Trending Assets

Top investors this month

Trending Assets

Top investors this month

2023 Birthday Buy #2 - $OZK

This year I initiated two new positions, both in my Roth IRA. Today I will be covering $OZK, Bank OZK!

You can check out my other Birthday Buy, $RICK, here. In my $RICK post I also talk about why I make these buys.

Let's get into it!

Company: Bank OZK

Ticker: $OZK

Acquisition Date: 1/17/23

Price: $41.69

Discovery:

I am not entirely sure how I first discovered $OZK. That being said, $OZK has been on my Watchlist for a long time (since at least June). I have written about it more than 5 times here on Commonstock.

Research:

I wrote this Quick Bites post that really helped me get a better understanding of the company in August. Since that point, $OZK has remained at the top of my Scorecard and it was just a matter of time until I added it to my portfolio.

The thing I do like about $OZK as a business is its push into Real Estate growth through large dollar mortgages. The three primary locations they are operating in in this segment are LA, Miami and New York. All three are large and growing population centers where more building will be required to solve the current housing shortage.

However, the real estate game is a double edged sword. As rates continue to rise and investment starts to slow, it could impact mortgage generation and the growth model for $OZK.

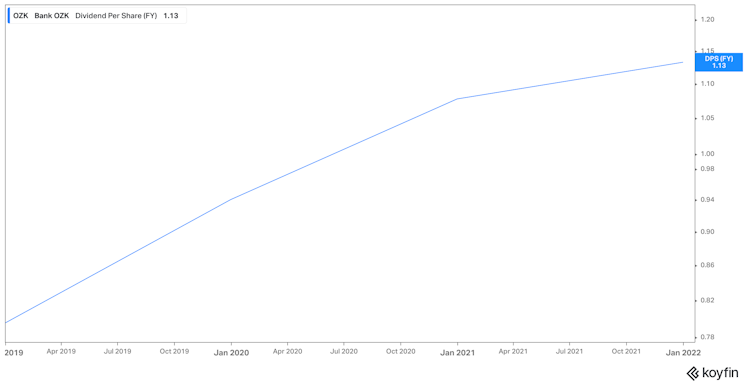

I like that there is also a growing dividend and positive Free Cash Flow. The dividend growth rate is slowing, but the dividend is still growing.

The price has tailed off recently, so maybe I am getting a slightly better "value".

Scorecard:

Price History vs S&P: Positive performance last 3 years, but not outperforming the market +0.5

Dividend/FCF Payout: Positive FCF, dividend is less than 50% of FCF (30.87%), +1

Conviction: High (thanks, research), +1

Dividend Yield: Top 5% of portfolio (3.04%), +1

Portfolio Weighting: 0% weight in Financials, +1

P/E: < 25 (9.2), +1

Overall: 5/6

Like I said above, $OZK has been at the top of my Scorecard for many months and really was a matter of waiting until January to make my buy. I performed research to confirm my purchase, but am not oblivious to the potential risks of the business.

What are your thoughts on $OZK? Do you own it?

Already have an account?