Trending Assets

Top investors this month

Trending Assets

Top investors this month

$TSLA just missed deliveries by 20K, what does this mean for Q3 results?

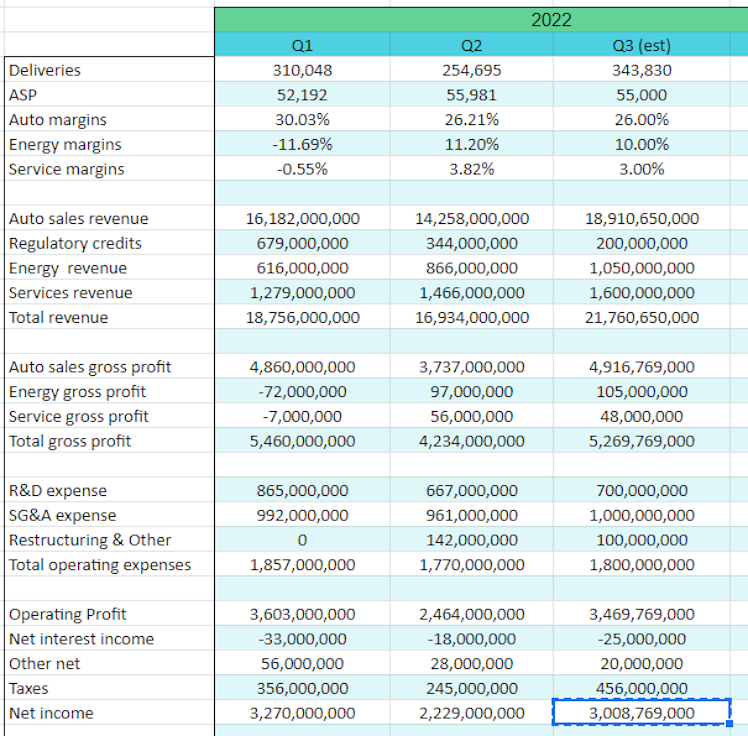

So $TSLA just released their Q3 delivery numbers, and they came way bellow analysts expectations. The street was expecting 360k deliveries and $TSLA delivered around 343K for the quarter. This is still a new record, but the implications for Q3 earnings are pretty big, both in margins and GAAP profit.

Before, I was expecting 357K deliveries, and margins of 30%, which would have meant a net profit of around $3.98B for Q3. I'm revising margins down to 26% because of the big disparity between production and deliveries, causing an increase in inventories. I posted my new estimates bellow, but we will see net profit come at around $3.0B.

So how can a change of 14K in deliveries change net profits by 1 billion? Well, that's $825M of revenue that will now come in Q4, but we accrued the costs of making the product already. I expect a lot of people to panic and sell their shares tomorrow, both institutions and retail. But a lot of institutions already knew, and this explains the massive drop last Friday, so part of it might be already baked in.

The question is "why such a big miss?" Simply put, China's economy sucks right now. So much so that Tesla had to ship around 1 week of production that would have been delivered in China to Australia and Japan instead. This means that going forward Tesla might need to start dropping prices, and the days of $55K ASPs might be over.

I'm not too worried about this, because as 3rd generation Gigafactories in Texas and Berlin ramp up, there's plenty of build efficiencies that will make up for the decrease in selling prices (structural battery packs, one piece body casting, etc). Going forward, watch out for price cuts in Q4, if there's none, that's extremely bullish for $TSLA stock. Long term thesis remains unchanged.

Already have an account?