Trending Assets

Top investors this month

Trending Assets

Top investors this month

@ifb_podcast

Dave Ahern

$6.1M follower assets

90 following1,079 followers

Cash App Getting It Done

WSJ

Cash App Gets the Money

More people are regularly putting their paychecks into Block’s Cash App, which could be a sign of its durability.

More resources for $FISV

X (formerly Twitter)

The Investing for Beginners Podcast (@IFB_podcast) on X

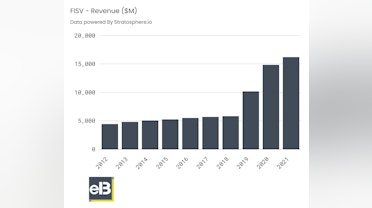

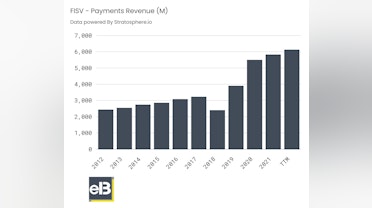

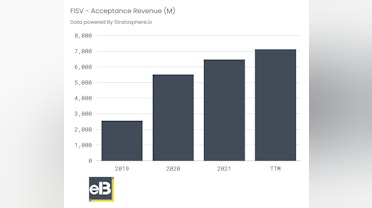

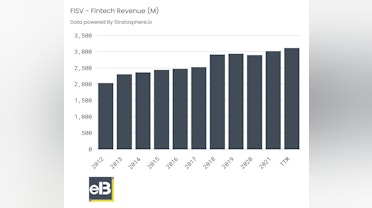

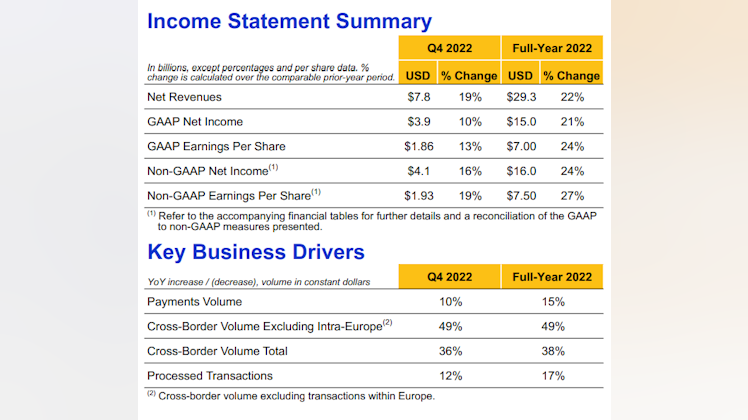

1. Today's deep dive will focus on Fiserv ($FISV), one of the leaders in payment and financial services.

Today's dive focuses on the business model, returns on capital, and valuation. Charts courtesy of @getstratosphere

To learn more about Fiserv, let's dive in. 🧵

+ 4 comments

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?