Trending Assets

Top investors this month

Trending Assets

Top investors this month

Disney ($DIS) - An unwinnable race?

Hi everyone - A quick Merry Christmas, Happy Holidays, and a Happy New Year to all!

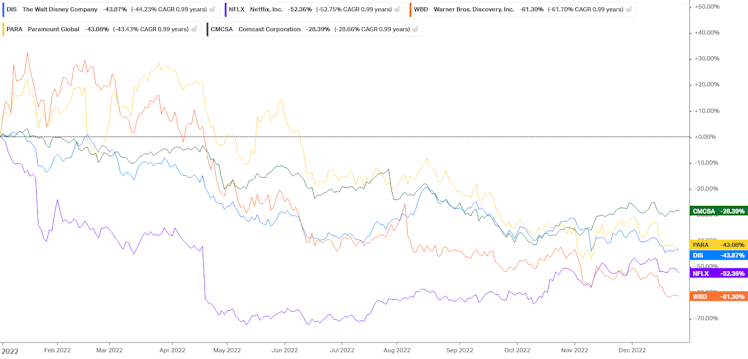

Today I wanted to share some thoughts on Disney $DIS, one of my longest-held positions and presumptuously one of the most popular retail stocks out in the market. As of this writing, Disney is trading just north of $80/share, or ~20x forward EPS estimates. More worryingly, however, Disney shares are a mere 5-7% higher than where they were during the March '20 low, when Disney's largest business segments were closed to accommodate COVID lockdowns. Nevertheless - despite the return of Disney theme park visitors, live sports, and box office blockbusters - investors seem dour as ever about Disney's outlook.

- The Elephant in the Room

While Disney is no stranger to controversy, shareholders would be prudent to acknowledge the elephant in the room - in this case, the return of former CEO, Bob Iger. Iger earned immeasurable levels of goodwill among Disney shareholders & customers over his tenure as CEO, as Disney's acquisitions under his leadership (Marvel, LucasFilms, 21C-Fox) serve as the cornerstones of Disney's media dominance. Collectively, it's hard to argue that any other media, streaming, or cable operators carry stronger IP than Disney does today.

That said, since Iger's departure in 2020, Disney's brand equity has noticeably diminished - and Iger himself is responsible for most of the blame. Recent reports in the WSJ, FT, and Barron's highlight the intra-company controversy that undermined Chapek's brief reign as Disney CEO. Chapek - despite being appointed by Iger to executing his strategy in line with the company's push to D2C - was ousted by a cadre of Iger lieutenants who felt Chapek was mismanaging the Disney brand. In a remarkable bout of unity, executives, employees, and fans alike were not pleased with Chapek's stature as CEO. Nevertheless - without getting into the specifics - it is worth considering that many of the same issues that hindered Disney under Chapek have not magically disappeared with the return of Iger.

- Under Fire: Linear TV & Theater

Part of the reason why Disney the business (as opposed to Disney the brand) has been struggling can be traced back to a broader shift in the media landscape. Given the prevalence of streaming platforms and "a la carte" television, households have been slowly weening themselves off of the linear cable business model that Disney maneuvered so meticulously. Historically, Disney's ballooning arsenal of channels and intellectual property (i.e. their bundle) gave them the upper hand over cable operators when it came to pricing and demand. Cable operators who wanted to air ESPN on their networks were also forced to pay for oddball assets like ESPNU, as well as the remaining Disney channels. In the age of streaming, however, Disney does not wield that same level of power, and it is uncertain if properties like FX, National Geographic, and ESPN can find success amidst this transition.

This brings me back to the largest indictment of Iger's leadership - the $71B acquisition of 21st Century Fox (FX, NatGeo, Fox Networks) is deeply antithetical to the D2C strategy. What's more, the price tag for those assets is staggering, comprising roughly half of Disney's market cap, and 33% of their enterprise value - with only a modest improvement in Disney's intellectual property.

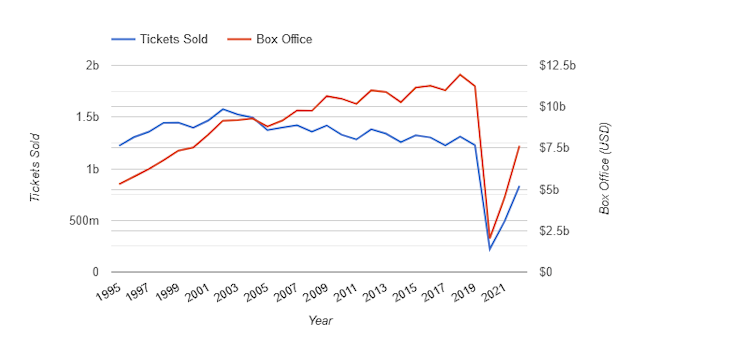

In addition to the slowdown in Disney's television segment, consumers en masse are spending less time at the movie theater, with theater attendance down nearly 33% in '22 versus '19. Per the chart below, movie theater attendance has been on the downward trend since the turn of the century, with 2003 marking the peak.

- Streaming - Is this even a good idea?

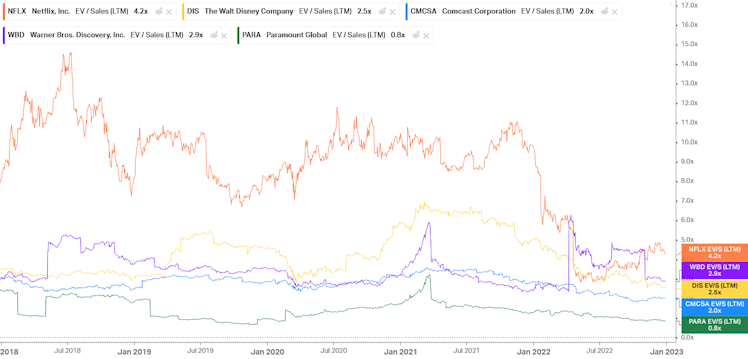

In July '18, Netflix had surpassed Disney in market capitalization (~$180B) as their product had effectively redefined the media category. Consumers grew increasingly enamored with the absence of commercials and a seemingly unlimited (yet familiar!) selection of shows and movies. No longer was Netflix a buyer of fringe media assets - Netflix had evolved into producing their own content while acquiring the rights to other popular franchises, threatening the dominance and viability of both cable television and movie rivals. On top of that - Netflix stock commanded an enormous premium to industry peers. At the point in which Netflix leapfrogged Disney in market cap, the company was worth 14x LTM sales, versus the 3.3x multiple assigned to Disney. Naturally, the width of this spread was the impetus behind the streaming wars of '19, as Disney (Disney+), Comcast (Peacock), Warner Media (HBO Max), among others unveiled their ambitions for an exclusive, direct-to-consumer product.

Fast forward to '22 and the premium assigned to Netflix has narrowed drastically relative to competitors. More so, the allure of streaming is not as hot as it once was: Churn rates have settled higher than executives might've previously estimated, and the cost of producing and acquiring IP remains incredibly capital intensive. As of Disney's latest reporting period, the direct-to-consumer division posted an operating loss of $1.5B, versus the $630MM lost posted over the same period a year prior. Sure - while Chapek's firing can be attributed to a multitude of factors - his failure to manage investors' expectations in a market that demands profitability turned out to be his biggest misstep yet.

- Why are you still optimistic on Disney?

Part of what I believe to be my investment edge is my ability to soberly assess the trajectory of a company amidst broader market noise and emotion. In the case of Disney - I, for one, don't believe their streaming business is underperforming to the degree that the market appears to think. Rather, I think Disney's D2C arm is splitting the difference between over and underperforming per their 2019 Investor Day (below, H/T @tsoh_investing). The company is two years ahead on subscriber growth (Exp. 90MM subs in '24 vs. Act. 103MM sub in Q4 '22) and is within the margin for error for peak operating losses. I am writing this under the conservative assumption that '23 will not show any margin improvement - surely Disney's recent price action reflects a high probability of steepening losses next year.

All in all - I don't believe Disney is a screaming BUY at these levels. There is, however, something to be said about the progress they've made amidst their transformation. Investors may be prudent to see how Iger manages his return - particularly as they restructure certain divisions and identify avenues for shareholder returns (ESPN spin-off, anyone?). I am personally staying put for now, but am keen to see what management will do to regain shareholder trust.

In the meantime, I may go catch Avatar 2 in theaters... I've heard good things!

Thanks for reading.

Already have an account?