Ethereum is set to undergo a massive structural shift as expenses will effectively be reduced to zero.

The shift will give rise to the first large-scale structural demand asset in crypto history.

First, it is useful to highlight aspects of the core Ethereum model to get a sense of some of the key fundamentals such as supply reduction and the post-Merge staking rate.

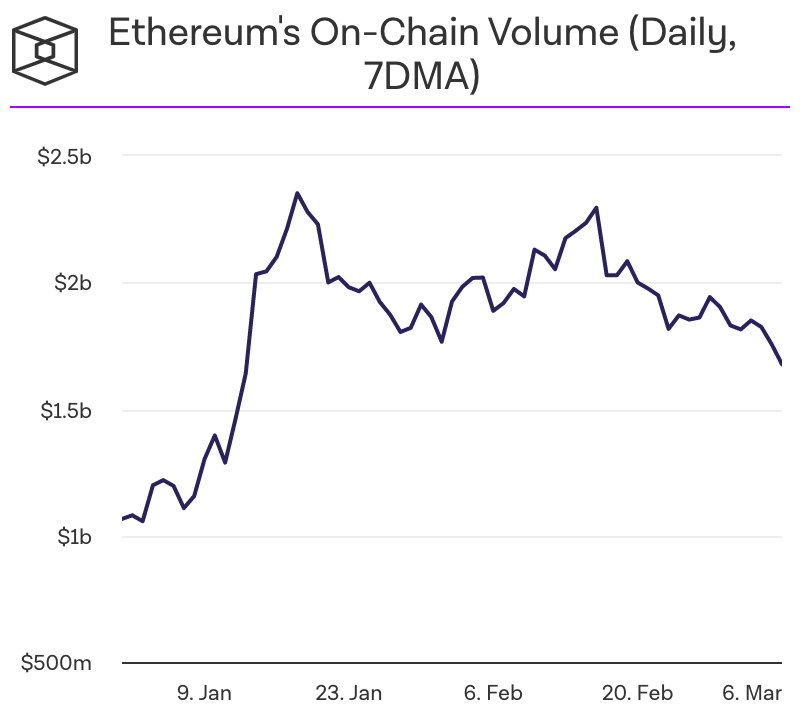

The largest shift since last December is that ETH-denominated fees have fallen significantly. However, there is an interesting dynamic at play here. Although fees have declined, active users have experienced a steady uptrend since late June.

This may seem inconsistent as more users should lead to higher gas. However, we believe this dynamic is caused by recent efficiency optimizations of various popular Ethereum applications. The best and most significant example is Opensea, which in migrating Seaport (from Wyvern) increased gas efficiency by 35%. This has led to a reduction in gas that doesn’t correlate to a decline in activity.

In fact, multiple indicators suggest that despite the low gas readings activity has been increasing recently (more on the specifics here later). This raises an interesting question: what is the optimal fee run rate for Ethereum? Higher fees mean more ETH is burned and post-Merge also correlates to a higher staking rate, but these higher fees also limit adoption.

As we saw in ’21, when fees are too high, some users get pushed to other L1 ecosystems. After roll-ups scale appropriately, Ethereum should be able to achieve both high fees and continued adoption. In the current environment though, it is interesting to think about the optimal mix. We believe the optimal point is approximately the point at which fees are high enough to burn all new issuance. This will enable ETH supply to be stable while also keeping fees low enough not to inhibit adoption. Interestingly, of late, fees have found an equilibrium near this point. Lower fees also seem to be having a positive impact on adoption as active users have begun to increase after a long downtrend.

Despite the fact that we seem to be near an optimal fee run rate, the reduced fees do negatively impact various model outputs. This impact is not critical as at the current run rate the burn would still be still large enough for ETH to be slightly deflationary post-Merge. Importantly, the current run rate would continue to drive structural demand as the majority of issuance is unlikely to be sold, while fees that are used must be purchased off the open market.

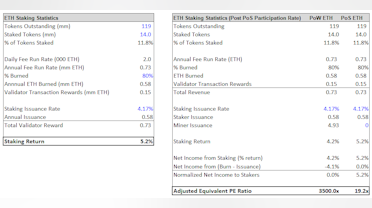

The staking rate will increase post-Merge by ~100 bps from 4.2% to 5.2%. However, this does not properly illustrate the true impact. To fully appreciate the shift, we must evaluate the real yield rather than the nominal yield. While the current nominal yield is ~4.2%, the real yield is close to zero, as 4.4% of new ETH is issued every year. In this context, the real yield is currently ~0% but will increase to ~5% post-Merge. This is an enormous shift and will create the highest real yield in crypto by a large margin. The only other comparable yield is BNB with a 1% real yield. ETH’s 5% yield will be a market-leading figure. What is the significance of this yield?

Stakers will receive a net ~5% rate, which equates to 100/5= ~20x earnings. This multiple is considerably cheaper than the revenue multiple because the staking participation rate is quite low, meaning stakers receive an outsized share of total rewards. This is one of the key advantages of

$ETH.X from an investment standpoint.

As there are so many other uses for ETH, throughout the crypto ecosystem, most ETH ends up locked in those applications rather than staked. This in turn allows stakers to receive an outsized real yield.

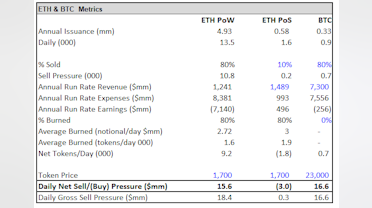

In terms of the flows, ETH will transition from enduring structural outflows of ~$18mm/day to structural inflows of ~$0.3mm/day. While the demand side of the flow equation has softened, the complete reduction of the supply side remains the most important variable. Our estimate for the ETH-denominated supply reduction is actually larger than it was previously. This is due to the fact that the price declines from the highs have not been accompanied by a corresponding hash rate reduction. As a result, miner profitability has decreased dramatically, and they are likely selling close to 100% of mined ETH.

For calculation’s sake, I have assumed 80% of miner issuance is being sold. In this context, ETH has found an equilibrium in which miners sell roughly 10.8k ETH ($18mm USD) per day. Given that fees have been averaging ~$2mm this yields a net outflow of ~$16mm. Post Merge this sell pressure will reduce to zero, and it is projected that there will be a structural inflow of ~$0.3mm/day post-Merge.

To conclude, while many of the numbers have shifted meaningfully in the last eight months, the conclusion remains roughly the same, ETH will shift from requiring ~$18mm of new money entering the asset to keep the price from declining to requiring ~$0.3mm exiting to keep the price from increasing.

To summarize, the staking rate and structural demand are lower than they were 6 months ago. However, this is to be expected in a period of slower activity, and if activity continues to rebound these rates will increase. The primary investment case remains the same, there is an enormous opportunity to front-run the largest structural shift in the history of crypto.

Another point that I think is often overlooked here is that the Merge is more than a shift in supply and demand. It is also a massive fundamental upgrade for Ethereum as the network becomes much more efficient and secure in many ways. This is part of what differentiates the Merge from prior BTC halvings.

It is 3x as large of a supply reduction combined with a massive improvement in fundamentals compared to a decline in fundamentals in the case of BTC halvings (reduced security).

Finally, there are two additional dynamics worth discussing.

- Time Harvesting

Before addressing how this relates to ETH it is important to lay some contextual groundwork.

Why is it that the SPX (or virtually any US/Global equity index) has been such a profitable and consistent investment vehicle over the long term? Most people think this dynamic has been driven almost entirely by earnings growth and multiple expansion. They would posit that if growth slows or the multiple stops expanding these investments would be unlikely to have positive returns going forward. This is incorrect.

The primary and most reliable source of growth for the price of these indices has been the passage of time.

Here is an example to illustrate this somewhat unintuitive point. A lemonade stand, LEMON (LEMON = The Enterprise, $LEMON = LEMON shares), earns $1 each year. There are 10 shares of $LEMON outstanding. LEMON has no cash or debt on its balance sheet. The market currently values $1 of ex-growth equity earnings at a 10x multiple. What is LEMON worth today? What about each share of $LEMON?

If we assume that next year LEMON will continue to earn $1 annually while the market applies the same multiple, what will LEMON/$LEMON be worth in a year? Take a minute and come to an answer.

If you answered $10/$1 for the first pair of questions you are correct. If you answered $10/$1 for the second pair, you are not. For part 1, LEMON is worth $10 as the market applies a 10x multiple to its $1 of earnings and assigns 0 value to its balance sheet. For part 2, the market continues to apply a 10x multiple to the $1 of earnings, but importantly, it also assigns $1 to the $1 of cash that now sits on LEMON’s balance sheet. LEMON is now worth $11 and each share is worth $1.10. When companies earn money, the money doesn’t disappear, it flows to the company’s balance sheet and the value of it accrues to the owners of the business (the equity holders). $LEMON has appreciated 10% in a year due to the earnings they have generated, despite 0 growth and 0 multiple expansion.

This is the power of earnings yield paired with the passage of time.

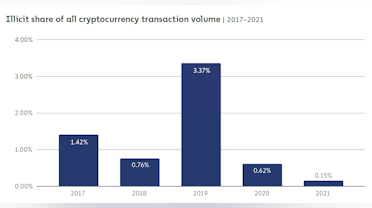

Crypto hasn’t benefited from this dynamic at all. In fact, crypto actually suffers from the reverse effect. Since almost all crypto projects’ expenses are greater than their revenues, they must dilute their holders to generate the funds necessary to cover their negative net income. As a result, unless earnings grow or their multiple expands, the price of each individual token will decline. The most notable exception I can think of is BNB, which is the sole current L1 to generate more revenue than expenses.

It is no surprise the chart of BNB/BTC is essentially up only and recently broke an ATH.

ETH will enter this exclusive class the moment it transitions to PoS. Post-merge ETH will generate a real yield of approximately 5%. This yield will be very different from virtually every other (non-BNB) L1 where the staking yield simply comes from inflation that offsets the yield. All else equal ETH holders will earn 5% each year. Time will become a tailwind rather than the headwind it is for 99.9% of other projects.

This will also change the psychology of holders and incentivize a stronger long-term buy and hold approach, effectively locking up more illiquid supply. Additionally, the “real yield” thesis and the fact that ETH will be the first large-scale real yield crypto asset will be particularly appealing to many institutions and should help accelerate institutional adoption.

- The Wall of Worry

Throughout the last few months, investors have been extremely skeptical about technical risks, edge cases, and timing risks.

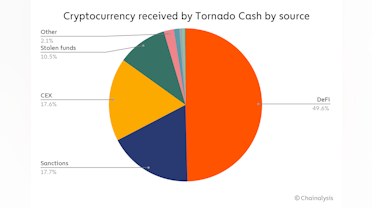

The latest edge case that has generated attention is the potential for PoW forks of Ethereum that live on after the Merge. Some PoW maximalists (miners etc.) would prefer to use PoW ETH and think that a forked version of the current ETH is superior to ETC, which already exists as a PoW alternative. We do not believe there is much value in the fork, but our opinion on this matter is not particularly relevant.

The important point is that this fork will have no impact on post-Merge PoS ETH. All of the potential risks are either easily managed or not risks in the first place. For example, replay attacks will most probably not be an issue as the PoW chain is unlikely to use the same chain ID. Furthermore, even if they maliciously choose to use the same chain ID, this can be managed by either not interacting with the PoW chain or first sending the assets to a splitter contract.

Finally, even if a user does get replay attacked, it will only impact that individual user’s assets and not the overall health of the chain. What the PoW fork does do is provide a dividend to ETH holders, further adding to the value of the Merge. If the fork has any value, ETH holders will be able to send it to an exchange and sell it for additional capital, much of which will then be recycled back into PoS ETH. While we view this as a positive for the Merge-related investment case, many are worried about the potential risks and a litany of other edge cases. We have weighed each risk and concluded the upside far outweighs the downside.

Nonetheless, these concerns are keeping many long-term believers sidelined.

As we approach the Merge many of these issues will be addressed. Eventually, many of these skeptics will be converted, creating fueling continued inflows as we approach the event and culminating with a large set of buyers who will purchase ETH the day the Merge occurs successfully. This should help offset any “sell the news” dynamic.

Just last month, less than 1/3 of people thought the Merge would occur before October. Now the date has been confirmed for mid-September and still, the market is only pricing in two-thirds chance of it occurring before October.

Given this backdrop how should we expect prices to move as we approach the Merge? This is the central question.

First, we acknowledge the reality that macro will continue to have a large impact on absolute price levels despite the Merge. However, it is still reasonable to think through how Merge related alpha will evolve over the coming weeks. In our opinion, the path gets harder to predict the further out you look but then at some point when you’ve gone far enough it starts to become easier again.

Short-Term

Despite the narrative that has already been building around the Merge, positioning is still quite light within the more discretionary pockets of the market. Perpetual funding has remained negative for most of the rally since June, indicating that there are more shorts than longs in the perp market.

Recently, Bitfinex longs, another notable discretionary pocket of ETH exposure, were reduced back to the lows.

IMO, this light positioning is likely due to many larger participants viewing this move as a “bear market rally” and therefore wanting to put hedges on as we have continued higher.

Historically, there is a large contingent of investors, who lean in the direction of BTC maximalism and will always look to fade the Merge narrative. Their theses primarily revolve around one of two central points.

The first is: “the Merge has been 6 months away for 6 years.” The second concern is around technical/execution risk. After evaluating the timing and execution risk, we have become comfortable with both. After the final testnet, Goerli, was successfully Merged earlier this week, the core developers set a target for the Mainnet Merge for September 15/16. All that remains is coordination.

While many are concerned about the execution risk, the upgrade has been tested extremely rigorously over the years and cross-checked by many teams. Furthermore, one of the core pillars of Ethereum is resilience. This is the reason there are so many different clients–the redundancy acts as a safety net to protect against singular edge cases or bugs. Multiple, usually well over two, unrelated fluke events occurring simultaneously would be required to affect the protocol.

This built-in resilience, the most accomplished developer team in the space, and many years of preparation have given us comfort that a technical issue, though a risk, is unlikely.

Given the cautious positioning and constant desire to “fade” the trade, I expect the next four weeks to follow a similar path as the prior four. There will be periods of pronounced fear as people overanalyze extremely unlikely edge cases. However, I expect the price declines around these periods to be shallow as there are many underexposed parties looking to add exposure on any weakness. Furthermore, almost everyone selling ETH over these next few weeks is only selling it tactically and planning to buy it back at some point before, or immediately after the Merge occurs.

This dynamic means net outflows are measured. On the flip side, I expect the hype around the Merge to magnify significantly as the date comes into focus and the narrative is picked up by the mainstream media. As I believe the thesis is extremely compelling and digestible by both institutional and retail capital, I expect inflows to accelerate as we approach the Merge creating a higher high, higher low dynamic as we approach the date.

What happens once the Merge actually occurs? Normally, you would think there would be risk of a “sell the news” reaction; many investors concerned about technical risk, plan to buy post-Merge. They believe they will capture the structural effect of the Merge without the technical risks. The post-Merge period will also depend on how much FOMO is generated as we approach the Merge and positioning when we actually get there.

We do expect significant buy flows and follow-through directly after the Merge as it is effectively “de-risked.”

Medium-Term

We expect a period of range trading as short-term traders sell, and this sell flow will be digested by the structural demand and larger slower moving institutional accounts. Price action in this period is less predictable and depends on the macro environment. As I have said previously, macro is incredibly hard to predict, but I will offer a few thoughts, nonetheless.

The crypto macro environment is driven by one core metric: whether adoption is growing, stable, or declining. This metric is somewhat impacted by the broader macro environment, but ultimately what matters most is this adoption metric. The reason this metric affects prices is because adoption also drives the long-term flow of funds into or out of the space. Simply put, when users are adopting crypto, they are generally also investing new money into the crypto ecosystem, and this is what drives the macro. When adoption is declining macro is hostile, when it is flat, macro is neutral and when it is growing, macro is accommodating. So how does the macro look today?

For the majority of the last 8-9 months, we have been in a declining adoption environment with a net outflow of users departing the ecosystem.

From May ’21 until the end of June daily active users have experienced a declining trend. Over the last ~6 weeks, we have seen a nascent recovery as users have steadily been increasing. This is a green shoot and indicates a potential thawing of the macro environment. We had been in a declining adoption phase, and we have now, at least, entered a stable adoption phase and potentially an increasing adoption phase. There are other green shoots that have been sprouting recently as well.

After many weeks of redemptions, Tether has started to slowly mint new coins. After a long period of outflows, new money has started to enter the space again.

This impact is not unique to the Ethereum ecosystem, AVAX has also recently seen daily active users increase.

NFT users and transactions have been stable recently

And certain web searches have started to positively inflect, while others are more stable.

These are not dramatic increases, nothing like the exponential increases we saw at the start of the ’21 bull market. This is why I label them green shoots. They are still young and fragile. If they are smothered, they will likely wither and die, but if nurtured they could grow into something material.

We think the broader macro environment will play a key role in determining whether these green shoots live or die. To us, inflation is by far the most important macroeconomic variable; therefore, we believe that if inflation moderates and allows the fed to pivot and ease monetary policy there is a good chance these green shoots will grow stronger. However, if inflation remains high and the fed is forced to continue tightening policy they will likely be smothered and die. Predicting the course of inflation is not our primary domain, however, due to its significance in markets today, we studied it closely. After review, we feel moderating inflation is the most likely outcome, which should give these green shoots a chance to blossom.

Another advantage, in favor of a more sustained bottom, is the fact that an enormous amount of vesting from project launches in the last 24 months has now been absorbed. Furthermore, as most of the projects are down 70-95%, the USD notional size of all future vesting is also vastly reduced. Together, these two dynamics help meaningfully reduce the overall daily supply the space must absorb.

Lastly, the final variable that we think will impact this equation is none other than the Merge. Investors underestimate the impact the Merge will have on the macro environment of the entire space. There is some uncertainty about how much the supply reduction caused by prior BTC halvings has fueled the ensuing price action rather than coincidentally aligning with the natural cycles of human emotion and monetary policy. We sympathize with these uncertainties and think there has been an element of luck in the timing. However, we think the supply reductions also had an impact and the truth likely lies somewhere in the middle. Another common criticism is that supply changes don’t drive price and all that matters are demand changes. We are not in accord with this thinking. A supply reduction is not different than a demand addition.

Let’s say miners sell 10k ETH/day, and instead of getting rid of this sell pressure we simply add 10k ETH/day of buy pressure. This would have the exact same impact as eliminating the miners’ sell pressure but would be a demand change rather than a supply change. It is obvious these two options would have the same impact and it, therefore, makes no sense to us why one would matter more than another.

If we then believe that BTC halvings have impacted crypto’s macro, then it stands to reason that the Merge should do the same. While ETH dominance is significantly lower than BTC dominance at the time of the last halving, the impact from the Merge is nearly as large as the prior BTC halving as a % of total crypto market cap and significantly larger on an absolute basis.

Post-Merge crypto will be relieved of ~$16mm of daily supply. This is not an insignificant amount. To recognize this, it is useful to consider the cumulative impact.

We think a Total-Weighted-Average-Price of 70k ETH per week would have a market impact. That is effectively the impact the Merge will have except it doesn’t stop after a year; it continues into perpetuity. This has the potential to positively influence the entire space as the positive flow impact trickles into other parts of the market. This should provide an added macro tailwind to help nurture the green shoots we referenced earlier and increases their odds of survival.

To conclude, if macro moderates at all, there is a real chance that what began as a bounce off of a capitulation bottom morphs into a more sustainable and organic recovery and the Merge should help aid this process.

Long-Term

In the long-term, the future becomes easier to predict, as structural flows are most important over this time horizon and easier to forecast. This is where the Merge’s impact is most pronounced. As long as Ethereum’s network adoption continues, which we deem likely, structural demand will remain and further inflows will also exist. This should result in sustainable and consistent appreciation, especially compared to other tokens, over many years (hopefully decades) to come.

We expect Ethereum to surpass Bitcoin as the largest cryptocurrency within the next few years as we believe flows are the most important variable in crypto. Ethereum will forever have a flow tailwind post-Merge. Bitcoin will forever have a flow headwind. To get a sense for how things may look, the BNB/BTC chart is a good place to start.

BNB/BTC has steadily increased and made multiple new ATHs during this bear market despite little narrative momentum. We believe this is primarily due to the fact that BNB is the only L1 with structural demand. Post-Merge Ethereum will have greater structural demand than BNB both on an absolute and market cap weighted basis.

Investment Strategies to Win the Merge

Before evaluating the ETH/BTC trade it is necessary to provide some more general context on the PoW vs PoS debate. Much of the following is paraphrased from the appendix of the first article but it is worth reiterating. We believe PoS is a fundamentally more secure system for a variety of reasons. Firstly, each unit of security costs less with PoS. To understand why PoS provides more efficient security than PoW we first need to explore how these consensus mechanisms generate security in the first place. A consensus mechanism is as secure as the cost to 51% attack it. The efficiency of the system can then be measured by the cost (issuance) required to generate a unit amount of security.

In other words, how many dollars the network has to pay out to receive $1 of protection from a 51% attack. For PoW, the cost of a 51% attack is primarily the hardware required to obtain 51% of the hash rate. The relevant metric is how much money miners require to invest $1 in mining hardware. The math tends to work out close to 1 to 1 meaning miners require 100% annual rate of return on their investment or in other words $1 of annual issuance for each $1 they spend on hardware and utilities. In this context, the network needs to issue roughly $1 of supply each year to generate $1 of security.

In the case of PoS, stakers are not required to purchase hardware, so the question becomes what return do stakers demand to lock up their stake in the PoS consensus mechanism?

In general, stakers require a significantly lower rate of return than the 100% miners typically demand.

The primary reason for this is that there is no incremental cost outlay and their assets do not depreciate (mining hardware typically depreciates close to 0 after a few years). The required rate should generally fall in the 3-10% range. As we calculated earlier, the current estimated post-Merge staking rate of 5% falls right in the middle of this range. This means that to gain $1 of security a PoS needs to issue $0.03-$0.10 of issuance. This is 10x-33x more efficient than PoW (20x more in the case of Ethereum’s PoS).

To conclude, this means that a PoS network can issue ~1/20th the issuance of a PoW network and be just as secure. In the case of ETH, they will actually issue about 1/10th of the issuance and the network will be twice as secure as it was during PoW.

This efficiency is not the only advantage. Both consensus mechanisms share a common issue, which is that the security of the chain is correlated to the price of the token. This has the potential to create a self-reinforcing negative feedback loop whereby the reduction in token price causes a reduction in security, which therefore causes a decrease in confidence and drives a further decrease in token price and then repeats. PoS has a natural defense against this dynamic, PoW doesn’t. The attack vector for PoS is much more secure than PoW.

First, to attack a PoS system you must control a majority of the stake. To do this you must purchase at least as many tokens as are staked from the market. However, not all tokens are available for sale. In fact, much of the supply is never traded and is effectively illiquid. Furthermore, and most importantly, with each token acquired the next token becomes harder and more expensive to acquire.

In the case of Ethereum, only ~1/3 of tokens are liquid (moved in the last 90 days). This means that once a steady state staking participation rate of closer to 30% has been reached it will be extremely difficult no matter the amount of money possessed, to attack the network. An attacker would need to purchase the entire liquid supply, which is impractical and nearly impossible.

Another important feature of this defense mechanism is that it is relatively unaffected by price. Because the limiting factor to attack is liquid supply rather than money it does not get much easier to attack the network with lower prices. If there is not enough liquid supply (measured as a % of total tokens) to purchase, it doesn’t matter how cheap each token becomes because the limiting factor is not price. This price-insensitive defense mechanism is incredibly important to deter the potential negative feedback loop that declining prices could otherwise create.

In the case of PoW, in addition to being 20x less efficient, there is no such defense mechanism. Each hardware unit may be marginally harder to acquire than the next, but there is no direct relationship, and if there is a correlation that does exist, it is weak at best. Importantly, it also becomes significantly easier to attack at lower prices as the number of hardware units required decreases linearly with price and the supply of hardware units does not change.

It is not reflexive in the manner the PoS liquid supply defense is.

Other advantages of PoS such as better energy efficiency and better healing mechanisms are articulated clearly elsewhere, therefore we will not focus on them in this piece.

Another misconception about PoS is that it drives centralization by rewarding large stakers more than small stakers. We believe this to be incorrect.

While large stakers receive more staking rewards than smaller stakers, this does not drive centralization. Centralization is the process by which large stakeholders increase their percentage of the stake over time.

This is not what occurs in the PoS system. As large stakers have a larger stake to begin with, the larger rewards do not increase their percentage of the pool. For example, if 10 ETH is staked between two counterparties, Counterparty X has 9 ETH and counterparty Z has 1 ETH. X controls 90% of the stake. A year later X will have received 0.45 ETH and Z will have received .05 ETH. X has received 9 times the amount of rewards as Z. However, X still controls 90% of the stake and Z still controls 10%. The proportions have not been altered and therefore no centralization has occurred.

These inherent differences impact the debate around ETH/BTC. Most consider ETH a totally different asset to BTC as they do think is designed to be a decentralized Store of Value (replace gold), while BTC is. We believe in many important ways Ethereum is better suited to be a long-term SoV than Bitcoin. Before we compare the two, it is first necessary to evaluate Bitcoin’s current security model and how it may evolve over time.

As discussed earlier, a system’s security is derived from the cost of a 51% attack. As a PoW network, this cost is determined by the amount of money it would take to purchase enough hardware rigs and other equipment/electricity necessary to control 51% of the hash power.

This is roughly equivalent to the cost necessary to recreate the current mining hash rate that exists on the network. In an efficient market (mostly an accurate assumption over the medium/long term), the total hash rate is a product of the value of the issuance that miners receive. Bitcoin is as secure as the value of its issuance. As discussed earlier, this security is both inefficient and importantly lacks the reflexive defense of a PoS system.

What happens when Bitcoin halves its issuance every four years? The system fundamentally becomes 50% less secure assuming all other variables are held constant. Historically, this has not been a large problem as the value of the issuance (and therefore the security) is a function of two variables: the number of tokens issued and the value of each token.

As the price of the tokens has more than doubled around every halving cycle, this has more than compensated for the issuance reduction on an absolute basis. The absolute security of the network has increased through each cycle despite the number of tokens being issued halving. However, this is not a sustainable dynamic long-term for multiple reasons. First, it is not realistic to expect the value of each token to continue to more than double with each cycle. An exponential price increase is mathematically impossible to sustain over long periods of time.

To illustrate this point, if BTC price doubled every halving cycle it would exceed global M2 after ~7 more halving cycles. Eventually, BTC price will stop increasing at this rate; when it does each halving cycle will drastically cut into its security.

If the BTC price declines around the halving cycle, the security reduction will be even more significant and could trigger the negative feedback loop referred to earlier. This security system is fundamentally unsustainable so long as prices are capped, which they are. The only way to counter this issue is to generate meaningful fee revenue.

This fee revenue could then replace some of the issuance and continue providing an incentive for miners and therefore provide security even after issuance is reduced. The issue for Bitcoin is that fee revenue has been negligible, and also declining, over a long period of time.

In our opinion, the only practical way to generate security over the long term is through significant fee revenue. Therefore, to function as a sustainable SoV a system must generate fees. The alternative is tail emissions, which guarantees inflation compromising the SoV utility.

Long-term security represents the most important property of an SoV. For example, gold has captured the majority of the SoV market for so long as nearly all market participants are confident that it will remain legitimate long into the future.

For a crypto asset to become an adopted and successful SoV, it too must convince the market that it is extremely secure and that its legitimacy is guaranteed. This can only be possible if the protocol’s security budget is sustainable for the long term, inherently favoring a PoS system that has a large and durable fee pool. We believe the most likely candidate for this system is ETH. It is one of only two L1s with a significant fee pool. The other, BNB, is extremely centralized.

Credible neutrality is the second critically important characteristic of a successful SoV. Gold has no allegiance or reliance on anything. This independence creates its success as an SoV. For another asset to be widely adopted as an SoV it must also be credibly neutral. For a cryptocurrency credible neutrality is accomplished through decentralization. Today, the most decentralized cryptocurrency is undoubtedly Bitcoin. This is primarily because Bitcoin has very little development effort, and the protocol is mainly ossified, but nonetheless, the fact remains that it is by far the most decentralized protocol today. If you tried to kill Bitcoin today, it would be extremely hard. If you tried to kill ETH today, it would still be extremely hard, but likely easier than BTC.

However, we believe it is more important to look at the end state than the current state so long as there is a realistic path to achieve this end state. Ethereum has a clear roadmap ahead of it. We believe that while we are currently only in the middle of this roadmap, eventually (I’d estimate ~8-12 years) this roadmap will be complete, and the significance of the core developer team will fade.

At this point, ETH will have a compelling case that it is more decentralized than BTC in addition to possessing far superior long-term security.

Contrary to popular belief, PoS naturally promotes decentralization more than PoW. Larger PoW miners receive a clear benefit from economies of scale, which drives centralization. Scale is much less relevant for PoS as the cost of setting up a node is vastly lower than a PoW rig and there is no real benefit to large-scale electricity as the electricity required for PoS is 99%+ lower.

The economy of scale is a large factor for PoW but is not for PoS.

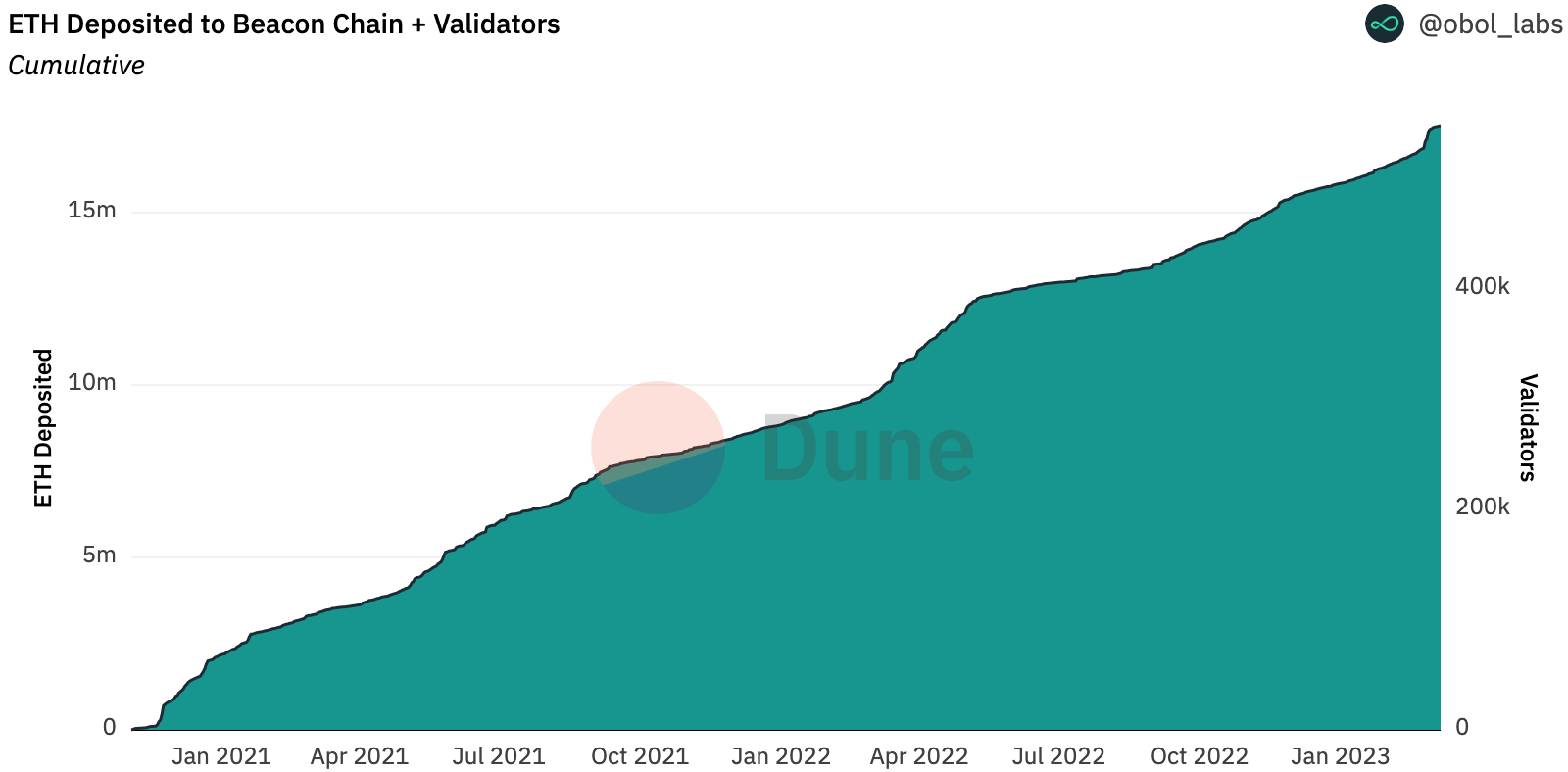

400,000 unique ETH validators exist today and the top 5 holders only control 2.33% of the stake (excluding smart contract deposit). This level of decentralization and diversity separates ETH from all other PoS L1s. Furthermore, this compares to BTC favorably as the top 5 mining pools today control 70% of the hashrate.

While some critics will point out that liquid staking providers control an overwhelming portion of Ethereum’s stake, we believe these concerns are overblown. Additionally, we expect these concerns to be addressed by the liquid staking protocols and expect additional checks to be put in place to further protect against these concerns.

In summary, PoS is a fundamentally better consensus mechanism for a crypto SoV. This is the reason the Merge will represent a major milestone on Ethereum’s roadmap, marking a critical juncture in its journey to become the most appealing cryptographic SoV.

The fundamental reasons discussed above are the reason we favor the ETH/BTC trade long-term and specifically around the Merge. However, flows, and specifically structural flows, are most important in determining price. It is the structural shift in flows that the Merge triggers that makes this trade so appealing and why the Merge is such a large catalyst for it. Historically, the structural flow for both BTC and ETH have been quite similar.

Although ETH has had a smaller market cap its issuance has been ~3x larger on a market cap weighted basis. This larger issuance has made it extremely difficult for ETH to ever surpass Bitcoin in market cap as it would require ETH to absorb 3x the daily USD denominated supply. An interesting exercise is to think about the chart above and what the inputs are as clearly there has been a strong relationship (stronger than normal correlation would imply). The charted values are a product of tokens issued and token price.

What happens if you reduce the tokens issued variable but want to retain the relationship? You must increase token price.

So what should we expect to happen when we reduce the token issued variable for Ethereum by 90%? This is not to say that price should 10x to offset this reduction as the impacts are not necessarily linear, but the relationships are worth considering.

To conclude, post-Merge the passage of time will forever be a flow tailwind for Ethereum while for Bitcoin it will always be a headwind. Ultimately, this straightforward reality is what we believe will be the primary driver of ETH eventually flipping BTC in market cap.

Staking Derivatives

As Ethereum is such a large ecosystem many other areas will be tangentially affected by the Merge. As an investor, it is often interesting (and profitable) to consider the second and third-order effects of certain catalysts to search for opportunities that may be inefficiently priced in the market. Regarding the Merge, there are many options such as L2s, DeFi, and Liquid Staking Derivative (LSD) protocols.

After a comprehensive review of the different alternatives, we have concluded that the liquid staking protocols are set to be the largest fundamental beneficiaries of the Merge (even more so than ETH).

The thesis is simple. The LSD protocols’ revenues are directly impacted by the price of ETH plus multiple other Merge related tailwinds that compound each other. Additionally, their largest expense, the cost of subsidizing the liquidity pool between their staking derivate token and native ETH, declines, effectively to zero, shortly after the Merge. At a high level, I expect a 4-7x Merge driven increase in ETH protocol revenue (assuming only modest a ETH price increase) and a 60-80% reduction in their largest expense. This is a uniquely powerful fundamental impact.

We must examine the revenue and expense model of these protocols to fully comprehend this thesis. Using Lido as an example, as it is the largest of the LSD protocols, let’s examine the model.

Note that these principles also apply to the other players as they are generally quite similar. Lido generates revenue as a percentage of the staking rewards that accrue to their liquid staking derivatives, stETH. Lido receives 5% of all staking rewards generated. If a user deposits 10 ETH for 10 stETH and generates an additional 0.4 stETH over the course of a year. The user keeps 90% of 0.4, the validator keeps 5% and Lido keeps the other 5%. As can be seen, Lido’s revenue is purely a function of the staking rewards generated on its LSD.

These staking rewards are a function of four separate variables: total ETH staked, ETH staking rate, LSD market share, and ETH price.

Importantly, the staking rewards are the product of all four variables. If multiple variables are impacted their effect on the output compounds. In other words, if you double one and triple the other the impact on the staking rewards is 600%. All the variables, except market share, are directly impacted by the Merge.

Total ETH staked will likely increase dramatically from the current 12% to closer to ~30% a 150% increase. As discussed earlier, the staking rate is likely to increase from 4% to ~5%, a 25% increase. There is no reason to think the Merge will significantly impact LSD market share so we can assume this is held constant and has no impact. Lastly, for the sake of this exercise let’s assume a 50% increase in the price of ETH. The aggregate effect of these different variables is 250%_118%_150%= 444% or a ~4.4x increase in revenue.

Expenses also meaningfully drop. The largest expense of these LSD protocols is incentivizing the liquidity pools between their LSD and native ETH. Given there are no withdrawals yet, it is extremely important to create deep liquidity to manage large flows between the LSD and native ETH.

However, once withdrawals are enabled these incentives will no longer be required. As there will then be an arbitrage if the two ever differ materially, natural market forces will keep them relatively pegged as arbitrageurs buy the LSD on any dips. This will allow the LSD protocols to drastically reduce their issuance (expenses), which will also materially reduce the sell pressure on the tokens.

LDO is trading at ~144x revenue on a pre-Merge number but this declines to ~31x when you look at it on a post-Merge number. While not overly cheap by traditional measures, this is attractive for a high-growth strategic asset in the crypto space where valuations are typically elevated. Importantly, this is real revenue that will accrue to the protocol.

A common concern among LDO critics is that this revenue does not get returned to holders. They often compare the protocol to Uniswap for this reason.

While it is true the revenue is not passed through to token holders at current, we do not think this is a legitimate concern nor do we think the Uniswap comparison is correct—just because token holders do not receive cash flow today does not mean they will not in the future.

We believe there will be a time when these returns are enabled. We also know that multiple large stakeholders agree on this issue. Furthermore, we do not think Lido should return cash today and would actually be very concerned with management’s competence if they did. This is an extremely early-stage business (~1.5 years old) that is still in its infancy growth phase. They require regular cash raises and are burning cash on a run rate basis today (this will change post-Merge).

It would not be sensible to raise money from investors to cover the burn and then distribute protocol revenue to token holders, in turn increasing the burn. This would be akin to a startup paying out investor distributions with early revenue despite not generating enough revenue to cover expenses. This would never happen in the traditional capital markets because it is not rational.

Many crypto participants are also concerned about Lido’s dominant market share. They have 90% share of the LSD market and stETH makes up ~31% of total staked ETH. While we think the concerns around centralization are overstated, we still believe Lido should remain below 33% share of staked ETH to eliminate any doubt about Ethereum’s credible neutrality. As far as the investment case for the protocol we do not think a 33% market share cap is concerning. In our opinion, there are many other growth vectors Lido can pursue other than market share, and the investment is already quite compelling with its current share.

To conclude, Lido is a key piece of infrastructure in the Ethereum ecosystem that has established product market fit and dominant market share in what will remain an incredibly fast-growing portion of the market. In our opinion, the frequently cited concerns around the protocol are either misplaced or misrepresented. Furthermore, it is reasonably priced considering its past and expected future growth prospects and therefore represents one of the most investable assets in the space.

While Lido is the market leader and largest player there are two other LSD protocols, Rocketpool and Stakewise, that also merit consideration. There are many unique aspects of each LSD and intricate detail that could be expanded upon. However, for the sake of digestibility, we will focus primarily on the high-level differences and expand upon the finer points in future discussions.

Both RPL and SWISE should benefit from any share that Lido cedes due to the centralization concerns. While we think any Lido share losses will be modest, even modest losses for Lido would equate to outsized gains for the smaller players.

For example, if LDO loses 4% market share, RPL gains 2.5% of that, and SWISE gains 1.5%, LDO will lose ~12% of their market share but RPL will gain ~50% and SWISE ~125%.

The 2nd largest player in the market, Rocketpool (RPL), has a unique staking mechanism and tokenomics. To stake through RPL, validators must pair RPL with native ETH and are required to maintain a minimum ratio between the two. This dynamic creates predictable and guaranteed demand for RPL as the ETH staking participation rises and more validators adopt the solution.

Another benefit of RPL is the practice of validators pooling with other users, allowing the required ETH to set up a staking node to be reduced from the normal 32 ETH to only 16 ETH. This reduced minimum allows for smaller operators to set up nodes and further incentivizes decentralization. This makes RPL a perfect complementary player to LDO, which should act as a tailwind for RPL’s market share as they will be a primary beneficiary of Lido’s effective market share cap.

Lastly, Stakewise is another interesting alternative to LDO. Their model is very similar to LDO’s but they are focused increasingly on institutional adoption, which should position them well for a post-Merge marketplace. They also benefit from a highly driven and professional team that has continued to execute well. Notably, they have discussed plans to eventually implement token-holder-friendly tokenomics that would see token holders directly receive excess protocol revenue.

Additionally, SWISE has been gaining notable traction with larger accounts looking to diversify their staking products (one proposal alone was recently approved by Nexus Mutual which would increase their TVL by 20-25%).

As they are the smallest player with the highest valuation, they are likely the highest risk/reward investment in the category.

To conclude, it’s hard to differentiate between value within the group. LDO is the cheapest and most secure, but with the least market share upside. SWISE is the most expensive, but with the most market share upside and RPL is in between with the added benefit of unique tokenomics and a decentralizing staking mechanism. Relative valuations are rational which suggests to us the market is efficiently pricing the different opportunities.

We have elected to own all three. We believe the LSD tokens are the highest EV Merge-related investments!

They will likely outperform ETH, but investors should expect higher volatility and lower liquidity.

The Merge Is Coming

The Ethereum Merge is coming. There’s no doubt about it.

With the date locked in for September 15th or 16th, this will be the biggest structural change in the history of crypto.

There are a lot of dynamics at play that investors need to consider.

Hopefully, this report helps you parse through all the information.

What’s the key takeaway? The Merge is not priced in.

Author Bio

Hal Press is the founder of North Rock Digital (NRD). NRD is a Digital Asset Hedge Fund focused on generating differentiated returns by investing in concentrated and high-conviction theses. Prior to founding NRD in 2021, Mr. Press worked as a senior analyst covering the technology sector, at Maverick Capital, a $12B Equity hedge fund.