Trending Assets

Top investors this month

Trending Assets

Top investors this month

A Historical Perspective On Software Valuations

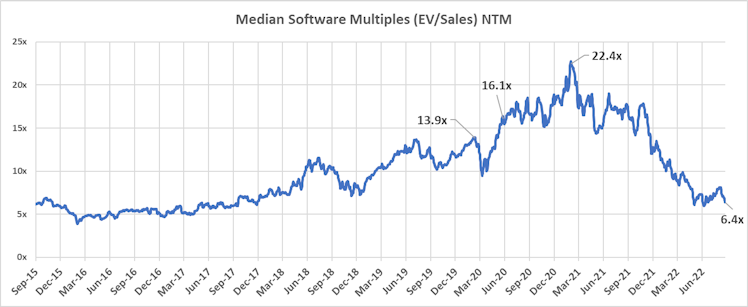

I pulled some data from Koyfin to determine where average software multiples for growth stocks lie against their 7-year history. Jamin Ball from Altimeter Capital had been putting up similar graphs on Twitter, but I thought I'd compute the numbers from my personal investment universe of software stocks.

I included the Median EV/Sales (Next Twelve Months) multiples from about 29 existing public names in growth-oriented software. These span applications, SaaS, cybersecurity, infrastructure, productivity, etc. Compared to software ETF indices, I'd say that my list leans towards more growth-biased businesses. There's no $IBM and $CSCO here.

Some of these names were not public in 2015-2017 and were excluded as data points for this graph. Anyway, here it is:

I recall 2017 being a goldilocks period for the market where multiples were neither too expensive nor cheap. Since then, however, there's a very strong argument for higher valuations considering the sheer speed and execution of growth for the cloud transformation crop.

- At the moment, we're at 6.4x on next twelve months.

- The pre-pandemic peaked at 13.9x, while the pandemic peaked at 22.4x

- The median and avg. of the chart across the 7-year period are 9.2x and 10.1x respectively.

- The pre-pandemic median and avg <March 2020 are 7.0x and 7.9x

Interest rates might be high, and inflation could continue to be painful, but I'm pretty confident investing in this space - partly because so many names have shown remarkable fundamental resilience in the last earnings season. The reinforcing theme is that a lot of software is mission critical and isn't just complementing operations - it is operations for any modern enterprise.

It's time to get greedy here for long-term investors. Software is eating the world.

Already have an account?