Trending Assets

Top investors this month

Trending Assets

Top investors this month

"Corporate America is fretting over Taiwan risks, regulatory filings show" -FT

On this platform, I've talked about the high likelihood of China's invading Taiwan in the near future. According to the Financial Times, it seems like Corporate America shares my concerns.

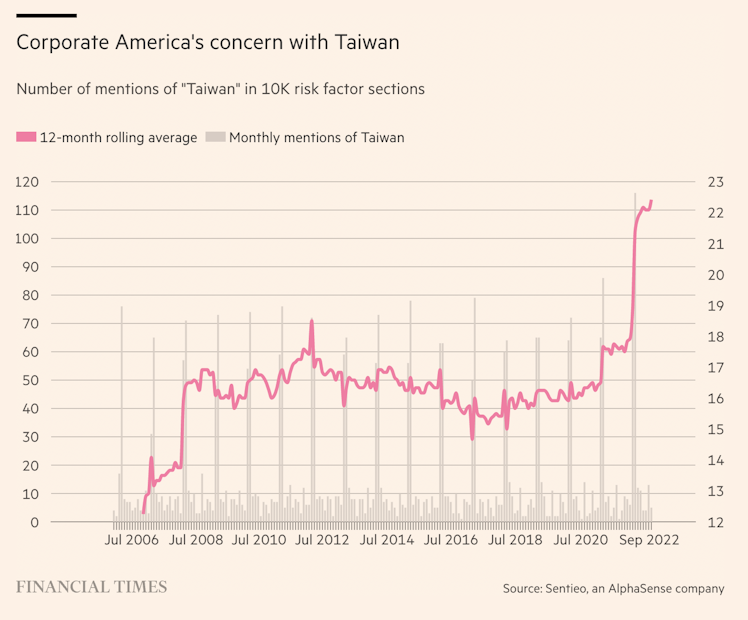

This chart, which can be found in the article, should catch people's attention. it shows a huge jump in mentions about Taiwan in the 10-K risk factors section.

Even if the chip shortage seems to be waning, it's important to note that "[t]he median US company had only had five days’ worth of chip inventories in 2021, down from 40 in 2019, according to a study the Department of Commerce."

In other words, this chip shortage could get a lot worse if China does decide to invade Taiwan.

Meanwhile, US Banks have recently prepared themselves for exiting China if ever the country faces a wave of sanctions, similar to what Russia endured, in the case of an invasion.

Typhoon season in the pacific is near an end. The seas of the Taiwan Strait are going to be calm for a month. China's window of opportunity for taking over Taiwan is near a close.

Out of all the sectors of the economy, the tech sector will be hit the hardest if China does invade Taiwan. With tensions between China and Taiwan being at a historic high, it's no wonder why insiders in the tech sector are scared of buying the dip in their company's shares.

Except for $INTC, because they are positioned to benefit the most from a war between China and Taiwan as their fabs will take over the majority of chip production and they're investing the most in building more chip production capacity outside of Taiwan.

www.ft.com

Corporate America is fretting over Taiwan risks, regulatory filings show

Technology is the sector most concerned, the semiconductor industry raising the loudest alarm

Already have an account?