loans.

Consumers can access credit lines through MELI once they score and approve them through Meli’s proprietary models.

Loans can be used for a purchase on the Marketplace or for a payment on another website where the payment solution is available at checkout.

Since 2019, MELI also has extended personal loans to recurring consumer credit borrowers, allowing them to buy products and services outside the platform.

In 2021, MELI launched the first Mercado Pago credit card in Brazil, which is free, internationally accepted, and digitally managed.

The credit card allows users to pay additional installments for purchases on the Marketplace and accrue extra points to their user loyalty program. In the following two topics, we’ll break down the payment business and Mercado Crédito.

##### Payment Business

The payment business aggregates the processing business (in/off-platform and wallet) and the prepayment operation.

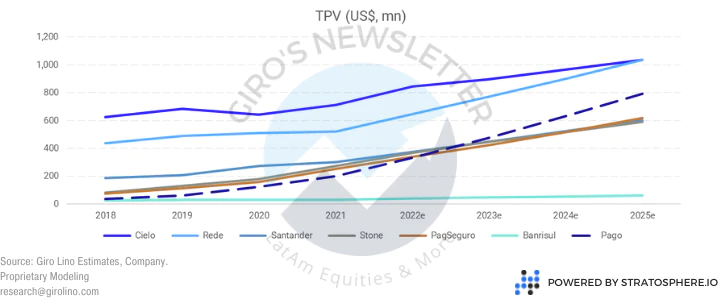

In this case, the closest peers would be the Brazilian acquiring companies, such as Stone, Pagseguro, Cielo, and Getnet.

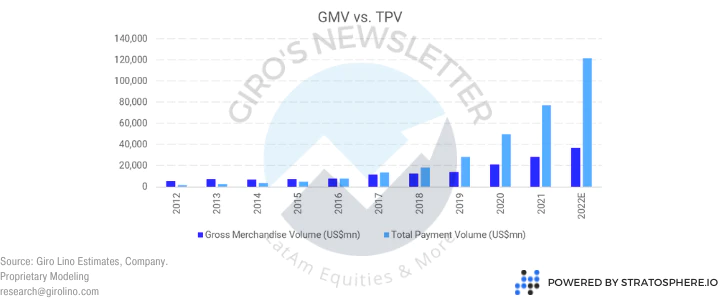

Initially, the Marketplace's success generated colossal traction for its payment business through in-platform transactions.

For the following years, we believe that most of the growth will come from off-platform volumes, such as QR Code payment and merchant solutions, pushing Pago as one of the dominant players in the market in the following years.

However, unlike traditional acquirers, which are asset-heavy, Mercado Pago is an excellent business, presenting an unparalleled competitive advantage.

A significant portion of the superior profitability comes from the products mentioned in the previous section.

Through the Marketplace, the company leverages its payment business enabling more customers to access online items.

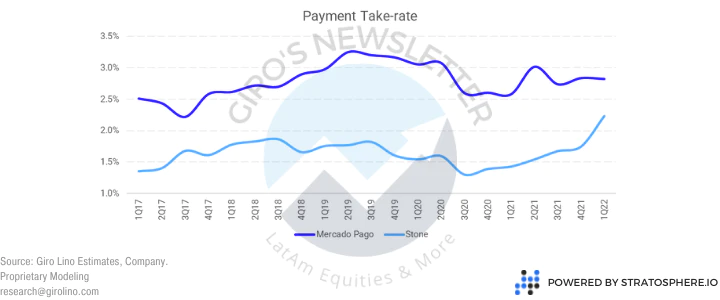

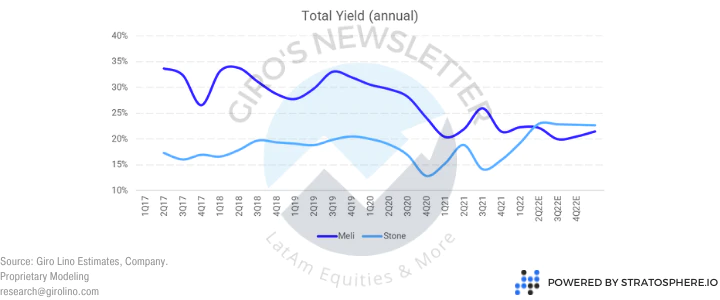

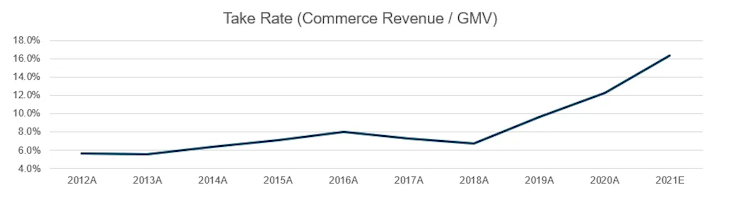

So, Mercado Pago has had an impressively stable take-rate throughout the years, remaining very competitive in traditional acquiring (minimize churn) while yielding juicy profitability in different products.

By maintaining a competitive fee in traditional acquiring, and higher fees in the different products, the company minimizes its churn, reducing friction in higher rate periods and, therefore, the CAC.

We diverge from the consensus when they mention the company charges higher fees for its clients. Instead, we believe that Mercado Pago generates a considerable gain for society, creating means for allowing new customers to join the system.

Also, Mercado Pago has been sharing gains of scale with its customers, offering a similar yield to Stone, for instance.

Even though the cost for the final customer is the same, Mercado Pago manages to keep its take rate above its peers through innovative products.

The take rate is superior, and the company is the lowest cost provider in the industry, distributing the product through the most significant Marketplace business in LatAm.

We believe the company operates with unparalleled competitive advantages, with higher profitability and lower cost to distribute its products, pushing the ROIC.

##### Mercado Crédito

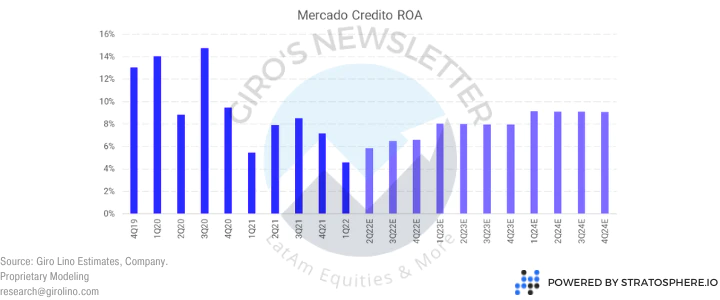

Until recently, Mercado Credito was a smaller business inside Mercado Pago, with minimal disclosure. It took us a lot of time to uncrack this one.

By the end of 2020, when $MELI received its IF license (Financial Institution), which allowed the company to collect deposits to fund its lending business through RDBs, the business gained traction.

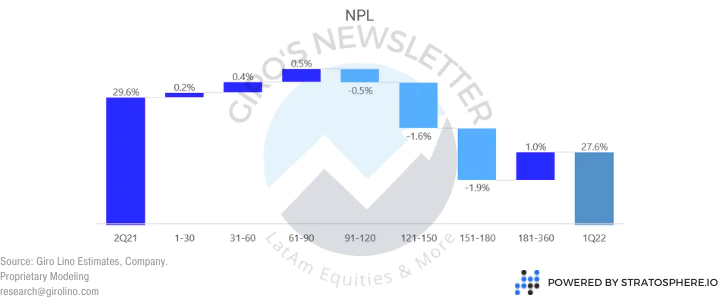

In the past couple of years, the credit portfolio grew from US$180mn to ~US$2.5bn in the 1Q22. So naturally, that raised questions from investors regarding the soaring provisioning.

In our opinion, Mercado Pago is executing its credit portfolio well, and NPLs will improve from 2023 onward. As a result, we believe it’ll be essential growth leverage in the following years.

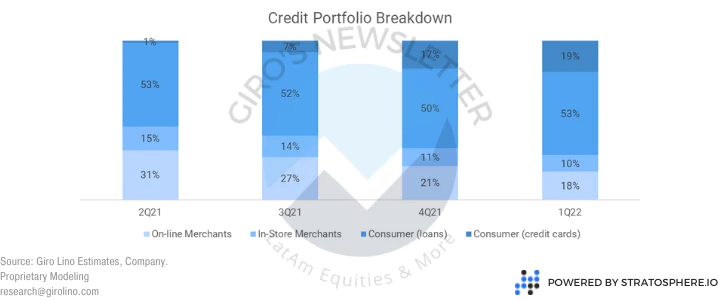

First, we need to consider the product mix is evolving. The company has been slowly introducing new products, such as credit cards and personal loans, and testing them.

The credit card strategy, in particular, reminds Nubank’s approach, releasing a small credit limit for new customers and increasing it as the customer proves himself as a good payer.

Second, we can’t evaluate Mercado Pago’s credit business without a broader context on how the company reports its provisioning since the company adopts different accountant practices compared to Brazilian banks.

Under accounting practices adopted in Brazil applicable to institutions authorized to operate by the Central Bank, loans are generally carried at cost and report losses under IAS 39.

As of March 31, 2000, loans should be categorized into 9 categories, and the minimum allowance is determined by applying specific percentages to each category.

Loans are classified following management’s judgment of the risk level, considering the economic situation, past experience, and specific risks concerning the transactions, the debtors, and the guarantors.

The regulation requires a systematic analysis of the portfolio and its classification, by risk level, into 9 categories between AA (minimum risk) and H (maximum risk - loss).

The minimum allowance is determined by applying specific percentages to the loans in each category, which vary on the product and customer.

Income from credit operations overdue for more than 60 days, independent from risk level, is only recognized as revenue when effectively received. Operations classified as level H remain in such classification for nine months.

After this time, the loan is charged against the existing allowance and remains controlled in memorandum accounts for five years, no longer appearing on the balance sheet.

Suppose there is objective evidence that an impairment loss on loans and receivables investments has been incurred.

In that case, the amount of the loss is measured as the difference between the asset’s carrying amount and the present value of estimated future cash flows discounted at the financial asset’s original effective interest rate.

The carrying amount of the asset is reduced through an allowance account, and the amount of the loss is recognized in the income statement.

However, Mercado Pago doesn’t report under IAS 39 but through IFRS 9, using ECL (expected credit losses), which is entirely different.

As commented, under IAS 39, impairment allowances were measured according to an ‘incurred’ loss model wherein the recognition of credit loss allowances was triggered by loss events after origination.

Losses ‘incurred but not reported’ were evaluated using diverse provisioning approaches, varying between banks and countries, such as we commented for Brazil.

The IFRS 9 impairment model requires impairment allowances for all exposures from the time a loan is originated, based on the deterioration of credit risk since initial recognition.

If the credit risk has not increased significantly (Stage 1), IFRS 9 requires allowances based on 12-month expected losses.

If the credit risk has increased significantly (Stage 2) and if the loan is “credit impaired” (Stage 3), the standard requires allowances based on lifetime expected losses.

The assessment of whether a loan has experienced a significant increase in credit risk varies by product and risk segment. It requires the use of quantitative criteria and experienced credit risk judgment.

Mercado Pago’s approach is ultimately quantitative since they’ve been gathering and processing data since 2004. It means that the company has an entire credit bureau at its disposal.

Primarily operating in countries such as Argentina and Brazil, Mercado Pago understands how default rate behaves under different economic scenarios, which is an advantage that will take years for many players to replicate.

Finally, as opposed to IAS 39, which required a historically estimate approach, IFRS 9 requires multiple forward-looking macro-economic and workout scenarios to estimate expected credit losses.

As highlighted previously, we believe that Mercado Pago’s short NPLs are impacted by a product mix change. According to our estimates, credit card accounted for 19% of the credit portfolio in the last quarter, from 1% last year.

Nevertheless, we’ve seen a tremendous improvement in long NPLs, which is a great leading indicator for the personal loan business, launched last year.

Still, we believe credit card will increase to ~25%, so we think that short NPLs will be pressured in the following quarters, but with promising expectations for the following cohorts.

Surprisingly, Mercado Credito already presents a very profitable operation, with a ROA close to 6%. We’ll keep to our conservative stance and not consider any profitability gain, even though all evidence suggests otherwise.

> For curiosity, our ROE estimates for Nubank’s personal loan and credit card business are 60% and 80%, respectively. For Meli, we don’t see the company managing risk as well as Nu, but our ROE ranges from 30%-40%, which is also great.

#### Mercado Envio

Meli shines out in logistics. Suppose you’re selling in Meli’s marketplace. In that case, there are two options: first, you can take advantage of Mercado Envios Full (“MEF”), a comprehensive fulfillment service, such as Fulfillment by Amazon (“FBA”), allowing the seller to store the items in Meli’s warehouses, where they handle the entire process.

The second option is through Mercado Envios Diretos (“MED”). The seller is responsible for storing the item and for the delivery processing, hiring, or realizing the delivery to the client.

A condition to hiring MEF’s or MED’s services is that the seller must be connected in the marketplace, register the invoice for each order, and fit the accepted dimensions. Meli had a liability with sellers dealing without invoices in the past, though they solved the problem many years ago.

Going deeper in MEF, the fully integrated service has no cost seller, and it’s collected by the Mercado Coletas, managed by Meli then.

The constraint for sellers is the coverage area. Again, MEF is a no-brainer, but the coverage area is limited to certain areas, established according to the distance between the seller and the distribution center (“DC”).

Source: BTG Pactual.

Quantitatively, Meli has fewer DCs than all of its competitors, but this isn’t entirely true from a qualitative standpoint. For example, Magazine Luiza, Americanas, and Via are older companies, and not all their DCs enable fulfillment service.

Via, for instance, recently launched its first fulfillment center to sellers, although they have the most significant number of DCs. Older DCs have lower productivity sorting items and more significant recurring Capex, though many companies don’t repair properly.

The process of opening new DCs is highly reliable on data. First, they gather and process a vast amount of data, turning then into analytics. Second, an analysis of areas with sufficient demand.

Third, Meli partnered with a company specializing in DC to execute the project (including Capex) in exchange for a long-term leasing contract. It's genius. They don’t have Capex investing in new DCs, minimizing the risk.

Beyond that, Meli launched an initiative to offer logistics as a service (“LAAS”), setting its first partnership with Pão de Açúcar ($CBD), which operates over 5,000 SKUs.

Meli can offer same-day delivery for 10 million items, from electronics to supermarkets, with no additional cost to the buyer.

The shipping policy is the same, with free shipping for purchases at R$79. Currently, the company can deliver on the same day for almost 25% of all zip codes in Brazil.

More recently, Meli launched an app called Mercado Envios Extra, connecting self-employed delivery drivers to the e-commerce platform, similarly to delivery apps, such as Rappi and iFood.

The driver can define deliveries pick-up locations in the app and notify the buyer that the package is on the way. Drivers are paid weekly through Mercado Pago.

Meli has over 600 enveloped vans, 10,000 third-party vans, four planes, 600 trailers, and 51 electric vehicles for the last mile.

According to Gustavo Pompeo, Logistic’s Director, Meli delivers 90% of its orders in less than 48 hours. Out of those, 75% are delivered within 24h.

####MercadoLibre Classified

It’s the service where sellers can list and buy motor vehicles, aircraft, real estate, and so on. The service is irrelevant compared to the marketplace and differs because the seller pays the fee upfront, not the usual take rate.

#### MercadoLibre Advertising

The service enables sellers and large advertisers (not necessarily sold on the marketplace) to display ads on a CPC (cost-per-click) basis.

It won’t surprise me if Meli adopts Alibaba's same strategy to replace the standard take rate for advertising revenue. Then, of course, there would be a discussion regarding scale and investment in clicks, but this is something to keep in mind if the commerce take rate starts reducing more aggressively somewhere in the future.

Last year, in LatAm, 7 of 10 searches for products began in a marketplace, so they became a mandatory media for agencies and companies.

Using analytics tools, Meli offers performance marketing for brands and products. Unlike Mercado Envios, customers grom Advertising don’t have to sell on the platform necessarily.

#### MercadoShops

MercadoShops (“Shops”) was the last initiative launched by Meli, designed to offer SMEs and longtail to create their website inside Meli’s environment, integrated with Meli’s universe of services.

Source: Mercado Libre.

The first thing that comes to my mind is Amazon Webstore. For those who don’t remember, in 2010, Amazon launched its own web service company, called Amazon Webstore (“Webstore”).

However, Webstore was a complete failure. After five years of operating, Amazon decided to shut down the operation, suggesting that clients migrate to Shopify.

Source: https://www.cws.la/shopify/

In my opinion, the product was horrible. First, Amazon charged $79/m for an interface identical to Amazon’s website (competitors were charging ~$30/m). Initially, Webstore was much cheaper (under $40/m), but Amazon hiked prices quickly.

Second, the value proposition was worse. Besides being more expensive and less customizable, Webstore charged sellers 2,1% to 3% to process payments.

On the other side, Shops offers a considerable value proposition to customers using their scale to offer most services for free or at a very competitive fee.

Source: Mercado Libre, Shopify, Numvemshop, Vtex, Loja Integrada, and Giro Lino, on 2022-01-25.

Shop’s strategy is to attract SMEs and longtail. In the layer behind, Meli is boarding clients in its ecosystem for a low CAC (Customer Acquisition Cost) to offer different financial and logistic services.

###How does Meli make money?

In its public filing, Meli identifies two main revenue streams: revenue linked to the marketplace operation and non-marketplace operations, where the company offers different services to clients.

- The commerce business is comprised of revenue streams that are mainly generated from marketplace fees that include final i) value fees and flat fees for transactions below a specific merchandise value, ii) shipping fees net of third-party carrier costs (when we act as an agent), iii) classifieds fees, iv) ad sales up-front fees; v)sales of goods and vi) fees from other ancillary businesses.

Source: Mercado Libre, Giro Lino estimates.

- 1) The fintech business is comprised of revenue streams that come from the Mercado Pago business. Concerning Mercado Pago, fees are attributable to commissions that are charged to sellers representing a percentage of the processed payment volume in connection with off-Marketplace transactions;

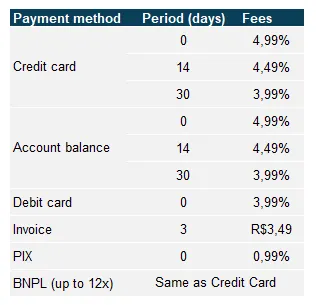

Source: Mercado Pago and Giro Lino, on 2022-01-28

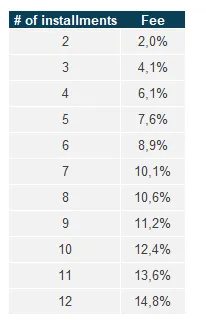

- 2) Commissions from additional fees are charged when a buyer selects to pay in installments through the Mercado Pago platform for transactions that occur either on or off-platform;

Source: Mercado Pago and Giro Lino, on 2022-01-27

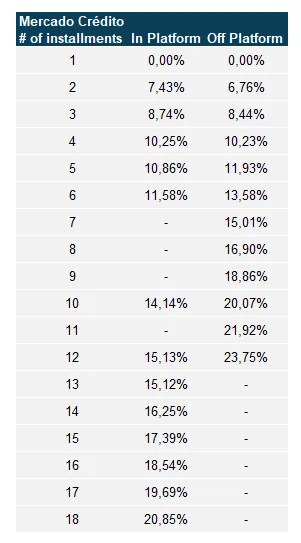

- 3) Commissions from additional fees are charged when sellers elect to withdraw cash, cash advances, fees from the merchant and consumer credits granted under the Mercado Credito solution, and revenues from the sale of MPOS products.

Source: Giro’s estimates consulting app and website on 2022-01-17.

###Management compensation

Probably management’s long-term alignment is one of the most undervalued elements in a company.

However, one of the best ways of verifying your thought about the company’s focus is looking where compensations are coming from.

A heuristic that has been working fine to me is that a company whose management doesn’t have skin in the game is doomed to a failure somewhere in the future.

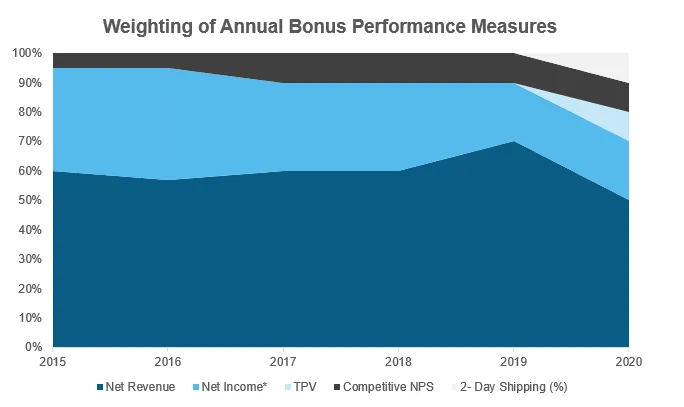

From 2011 to 2017, Meli’s compensation and performance measuring looked much like a commerce company, with a greater focus on revenue growth and net income.

In 2018, Meli hired Mercer Consulting to establish better compensation peers and draw better weighting performance measures.

Source: Mercado Libre and Giro Lino. *In 2020, Net Income was replaced by Ebit.

The relevant highlights are the inclusion of “2-Day Shipping (%),” “TPV,” and changing “Net Income” criteria to Operational Income.

There is a circular reference from “2-Day Shipping (%)” to NPS and from “TPV” to Net Revenue, meaning that Meli kept Net Revenue importance unchanged, increasing the priority for better “NPS” using an operational metric, instead of a subjective metric. NPS has an inherent problem because it is affected by external factors that management might not interfere with.

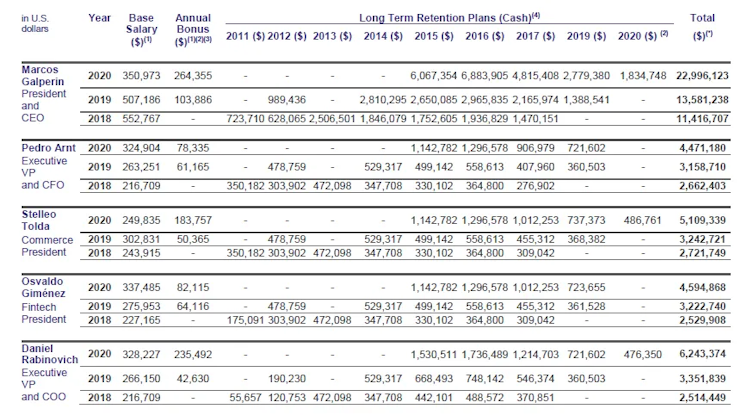

In 2020, 98.5% of our chief executive officer’s total target direct compensation for our 2020 fiscal year was performance-based, and 93.8% of our other named executive officers’ average total direct target compensation was performance-based.

Source: Mercado Libre.

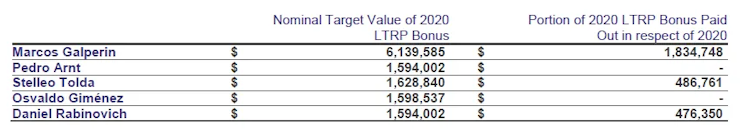

The vesting for the Long Term Retention Plans (LTRP) is six years, meaning that every year management receives 16,67% of the nominal target value for the LTRP if there is any.

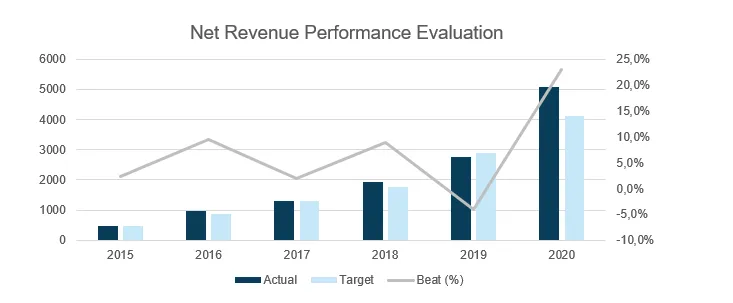

Historically, Meli’s management beats its operational targets year over year, receiving greater LTRP.

Source: Mercado Libre.

Source: Mercado Libre and Giro Lino.

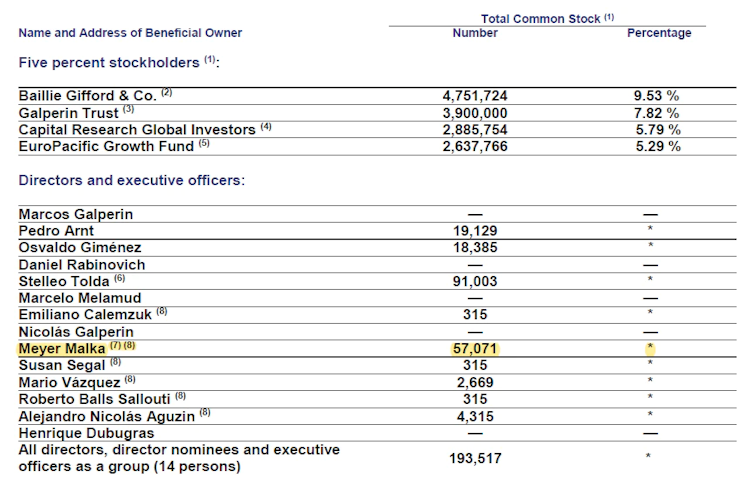

Also, the Chairman of the Compensation Committee is Mr. Meyer Malka (“Micky”), who has been on Meli’s board since 2013 and founded Ribbit Capital, a Venture Capital company focused on Fintech companies.

The ultimate evidence that Micky has no conflict of interest with other stockholders is that he is a stakeholder, having more shares than most directors.

Source: Mercado Libre

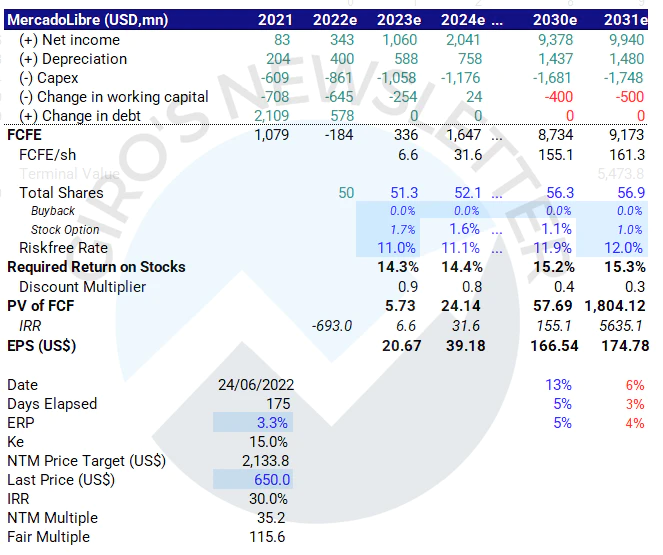

### Valuation

### Disclosure

###### All posts on Giro’s Newsletter are for informational purposes only. This post is NOT a recommendation to buy or sell securities discussed. So please, do your work before investing your money. Giro’s Newsletter makes no representation, warranty, or undertaking, express or implied, regarding the accuracy, reliability, completeness, or reasonableness of the information contained in the piece. Any assumptions, opinions, and estimates expressed in the article constitute the author’s judgments as of the date hereof and are subject to change without notice. Any projections contained in the information are based on several assumptions about market conditions, and there can be no guarantee that any projected outcomes will be achieved. Giro’s Newsletter does not accept any liability for any direct, consequential, or other loss arising from reliance on the contents of this presentation. Giro’s Newsletter is not acting as your financial, legal, accounting, tax, or other adviser or fiduciary capacity.

Already have an account?