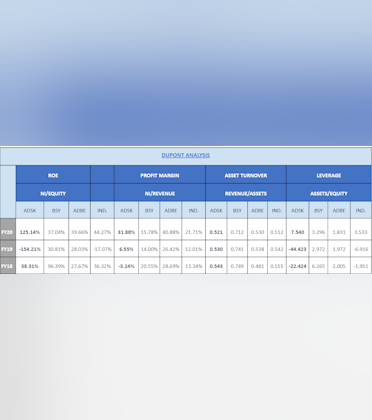

DuPont Analysis

Looking at numbers on the balance sheets and income statements could never be an outdated valuation method. Plugging those numbers into simple financial ratios like ROE, ROA, profit margin, etc. could right away indicate a company's performance. We could also tell where that company is in the industry and among its peers. That's why DuPont analysis is always one of my main methods when it comes to equity analysis besides other common and complex valuation frameworks. Additionally, by combining this quantitative analysis with other qualitative ones like SWOT and Macros thesis we would be able to have a more in-depth understanding of the firm's situation or what is influencing its performance.

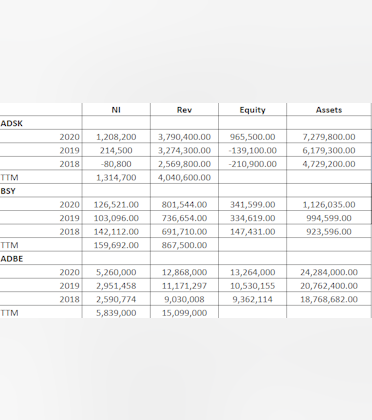

This is a DuPont Analysis that I did for $ADSK as a volunteer equity analyst, let me know what you think!

+ 2 comments