Trending Assets

Top investors this month

Trending Assets

Top investors this month

Coca-Cola FEMSA: Valuation Starting To Run Out Of Fizz $KOF

Summary

Coca-Cola FEMSA has posted impressive results with higher volumes sold for the last year as compared to the previous year.

As the world's largest bottler and distributor of Coca-Cola branded beverages, the firm is in a strong position with regard to not only defending margins but also future growth.

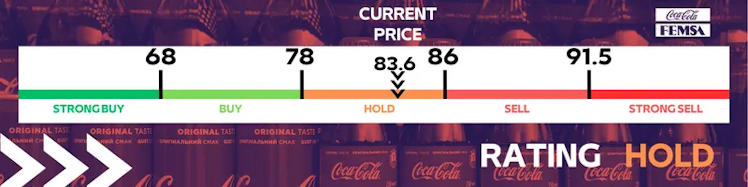

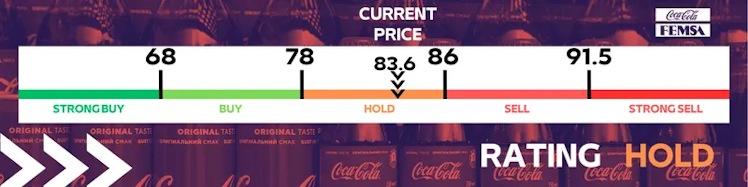

With the recent price rally, the US-listed shares look broadly fair value, and as such I rate them as a HOLD.

From a dividend perspective, the company offers an attractive and stable dividend. Thanks to the robustness of the business, could offer a stable forward dividend yield of close to 4%.

Company Overview

Coca-Cola FEMSA is the largest franchise bottler in the world by volume, with a portfolio of over 129 brands. These brands include Coca-Cola, Sprite, Powerade, and Monster amongst others.

These beverages are sold across over 2 million points of sale, from 49 manufacturing plants and 268 distribution centres across Latin America. This includes countries such as Mexico, Brazil, Venezuela, and Uruguay.

The company produces, markets, sells and distributes Coca-Cola beverages in the regions Coca-Cola FEMSA is active in. This is done in containers authorised by The Coca-Cola Company in other words its world-famous glass bottles and cans.

47.2% of shares are owned by FEMSA, 37.8% are owned by The Coca-Cola Company and the remaining shares are publicly listed across two different series Series B and Series L. The publicly traded shares are listed on the Mexican Stock Exchange in the form of units, with each unit consisting of 3 Series B shares and 5 Series L shares. The New York Stock Exchange listed ADRs represent 10 units.

Latest Updates

Sales volumes increased by +8.6% for the full year 2022 as compared to 2021, with volume growth seen across all countries. Total revenues were up +16.4% for the same period, not only thanks to the increased sales volumes but also a better pricing environment.

Despite inflationary pressures and slowing global economics, these results demonstrate the strength of Coca-Cola's branding to weather these economic headwinds.

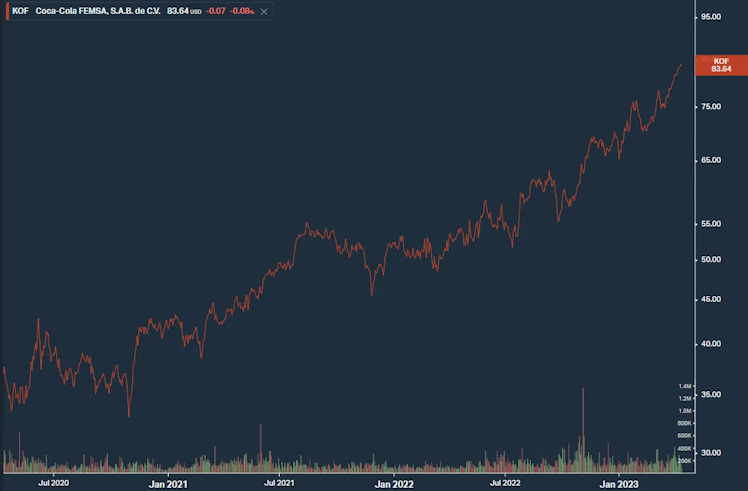

The KOF share price has been performing very robustly in the last few years, with the price up close to +50% year to date.

KOF Share Price Last 3 Years Source: Koyfin

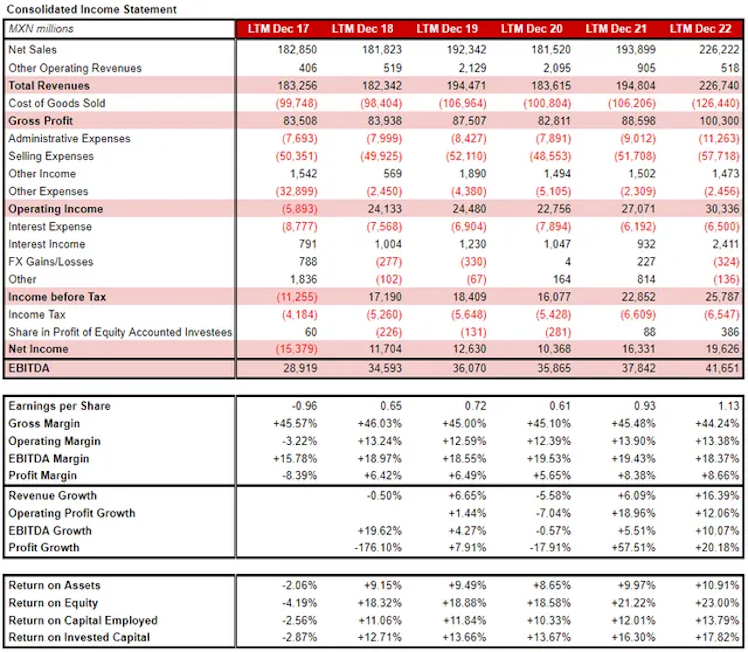

Income Statement

The income statement really presents a lot of the story with Coca-Cola FEMSA. Solid revenue growth with as stable margins as you would ever see. Both of these clearly demonstrate the economies of scale with a business this size and geographic footprint, and the strength of the Coca-Cola brand.

From a profitability and efficiency, the figures are good and steady as you would expect. Return on Invested Capital is at a healthy level but not huge. Likely as a result of the large investment involved in bottling particularly when it comes to setting up plants and factories, and that the efficiencies that come from that kind of investment being broadly fair.

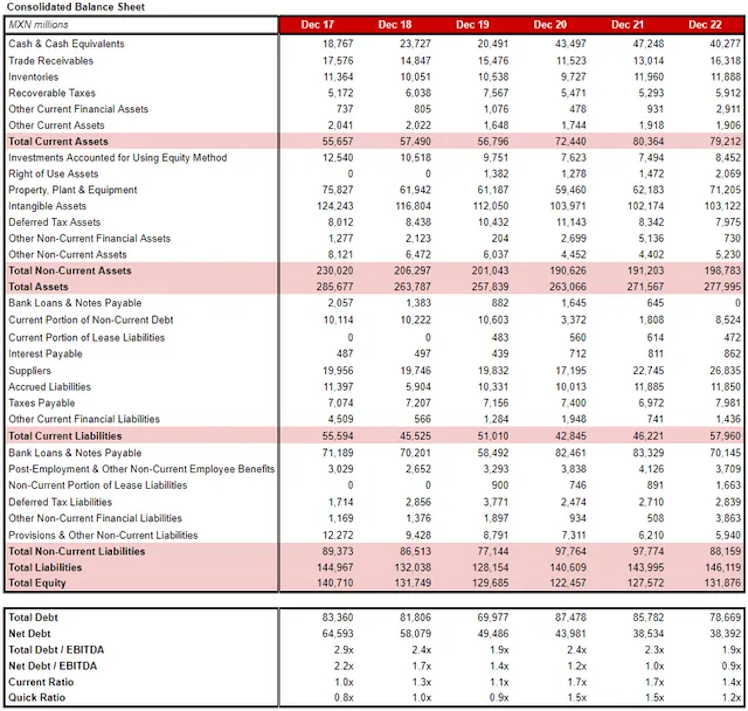

Balance Sheet

The Balance Sheet overall is very healthy. Net leverage is very low and has been steadily falling and now sits at around 1x Net Debt to EBITDA. Important also to notice the value of the Non-Current Assets here in particular the Intangible Assets.

These Intangible Assets will be the value of the Coca-Cola branding and distribution rights which are of huge value understandably given the brand's strength.

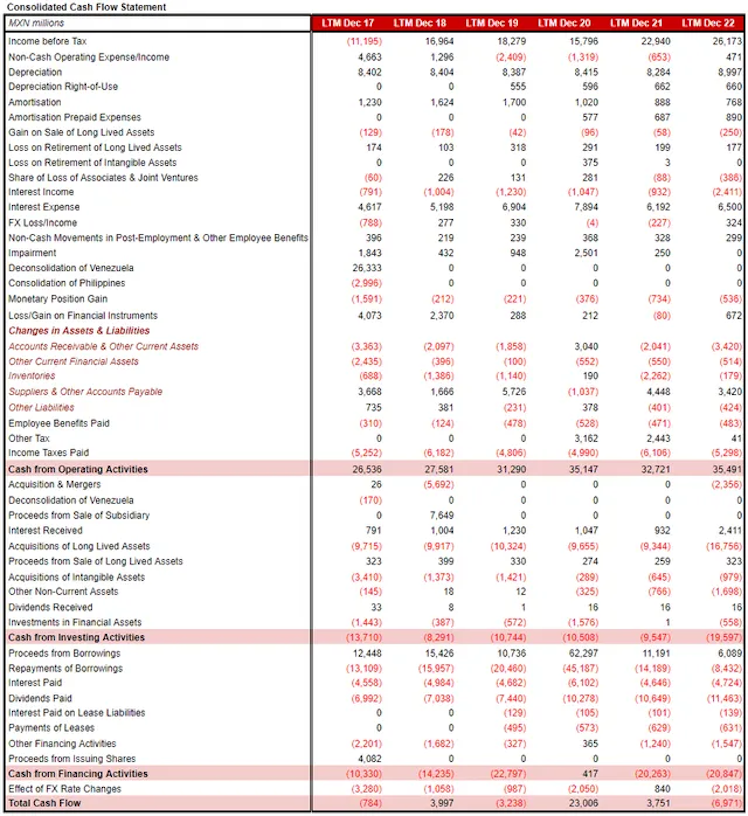

Cash Flow Statement

For the Cash Flow Statement, again things are very healthy. The company has solid positive Cash generated from Operations year to year. Dividends I will cover in detail in a later section of this note.

The only thing to flag here is the rise in Capital Expenditure for 2022. It has risen from the usual level of around MXN10 billion to close to MXN17 billion. This has been a result of increased spending on its B2B (business-to-business) and D2C (direct-to-consumer) platforms. This omnichannel platform called Juntos+ should help expand the company's client base and help to connect the company's 2 million trade clients.

Initial Valuation

For the valuation, we will look at the Price/Earnings ratio of Coca-Cola FEMSA through its recent history and apply this to various forward earnings scenarios for the company.

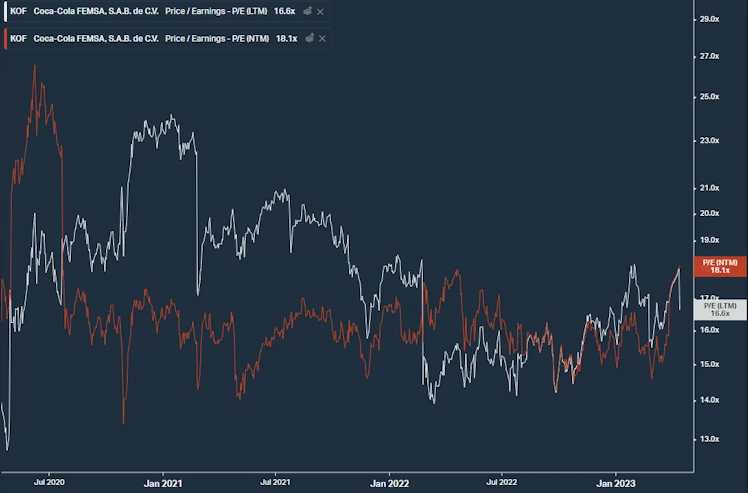

KOF P/E Ration Last Twelve Months vs Next Twelve Months Source: Koyfin

Over the past year or two, the share price broadly seems to be contained between 14x and 17x Price/Earnings. When it hits either end of that range it trends back towards the centre. As such we will set our buy, hold and sell signals based on Price/Earnings multiples as below:

Less than 13x - STRONG BUY

Between 13x and 15x - BUY

Between 15x and 16.5x - HOLD

Between 16.5x and 17.5x - SELL

Above 17.5x - STRONG SELL

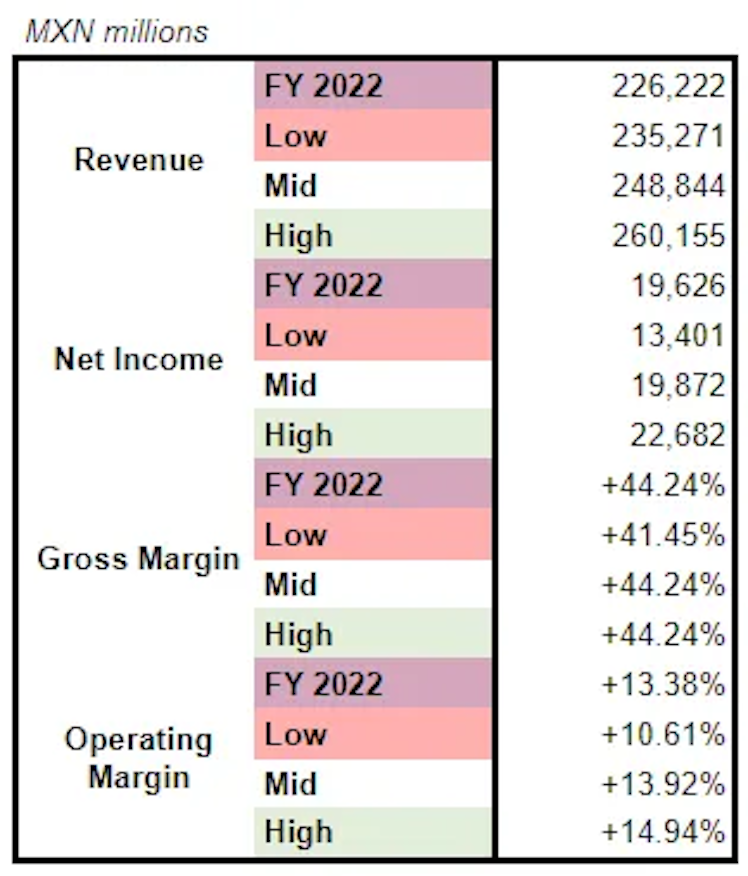

For our scenarios for the company, we will consider a mid, low and high case. For each, we will project earnings for the next 12 months under various assumptions:

Mid Case

- +8% increase in revenues;

- Gross margins and operating margins are maintained where they are.

Low Case

- +4% increase in revenues;

- Margins tighten slightly, with Gross Margins falling to 41.5% from 44.2% and Operating Margins falling to 10.6% from 13.4%.

High Case

- +15% increase in revenues;

- Gross margins and operating margins are maintained where they are.

Given the performance from the past twelve months, the mid and high cases look reasonable, certainly when considering the company's growth intentions. If we want to consider a recession case as our low case, then as inflation remains stubborn, the company would no doubt see margins tighten as raw material prices and wages increase.

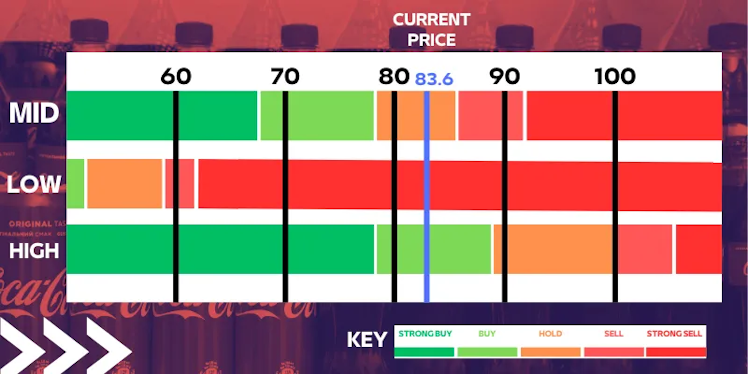

We then feed these earnings assumptions for the next 12 months into our range of Price/Earnings multiples above, to determine whether the current share price of USD 83.6 for the US ADRs is fairly valued.

Versus the mid case, the current share price sits right in the HOLD range, whereas unsurprisingly when considering our two more extreme cases, these sit in the STRONG SELL and BUY ranges.

Risks

The first risk to consider is more related to the market. Although we have taken steps toward building our own valuation, it is important to consider what the broader market may believe.

Referring back to the Price/Earnings chart from the previous section, the Price/Earnings using the market's earnings expectations have shot up to 18x with the recent rally in the share price. If we believe the stock to be trading within a range, there is certainly room for the price to fall for those expectations to come back in line. This is a shorter-term dynamic worth keeping in mind.

This could also be a result of prices reflecting a more bullish outlook for the company without sell-side analysts updating their forecasts. Sell-side analysts updating their earnings forecasts upwards would also bring the Price/Earnings ratio downwards.

We must also consider the risks to the business from a microeconomic and macroeconomic perspective. These could impact the performance of the business and we could see the low case forecast from the previous section or even lower.

If we look at the performance of the company in 2020, this should give us a strong indicator of a very worst case, since there was the COVID-19 pandemic. During that period, revenues only fell around -5% with margins not budging at all. This is a testament to the strength of the Coca-Cola brand and the company's flexibility when it comes to its operations.

If inflation continues to take hold, there could be significant pressure on margins as the price of raw materials increases. Although this could be passed on to the consumer through final product price increases, the demand for Coca-Cola is initially price inelastic thanks to brand loyalty, though there would come a point where price increases would be so high that consumers would switch to cheaper alternatives.

Thanks to the impressive performance in 2020 demonstrating the strength of the business, I believe Coca-Cola FEMSA should comfortably weather continued inflationary headwinds. I don't believe the situation could be as severe as in the low case, however, there could be scope for some margin tightening.

Final Valuation

Considering the risks, the mid case in our Valuation appears to be a fair case. Even in the most difficult of times, Coca-Cola FEMSA has managed to maintain margins stable. Even under some raw material cost pressures from inflation, the company could pass these on to the consumer fairly comfortably thanks to the strong brand loyalty of the Coca-Cola products.

As such the current share price offers a broadly fair valuation, and as such I rate it as a HOLD.

Dividend Considerations

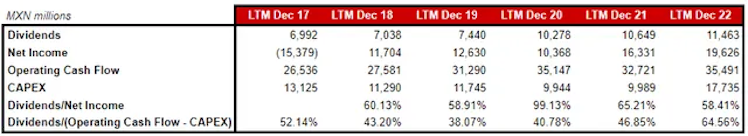

Coca-Cola FEMSA does have a dividend policy and has been steadily issuing a dividend, and as such could be a position for an investor interested in cash flow generation. The stable margins and business certainly support a steady dividend.

The trailing last twelve-month dividend yield has been 3.08% with a market forward expected twelve-month dividend yield of 3.82% according to Koyfin.

The dividend policy is currently that it can issue dividends up to 20% of earnings without board approval. Dividends above that level need to be approved by the board. In recent history, the company has issued dividends that are far above that level.

We will attempt to forecast the path of dividends for the company to each of our previous low, mid, and high valuation cases. For this, I will look at not Dividends/Earnings but instead Dividends/(Operating Cash Flow - CAPEX) or what I will call Available Cash for the rest of this note. This is a fairer reflection of how much cash the company has available to issue as a dividend.

Up until 2021, the company issued between 40 and 45% of this amount as a dividend, but this increased significantly in 2022 to close to 65%. We will again use different assumptions for our three cases for how much of a dividend the company might issue.

Mid Case - 60% of Available Cash

Low Case - 55% of Available Cash

High Case - 60% of Available Cash in 2023 and 2024, then 65% after

These assumptions give the below results when it comes to a dividend:

Using the latest share price, our mid case would deliver a 4% dividend yield under these assumptions with the dividend steadily growing over time. This could be an attractive proposition for a dividend investor looking for a stable cash flow and a position to diversify their existing portfolios.

Disclaimer: This article is purely intended for informational purposes and should not be considered investment advice.

Already have an account?