Trending Assets

Top investors this month

Trending Assets

Top investors this month

What Dividend Strategy Does Best in a Bear Market?

From my most recent article: As the economy falls further into bear market territory, it is clear that dividend investing strategies have held up better than most other investing strategies this year. Today I read an article from a Morningstar writer about which dividend investing strategies are outperforming year to date 2022. This article looked at how much that performance has varied depending on specific dividend investing approaches.

Generally speaking, there are usually two schools of thought when it comes to dividend investing: dividend yield investing vs. dividend growth investing. Dividend yield is calculated as the latest dividend payment annualized divided by price. Dividend growth is defined as the rate of change of dividends paid by a company over time, generally the most recent 3 or 5 year period. Clearly, a high dividend investor is more focused on the size of the dividends they receive while a dividend growth investor cares more about the historical and potential growth of the dividend. Both styles generally have the same goal, which is create an income stream.

However, an investor’s time horizon can play a significant role in determining which strategy they focus on. Older folks may want to put their money in high yielding yet consistent payers like Realty Income ($O) or Enterprise Products Partners ($EPD). This is because reliable income now is more important to them than growing long term wealth. For younger investors, it may make more sense to focus on a dividend growth strategy by investing in companies that have low payout ratios and potential to create a long track record of increasing dividends like Lowe’s ($LOW) or Visa ($V).

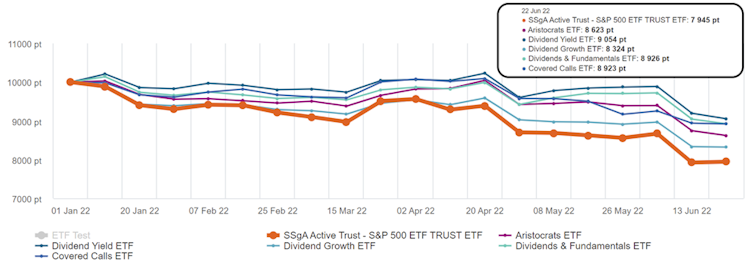

With dividend strategies faring better than most other for 2022, the article looked at which one is doing the best. The article concluded that strategies that invest in high yield companies with healthy financials outperformed the most. After reading that, I decided to evaluate that conclusion for myself by back-testing a handful of dividend paying ETFs which follow various strategies. Using Sharesight, I was able to back-test ETFs that follow various dividend investing strategies.

As you can see in the graph above, the S&P has fallen by 20.55% year to date. The best performer of the dividend strategies was the dividend yield strategy down by only 9.46% year to date, followed by the dividend fundamental strategy down by 10.74% year to date. Surprisingly, the covered call high yield ETF was a very close third down by only 10.77% year to date!

I dive into a little more detail in the article, but this is enough to give you the full idea. Thanks for reading!

Dividend Dollars

What Dividend Strategy Does Best in a Bear Market? | Dividend Dollars

Dividend investors are faring better than most of the market in this down trend, but what dividend strategy is doing the best?

This is so timely. As you said the time horizon is crucial to determine which of the two dividend strategies fair better in a bear market. I know that @reasonableyield @dividendtown @eggplant @justdividends @stock.owl will really enjoy this article too.

Already have an account?