Trending Assets

Top investors this month

Trending Assets

Top investors this month

MercadoLibre $MELI

(Shared this on twitter yesterday but feel it's also worth sharing here for anyone that doesn't follow me there)

I’ve been taking a look at $MELI recently from a financial perspective.

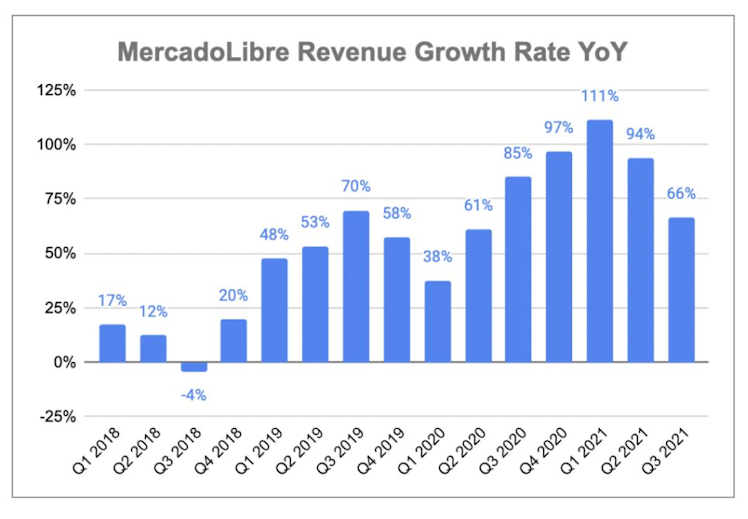

Revenue: Extremely strong growth since the start of 2019. $MELI also estimate 55% growth in Q4 and 36% for full year 2022.

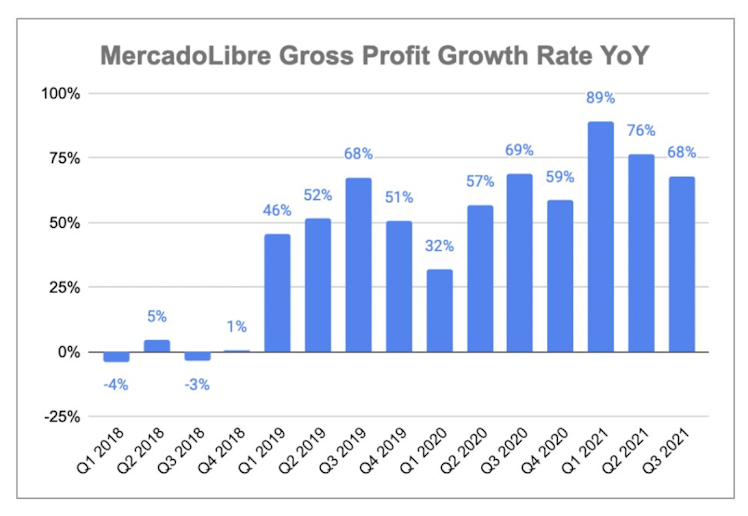

Gross Profit: Similar trend to revenue. Interesting to note that gross profit (68%) increased faster than revenue (66%) last quarter. Scale. Gross margin currently sits at 43%.

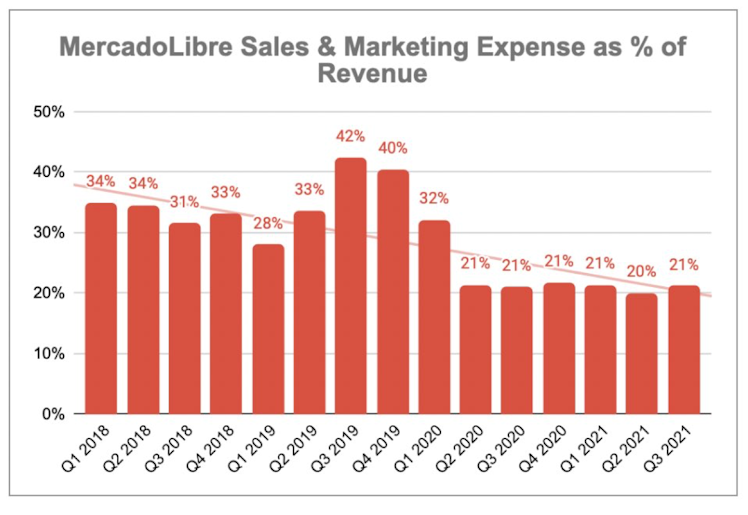

Operating Expenses: Main item I am focused here on is Sales & Marketing. As we can see S&M as a % of revenue is trending down over time.

This means that $MELI cannot be deemed to be subsidising e-commerce revenue through excessive S&M. For comparison $SE ratio is 40%.

Valuation: Despite all of this growth, $MELI is at its lowest Price/Sales valuation multiple since March 2020 when the pandemic hit.

For further comparison, $SE trades at a price to sales multiple of 18 vs $MELI 13 with $MELI also having a 3% point better gross margin.

Conclusion

I really need to keep digging with this one. As growth stocks go, this one looks very reasonably priced at the moment and the upside appears to well outweigh the downside.

Already have an account?