Trending Assets

Top investors this month

Trending Assets

Top investors this month

6th June 2022 - Trading Journal

News: I am delighted to have partnered with Interactive Brokers for for the next few months. I use IBKR as my main brokerage having tried many others including Degiro, Tastyworks, Trading212. For a trader or investor based in Europe it is by far the most powerful and professional platform to use long term in my opinion. I'll be writing some more about it's pros and cons going forward but for now if anyone has any questions please feel free to DM me or comment below. You can check out their platform here: Interactive Brokers - Please note I do not receive any bonus or referral if you sign up, I will speak honestly about my experience (good and bad) with the platform and others. Thanks for the support!

Recap from last week: My better half had an appendicitis last week so I was trading minimally and didn't have time to do my write ups. On Friday 3rd June I traded $HDSN & $SHLX. On the former I was stopped out as it reversed quickly. In hindsight the volume wasn't there. I'm still in $SHLX from $14.39 with a stop at $13.80. So far it hasn't made the move I wanted but it's in a strong sector with a good setup.

I did not do much work last week except work on some scans and I also want to streamline my watchlists a bit better. I currently use TC2000 & Tradingview. I love tradingview for many things but they fall down with scans and the speed at which you can go through watchlists. I think I need to have only my focus list on there and use TC2000 for everything else including my sector lists. This will require a bit of work.

Situational awareness:

Cautiously Bullish on Monday. The market is coiling for an explosive move one way or the other. I believe that will be upward but my belief is of course weakly held.

Pre Market Work:

Chinese names rallying early pre market. I had been keeping an eye on $PDD other names with a lot of volume were $FUTU & $DQ. Regardless of big moves none of these names currently meet my criteria to trade in terms of a proper setup. I am also on the fence on whether I would even want to trade Chinese names, however it must be considered if they show significant accumulation and trend. So far they have not in my opinion.

$ASH a Chemical name had a nice setup and a strong pre-market volume. It also had a positive shake out in the last week or so testing the 200 Day twice with a strong bounce on the second time around. Some other notable names I've mentioned recently were $BMBL & $DOCN both of which are continuing to set up well for a longer outlook.

Trading day:

Identified in Pre-Market I took $ASH at $111.20.

Notice the higher than average volume on the day + RS + Price breakout. To me this looks like a positive name to be long despite the fade with the market late in the day.

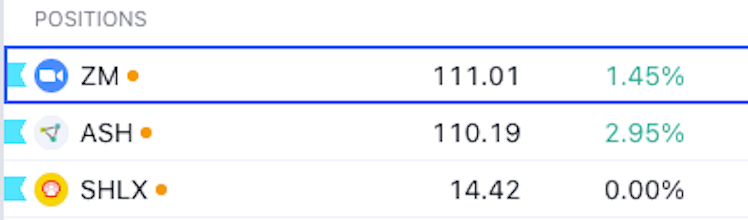

Shell stayed largely flat for the day and $ZM. was all over the place but it's range is still very tight with the moving averages converging more each day. On a breakout from this point I would considering adding to my call spread position which is currently slightly in the green. Notice the volume dry up in orange.

End of day Thoughts:

As mentioned in pre market I certainly wish to improve my watchlists. They're pretty good but some fine tuning and ability to scroll through them quickly would help. I also want to develop my scans a bit more in TC2000.

Notes & Open Trades:

- $SHLX - 5% Stock Position - Entry $14.39 - Stop: $13.80

- $ASH - 5% Stock Position - Entry $111.20 - Stop: $104

- $ZM - August 19th $150/$170 Bull Call Spread - Cost $1.49 per contract

Please note I operate my risk with options that I can lose 100% of the premium. This is the safest way to trade them in my opinion. Even if I cut at 50% once I am setup to lose 100% within my risk threshold then I will stay ahead of my required R:R.

Already have an account?