Trending Assets

Top investors this month

Trending Assets

Top investors this month

Altria $MO: One More Step

I was recently a guest on the Chit Chat Money podcast to discuss Altria’s $MO operations, outlook, and valuation, as well as the most pressing opportunities and challenges facing the industry. The episode is accessible on Google Podcasts, Apple Podcasts, and Spotify.

One issue with a pure audio format is that it does not allow visualization of the data discussed. There is a similar dissatisfaction when looking at Altria’s investor presentations. Altria’s Q1 2023 results were released last Thursday, and management spent quite a bit of time referencing their long-term focus. Yet much of the data and visuals used to explain operations only contain year-over-year comparables or a narrow timeframe of data. Other bits important are missing entirely.

That’s worth exploring in detail.

Altria Q1 2023

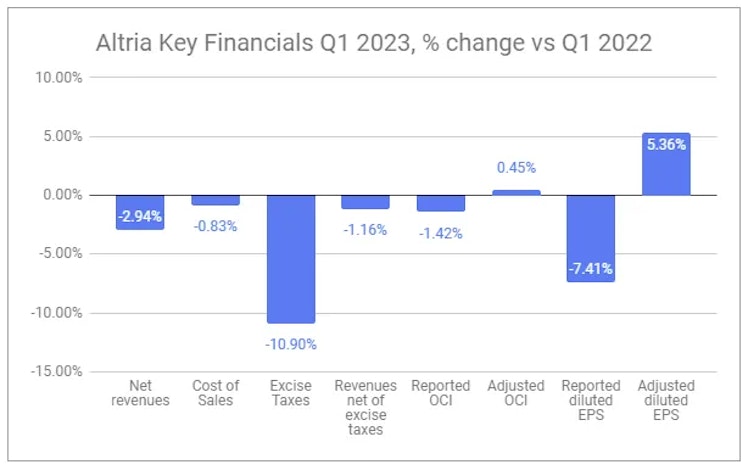

For Q1 2023, Altria’s headline numbers were:

- Net revenues of $5.719 billion, -2.9% y/y

- Revenues net of excise taxes of $4.763 billion, -1.2% y/y

- A reported tax rate of 27.9%, +1.2pp y/y

- An adjusted tax rate of 25%, -0.1pp y/y

- Reported diluted EPS of $1.00, -7.4% y/y

- Adjusted diluted EPS of $1.18, +5.4% y/y

Unlike the first 9 months of last year, we can’t blame part of the reported drop on the divestiture of the Ste. Michelle wine business in 2021. Altria continues to face elevated pressures. But is it all doom and gloom? Management has reaffirmed guidance to reach fulled-year adjusted diluted EPS of between $4.98 and $5.13, reflecting a growth rate of 3-6%. As always, one must examine deeper.

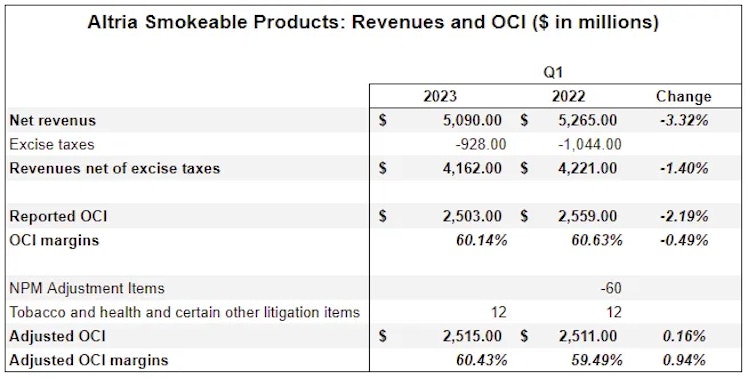

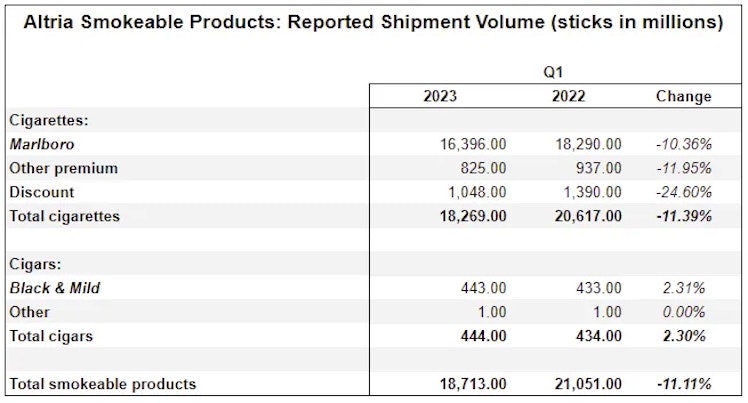

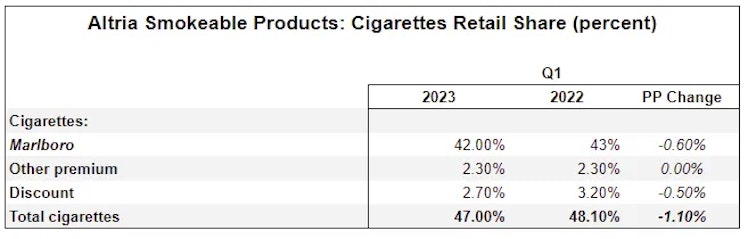

Smokeable Products

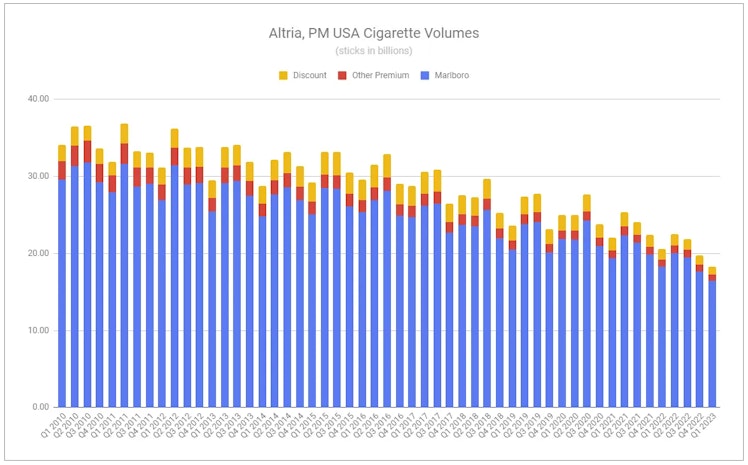

The Smokeable products segment saw net revenues down 3.32% and revenues net of excise taxes down by 1.4% y/y. Reported operating company income fell by an even greater degree, 2.19%. However, beyond TH&OL adjustments, which were even y/y, adjusting for the 2022 NPM benefit showed OCI growing, albeit negligibly, and OCI margin expanding. This is despite total company cigarette shipment volumes dropping by 11.39% y/y for the quarter. Is this a relative success to celebrate? Or should we be seriously asking what is truly behind the volume declines and whether will they continue? Yes to all.

Part of recent volume pressures relates to the late-2022 flavor ban in California, which caused state industry volumes to fall by 11.1% sequentially and 18.8% y/y. While alarming on its face, Altria’s state volumes were down less, at 12.8%. Note, this paints an incomplete picture, with the company citing increasing sales volumes in bordering states such as Nevada. It remains uncertain what the net impact will be long-term.

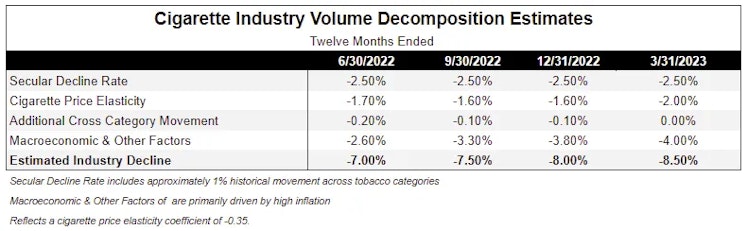

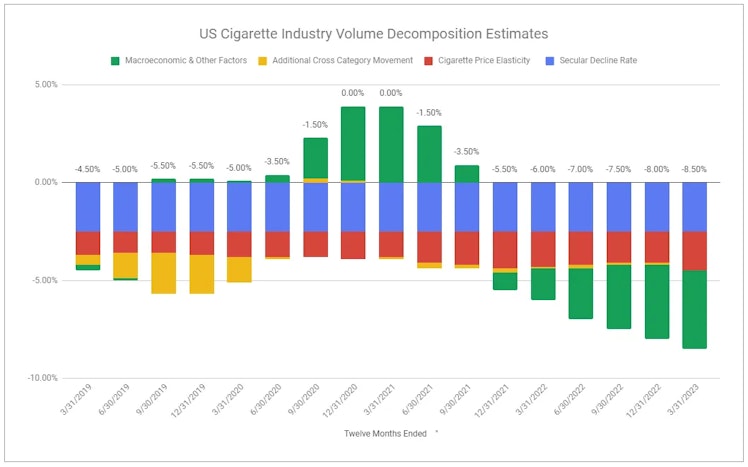

The chart above is the data most recently provided by Altria breaking down the trends in cigarette industry volumes. The biggest standout is that the total trailing twelve-month estimated industry decline has continued to grow. Continually throughout the last year, I have said that I believe this period’s volume decline is likely an outlier, opposite of covid, which led to greater time at home, a spike in consumer discretionary income, and larger stocking purchases. My insistence is grounded in looking at a longer-term trend.

Over the last year, Macroeconomic & other factors continue to be the greatest contributor to cigarette industry volume declines. While gas prices continue to come down from H1 2022, inflation, despite lessening, is still overall persistent. In addition, consumer discretionary income continues to be weighed on by interest rates. Altria CEO William Gifford elaborated on this during the Q&A:

"So it's not just high inflation in the quarter, it's the cumulative impact of that through time. I think certainly, you're seeing interest rates climb, which is impacting consumers, mortgages, credit cards, car loans. And underneath all that, to respond to the consumer, we are seeing accelerated debt as well as decline of savings rates.

So they're using what they have available to them. But it's the cumulative impact of that. It's not new to the cigarette space. I think you can go back in history a bit, and we see other instances where the consumer came under extreme pressure. You can look at the '08, '09 period or '01, '02 period.

And you see where the consumer in those instances were under pressure because of the recessions that were taken place. Here, the other factors I described, we feel like we have the tools in place. I think you see the resiliency of Marlboro in the marketplace, gaining share in the premium space. Certainly, we've seen competitors, I'll call it using your term, Bonnie, running share at the bottom, where they're pricing some of their discount brands at deep discount levels.

And really, if you think about our strategy in the cigarette space, that's to maximize profitability over the long term while making appropriate investments in Marlboro and the growth areas. I think when you think about the question about price elasticity, yes, we made the minor investment at Investor Day. But if you look at even the decomposition that we provided in our metrics, you can see that's been pretty consistent over the past 4 periods that we showed on a 12-month moving. We really don't see anything there from a standpoint of the consumer -- any changes in the price elasticity other than the minor adjustment that we made going into Investor Day."

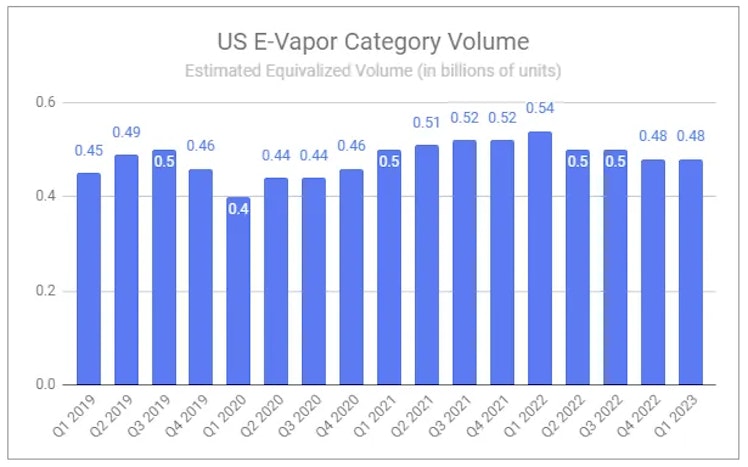

None of this is to say that the trend will fully mean-revert to the 4-5% annual decline rate we’ve seen historically. That should have never been expected. For starters, an additional concern related to the US cigarette industry volume declines is cross-category movement. The secular decline rate of -2.5% remains unchanged and automatically includes a 1% impact of cross-category movement, but Q1 2023 listed a 0% additional contribution. Can this be right? We know there is a cross-category shift occurring from legacy to modern oral, but according to Altria, the shift to e-vapor, which was for a time the largest driver, has been stunted. Gifford explained on the Q1 call:

"We believe the category is continuing to undergo a significant reset, and we estimate that first-quarter e-vapor volumes decreased 11% versus a year ago and 1% sequentially. We have observed a decline in traditional multi-outlet and convenience channel volumes, which we believe is primarily a result of the FDA marketing denial orders issued for JUUL and MyBlu. This volume decline has been partially offset by increased volume in nontraditional channels, such as e-commerce and vape stores."

While Altria’s explanation makes sense and is...

Finish reading the entire comprehensive report at the link below:

invariant.substack.com

Altria: One More Step

A comprehensive look at Q1 2023 results.

Already have an account?