Trending Assets

Top investors this month

Trending Assets

Top investors this month

Voyager's fall: A closer look at the cryptocurrency firm's financials and the role of FTX and Binance

$VYGVF, a Canadian public crypto-asset broker, is crypto's most sought-after acquisition target. Two major players, FTX and Binance, made bids for the company worth $1.4B and $1.0B, respectively despite its market capitalization of just $7M and a history of billions of lost customer funds, sour loans, and no profits. These bids raise questions about the reasons behind such high valuations and offers. Below, I analyze Voyager's financials and shed light on the events that led to its downfall and the potential implications of FTX and Binance's bids.

Voyager might hold the keys to the crypto kingdom.

FTX and Binance bid $1.4B and $1.0B, respectively, for Voyager, a company with:

- A market capitalization of $7M.

- Billions of lost customer funds.

- Millions of sour loans to 3AC and Alameda.

- And no profits.

It makes no sense!

FTX and Binance's offers for Voyager were unjustified by the market or fundamentals and assumed most customer funds are lost and won’t be repaid. Below are the most common ways to justify the value of an acquisition.

❌ Market capitalization. Voyager’s stock is currently valued at ~$7M.

❌ Profitability. Voyager is far from being (or expected to be) a profitable business.

❌ Assets exceed liabilities. Customer funds massively exceed Voyager assets.

✅ Assets exceed liabilities because most customer funds won’t be repaid.

Based on my analysis, it’s possible that Voyager played an important role in the misappropriation of billions of customer funds by FTX (and Binance?)

Most crypto firms are private and opaque (FTX, Binance, Celsius, BlockFi, etc.). However, Voyager is a Canadian public company with quarterly financials. Let’s analyze Voyager's filings for answers.

Caveats:

- Voyager’s financials are a mess. Coinbase passed at the opportunity to acquire it and concluded that financials don’t add up.

- A short operating history and poor disclosure limit analysis and add speculation.

Let’s do a quick overview of the company.

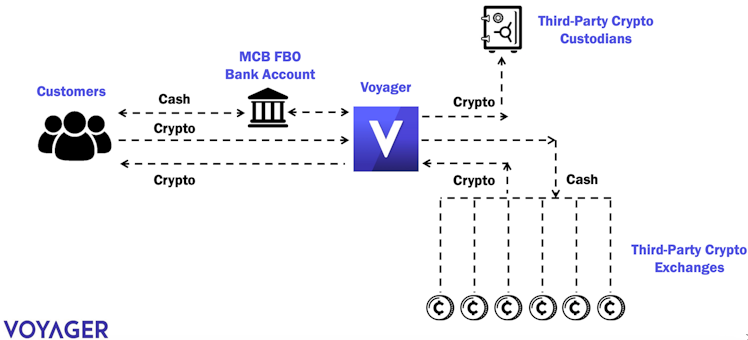

Voyager operated a crypto asset brokerage business. Customers deposited funds and traded them via Voyager’s trading partners, primarily in the US (FTX?) and in Cayman Islands (Binance?)

Voyager First Day Presentation US Bankruptcy Court (July 8, 2022)

Q3’22 Voyager Interim Financials

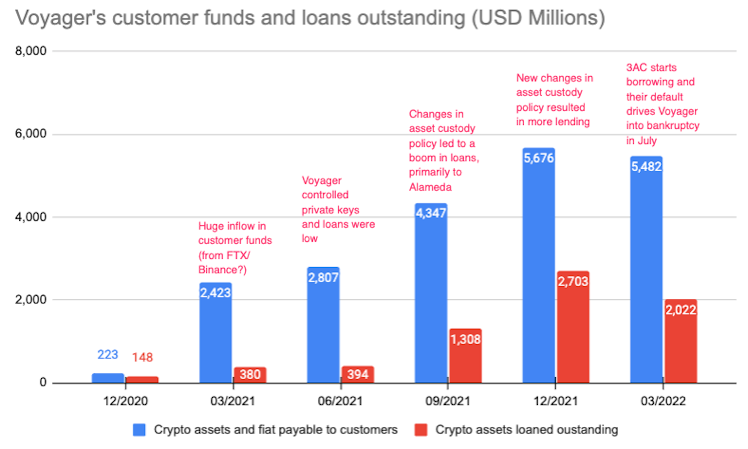

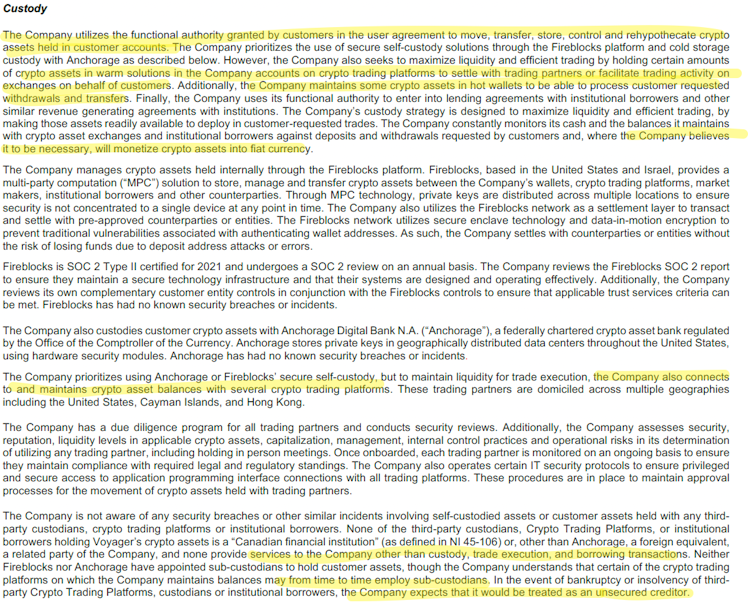

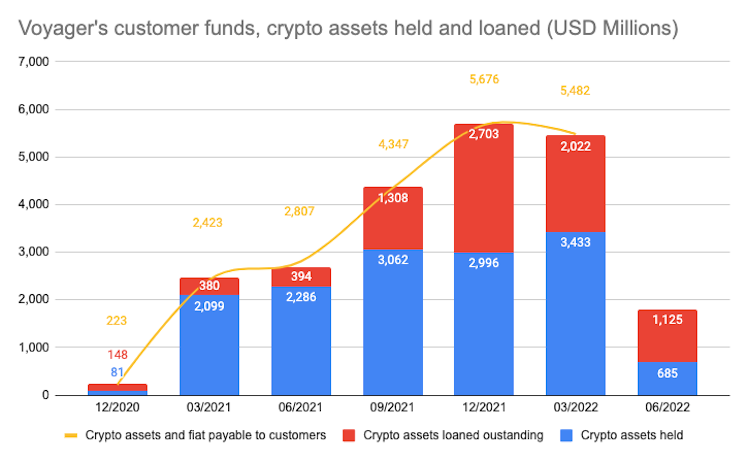

- The rapid jump in customer assets suggests prominent crypto players likely drove deposits, while changes in asset custody policies gave Voyager (and trading partners?) unlimited control over customer deposits.

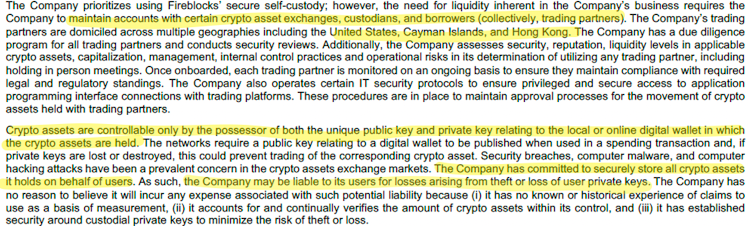

- In June 2021, Voyager held crypto assets at trading partners but controlled the keys required to make transactions, limiting access to funds.

- Only 14% of customer funds were loaned out.

Voyager FY 2021 Annual Report

- In Sep 2021, Voyager changed the asset custody policy providing access to and connecting directly with trading partners.

- Material changes included:

- A new user agreement allowed Voyager to “move, transfer, store, control and rehypothecate crypto assets held in customer accounts.”

2. Trading partners could settle, trade, withdraw and transfer on behalf of customers, which implies they controlled users’ private keys.

3. Trading partners can appoint sub-custodians to hold customer assets, meaning a third party could have access to funds.

4. Voyager is an unsecured creditor in case of trading partners’ bankruptcy, making it harder to recover funds.

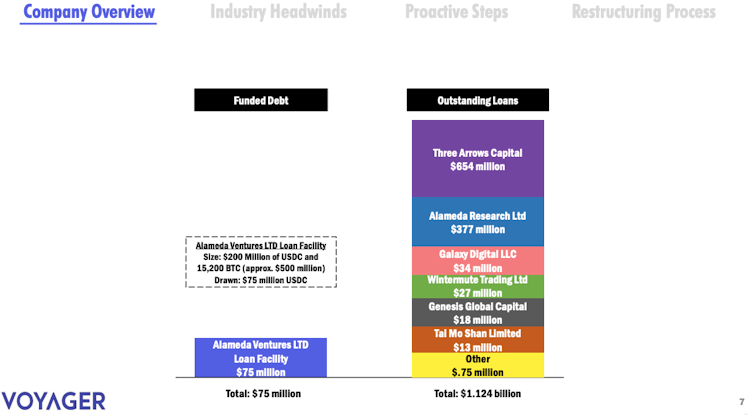

- Customer assets jumped by $1.5B, and loans increased by ~$1B, primarily to Alameda ($514M loans outstanding.)

Voyager Q1 2022 Interim Report

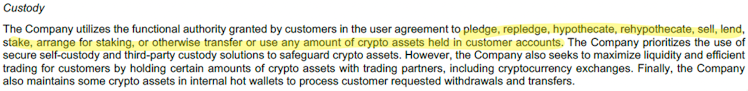

- In Dec 2021, Voyager loosened the user agreement allowing them (and trading partners?) to invest customer funds in new and riskier ways.

- Customer assets and loans jumped by ~$1.3B (to $2.7B), with Alameda’s outstanding loans at $1.7B (60% of total loans.)

- The new agreement allowed the ability to “pledge, repledge, hypothecate, rehypothecate, sell, lend, stake, arrange for staking, or otherwise transfer or use any amount of crypto assets held in customer accounts.”

Voyager Q2 2022 Interim Report

• By March 2022, the crypto market had hit an all-time high and started to decline as 3AC (Three Arrows Capital) started borrowing from Voyager that quarter, which led to both companies’ bankruptcies.

- On July 1, Voyager halted trading, deposits and withdrawals after 3AC filed for bankruptcy. Voyager declared bankruptcy on July 6.

Voyager First Day Presentation US Bankruptcy Court (July 8, 2022)

- The sharp decline in crypto assets in June without disclosing the value of the liability (i.e., customer funds) raises questions about Voyager’s access to funds.

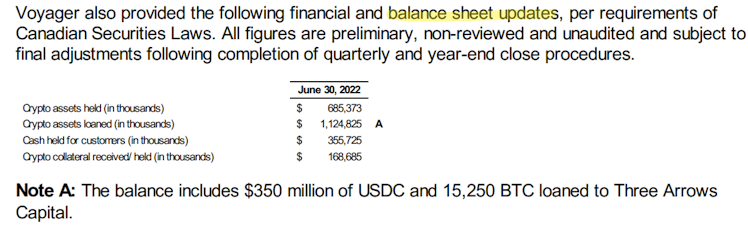

- As of June 30, 2022, crypto assets held by Voyager declined by $2.8B (-80%), likely driven by the -60% market decline and customer withdrawals (-20%).

“Voyager Digital Provides Market Update” July 1, sedar.com

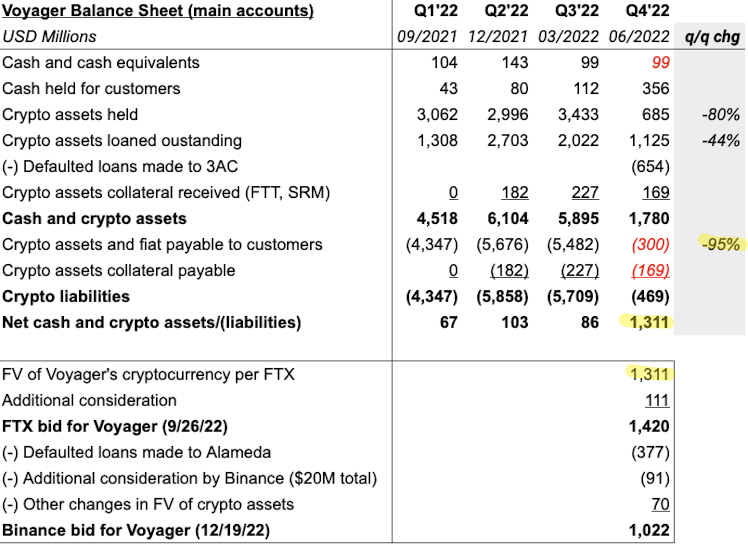

- Based on FTX and Binance’s bids, the implied value of customer deposits is $300M in June 2022, a -95% decline from $5.5B in March, indicating that most funds were lost.

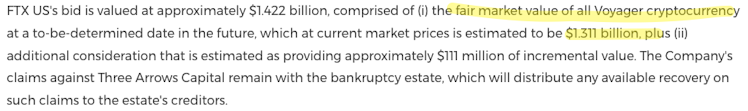

- On Sept 26, 2022, FTX agreed to pay $1.42B, of which $1.3B was the value of Voyager’s cryptocurrency.

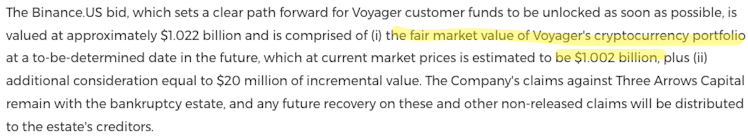

- On Dec 19, 2022, after FTX's implosion, Binance agreed to pay $1.022B. The discount is mainly from Alameda’s defaulted loans ($377M.)

Closing thoughts:

If Voyager only owes $300M in customer funds but holds +$1B assets in crypto and fiat, why is Voyager bankrupt?

I think that most customer funds originated from FTX/Binance and were lost with risky bets. By acquiring Voyager at this valuation, FTX (before) and Binance (now) would come full circle and cover the balance sheet hole left by the missing funds. In addition, the scheme stays under wraps, and no other competitor can access the trades or uncover any wrongdoing related to Voyager.

www.prnewswire.com

Voyager Announces Agreement for Binance.US to Acquire Its Assets

/PRNewswire/ -- Voyager Digital Ltd. ("Voyager" or the "Company") (OTC Pink VYGVQ; FRA: UCD2) announced today that its operating company Voyager Digital LLC...

Already have an account?