Trending Assets

Top investors this month

Trending Assets

Top investors this month

The Story of HashiCorp ($HCP)

HashiCorp ($HCP) resonates with many as the company that makes multi-cloud operations a well-oiled machine.

It's made a name for itself with a suite of open-source tools that automate and streamline infrastructure management.

As we wrote in the second edition, HashiCorp recently acquired BluBracket, integrating it's code scanning and secrets detection technologies into HashiCorp's existing suite - enhancing its appeal to enterprise customers seeking secure and compliant multi-cloud deployments.

HashiCorp succeeded by fostering a broad community of users while catering to the needs of enterprise customers, and it continues to shape the future of software infrastructure.

Today, HashiCorp is a crucial player in the cloud-native landscape and a $5.56B behemoth.

HashiCorp recently became part of the prestigious Russell 3000® Index.

They have 4,392 paying customers, and 830 of them are $100k ARR customers.

HashiCorp Origins

=================

Mitchell Hashimoto and Armon Dadgar

On March 8, 2010, Mitchell Hashimoto, then an operation engineer at Kiip, released an open-source tool called Vagrant.

The concept? A tool to build and distribute virtualized development environments. It quickly gained traction among network and infrastructure engineers, and before long, firms like The New York Times, BBC, and Expedia were using it.

You can still find the original release, Vagrant 0.1.0, on GitHub.

By providing automated creation and provisioning of virtual machines using Sun's VirtualBox, Vagrant delivers the tools to create and configure lightweight, reproducible, and portable virtual environments.

Mitchell Hashimoto from the Vagrant README.md file

Vagrant's success enabled Hashimoto to offer downloadable add-ons for enterprise customers, and in 2012, HashiCorp was born. In 2013, his college buddy Armon Dadgar joined as co-founder.

Over the following seven years, HashiCorp raised a total of $349.2M in funding. It raised $10.2M in its Series A, $24M in its Series B, $40M in its Series C, and $100M in its Series D, before scooping up a hefty $175M in its Series E in 2020.

HashiCorp’s 2021 IPO valued it at a astounding $14B.

Today, HashiCorp is a crucial player in the cloud-native landscape, and its story isn't over.

Surfing The Multi-Cloud Wave 🌊

===============================

Having all your eggs in one basket (or your data & compute in one cloud) is risky business.

Companies increasingly use multiple cloud computing services from public vendors within a single, heterogeneous architecture.

Why Multi-Cloud?

Think of your business as a factory: Instead of relying on one power plant (a single cloud provider), you spread your bets across multiple.

That's the essence of a multi-cloud strategy. Other “plants” are always running, so if one cloud service has an issue, your factory doesn't halt.

HashiCorp's Role 🛠️

HashiCorp is like a trusted power grid operator.

It provides the tools that help businesses distribute their operations across multiple clouds. And it's not just about reducing risks.

With HashiCorp's tools, companies can use the best features from different cloud providers.

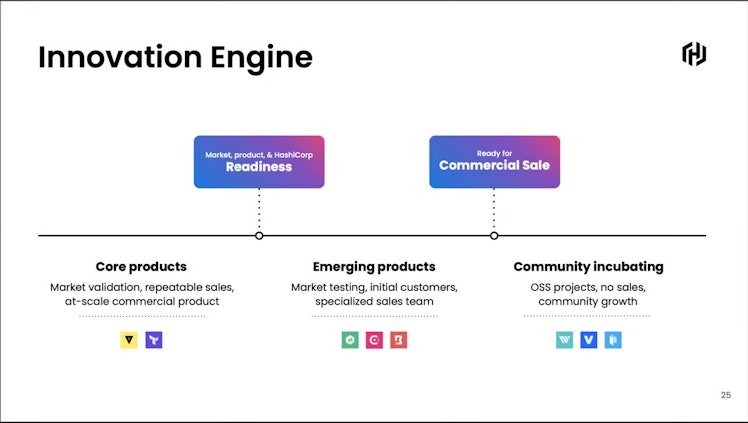

HashiCorp Open-Source Innovation Engine

=======================================

HashiCorp's products address a range of needs:

- Infrastructure Automation

- Secret Management

- Multi-cloud Operations

- Networking and Security

Think of them as robots for setting up your company's computer systems, a secure digital key box for your company’s most valuable assets, a multi-plant power supply for your company's operations, and a city planner for your company's computer systems.

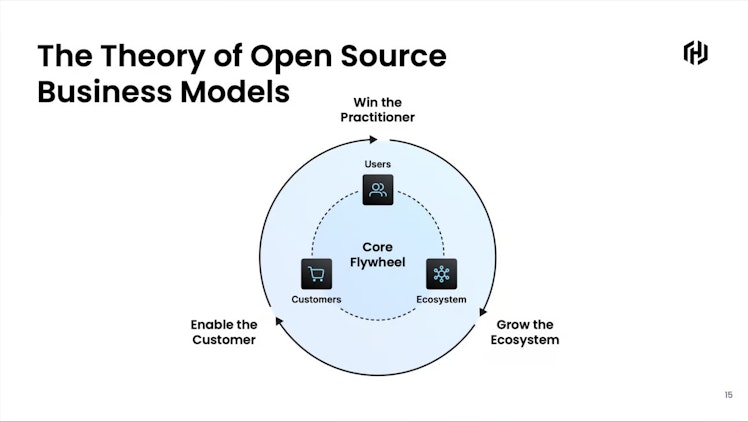

From its roots in the Vagrant project, HashiCorp made a name for itself by taking a unique approach: they offer open-source tools and then build them into commercially viable, enterprise-scale products.

It's a model that has served them well, fostering a broad community of users while catering to the needs of enterprise customers.

Open Source as Business Model (HashiCorp Q1 FY2024 Report)

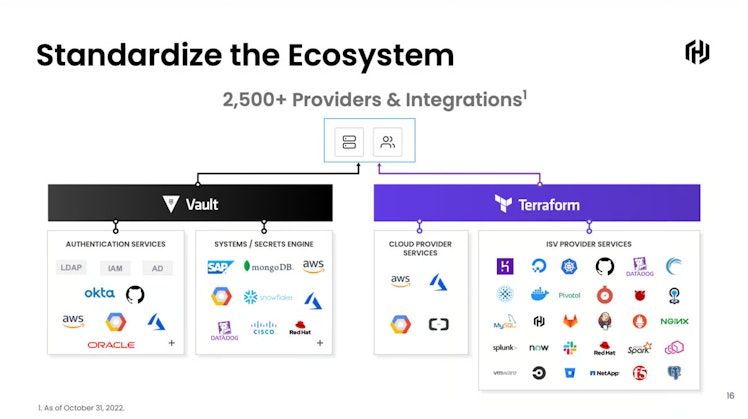

HashiCorp's popular open-source tools, indicated by the volume of stars (GitHub's equivalent of likes) and contributors, include:

- Terraform (38.2k stars, 1,750 contributors): A go-to tool for infrastructure as code.

- Vault (28.1k stars, 1,217 contributors): Manages secure access to programming secrets.

- Consul (26.7k stars, 879 contributors): Automates network configurations and enables secure connectivity across any cloud or runtime.

Other notable tools are Nomad, Waypoint, Boundary, and Vagrant, each boasting thousands of stars and contributors.

But it's not just about the tools - it's about the people.

HashiCorp's tight-knit relationships with its users and with DevOps developers have fostered a community around collaboration and innovation.

HashiCorp is also a pioneer of the Infrastructure As Code (IaC) movement, a key component of modern DevOps practices.

HashiCorp Market & Competition

==============================

Ideal Customer Profile

----------------------

HashiCorp's products are engineered with large-enterprise platform teams in mind. Platform teams create the foundation of a company's products and include DevOps engineers, IT managers, and software engineers.

Each of HashiCorp's products tackles a different headache for these pros, and they love the company’s approach: start with open source, then scale up to commercial, enterprise-level products.

And those ICPs loving HashiCorp's approach: Start with an open-source, then scale up to commercial, enterprise-level products.

Competition

===============

Cloud infrastructure automation and management is a challenging sector to compete in.

Key competitors and their offerings include:

- Amazon Web Services (AWS): AWS CloudFormation for infrastructure provisioning, AWS Secrets Manager for secrets management, and AWS VPC and AWS PrivateLink for service networking.

- Microsoft Azure: Azure Resource Manager for infrastructure provisioning and Azure Key Vault for secrets management.

- Google Cloud Platform (GCP): Google's Cloud Deployment Manager for infrastructure provisioning and Google Secret Manager for secrets management.

- IBM Cloud: IBM Cloud Schematics for infrastructure as code and IBM Cloud Secrets Manager for secrets management.

- Puppet: Puppet Enterprise is a competitor in the infrastructure automation and configuration management space.

- Ansible (Red Hat): Ansible competes directly with HashiCorp, providing open-source software for provisioning, configuration management, and application deployment, like Terraform.

- Docker & Kubernetes: While not direct competitors, Docker and Kubernetes have changed how applications are packaged and run, intersecting with HashiCorp's toolset.

The choice between HashiCorp and its competitors often depends on the organization's specific needs and its technology stack.

HashiCorp's comprehensive toolset and commitment to open-source software make it a strong contender in the infrastructure management space.

But HashiCorp and many of its competitors are also frenemies: The company's tools integrate well with many competing services.

This bold strategy allows for combined usage with your direct competitors.

Terraform and Vault Integrations

A Snapshot of HashiCorp’s Financials

========================================

HashiCorp stock price stood at $28.51 (28/7/23), and it performed well in the preceding month (Jul 2023), growing by 13.97%. Though in the past 12 months, it lost 10.75%.

Let’s look at the latest report from HashiCorp, covering Q1 2023.

Revenue Growth: 37% YOY, $138M (Q1 FY2024)

NRR (Net Dollar Retention Rate): 127%

Profitability Margin: -48.61%

Free Cash Flow: -93.5M

P/E Ratio: -21.8

The company is raking in revenue. It reported a 37% YoY increase, reaching $138M. And its customer base isn't just loyal—it's spending more over time. An NRR of 127% is nothing to sneeze at.

But HashiCorp isn't profitable yet.

With a net profit margin of -48.61% and a free cash flow of -$93.5M, it's clear that HashiCorp is playing the long game, investing big in scaling up.

The P/E ratio of -21.8 might seem uncomfortable, but it isn't uncommon for tech companies in their growth phase.

Its journey to profitability will have twists and turns, but HashiCorp is riding a powerful wave.

Conclusion

==========

The world of cloud infrastructure is vast and complex, but HashiCorp has carved out a unique space in it.

By balancing open-source community-building with scalable enterprise solutions, they've managed to attract a loyal user base and consistently innovate.

Though profitability may be a future goal, their financials show that the company is confident in its growth trajectory.

HashiCorp isn't just a major player in the multi-cloud management space; It's a beacon for modern infrastructure management and the future of cloud-native technologies.

Keep an eye on them - their journey is far from over.

Published originally at The Developer Tools Index

Already have an account?