Trending Assets

Top investors this month

Trending Assets

Top investors this month

@kylepicha

Kyle Picha

$14M follower assets

23 following322 followers

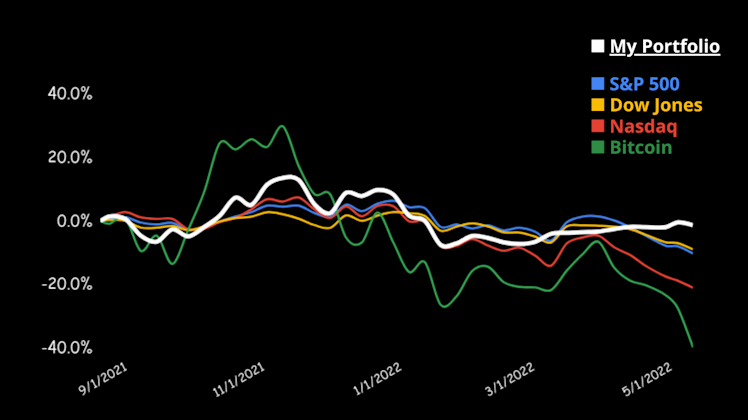

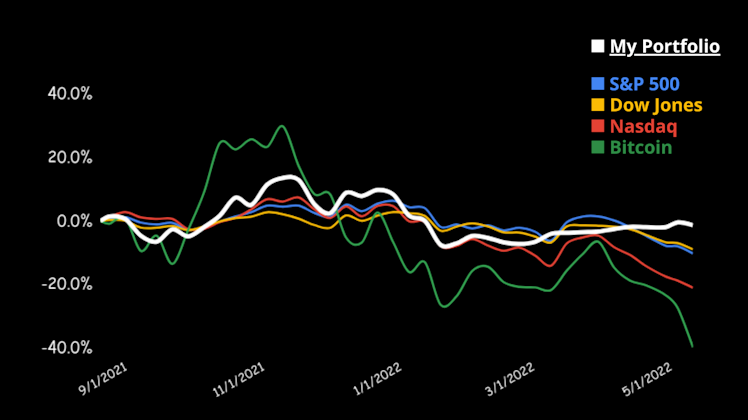

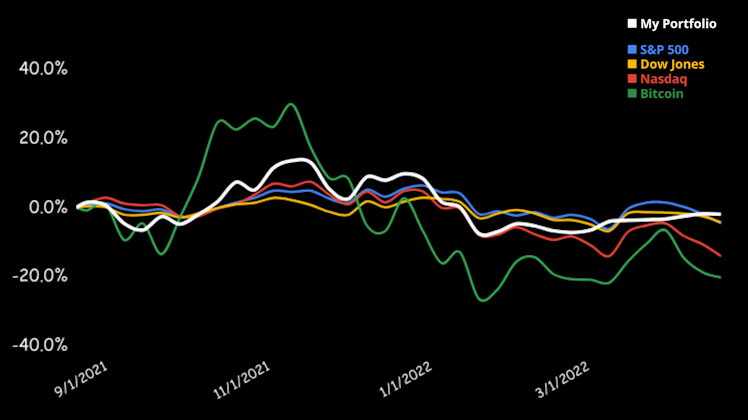

ME vs THE MARKET*

Damn $BTC.X get ur shit together lol

*reflects performance since 8/23/2021, when I started my strategy.

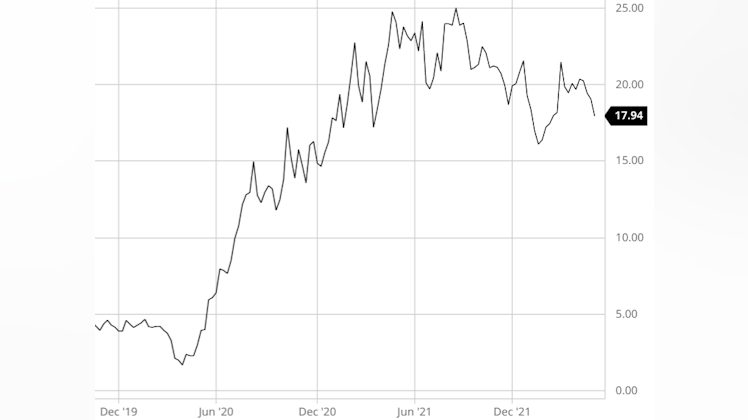

Review Update: $LAZY

OVERALL THOUGHTS 💭

- If the market wasn’t in a major downtrend, I’d buy this stock in a heartbeat.

STOCK SUMMARY:

- I first reviewed this stock 3/11/2022.

- They recently released a fantastic Q1 2022 report.

- Their 2022 revenue, net income, and EPS are all on track to beat 2021.

REVENUE:

2019: $644.9M

2020: $817.1M

2021: $1.2B

2022: on track to beat 2021

NET INCOME:

2019: $4.5M

2020: $11.9M

2021: $55.3M

2022: on track to beat 2021

EARNINGS PER SHARE (EPS):

2019: 0.46

2020: 1.21

2021: 4.85

2022: on track to beat 2021

MARKET CAP:

$248.9M. Small cap. Still plenty of room for rapid stock price (and overall company) growth.

GUIDANCE:

I could not find any guidance in the Q1 press release.

COMPANY INFO:

LazyDays RV is an American company specializing in the sales and service of recreational vehicles, RV rentals, parts and accessories.

ONE LARGE EXTERNAL FACTOR?

No. I could not locate any external factor that alone heavily affects their earnings.

STOCK PRICE UPTREND:

Price has increased from $1.69 to $17.94 since April 2020.

FOLLOW ME 😎

To hear about more high-potential stocks EARLY, long before they produce life-changing returns.

Review Update: $ACU (stay away)

KEY TAKEAWAY:

- I first reviewed this stock on March 1, 2022.

- I now have a NEGATIVE outlook on the stock, after their Q1 financial report was released.

- If I owned this stock, I would’ve sold immediately after seeing their report.

STOCK SUMMARY:

- Their 2022 net income/EPS are NOT on track to beat 2021.

REVENUE:

Q1 21’: $43.5M

Q1 22’: $43.3M

NET INCOME:

Q1 21’: $2.1M

Q1 22’: $830K

EARNINGS PER SHARE (EPS):

Q1 21’: 0.61

Q1 22’: 0.24

FOLLOW ME 😎

To hear about high-potential stocks EARLY, long before they produce life-changing returns. (and to know which stocks to stay away from)

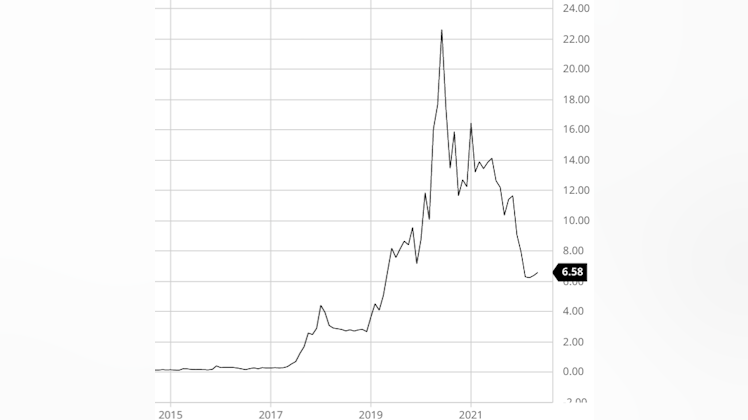

Stock Review: $ZYXI

OVERALL THOUGHTS 💭

- I’m now watching this one closely. If the market wasn’t in a bad downtrend, I’d buy this stock rn.

STOCK SUMMARY:

- Their Q1 22’ report beat Q1 21’ in revenue, net income, and EPS. Meaning their FY 22’ is on track to beat FY 21’ in all 3 categories.

- CEO gave great FY 2022 guidance.

- Announced Share Buyback Program up to $10M over next 12 months.

REVENUE:

2020: $80.1M

2021: $130.3M

2022: $150M - $170M (guidance)

NET INCOME:

2020: $9.1M

2021: $17.1M

2022: on track to beat 2021

EARNINGS PER SHARE (EPS):

2020: 0.24

2021: 0.41

2022: on track to beat 2021

MARKET CAP:

$256.9M. Small cap. Lots of room for rapid stock price (and overall company) growth.

2022 GUIDANCE:

From CEO: “March saw the largest number of orders in the Company's history, and we are expecting continued growth throughout all of 2022. We recently announced a stock buyback program of up to $10 million over the next 12 months to signal our confidence in the Company's long-term strategy. We believe that the decision will ultimately drive shareholder value and have already repurchased approximately $5 million from April 12th through April 27th, 2022.

Full year 2022 revenue is estimated in the range of $150-$170 million and Adjusted EBITDA between $25 and $35 million. Profitability is expected to grow as sales reps become more efficient, further highlighting the anticipated EBITDA growth in 2022.

The estimated range for second quarter 2022 revenue is between $35.0 and $38.0 million, an increase of approximately 18% from 2Q21.

Second quarter 2022 Adjusted EBITDA is estimated to range between $4.0 and $6.0 million, an increase of approximately 5% from 2Q21.

COMPANY INFO:

Zynex, Inc is an innovative medical technology company specializing in the manufacture and sale of non-invasive medical devices for pain management, rehabilitation, and patient monitoring.

ONE LARGE EXTERNAL FACTOR?

No. I could not locate any external factor that alone heavily affects their earnings.

STOCK PRICE UPTREND:

Price has increased from $0.27 to $6.58 since Dec 2016.

FOLLOW ME 😎

To hear about more high-potential stocks EARLY, long before they produce life-changing returns.

I wouldn’t call $ZYXI innovative, they sell cheap tens units to medicare patients and sometimes over bill

There been a few shorts on it’s tails and I think for a good reason

I would be very careful with this one

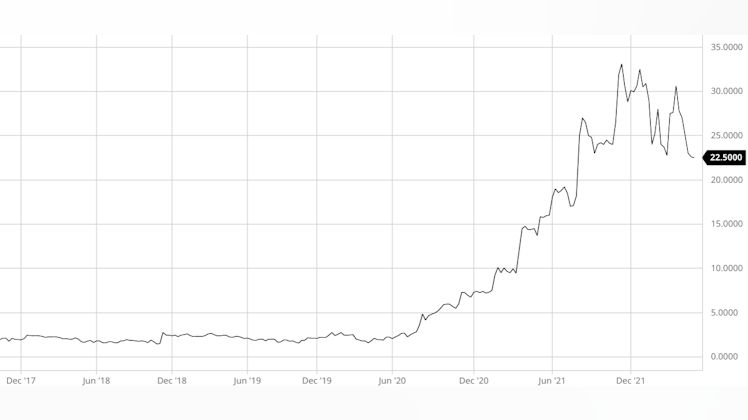

Stock Review: $LEAT

KEY TAKEAWAY:

- They recently released a great FY 2021 report. Record growth.

- I’m now watching this one closely. If the market was in a better condition, I’d buy this stock.

STOCK SUMMARY:

- Their 2021 revenue, net income, and EPS all beat 2020. (They’ve been growing Y/Y since 2017)

- CEO gave great guidance for 2022.

REVENUE:

2017: $20.1M

2018: $24.4M

2019: $28.3M

2020: $38.6M

2021: $72.5M

NET INCOME:

2017: $237.3K

2018: $1.2M

2019: $1.4M

2020: $4.4M

2021: $12.6M

EARNINGS PER SHARE (EPS):

2017: 0.04

2018: 0.22

2019: 0.26

2020: 0.82

2021: 2.29

MARKET CAP:

$129.4M. Small cap. Lots of room for rapid stock price (and overall company) growth.

GUIDANCE:

From CEO: “2021 was an absolutely exceptional year for Leatt, led by strong financial performance and global brand development in the context of surging demand for our innovative award-winning products. We closed out the year with a strong fourth quarter, the strongest quarter in our history in terms of revenue. Revenues for the fourth quarter of 2021 increased to $23.2 million, up 82%, compared to $12.7 million for the fourth quarter of 2020. We have now achieved record-breaking revenues for six consecutive quarters.

Our goals are to continue to refine our product categories to deliver exceptional products to a wider community of riders and to gain market share through product innovation and brand engagement. Many of our categories that have launched well are still in their infancy and show great potential to contribute to exponential growth.

We still have a lot of work to do to remain at the forefront of product innovation and invest in building a global consumer brand in a competitive environment, but we are enthused by our team’s resilience and our ability to gain market share, which we expect will continue in 2022 and beyond.”

COMPANY INFO:

Leatt Corp. is the global distributor of the Leatt-Brace®, a revolutionary neck protection system for all helmeted sports. The main area of focus is the prevention of neck injuries in persons wearing a crash helmet, for whatever purpose.

ONE LARGE EXTERNAL FACTOR?

No. I could not locate any external factor that alone heavily affects their earnings.

STOCK PRICE UPTREND:

Price has increased from $1.58 to $22.50 since April 2020.

FOLLOW ME 😎

To hear about more high-potential stocks EARLY, long before they produce life-changing returns.

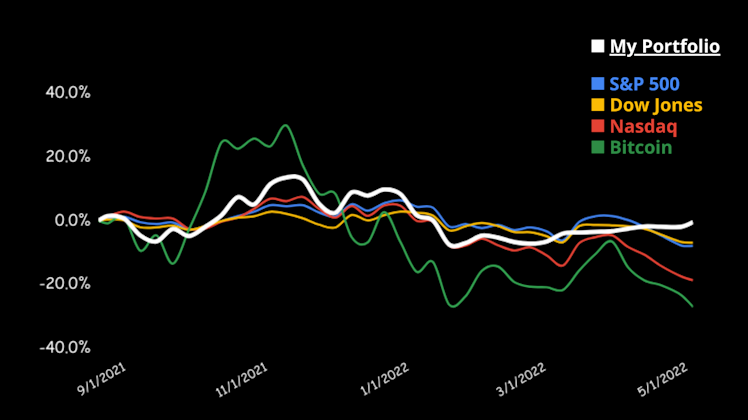

Me vs The Market

Hold on tight, this downturn may last awhile! Glad I’m still #1 compared to the market 😎

*reflects performance since 8/23/2021, when I started my strategy.

I think i'd like to buy more $BTC.X after looking at the chart.

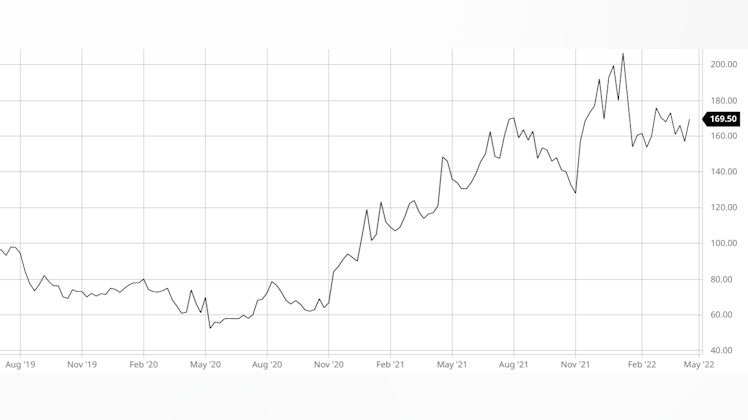

Stock Review: $DIT

KEY TAKEAWAY:

- They recently released great Q2 results, even with supply chain issues.

- I’m now watching this one closely.

STOCK SUMMARY:

- Their 2022 revenue, net income, and EPS are all on track to beat 2021.

- They’ve been growing Y/Y since 2020.

REVENUE:

2020: $1.5B

2021: $1.7B

2022: on track to beat 2021

NET INCOME:

2020: $5.5M

2021: $15.6M

2022: on track to beat 2021

EARNINGS PER SHARE (EPS):

2020: 9.9

2021: 28.2

2022: on track to beat 2021

MARKET CAP:

$99M. Small cap. Plenty of room for rapid stock price (and overall company) growth.

GUIDANCE:

From CEO: “We are pleased with our results for the second fiscal quarter. Our management team has remained highly focused on delivering a consistently superior level of customer service in a highly challenging operating environment. AMCON continues to seek out acquisition opportunities for distributors who want to align with our growing platform and customer centric management philosophy.”

From COO: “Ongoing supply chain disruptions with the consumer-packaged goods companies we partner with have impacted product availability across all markets, including the convenience distribution industry in which our company operates. The United States continues to experience an acute workforce shortage which we work diligently to address in our daily operations. Our Annual Spring Trade Show was well received and provides momentum as we enter our summer season. AMCON’s customer base continues to grow geographically and we are deploying the capital and human resources necessary to support this growth in a collaborative fashion.”

COMPANY INFO:

AMCON Distributing Company is one of the largest wholesale distributors in the United States serving approximately 4,000 retail outlets including convenience stores, grocery stores, liquor stores, drug stores, and tobacco shops.

ONE LARGE EXTERNAL FACTOR?

No. I could not locate any external factor that alone heavily affects their earnings.

STOCK PRICE UPTREND:

Price has increased from $52.40 to $169.90 since May 2020.

FOLLOW ME 😎

For more stock reviews

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?