Trending Assets

Top investors this month

Trending Assets

Top investors this month

$OZK - Quick Bites

As I have noted in my last two watchlist posts that $OZK is at the top of my list to add to my Roth IRA.

I am working to do more "quick bites" of research to help round out my understanding leading up to my Birthday Buys in January.

I want to use a standard approach as I do research on my watchlist positions. I will cover the following:

- Core Business/Operating Locations

- Growth Engines

- Financials Performance

- Key Takeaways

This past weekend I took some time to look through $OZK's most recent investor presentation to see how this bank currently makes money, and plans to make money in the future.

Core Business

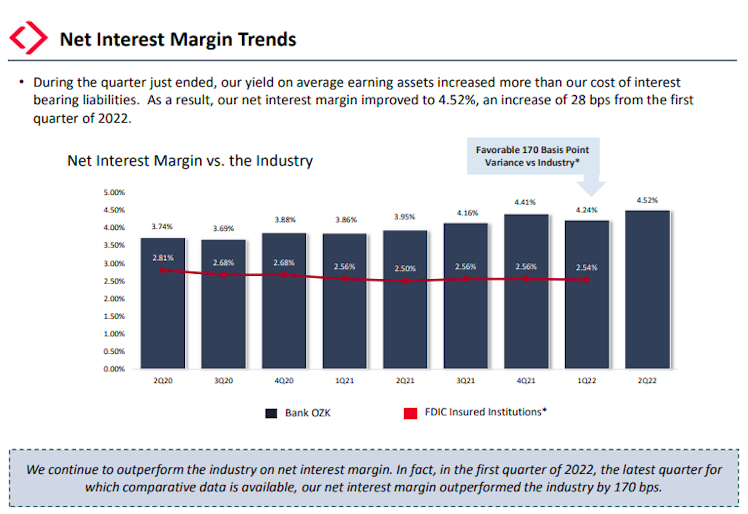

$OZK's core business is loan interest. In their investor presentation, $OZK calls out that they are currently achieving a net interest margin of mid 4%, versus an industry average of 2.5%.

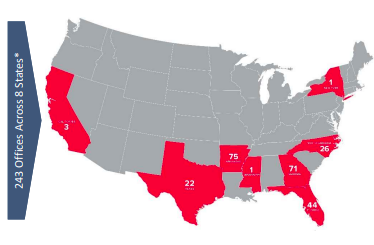

$OZK operates branches in 8 US states, primarily in the Southeast. However, they have loans currently in over 50 US markets.

Growth Engine

The primary growth engine for $OZK moving forward is growing their Real Estate Specialties Group (RESG).

The top 3 segments in their RESG portfolio currently are Multifamily, Mixed Use and Office.

The top 3 markets in their RESG portfolio (by value) are NYC, Miami and LA. All of these are large, and growing, markets that should continue to provide opportunity in the real estate space.

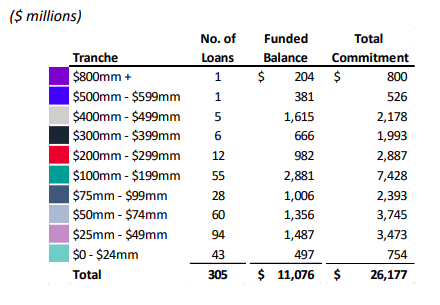

The RESG portfolio currently consists of 305 loans, with the majority in the $100 - $199MM range. These are some pretty substantial loans!

Financials

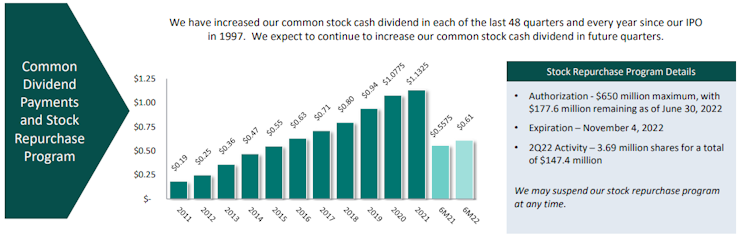

I would not be considering this company for my Roth IRA if it did not have a strong dividend history, so I will start there. $OZK has raised its dividend each of the last 48 quarters & every year since its IPO in 1997.

A second way $OZK is returning value to shareholders is through stock buybacks. $OZK is set to complete its $650MM share buyback plan in November, 2022.

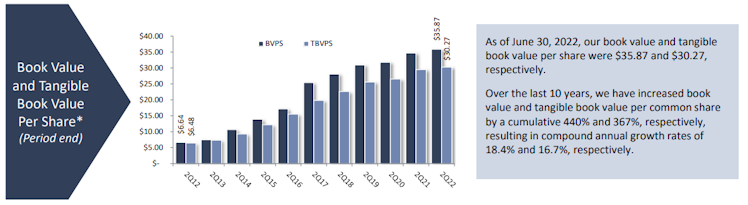

The financial metric that $OZK published and shared in their presentation was Book Value per Share. $OZK's BVPS and Tangible BVPS have both steadily increased over the last 10 years.

Key Takeaways

Overall, I think $OZK would be a solid add to my portfolio. This "Quick Bite" of research I did helped support the high ranking this company is currently getting in my Scorecard. My 3 Key Takeaways from this activity are:

- Have a defined and measured growth strategy through RESG

- Are not dependent on personal loans and personal mortgages for interest income

- Returning value to shareholders through Dividends and Buybacks

Thanks for following along! This is the deepest I have dove into a prospective new addition in a long time and is an area I am working to improve in. I would love to hear your feedback on my summary or input on the business!

Already have an account?