Trending Assets

Top investors this month

Trending Assets

Top investors this month

Don't be blinded by the AI craze! Major banks warn of topping out of speculation, traditional cyclical stocks poised to rise

Despite the market's frenzy over artificial intelligence, investors have been quietly displeased with the tech oligarchs' recent stock market moves. t Rowe Price Group, Bank of America and Citigroup, among others, believe the hype around AI has peaked. But that's not bad news for the market, they argue, because so-called cyclicals, the "old economy" companies like banks and mining, are poised for a rebound.

In recent months, artificial intelligence-related stocks such as $NVIDIA (NVDA.US)$ and $SUPER Micro (AMD.US)$ have been in demand. With record capital flows, these stocks led the Nasdaq 100 to its largest-ever performance gap over the Russell 2000 small-cap index. For example, a $1,000 investment in the Nasdaq on Jan. 1 would have returned $330 by now, while the same amount invested in the Russell 2000 would have yielded nothing.

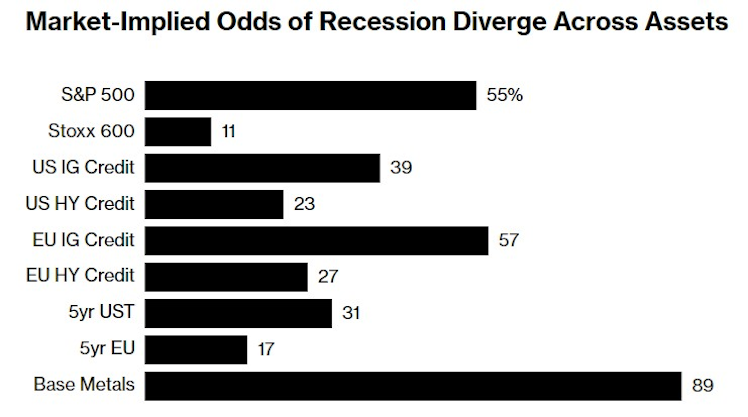

Nevertheless, small-cap stocks are starting to recover lost ground. This week, the Russell 2000 index rose more than the Nasdaq by nearly 5%, as more and more investors are betting that hard-hit cyclical stocks will earn greater returns than "bubble" technology stocks in the future. This is because they believe that the U.S. recession and interest rate cuts are expected to be too much, and this is a powerful driver of technology stocks.

Sebastien Page, chief investment officer at asset management firm T Rowe Price, has been snapping up small-cap stocks because he believes the market is overstating the risk of recession. These assets look really cheap, and this is an opportunity to get in when others aren't ready."

Some are also skeptical that the rally around large-cap stocks can be sustained. The S&P 500 is hovering in bullish territory, but more stocks touched 52-week lows in May than touched 52-week highs. Market concentration is at an extreme, with the index's five largest constituents (especially all technology stocks) now accounting for nearly a quarter of the index's market capitalization. page noted: "This has been an incredibly concentrated market rally. A handful of stocks are up and others are essentially flat."

Some long-time technology stock longs are also reducing their positions. Edmond de Rothschild Asset Management cut its holdings in Nvidia, which it had held since at least 2020, citing "overvaluation" in the artificial intelligence technology sector.

Cyclical stocks suffered a setback

Cyclical banking and mining stocks performed strongly in 2022, thanks to rising interest rates and normalization after the new crown epidemic. But as the U.S. banking turmoil in March sparked fears of a severe recession, investors rushed to buy so-called growth stocks, which benefit more when borrowing costs fall.

But many economists now expect the recession to be mild and short-lived - Bank of America, for example, expects U.S. GDP to fall 0.8 percent from peak to trough, and its head of U.S. equity strategy, Savita Subramanian, says the resolution of the U.S. debt ceiling, along with a tight job market, provides "a less scary recession" is in place. She expects cyclical stocks to lead the market higher from now on, rebounding from the largest position reduction since 2008.

Similarly, a team of Citi strategists led by Scott Chronert is urging clients to allocate wait-and-see cash to cyclicals, predicting that "cyclicals in the S&P 500 will gain market cap share at the expense of growth."

Chronert's recommendations are based in part on valuation gaps, with an expected P/E ratio of about 30 times for the Nasdaq 100 and 20 times for the S&P 500 cyclicals. He also expects a mild downturn, with the "shock effect" not as severe as in previous periods, given that much of the market is on the defensive.

Artificial intelligence wave

Although Chronert is bullish on cyclical stocks, he admits that it is difficult to "fight" the tailwinds of artificial intelligence. As a result, he advises investors who are already invested in technology stocks to hold their positions, while warning that the current rally has gone too far for new investors to join. He added: "The momentum is still strong, but it's hard to catch up."

Meanwhile, economic data was mixed. A measure of economic surprises showed that key indicators exceeded expectations as the labor and housing markets slowed, but only gradually. But inflation did not cool as quickly as hoped, and the U.S. Treasury yield curve, a key recession indicator, continued to warn.

This leaves those hoping to prepare for a cyclical rebound in a dilemma, all the more so if they suffer a setback earlier in 2023 due to the market's sudden shift toward technology stocks. BNP Paribas Investment Management was one of the firms found to have increased its holdings in financials and value stocks earlier this year. They are hesitant to put more money into cyclical stocks despite doubts about an AI-driven rally.

Despite the market's frenzy over artificial intelligence, investors have been quietly displeased with the tech oligarchs' recent stock market moves. t Rowe Price Group, Bank of America and Citigroup, among others, believe the hype around AI has peaked. But that's not bad news for the market, they argue, because so-called cyclicals, the "old economy" companies like banks and mining, are poised for a rebound.

In recent months, artificial intelligence-related stocks such as $NVIDIA (NVDA.US)$ and $SUPER Micro (AMD.US)$ have been in demand. With record capital flows, these stocks led the Nasdaq 100 to its largest-ever performance gap over the Russell 2000 small-cap index. For example, a $1,000 investment in the Nasdaq on Jan. 1 would have returned $330 by now, while the same amount invested in the Russell 2000 would have yielded nothing.

Nevertheless, small-cap stocks are starting to recover lost ground. This week, the Russell 2000 index rose more than the Nasdaq by nearly 5%, as more and more investors are betting that hard-hit cyclical stocks will earn greater returns than "bubble" technology stocks in the future. This is because they believe that the U.S. recession and interest rate cuts are expected to be too much, and this is a powerful driver of technology stocks.

Sebastien Page, chief investment officer at asset management firm T Rowe Price, has been snapping up small-cap stocks because he believes the market is overstating the risk of recession. These assets look really cheap, and this is an opportunity to get in when others aren't ready."

Some are also skeptical that the rally around large-cap stocks can be sustained. The S&P 500 is hovering in bullish territory, but more stocks touched 52-week lows in May than touched 52-week highs. Market concentration is at an extreme, with the index's five largest constituents (especially all technology stocks) now accounting for nearly a quarter of the index's market capitalization. page noted: "This has been an incredibly concentrated market rally. A handful of stocks are up and others are essentially flat."

Some long-time technology stock longs are also reducing their positions. Edmond de Rothschild Asset Management cut its holdings in Nvidia, which it had held since at least 2020, citing "overvaluation" in the artificial intelligence technology sector.

Cyclical stocks suffered a setback

Cyclical banking and mining stocks performed strongly in 2022, thanks to rising interest rates and normalization after the new crown epidemic. But as the U.S. banking turmoil in March sparked fears of a severe recession, investors rushed to buy so-called growth stocks, which benefit more when borrowing costs fall.

But many economists now expect the recession to be mild and short-lived - Bank of America, for example, expects U.S. GDP to fall 0.8 percent from peak to trough, and its head of U.S. equity strategy, Savita Subramanian, says the resolution of the U.S. debt ceiling, along with a tight job market, provides "a less scary recession" is in place. She expects cyclical stocks to lead the market higher from now on, rebounding from the largest position reduction since 2008.

Similarly, a team of Citi strategists led by Scott Chronert is urging clients to allocate wait-and-see cash to cyclicals, predicting that "cyclicals in the S&P 500 will gain market cap share at the expense of growth."

Chronert's recommendations are based in part on valuation gaps, with an expected P/E ratio of about 30 times for the Nasdaq 100 and 20 times for the S&P 500 cyclicals. He also expects a mild downturn, with the "shock effect" not as severe as in previous periods, given that much of the market is on the defensive.

Artificial intelligence wave

Although Chronert is bullish on cyclical stocks, he admits that it is difficult to "fight" the tailwinds of artificial intelligence. As a result, he advises investors who are already invested in technology stocks to hold their positions, while warning that the current rally has gone too far for new investors to join. He added: "The momentum is still strong, but it's hard to catch up."

Meanwhile, economic data was mixed. A measure of economic surprises showed that key indicators exceeded expectations as the labor and housing markets slowed, but only gradually. But inflation did not cool as quickly as hoped, and the U.S. Treasury yield curve, a key recession indicator, continued to warn.

This leaves those hoping to prepare for a cyclical rebound in a dilemma, all the more so if they suffer a setback earlier in 2023 due to the market's sudden shift toward technology stocks. BNP Paribas Investment Management was one of the firms found to have increased its holdings in financials and value stocks earlier this year. They are hesitant to put more money into cyclical stocks despite doubts about an AI-driven rally.

Already have an account?