Anchor Protocol: 20% guaranteed yield on your USD

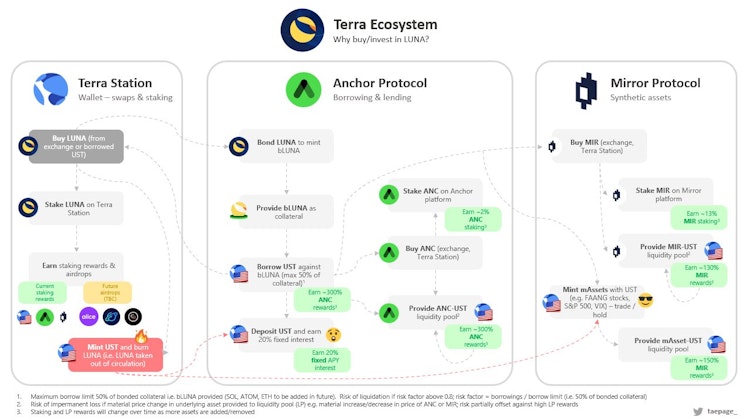

I talked about Anchor Protocol in my memo on the Terra Ecosystem. If you haven't read the terra memo yet, you should surely check it out, but I'll bring you up to speed on Anchor here anyways. Anchor is a low-volatility yield platform that guarantees a 20% yield on your UST (Terra's USD pegged stablecoin). Yes, you read that right 20% yield on an asset meant to have no volatility. Established Ethereum based leading applications completely pale in comparison to Anchor due to two big reasons:

- None of them offers a 20% yield on stablecoins. Compound, for example, has a 30 day average of around 6% for both USDC and USDT.

- The yield on these platforms is also volatile, making it unwelcoming for newcomers to DeFi (thus, the need to look at a 30-day average instead of real-time yields).

Okay, so Anchor sounds like it's a lot better than the competition. But how?

Anchor, like a bank, has two sides, lending and borrowing. Lenders deposit their UST to Anchor and get 20% returns (yields are also in UST), easy. But the borrowers who take UST loans out make the 20% interest for depositors happen.

When someone takes a loan from Anchor, they deposit assets called bASSETS as collateral. Now, these bAssets are actually tokens you'd get when you stake a Proof-of-Stake (PoS) blockchain asset. For example, by staking [[[[[$LUNA.X](/asset/LUNA:crypto)](/asset/LUNA:crypto)](/asset/LUNA:crypto)](/asset/LUNA:crypto)](/asset/LUNA:crypto) on Anchor, you get bLUNA. This bLUNA essentially grants its holder the ability to claim rewards (which come from mining on the PoS blockchain) for the $LUNA.X that's been staked. By collateralising the bAsset, a borrower allows Anchor to claim the rewards they would receive from staking their asset. These rewards normally range between 10-15% APY. Anchor's minimum collateral ratio is 200%, so you'd need to collateralise at least $2 worth of bLUNA to get $1 UST on loan. Thus, there's a clear opportunity for Anchor to provide very attractive interest rates to depositors by diverting staking rewards to them.

Beyond sacrificing staking yields, borrowers also pay around 38% in interest on the amount of UST they take as loan on Anchor, but they are incentivised to take these loans out with a variable drop of Anchor's Governance token $ANC. Currently, the rate for the drop is 82% on the loan amount, meaning that borrowers are actually getting paid 40% more in $ANC airdrops than they'd need to pay in interest (but they should also consider that they are giving up staking yields). I think taking a loan out from Anchor probably makes sense if you've got assets that you'd like to hold long-term but would like to have some liquidity for shorter-term plays, but it's not meant to be extremely lucrative in a vacuum (Borrowers make ~10-15% on their loan amount right now assuming a collateral ratio of 250%, look at the borrow section of Anchor Simulator to see a more accurate breakdown).

There is also the risk of liquidation every time someone takes a loan out on Anchor. The minimum collateral ratio is 200%, but I'd think borrowers should provide at least 250% in collateral given the volatility of the collateralised assets (currently only bLUNA). Note: If your collateral value is > 500 UST, then your loan is only partially liquidated; in case it's <= 500 UST, it is completely liquidated when under risk of under collateralization. This page on the docs has more information on loan liquidations, and I'd recommend reading it before taking out loans.

Some other things to note are:

- Once you stake your $LUNA.X to get bLUNA, unstaking to get back $LUNA.X takes 21 days. There is an option to burn bLUNA for $LUNA.X instantly, but it tends to lead to a loss of some funds. bLUNA is liquid, so it can be swapped on websites like Terraswap, but swaps to $LUNA.X also come at a 1-2% premium.

- The $ANC token, which gets dropped to borrowers and is used to govern the whole protocol, accrues value over time by capturing a portion of Anchor's yield. So the more assets Anchor has under management, the higher the value of the $ANC token.

- The amount of $ANC token that gets dropped to borrowers depends on how much UST has been borrowed from Anchor. If a small percentage of deposits have been borrowed, the amount of $ANC that is dropped on borrowers is increased to incentivise borrowing, and the inverse happens when there is no need to incentivise borrowing.

So, I've used 80% of a memo on earning 20% yield talking about borrowing. I think this is important because borrowing on Anchor enables the 20% yield. The only way to have confidence that any of this makes sense is to understand how the protocol can generate this yield and protect the depositors' principle. Hopefully, I've done a decent job explaining most of the moving parts when it comes to Anchor, including outlining all the risks involved.

Protocols like Anchor completely change how I think about finance and what is possible with decentralised finance. I have no clue whether the 20% is sustainable long-term (it surely looks feasible for the next couple of years with $ANC airdrop coming). Still, even if they achieve ~10% APY whilst giving many people a lot of confidence when depositing their money into the protocol, they would have added a lot of value to the world.

Thanks for reading!

Resources

Anchor Web App: https://app.anchorprotocol.com/earn

Anchor Whitepaper: https://anchorprotocol.com/docs/anchor-v1.1.pdf

Anchor Docs: https://docs.anchorprotocol.com/

Anchor Simulator: https://anchor-simulator.com/

Lido Finance: https://lido.fi/ (implementers for liquid staking of $LUNA.X using bLUNA)

lido.fi

Lido - Liquid Staking for Digital Tokens

Lido is a liquid staking solution for PoS blockchains.