Trending Assets

Top investors this month

Trending Assets

Top investors this month

Did Airbnb prepare for a recession by lowering its expectations?

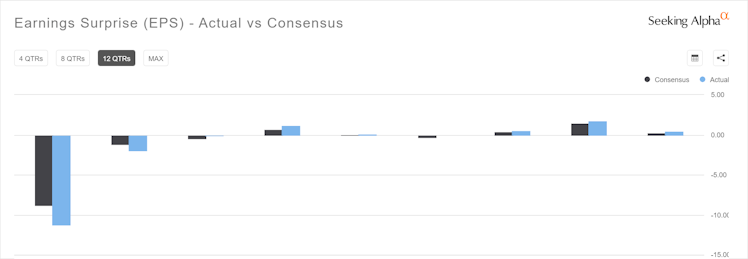

As the travel industry began to recover in the second half of 2022, Airbnb ($ABNB), a leading player in the vacation rental industry, rebounded from its lows since the second half of last year. As a result, market expectations for its performance have continued to rise. Of course, the company has surpassed market expectations every quarter since 4Q21.

The Q1 results, which were announced after the market closed on May 9, once again exceeded market expectations and met the high expectations that the market had already "priced in" in advance. However, Airbnb's guidance for Q2 was clearly more conservative, with a more cautious adjustment to its outlook for booking volume and revenue. As a result, the stock fell more than 11% after hours and completely gave back the overbought status of the previous two days.

Q1 Financial Results:

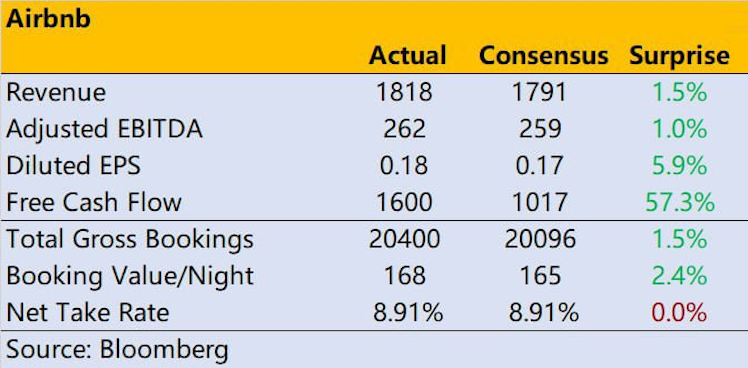

Revenue was $1.82 billion, a YoY increase of 20.5%, which exceeded the expected $1.79 billion.

Net profit was $117 million, compared to a net loss of $19 million in the same period last year, indicating that the company has turned a profit in Q1 for the first time.

Adjusted EBITDA was $262 million, a YoY increase of 14%, higher than the expected $259.4 million.

Earnings per share were $0.18, better than the expected $0.10, and compared to a loss of $0.03 per share in the same period last year.

In terms of bookings, the average daily rate was consistent with the same period last year, at $168, slightly higher than the expected $165.

Total booking value (including host income, service fees, cleaning fees, and taxes) reached $20.4 billion in the first quarter, a YoY increase of 19%, higher than the expected $20.1 billion.

Looking ahead to Q2 2023, the company expects another strong summer travel season, but comparisons with Q2 2022 will be "challenging."

Specifically, revenue is expected to be between $2.35 billion and $2.45 billion, a YoY increase of 12% to 16%, with the average of this revenue outlook at $2.4 billion, falling short of the expected $2.42 billion.

In addition, the average daily rate (ADR) will be lower than the same period last year, and adjusted EBITDA will be consistent with the previous year, but the profit margin will decrease YoY. It is expected that the growth rate of overnight and experience bookings will be lower than the YoY revenue growth rate.

The main reason for this is that a large amount of pent-up demand was released after the Omicron wave last year, leading to rapid overall performance growth. This explosive demand also raised the comparison base for Q2.

However, this is the company's perspective, and lowering guidance is also a form of managing investor expectations, which can help Q2 performance continue to exceed expectations.

We believe that ABNB still has opportunities despite the challenges it faces.

1.It is sensitive to economic cycles. Due to travel and entertainment demands, it is relatively sensitive to economic cycles, and this is the main reason why investors are concerned about ABNB's poor performance. If the Fed's tightening policy lasts longer, and global central banks follow suit, the unemployment rate is bound to continue to rise. This, in turn, makes consumers consider every penny they spend before spending. Low-income or unemployed people are unlikely to spend their savings on travel. According to statistics, the number of global tourists decreased by 8% during the global financial crisis.

2.If the strong period of the US dollar comes to an end, it will be good news for global travel business activities. If the US dollar is too strong, ADR denominated in US dollars will remain low or even decline YoY, as the appreciation in price is offset by factors such as exchange rates and consumers' willingness to pay. It will also increase the cost of the company's debt and increase interest expenses.

3.The company is expected to continue to improve its profit margin. ABNB achieved profitability for the first time in 2022 while increasing its pre-tax profit margin to 23.7%. With the decrease in costs and increase in efficiency throughout the internet industry, as well as economies of scale, ABNB's pre-tax profit margin is steadily increasing and is expected to reach 28% by 2025.

In terms of valuation, the company's trailing twelve months dynamic PE ratio is currently at 39x, and is expected to reach 30x by the end of 2024. Although this is still relatively high compared to the two largest companies in the industry, $BKNG and $EXPE, internet companies have greater flexibility and are expected to receive larger holdings during interest rate cuts.

Already have an account?