Trending Assets

Top investors this month

Trending Assets

Top investors this month

Brief thoughts on proxies and management financial incentives

The reason for this post is a discussion we had with @ifb_podcast.

Regarding proxies we look for insiders’ ownership to get an understanding if there is skin in the game.

Regarding financial incentives we would like to see compensation that is tied to long term performance but not solely on revenue or EPS metrics as a company can grow without making profits whereas EPS can be manipulated through share repurchases when the price does not justify repurchases. There is no one size fits all but looking at their characteristics you can get an idea whether it drives short-term thinking or long-term.

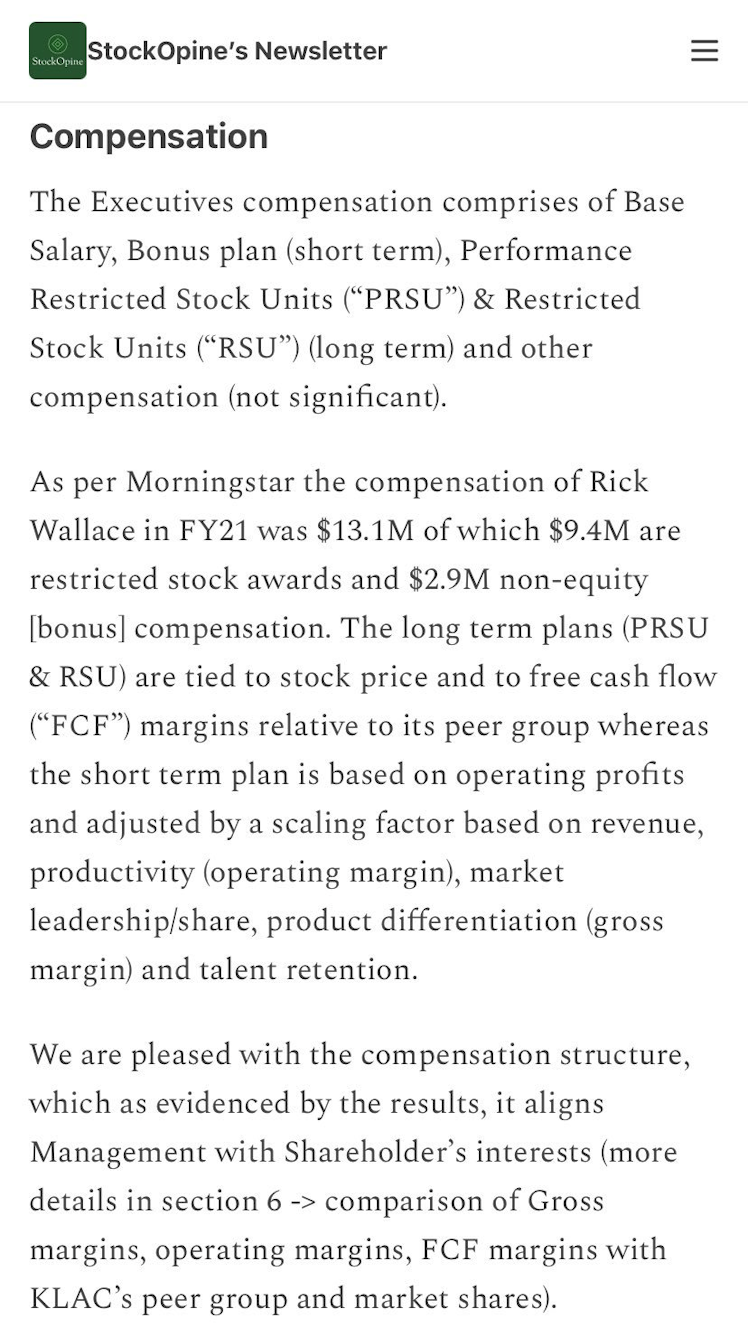

There are two examples that we would like to share through screenshots from our write-ups on $KLAC and $ABNB. $KLAC 👇

As you can see, long term plans account for the vast of $KLAC CEO’s compensation. These plans have FCF as a key determinant. What a better way to measure actual performance and eliminate any accounting inconsistencies?

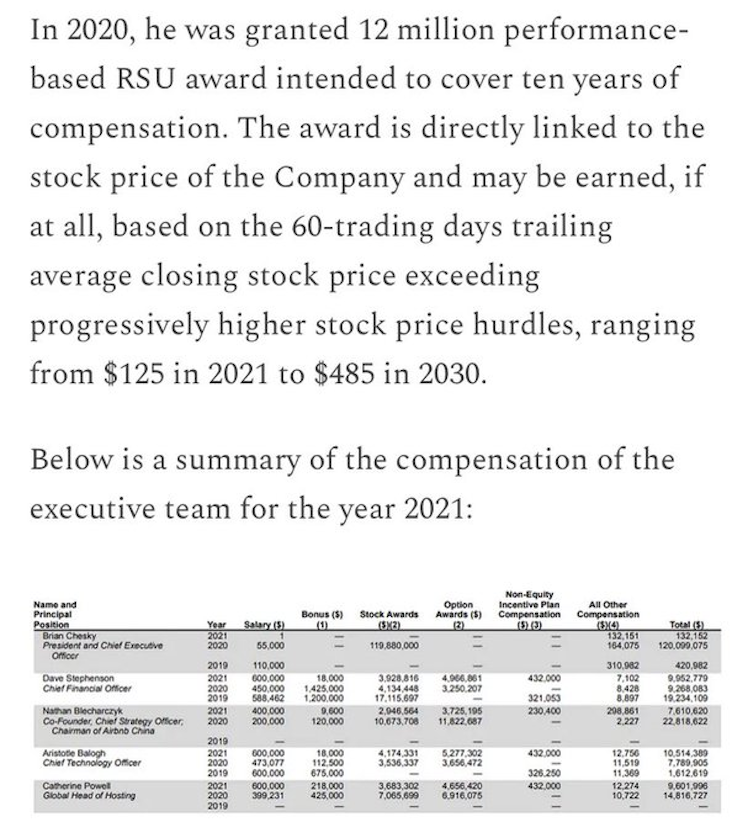

$ABNB 👇

At first glance this may look weird as it focuses on share price, and it can be ‘manipulated’ through share repurchases. Nonetheless, the long-term thinking (10 years ahead) show that the CEO is here to stay (despite being the cofounder).

Striving for c. 4x growth in share price for shareholders it shouldn’t be that bad. Why? If $ABNB doesn’t execute & profits deteriorate and if management takes wrong decisions that destroy shareholders’ value, it would be unlikely for the price to reach those levels.

Any thoughts?

Not a financial advice.

Already have an account?