Trending Assets

Top investors this month

Trending Assets

Top investors this month

How to Reject a Good Story

"Valuation is the intersection of numbers and stories".

The mantra of NY Stern's Dean of Valuation, Aswath Damodoran, is often repeated.

My investment philosophy has been profoundly influenced by the professor's lectures and musings on markets.

It is human nature to love a compelling story. Information has been passed down in this way throughout history. By using narrative-based storytelling, we can access a different part of our memory systems and can also trigger emotional reactions.

One of my favorite books on this topic is Annette Simmons' Whoever Tells the Best Story Wins. In it, she points out the following:

"The emotional payoff of a powerful story warrants the act of letting go of critical thinking long enough to find a story."

This passage immediately chilled me. Having the ability to think critically is something I take great pride in. In the process of enjoying a fascinating story, I realized I may be killing a part of myself subconsciously.

In other areas of life, this may be a strength (such as memory), but in terms of investing this is a weakness.

As much as anyone, I love a fascinating story. A well-written novel is often difficult for me to put down.

As humans, we're prone to getting swept up in the latest craze, or attaching our ideas to whatever's hot or sexy at the moment.

Inflation, for example, is ravaging the entire globe. It was only six months ago that Web3, NFTs, and your average shitcoin were going to change the world forever and would survive any macroeconomic uncertainty.

This is the "Millennial Gold". You better buy now before inflation hits and the Fed starts hiking interest rates! There's no doubt that it's the premier store of value!

Ooof.

Furthermore, you don't even have to rely on these big overarching macro narratives. Specific company narratives are just as powerful.

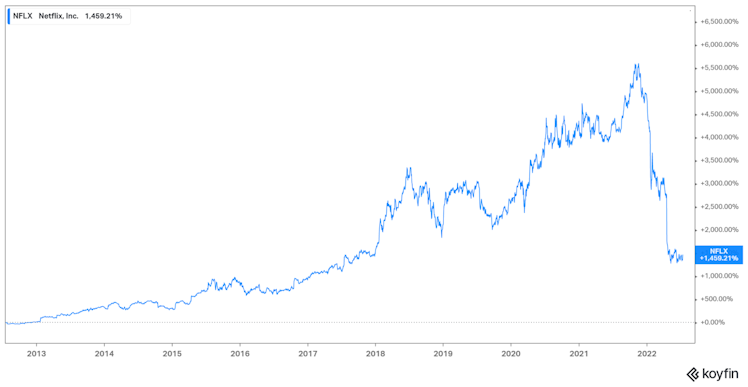

I remember the good ole days of 2021 when Netflix was THE stock to buy, since it basically had the whole world as its TAM. What's that? You're worried about profitability, margins, and the business model?

Nah, it'll all come later. Just keep buying.

Again: Ooof.

A positive story is hardwired into human nature to make us eager to believe it. What person wouldn't want to be part of the electric car revolution? What are you, a caveman?

Of course, I too am vulnerable to mythical narratives despite my facetious tone. But I try to insulate myself from these stories by doing one thing: looking at numbers first.

Like a lot of other investors, I occasionally screen for favorable metrics on certain platforms. What do I like to look for?

Pretty simple really:

- Increasing annual net income/FCF without excessive dilution

- High profitability and quality metrics (ROIC, ROE, and ROAs)

- An acceptable asset/liability ratio

Of course, this is just a small sample of what I am looking for in an investment, but this is as appropriate a place to start as any. If I find a business that seems viable to me numbers-wise, I will start looking at the story of the business.

I'll start to ask questions like:

- Is this a sound business model?

- How has it performed in the past?

- Is it sustainable?

- Does management understand what makes the company successful? If so, what are they doing to continue/better the success of the business?

- Do I trust the management?

- What are the risks to the company?

- Can they reinvest with high returns?

Annual reports (sometimes a few) usually provide the answers to these narrative-based questions. A while later, I'll be able to tell if an idea sounds good or not. I know I’m onto something when I get a warm and fuzzy feeling.

A prime example of this is Johnson Outdoors ($JOUT), one of my favorite businesses. The research I have done on that company doesn't leave me excited, but simply comfortable.

Now, if I get hyped after research, that's a sign to take a step back and think about it. I'll go for a walk and have a think. I'll ask questions like:

- What has me so excited about this story?

- Why does it excite me so much?

- Is it the potential profit?

- Do I just want to become a part of the story?

- Is the story actually realistic?

- Is it a profitable venture?

- Does management demonstrate competence, or do I just like how they look or sound?

After taking a step back and giving myself a chance to settle down, I almost always reject the story and move on to the next idea. This has saved me from a lot of unwise decisions.

But here's the thing. Putting myself through this process has almost always yielded me the same results: (seemingly) boring investments.

What may seem like a boring type of stock (or story) often yields the greatest returns.

Investing in a dull company with a high potential return should make you more excited than an interesting story.

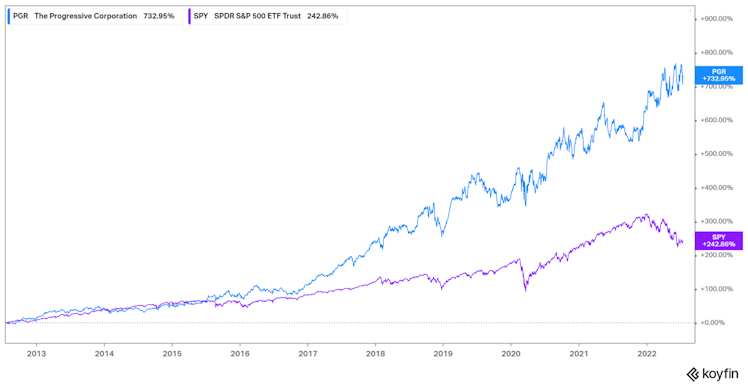

For example, I can't think of a more boring business than insurance. Investing your money in a company that receives cash from you every month for something you feel like you never use is not exactly an exciting story.

I get it.

But here's the truth. Progressive Insurance ($PGR) is one of the nation's largest P&C insurers. The story over the past decade has been anything but exciting. Write premiums, collect those premiums, pocket the difference. Boring.

But over the same time period, the returns are anything but boring.

Referring back to Professor Damodaran's quote, the last piece of the puzzle for me is to then craft my own story for the future of the company I am researching. The key to this is to compare risk and reward, use management's own words and estimates, and then return to the raw data and numbers.

Asking questions like:

- Are profits/expenses likely to increase or decrease?

- What growth rates are acceptable to assume?

- What if the company suffers through a rough patch in year five of my ten year valuation?

- What returns am I willing to accept?

- How much risk am I willing to accept?

I'll ask myself these questions as I plug in numbers into my spreadsheet for valuation. If the company clears my 15% hurdle rate, I buy immediately.

Just kidding!

I venture out for another walk. Take a day to think about it. A week. Maybe a month or more. I do my utmost not to rush a decision. Those usually end up being the wrong ones.

Nobody wants a boring life; the same holds true for our investments. But the truth is that the most boring stories and investments are often the ones that provide the most stability and profits to our portfolios.

I love this insight: "If I find a business that seems viable to me numbers-wise, I will start looking at the story of the business."

I find myself wanting to tie myself to the "sexy & new companies" but most times they're not making any money! Maybe this is ultimately a reflection of the fact that as a society we want things to look good on the outside, while at the same time we refuse to be honest & deal with the real issue. Either way, I'm definitely going to start asking myself some of the questions you presented before making any investment, and thank you for this well-thought out post!

Already have an account?