Trending Assets

Top investors this month

Trending Assets

Top investors this month

Roku

Does This Change Anything For Roku Stock?

Roku will start building its own TVs while also still partnering up with the likes of Hisense and TCL.

Hardware is a money-losing business so let's see if the platform revenue increases substantially thanks to this move.

We got some positive news as well.

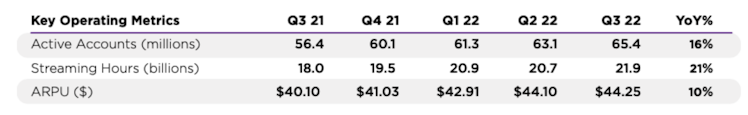

- Roku reached 70 million Active Accounts

- 23.9 billion hours streamed in Q4

- 87.4 billion hours streamed in 2022.

That's a nice increase QOQ as well.

My big question is, can they get expenses under control and work their way back to positive FCF?

What do you think?

YouTube

Does This Change Anything For Roku Stock?

In this video, I will talk about Roku stock, why the company will be building its own TV, and the new milestone the company has reached.👉A portion of this v...

Already have an account?