Trending Assets

Top investors this month

Trending Assets

Top investors this month

High-Quality Small-Cap Stocks are Thriving in 2024

Most stocks have gone nowhere for months.

The media will have you believe equities are doomed as rates drive higher.

Don’t fall for that story. Under-the-surface reveals plenty of leading companies.

High-quality small-cap stocks are thriving in 2024.

Let’s face it, fear is a powerful emotion. There’s no better place to witness this fight or flight response than in the stock market.

The latest stressor du jour is inflation. After the hotter than expected March CPI dropped 24-hours ago, equities suffered across the board.

The year-over-year inflation reading saw overall prices rise 3.5%…a tad above consensus estimates.

This clearly spooked investors as few stocks were spared yesterday. The S&P 500 fell .95%. Even worse, left for dead small-caps were crushed. The S&P Small Cap 600 crashed 2.94%.

Keep in mind, those paltry returns are measuring popular benchmarks.

The reality is that when you only focus on indexes, you can miss massive opportunities hiding in plain sight.

Today, we’re going to do a data dive looking at the overall state of the market. Our Big Money Index is breaking down to fresh lows.

But that isn’t stopping outlier stocks from racing higher.

If you want to learn how markets work, study supply and demand mechanics. When buyers are more aggressive, stocks rally.

When sell orders are increasing, equities fall.

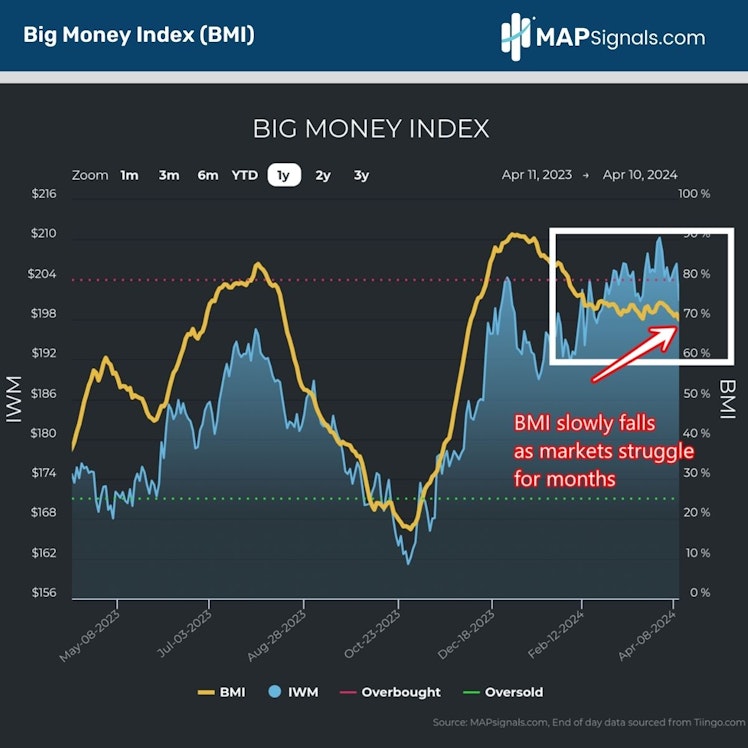

The latter is what is causing the Big Money Index (BMI) to make a fresh year-to-date low. I’ve mapped the BMI to the Russell 2000 ($IWM) ETF as the correlation has been uncanny the past year:

Boxed in white shows how stocks are struggling. This gravitational pull on equities has been more pronounced on smaller companies due to recent rising interest rates.

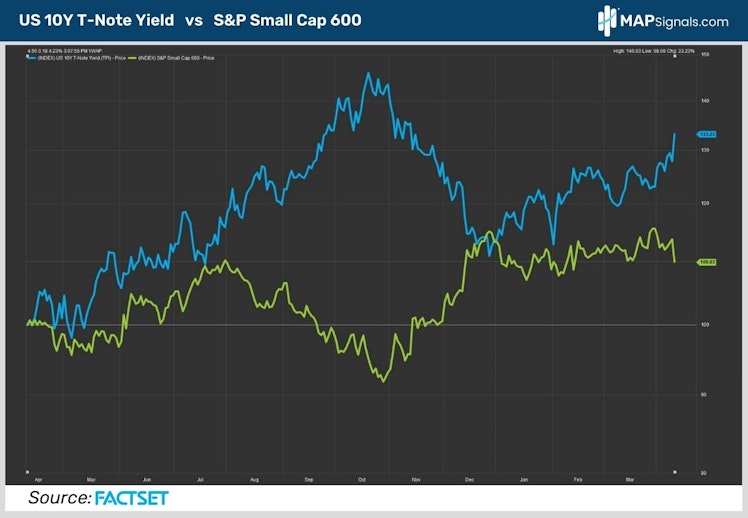

The 10Y yield jumped to 4.55% yesterday, a multi-month high. Notably, there’s been a beautiful inverse relationship between interest rates and small-cap companies.

Below shows an auto-indexed performance of the 10Y yield relative to the S&P Small Cap 600. In late October, yields peaked and stocks began their march higher.

Lately, rates are ripping as small-caps are dipping:

Given the media’s obsession with rising rates recently, you may believe the area is dead money.

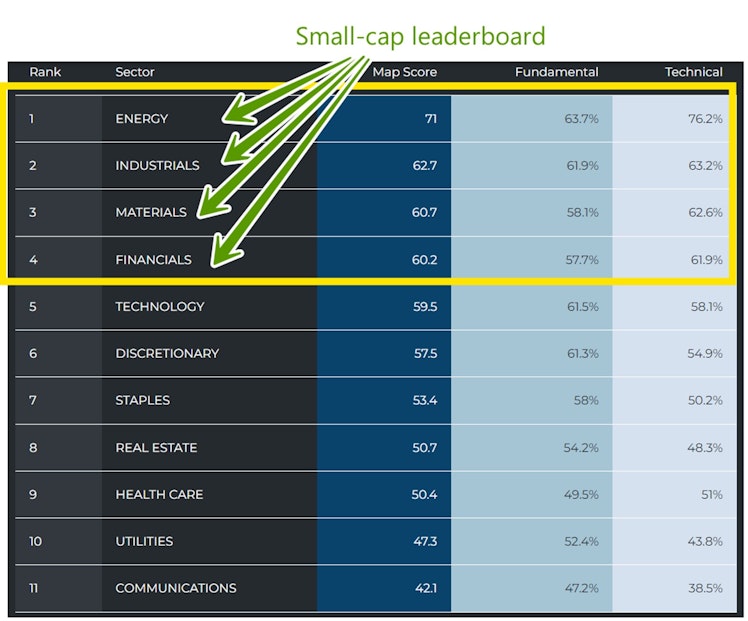

But you’d be dead wrong. As I’ve been hinting for nearly a month, a major shift began in mid-March. Brand new leadership was emerging.

Energy stocks vaulted to pole position practically overnight.

I even showcased reasons to believe small-caps will eventually make new highs.

And last week, I noted a very strong case to own Financials.

Those calls were not only grounded in data-driven insights, but more importantly in institutional money flows.

At MAPsignals, we are single stock evangelists. What major benchmarks do is of less relevance. The portfolio we care about is where the money is flowing.

And high-quality small-cap stocks are thriving in 2024 as evidenced by our latest sector rankings. Technology has taken a backseat to new monies rotating into Energy, Industrials, Materials, and Financials:

This new under-the-surface reality reverberates the top names beaming in our data. This is where our unique lens on the market sets us apart from other research shops.

As I said earlier, if you only focus on popular equity benchmarks, you’ll miss the stocks that matter most.

Every day we score and rank thousands of stocks. Additionally, our power signal overlays a reliable unusual buy and sell measurement.

From here, we isolate the tails… the Top 20 ranked stocks under accumulation. This allows us to see an up-to-the-minute reading of money flows.

Given the monumental shift we saw a month ago, here’s where institutions have been placing their bets.

- 36% of buys went after energy names.

- 21% vaulted into industrials.

- 19% poured into financials.

Those 3 groups alone accounted for 76% of our leaderboard since March 19th:

Mapping out money flows reveals market-crushing opportunity. Keep in mind that each of these signals are individual stocks that have idiosyncratic attributes.

In other words, buying a sector ETF to play a theme may not be as relevant due to the basket makeup.

Let’s look at an example industrial stock that we’ve been all over in the past year. If we rewind the tape to early last summer, I made the bold claim that the 2023 bull market is just getting started.

I noted the broadening out of the market happening in our data. Fresh new small-cap stocks were beginning to show up as Big Money magnets.

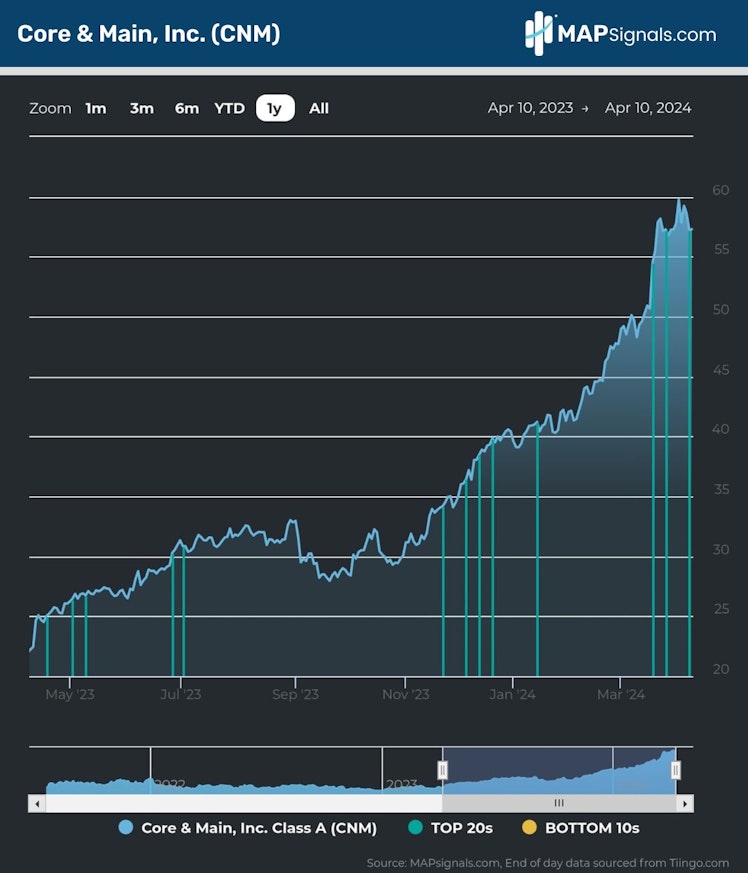

Take industrial distributor Core & Main (CNM) as a prime example. Strong high-quality inflows were spotted.

Here you can see 13 Top 20 appearances for CNM the past year beginning when the stock was $25 per share. The recent price is $57:

Now, I bring this company to the forefront because we’ve recently been bullish on industrials…specifically the ones under heavy accumulation.

What made Core & Main worthy of being a Top 20 stock?

It came down to accelerating revenue and earnings growth. That’s what drives big investors into stocks at a breakneck pace.

Last June, estimates pegged 2025 EPS at $2.25. Turns out that was too low. As of this morning, the estimate has jumped to $2.42.

If you want to uncover the best stocks in the market, do 2 things:

- Focus on stocks where earnings estimates are rising

- Zero in on Big Money inflection points – only then is a stock ready to fly higher

So, while small cap indices face headwinds, just know there are plenty under the surface doing just fine.

Playing defense is a great way to underperform over the long-term.

Riding the wave of Big Money in the best stocks is a great way to build wealth over the long-term.

You just need a map to hunt them down.

Let’s wrap up.

Here’s the bottom line: Stock picking is alive and well. While investors flee small-cap benchmarks stressing about inflation, many under-the-radar companies are growing and thriving.

Energy, Financial, and Industrial companies are not only top-ranked…the outliers in the groups have massive Big Money tailwinds.

Core & Main is a prime example of a company beaming with institutional support for over a year. It’s been a name we’ve recommended over and over to our subscribers.

Don’t fear inflation and don’t dwell on rate-cut predictions. You’ll miss the next big winning stock.

Focus on incredible companies that can transform your portfolio.

It’s simple.

Follow the money.

If you’re a serious investor, money manager, or Registered Investment Advisor (RIA) – get started with a MAP PRO subscription.

MAPsignals

Solutions - MAPsignals

MAPsignals’ volume and price analysis tools enable investors to identify unusually large trading activities around individual stocks and ETFs. This allows traders and investors to move beyond sentiment with a more precise, predictive, and measured data analysis tool that MAPs the signals being delivered by the market’s biggest players.MAPsignals capabilities include: Read more »

Already have an account?