Trending Assets

Top investors this month

Trending Assets

Top investors this month

Opportunities in Wine

At the height of the SPAC boom, the US stock exchanges saw two winemakers go public: Duckhorn, which goes by the ticker $NAPA, and Vintage Wine Estates $VWE.

Vintage Wine Estates has over 50 wine brands. Duckhorn Portfolio has 10 wine brands. While Vintage encompasses wines in all price segments, Duckhorn Portfolio is focused on the luxury wine market.

Both winemakers grew via bolt-on acquisition. Because wineries are known for being profitable (unlike many startups), success was a given. There is going to be the fear that when a larger winemaker acquires a smaller winemaker, the company will mismanage the brand that the smaller winemaker built and the acquisition will turn out to be a failure, but thankfully, the management team at Vintage and Duckhorn has been able to avoid that fate and have instead helped those wineries grow faster than if it were independent. The success of these wineries' acquisitions does inspire smaller winemakers, who cater to niche audiences that larger winemakers can't access, to consider selling their operation to the larger winemakers.

When comparing Duckhorn to Vintage, even though both firms are more diverse in the geography of their supply chains, Duckhorn is more concentrated along the West Coast while Vintage has its vineyards in various parts of the US.

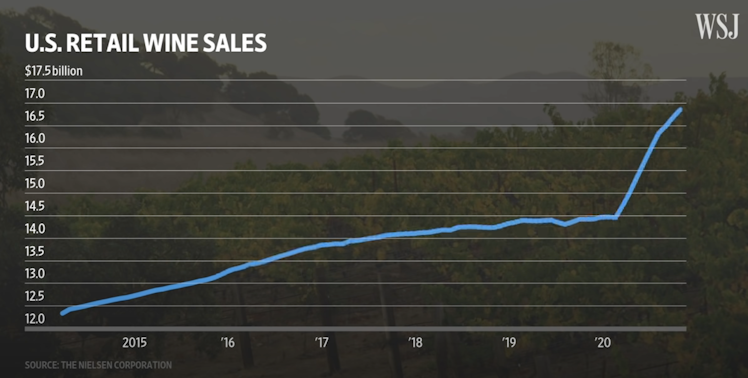

During the pandemic, US retail wine sales shot through the roof. Vintage saw its net revenues grow by 14% YoY from 2019 to 2020. Duckhorn saw its revenues grow by 12.2% YoY within that same time period.

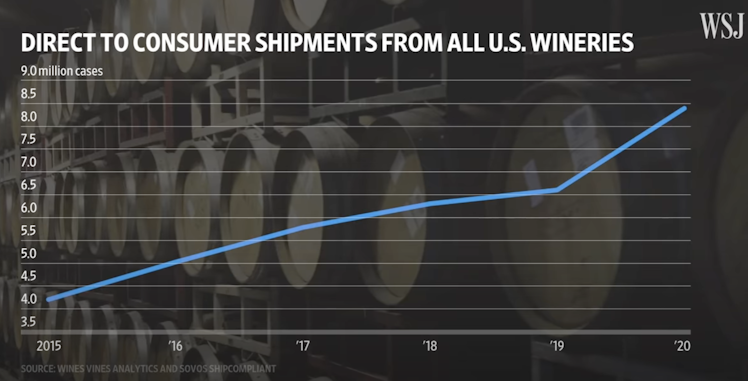

Here are some charts that the WSJ featured when talking about the winemakers going public.

In the past, other winemakers have gone public. Some have gone bust because competition in the wine industry is fierce and others sold themselves (notoriously to Constellation Brands $STZ) because they couldn't keep up with Wall St. growth expectations.

With the severe wildfires that happened in Napa County over the past few years as well as wildfires near Santa Barbara and other areas known for winemaking, geographic diversity has been something the wine industry has been emphasizing since. Vintage and Duckhorn use M&A to help fulfill that geographic diversity while at the same time, being able to appeal to different wine drinkers.

At the end of the day, wine is an experience good and the weather is what determines the price of the wine. If the weather was good that year, one can be assured that that wine will be tasty, because great weather = great grapes = tasty wine. Since Duckhorn is focused on the luxury wine segment, it is more prone to the weather than Vintage.

Something that I found intriguing was that both Duckhorn and Vintage are investing more in their DTC sales channel than in their B2B and wholesale channel. $NKE and $UAA as well as other retailers have been focusing on building their DTC channel too. The margins for DTC are generally higher and for the wine industry, many of these wine brands are trying to gain the same depth of customer relationship, if not more, than what retailers like Nike and Lululemon already have. For the majority of people, we know that Nike shoes are the best shoes out there for the common person, but when it comes to wine, there's a lack of brand loyalty in that space. Duckhorn and Vintage are trying to change that.

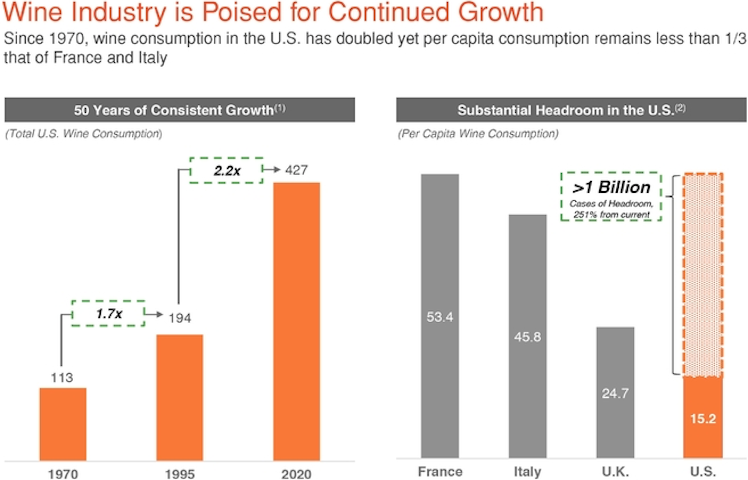

When looking through the S-1s for both Duckhorn and Vintage, I found Vintage's S-1 describing the entire wine industry while Duckhorn's S-1 focused on why the luxury wine segment is the place to be. With that, let's look at how the wine industry is doing overall.

Firstly, Vintage thinks that by comparing the wine consumption per capita metric in the US with that of France, Italy, and the UK, it shows that the wine industry is positioned for more growth.

I do have some issues with that, mainly that wine isn't a big part of American culture and that wine seems to be something that the upper class prefers to spend its money on while the majority of alcoholic beverage consumers prefer beer.

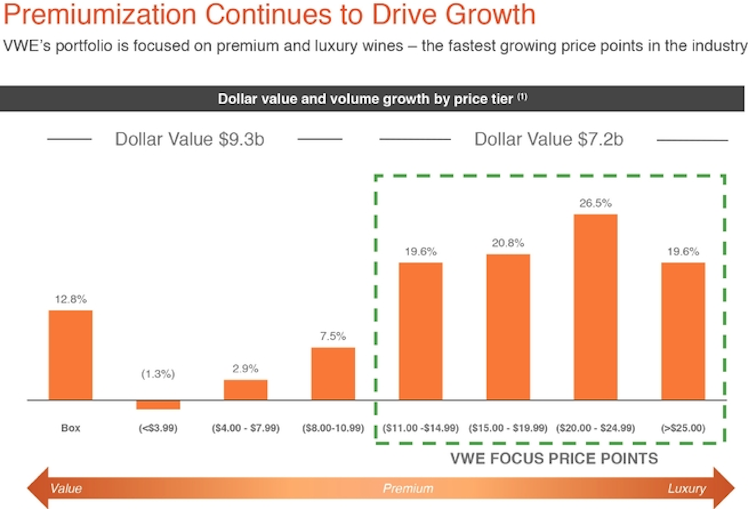

That could explain why premiumization is driving growth in the wine industry.

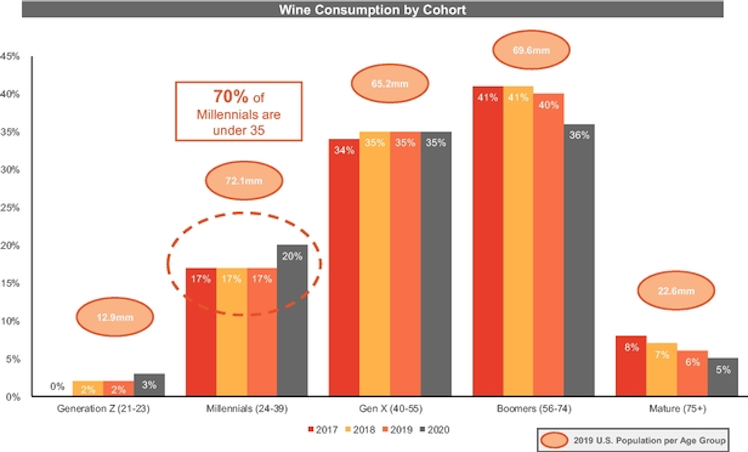

Vintage supports the trend of growing wine consumption by noting that millennials are looking to become major consumers of wine.

In the S-1, Vintage notes:

"As the millenial cohort approaches mid-30s, a greater proportion of that group has tended toward wine consumption and is widely expected to underpin generational adoption of wine as an alcoholic beverage of choice. The same dynamic occurred as Baby Boomers reached their mid to late 30s and their lifestyle and purchasing power changed such that they began to consume wine in greater quantities. Management's expectation is that a similar dynamic will take place with millennials, augmented by lifestyle marketing, social media and other direct-to-consumer campaigns to increase awareness and purchase activities.

Additionally, younger consumers are shown to patronize and support companies that align with their values and sustainability practices. A 2019 Deloitte Global Millennial Survey found that around 42% of millennials responded that they have begun or deepened business relationships with companies and brands that have a positive impact on society and the environment. Our portfolio is well-positioned to attract this fast-growing segment of younger generation of sustainability-focused, affluent wine consumers."

Will millennials replicate the wine consumption patterns as baby boomers? That is yet to be seen. While the paragraph notes that purchasing power had a strong influence on how Baby Boomers were able to afford to consume wine in greater quantities, there is concern that the drastic reduction in earnings with the millennial generation will hinder their ability to afford wine in larger quantities. Furthermore, the DARE program, which was made in 1983 and spread throughout the entire US as time went on, has played a major influence on why Gen Z is less willing to try alcohol compared to the older generations. Millennials had exposure to the DARE program when they were in grade school, but I doubt that the program was in every school district by the time most people in that generation graduated from high school because these types of programs take time to expand throughout the nation.

Now moving on to Duckhorn's S-1.

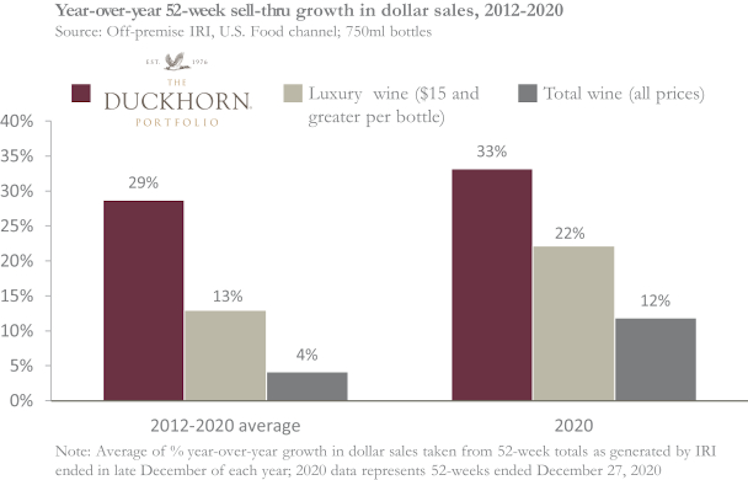

The first chart I see is this chart:

Here's an explanation:

"We expect premiumization to continue to shape the wine industry in the United States. According to IWSR, the U.S. luxury wine segment aggregate sales value from 2020 to 2024 is expected to generate a CAGR more than four times greater than that of the CAGR of the overall wine industry in the same period."

In sum, Duckhorn Portfolio is expected to grow faster than the entire wine market because it is focused on the luxury wine segment.

Duckhorn notes in their S-1 that the luxury wine segment is highly fragmented. In my head, that signals M&A opportunities. At the same time, with Duckhorn's size and resources, Duckhorn has positioned itself to be one of the few luxury winemakers that can scale its production and profits, making it a "one-stop-shop" for consumers' luxury wine needs.

Having a strong position in the luxury wine segment makes Duckhorn more appealing to retailers and distributors. This helps Duckhorn grow the number of places where it can sell wines and increase brand awareness, which helps drive even more demand for Duckhorn's wines.

Scalability is a big reason why Duckhorn is a fantastic wine business to invest in. Here's a paragraph within the S-1 where you can learn more about the advantages that come with scalability in the wine business:

To add more emphasis on scalability, Duckhorn has a part called "rapid scalability" and it notes:

"Contracted supply from our trusted grape grower and bulk wine supplier network enables us to react to market trends and grow luxury winery brands, like Decoy, quickly while maintaining quality excellence."

As for the target market, Duckhorn notes:

"Consumers in the United States have steadily increased their per capita spending on wine over time to $163 per year in 2019, up from $141 in 2017, equating to a 7% CAGR, according to Statista. Compared to peer countries, the United States experienced one of the highest annual growth rates per capita in wine consumption in 2019, and we believe the United States still holds ample opportunity for growth."

While Vintage notes that US wine consumption per capita is behind France and other nations, Duckhorn notes that the growth in US wine consumption per capita is fast growing. In a way, it shows that the US wine market isn't established and is growing fast while other markets like France or Italy are established.

Summary

Vintage Wine Estates is a pure play on the overall wine industry as it's dedicated to producing wines at nearly all price points. Duckhorn Portfolio is a pure play on the luxury wine segment. While both companies are fantastic plays on the consolidation of the wine industry as well as on the wine industry itself, I think that Duckhorn Portfolio is a better and safer play on the wine industry mainly because its targeted demographic is wealthier and is less impacted by the economic cycle compared to Vintage.

In a way, Duckhorn is like the LVMH of wine and Vintage is like the "affordable luxury" peer of the wine market.

www.sec.gov

S-1

Already have an account?