Looking back at one of my previous posts made me question 2 things:

- How powerful is TA?

- Are my post titles too aggressive?

- "Think For Yourself. ?? Yeesh.. settle down jerk and don't tell me what to do."

I also need give

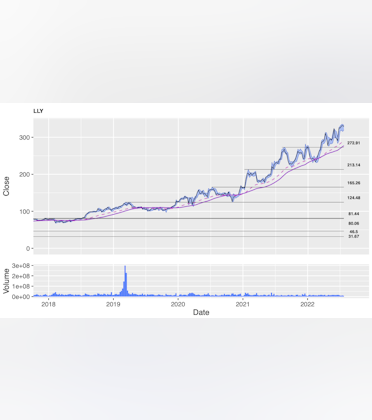

@irish credit for, in the comments of the original post, predicting the lower prices in the following 3weeks. It is also interesting that the price range originally identified has, so far, held up well (below). I still believe that, despite the demand concerns, the price will continue upwards during the busy/holiday shipping season and more accurately reflect the company's fundamentals.

I also hope this is the case as it will support the idea that 2 people (with differing timeframes) can both be "right" about a stock. No need for pumping / bashing... we all have the same objective and should celebrate/embrace the different strategies used to achieve this goal.

For the record, I think ZIM may reject off of ~$52 temporarily before continuing up. Watching and waiting!