Trending Assets

Top investors this month

Trending Assets

Top investors this month

Yum! Brands (Ticker: $YUM) - Brief Breakdown

For the full article check it out here.

Company Description and Qualitative Analysis

YUM! Brands, Inc., develops, operates, and franchises four fast food chains including KFC, Taco Bell, Pizza Hut, and Habit Burger Grill. These fast food chains specialize in various food types such as chicken, pizza, burgers, sandwiches, Mexican-style food, and other food products. At the end of 2021, YUM! Brands had nearly 27k KFC stores, over 18k Pizza Hut stores, nearly 8k Taco Bell stores, and just over 300 Habit Burger in approximately 157 countries and territories. The multiple brands and some side-by-side in one store front. The variety of brands and food products with a large retail footprint gives YUM a moat on various food products. With the diverse products, YUM is almost immune to various food trends and potential FUD surrounding a single brand.

Quantitative Analysis

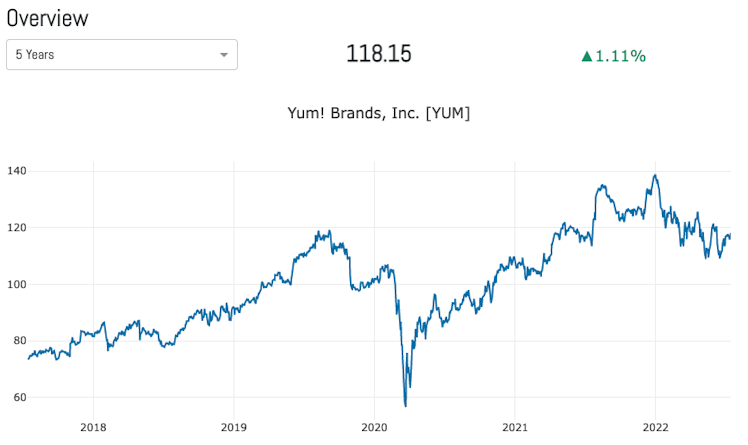

At the time of this writing (7/17/2022), $YUM is trading at $118.15 with a 52 week range of $108.37 - $139.85 and a market cap of $33.69B. In Q1 of 2022 YUM! Brands worldwide system sales grew 8% with 6% unit growth and 3% same-store sales growth. The first quarter GAAP EPS was $1.36 an increase of 27% YoY and first quarter EPS excluding Special Items was $1.05, a decrease of 1% YoY. Return of equity (ROE: Net Income / Total Equity *100) of YUM is -20.21% and net margin (net income / revenue) is 24.8%. The price to earnings (price per share / earnings per share) ratio was 21.48 and the debt to equities ratio (total liabilities / total equity) is -1.68. You can view YUM’s Q1 2022 earnings here and you can download their 2021 Annual Report here.

Bullish Thesis

Here are three points to support the bullish thesis:

- Restaurant Sales Increasing: According to Yahoo! Finance, restaurant sales increased by 0.7% in May while other spending such as retail has slowed. This is positive for the entire fast food sector but Yum! Brands are expected to grow 4.3% over the entire year and a 0.4% earnings growth over April and May lead to positive signs ahead for Yum!. More people flocking to restaurants means more will flock to fast food and Yums! Retail footprint gives it a leg up on most other fast food brands.

- Retail Footprint: As the world is more open and housing is increasing within cities, more people will be in the vicinity of a Yum! Brands store. Whether people get this food delivered, through the drive through, or sit in a store, having 50k retail stores is extremely beneficial when people are moving away from the city into the suburbs and smaller towns which have many of these locations.

- Menu Simplification: As many places are starting to take items off of the menu to “simplify” the menu, the Yum! Brands stores do not have that issue. The Yum! Brands play the hits. The menu has not changed for many of these brands with a few exceptions of small testing and additions when things are going well. People are creators of habit and the main items in the Yum! Brands menus have not changed in a very long time. The comfortability people face and the name brand of these fast food places will prove to be a benefit going forward.

Bearish Thesis

Here are three points to support the bearish thesis:

- Decrease in EPS: Although earnings have seemed to be positive, the earnings per share has decreased. This may seem like a trend in most companies as capital becomes difficult to get and a recession looming. A recession would mean that consumers spend less, although shown above that more consumers are spending at restaurants that may not translate to fast food. My thesis is that it will, but it is also a risk that fast food will not be a part of the beneficiaries of this movement. This decrease in EPS is worrisome but not the end of the world.

- Health Trend: This is a growing worry for all fast food brands as a whole. People are beginning to take control of their health and understand what is going into their bodies. This is positive for humanity but negative for fast food brands as it costs more to provide healthier and more fresh foods. Many fast food brands have moved towards the healthy trend but it is hard to escape things like fried chicken when the name of one of the chains is Kentucky Fried Chicken. It will be difficult to become healthy based on the reputation of the Yum! Brands, but I could be wrong on this front and people could continue to eat unhealthy in order to eat for less money.

- Involvement in Politics: YUM! Brands are now pulling their stores out of Russia which some may see as a positive for publicity, but lowering the retail footprint in an inflationary time globally does not seem fiscally smart in my opinion. There is obviously geopolitical risk with maintaining these store fronts in Russia, but limiting the amount of stores in a country will limit revenue in a very inflationary time. My thesis on the fast food industry is that it will grow during an inflationary time because people will find ways to cut expenses, but if there are not the YUM! Brand options consumers will just find another alternative. Consumers will also not eat at a fast food place based on their political stance. We’ve seen it with Chick-fil-A. No matter what these places say, if it is convenient and good, people will come.

For the full article check it out here.

greencandleinvestments.substack.com

Yum! Brands (Ticker: YUM) - Brief Breakdown

In my Brief Breakdowns,I pick a stock and present opposite sides – I present the bullish argument and the bearish argument.

Already have an account?