Trending Assets

Top investors this month

Trending Assets

Top investors this month

lululemon Athletica Inc. – Investment Thesis

Why did we decide to initiate a position in $LULU? Here is the investment thesis that was released to our newsletter subscribers.

Brief overview

- lululemon Athletica Inc. (“LULU”, “Company”) is engaged in the design, distribution, and retail of technical athletic apparel, footwear, and accessories.

- Its stock price has a 52-week high of $410.7 and a 52-week low of $251.51, whereas it currently trades at $312.80 with a Market Cap of $39.9B (as of 20th January 2023).

- LULU serves its guests through 623 company-operated stores and through e-commerce accounting for 46% ($3.4B) and 44% ($3.3B) of its Trailing Twelve Months (“TTM”) sales, respectively.

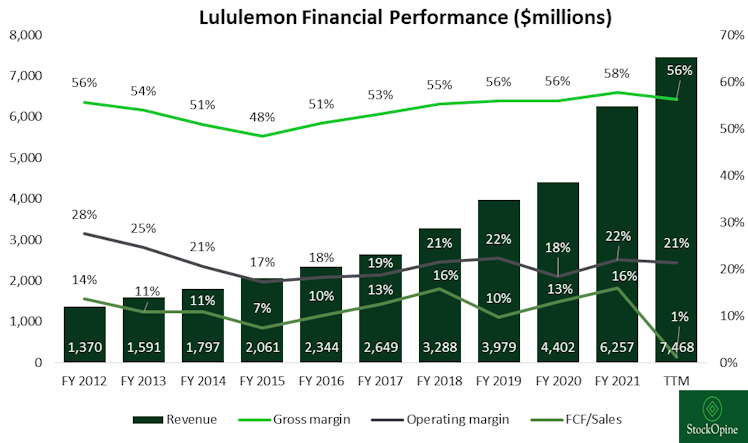

- During the last 10 years it depicted a revenue and operating income Compound Annual Growth Rate of 19% and 15.9%, respectively, with an average operating margin of 21.2%. TTM revenue stands at c. $7.5B and operating income at $1.6B (margin of 21.4%).

- LULU has a cash position of $353M, undrawn facilities of over $400M and lease liabilities of $1,039M. Cash position was abnormally low due to the investments in inventory in Q3’FY22 so as to meet demand.

Source: lululemon Annual Reports, Koyfin, StockOpine analysis

Thesis

- Power of Three x2 ( a) Double Men’s Product, b) Double DTC and c) Quadruple International sales ) – Management expects to double its revenue over the next 5 years (from $6.3B in FY21 to $12.5B by FY26) whilst achieving moderate expansion on its operating margin. They did it under the initial Power of Three and they can do it again.

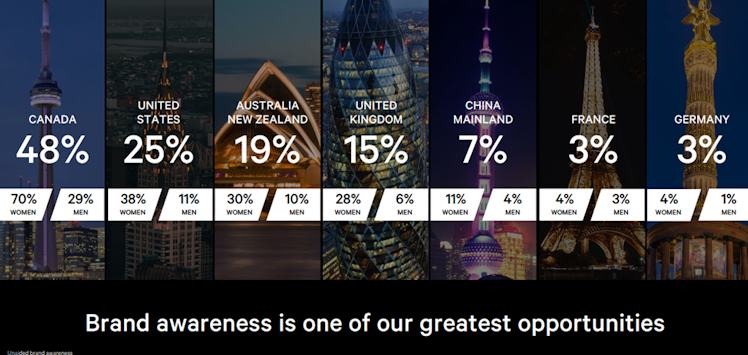

- Low unaided brand awareness - the unaided brand awareness for LULU is low (US only 25% whereas it is 11% for Men, China only 7%, France and Germany <5%) leaving a significant room for expansion. See screenshot below

Source: Lulu Investor Day April 2022 presentation

- Low market share of c. 5% in North America and at most 1% in international markets with an estimated Total Addressable Market (“TAM”) of $650B.

- Best in class margins and among the highest Returns on Capital in the industry demonstrate efficient business model.

- Fairly priced under our DCF model while it trades at an EV/EBITDA of 21.7x compared to its 5-year average of 26.2x.

Risks

- Uncertainty in macroeconomic environment, rising interest rates and inflation impact production costs and potentially margins. At the same time, these factors affect consumer confidence and therefore consumer spending.

- Geopolitical risks can distort both the supply chain, as the production is mainly in Asian countries, as well as LULU’s expansion plans in China which is expected to be the #2 largest market under the Power of Three x2.

- The abnormally high inventory can result to markdowns or write-offs, negatively impacting profits.

Concluding Remarks

We decided to initiate a position of 3.5% in LULU, despite being fairly valued, since we believe that its best in class margins can be maintained while the huge international TAM and the low unaided brand awareness can positively surprise its shareholders.

If you are interested to read more, you can read the write-up we released on $LULU -> lululemon Athletica Inc. - It’s all about branding

Disclaimer: The team does not guarantee the accuracy or completeness of the information provided in the newsletter. All statements express personal opinions based on own financial and business analysis. Any estimates or forward-looking statements made are inherently unreliable. No statement of opinion is an offer or solicitation to buy or sell the financial instruments mentioned. The content of our newsletter is not a trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient. This post may contain affiliate links, which means that we might get a commission if you decide to sign-up using any of these links. No extra cost is charged to you.

stockopine.substack.com

lululemon Athletica Inc. - It’s all about branding

lululemon Athletica Inc. is engaged in the design, distribution, and retail of technical athletic apparel, footwear, and accessories,, mainly sold through its 623 company-operated stores and e-commerce.

Already have an account?