Trending Assets

Top investors this month

Trending Assets

Top investors this month

$PINS, Quality Amidst Rot?

Pinterest is kind of a weird company. Despite its steep drop in price, the actual fundamentals of the company improve after every earnings.

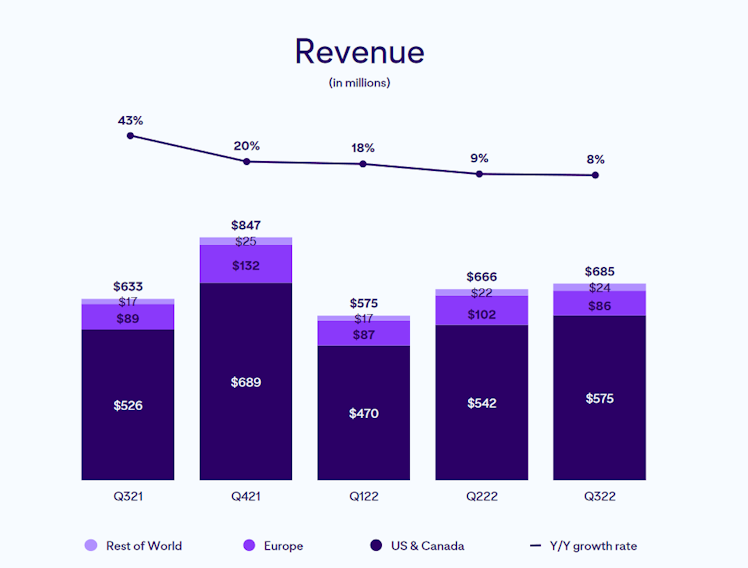

Revenue is up ~8% Y/Y overall and a slight decline in Europe is made up for by the 36% leap in the Rest of the World's revenue.

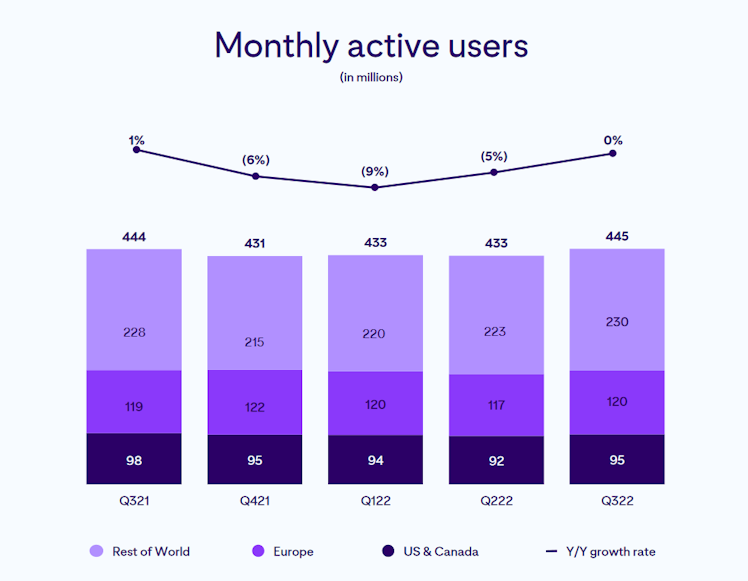

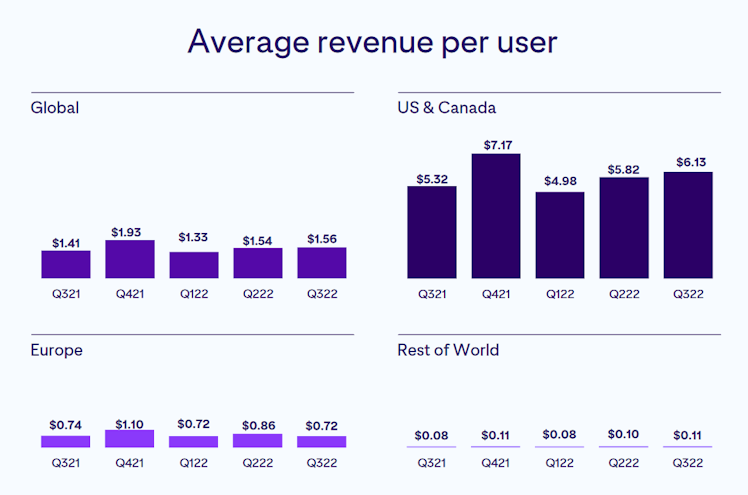

MAUs are a slight drawback remaining flat Y/Y. But this is made up for somewhat by the huge growth in ARPU.

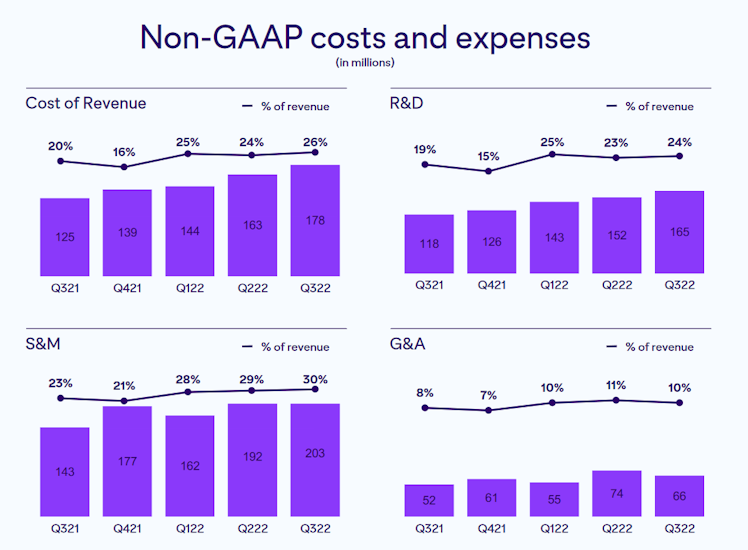

The costs associated with this growth have been somewhat high, however.

I think the massive revenue beat sort of covered up the fact that Pinterest's R&D and S&M exploded by nearly 30%. I imagine this is a result of Bill Ready taking over as CEO in June. As a former Google employee, he has seemingly brought the company's readiness to spend money on seemingly nothing.

Regardless, with the massive revenue beat ($0.11 EPS VS $0.05 Expected/$684.6m Revenue vs. $666.7m expected), Pinterest once again has seemingly proven its business quality. They just have to keep a close eye on those costs and make sure they don't get too out of hand.

Already have an account?