Trending Assets

Top investors this month

Trending Assets

Top investors this month

Stock Review: $ZYXI

OVERALL THOUGHTS 💭

- I’m now watching this one closely. If the market wasn’t in a bad downtrend, I’d buy this stock rn.

STOCK SUMMARY:

- Their Q1 22’ report beat Q1 21’ in revenue, net income, and EPS. Meaning their FY 22’ is on track to beat FY 21’ in all 3 categories.

- CEO gave great FY 2022 guidance.

- Announced Share Buyback Program up to $10M over next 12 months.

REVENUE:

2020: $80.1M

2021: $130.3M

2022: $150M - $170M (guidance)

NET INCOME:

2020: $9.1M

2021: $17.1M

2022: on track to beat 2021

EARNINGS PER SHARE (EPS):

2020: 0.24

2021: 0.41

2022: on track to beat 2021

MARKET CAP:

$256.9M. Small cap. Lots of room for rapid stock price (and overall company) growth.

2022 GUIDANCE:

From CEO: “March saw the largest number of orders in the Company's history, and we are expecting continued growth throughout all of 2022. We recently announced a stock buyback program of up to $10 million over the next 12 months to signal our confidence in the Company's long-term strategy. We believe that the decision will ultimately drive shareholder value and have already repurchased approximately $5 million from April 12th through April 27th, 2022.

Full year 2022 revenue is estimated in the range of $150-$170 million and Adjusted EBITDA between $25 and $35 million. Profitability is expected to grow as sales reps become more efficient, further highlighting the anticipated EBITDA growth in 2022.

The estimated range for second quarter 2022 revenue is between $35.0 and $38.0 million, an increase of approximately 18% from 2Q21.

Second quarter 2022 Adjusted EBITDA is estimated to range between $4.0 and $6.0 million, an increase of approximately 5% from 2Q21.

COMPANY INFO:

Zynex, Inc is an innovative medical technology company specializing in the manufacture and sale of non-invasive medical devices for pain management, rehabilitation, and patient monitoring.

ONE LARGE EXTERNAL FACTOR?

No. I could not locate any external factor that alone heavily affects their earnings.

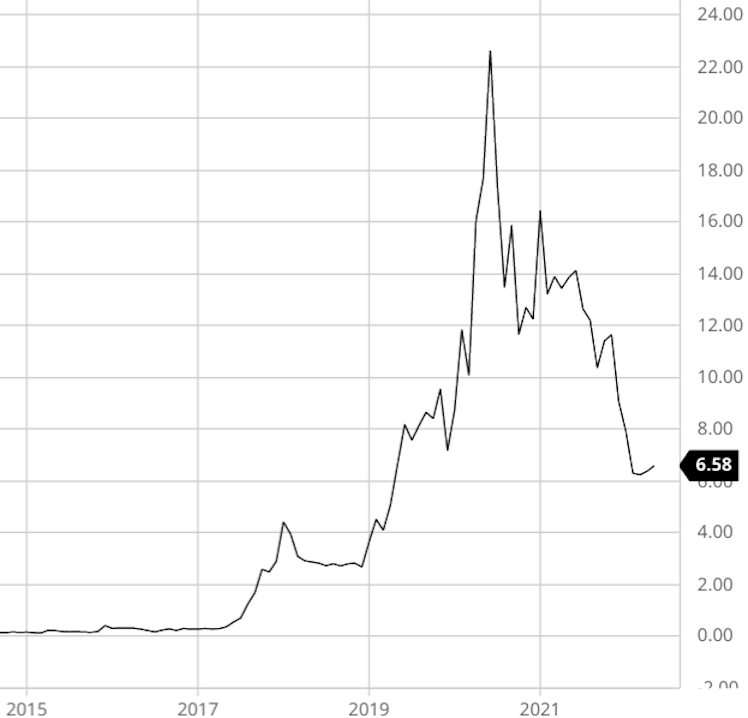

STOCK PRICE UPTREND:

Price has increased from $0.27 to $6.58 since Dec 2016.

FOLLOW ME 😎

To hear about more high-potential stocks EARLY, long before they produce life-changing returns.

Already have an account?