Trending Assets

Top investors this month

Trending Assets

Top investors this month

Portfolio Update - Luck or Perfect Timing?

Weekly Performance Summary

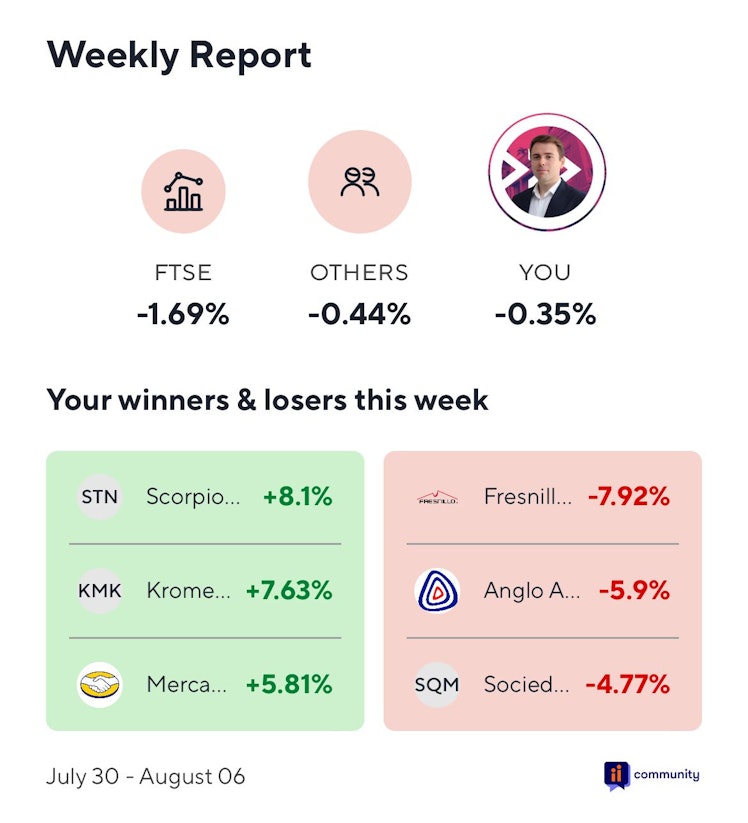

Another really encouraging week, with strong outperformance again to both the FTSE100 and the others on the platform.

Part of it could either be incredible instinct or totally luck on my part, choosing to exit some fairly chunky positions at the start of the week and holding significant cash through the midweek sell off before reinvesting those proceeds.

With earnings season in full swing, we got some nice boosts in some parts of the portfolio.

Scorpio Tankers, the oil shipping company, was the biggest winner in the week. Falling oil inventories means more business for companies like Scorpio Tankers as those buying oil look to ship more than rely on inventories. Q2 earnings for the company were broadly resilient considering the global demand picture of the past quarter and falling freight rates. To me, thanks to these inventory dynamics, a young fleet and solid management, I continue to like Scorpio Tankers despite the rally.

Another strong performer in the week was MercadoLibre, the Latin American commerce platform. The company's chares surged +13% on Q2 earnings this week. Results continue to be impressive with continued strong growth. Revenue up +57.2% year on year and a +47.2% increase in volumes. I generally tend towards value investing over growth, and MercadoLibre may look expensive on the face of it, however given the scope for growth, I feel the shares are more than fairly values and remain bullish.

Over the week there was some trading in the portfolio, with three positions exited, two existing positions added to and three new positions.

Exits: Antofagasta (+17.1% return), Gaztransport et Technigaz (+11.9% return), Moncler (+2.0% return)

Additions to Existing Positions: Sylvania Platinum, Fresnillo

New Additions: Kromek Group, Coca-Cola FEMSA, Anglo American

Coca-Cola FEMSA is the Mexico based bottler of Coca Cola. I did a write up on the company in April and at the time I felt the company just about fairly valued to quite expensive. The stock price has fallen since and now feel there is a much better entry point. It is also a fairly defensive stock, and as such balances out nicely with some of the more aggressive additions to the portfolio recently.

Finally I wanted to mention Kromek Group, a new small cap added to the portfolio. Kromek is a radiation detection company based principally in the UK. Not only do their products have application for the nuclear sector but also in defense and in the medical sectors. All three of these sectors I see bullish headwinds for in the medium term. The company has recently seen strong margin expansion and a significant boost to revenues. Although there was a smallish rally this week, I still see plenty of room for the stock to rise further based on current and potential operations.

Little bit of both luck and timing! Gotta be in the right position to take advantage of the situation

Already have an account?