So what direction is the Fed going to choose?

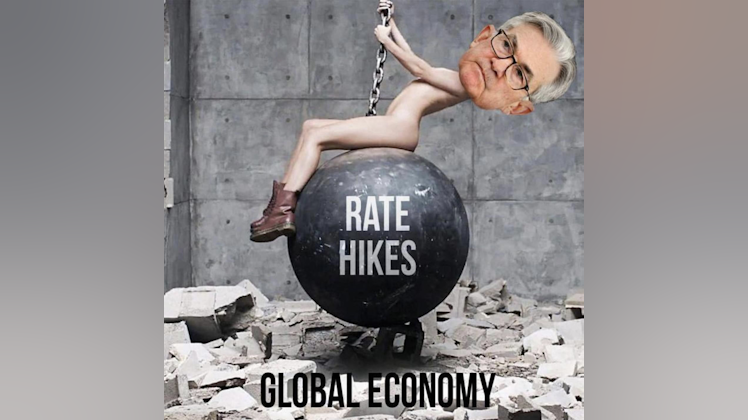

I believe the Federal Reserve is between a giant rock and a hard place and it’s going to have to make a hard choice – inflation or economic implosion. We are in fact very close to another financial crisis and it could be worse than in 2008.

2008 was all about too much debt and the inability to pay. Well, we’ve got a lot more debt now, and we’re even less able to pay. The only thing that kept it going was the artificially low interest rates.

The national debt has spiraled above $31 trillion. State and local governments are buried in debt. Corporations are levered to the hilt. And consumer debt is at record levels.

About a year ago, Treasury Secretary luminary Janet Yellen said there was no reason to worry about the national debt because interest rates were so low. But since the Fed started jacking up interest rates, the cost of financing the national debt has increased by a factor of 16.

So, if the debt wasn’t a problem because it was so cheap to finance it, well, it’s a huge problem now when the cost is 16-times higher and the Fed's balance sheet which in 2018 was at $4 trillion is now close to $9 trillion.

If the Fed really couldn’t get interest rates above 2.5% back then — it’s already got them above that now…

The Fed clearly needs to pivot. But inflation is going to run out of control. They’ve got to make a choice. Do they want inflation? Or do they want economic implosion?

Of course, if the central bank chooses inflation, we’re still going to have an implosion because we’ll ultimately end up with stagflation. It will just happen later.

That’s good enough for the politicians because all they care about is that it doesn’t happen now.

There’s only one way to legitimately fight inflation. They have to raise interest rates above the rate of inflation so real interest rates are positive. Right now, real rates are at -5%, Meanwhile, the US government has to make massive spending cuts.

They’re not even considering that. Because right now, the way the government pays for spending is with inflation. Inflation is the stealth tax by which the government pays for everything. … How did we get all this government? We didn’t get it for free. We paid for it with inflation. They created money to pay for all this stuff. Now, if the government wants to get rid of inflation, they have to get rid of that money.

That’s not happening. So, that brings us back to the choice.

Do we want to have a financial crisis, and cut government spending, and allow bankruptcies and defaults and all these losses, or, do we want to have inflation?

The reason the Fed is going to pick inflation is because that happens later. And, as we’ve seen, they can come up with a scapegoat — blame inflation on somebody else.

And these are supposed to be the smartest people around who set monetary and fiscal policy? Go figure...