Trending Assets

Top investors this month

Trending Assets

Top investors this month

‘Buy the Dip’ Idea Competition – Our take is $BKNG

Our ‘Buy the Dip’ Idea is the leader in OTA industry, namely $BKNG. At first glance, it might seem a contrarian choice considering the recession fears, although we expect a decent performance on a risk/return basis for the next 12 months and in the years ahead. Let’s dive in (11mins read) to see what shaped our decision.

- WHAT'S THE THESIS?

Valuation: We consider that Booking is currently undervalued and recession fears are priced in. The stock can go lower but per our assumptions we estimate an upside of 35%-40%. As Warren Buffet said, “If a business does well, the stock eventually follows".

Travel Recovery: Summer 2022 bookings for $BKNG are already higher Vs 2019 by 15% and industry forecasts are promising (CAGR of c. 17% for 2021 – 2026).

Moat: A Leader in OTA market benefiting from its network effect (+220 countries, +28m listings, 2.4 million properties) and optionality (airline tickets, rent a car, alternative accommodation) which translate to a quality business with higher margins relative to competition.

Capital allocation: Heavy share buybacks over the last 10 years with around 70% of the cash generated from operations returned to shareholders, without disrupting the business from growing. The management view (Cowen conference) remains unchanged -> a) invest in the business (organic, strategic partnerships or M&A) and b) return excess cash to shareholders.

- DO WE SEE ANY UPSIDE FROM CURRENT PRICE LEVELS?

2.1 The DCF Approach

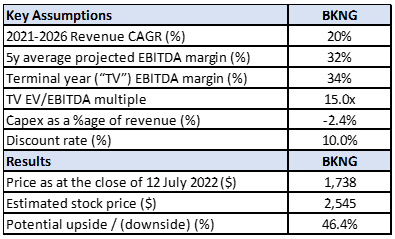

Per our revised valuation the estimated stock price is $2,545 giving a potential upside from the current price of $1,738 (as of 12th July 2022) of c.46.4%.

In brief, the revenue was based on analysts’ consensus and was compared to industry forecasts for Travel & Tourism as provided by Statista (i.e. 17% for 2021-2026), whereas for the EBITDA margin we assumed an average projected margin of 32% increasing to 34% at terminal year. It should be noted that the average EBITDA margin for 2012 to 2021 stood at 31.5%, whereas if 2020 is excluded the average EBITDA margin is 37.2%.

To account for the additional macroeconomic risks, our minimum required return of 10% was used in our model to discount projected cash flows rather than the estimated WACC of c.9.3%.

In respect to the terminal multiple, we used 15x which is lower than the 5 year average and the TTM multiple of 18x. A lower multiple was used to account for the reduced growth opportunities after 2026 (provided that CAGR of 20% materializes) and to be in line with the average of 15.1x EV/EBITDA (NTM) of selected Hotels, Restaurant and Leisure stocks.

2.2 The Multiple / Hybrid approach

Due to the current uncertainty, we run a scenario analysis adjusting the estimated EBITDA for the next 12 months and the EV/EBITDA multiple. Based on our analysis, we estimate that there is a weighted potential upside of c.31.8%.

To shed some light on our assumptions (which may not materialize) the estimated EBITDA (TTM) was based on analysts’ consensus adjusted for timing (as historically the majority of EBITDA of $BKNG occurs in Q3) and applied a discount of 5%, 20% and 0% for Base, Pessimistic and Optimistic scenarios, respectively.

The Multiples used were based on a) Base: the TTM multiple of $BKNG of 18x discounted by 10%, b) Pessimistic: average of NTM multiple of the selected peers discounted by 10% and c) Optimistic: the average EV/EBITDA multiple of $BKNG for the years 2012 to 2021 (excl. 2020).

- A HIGHLY PROFITABLE AND CASH GENERATING BUSINESS

3.1 Growth and Margins

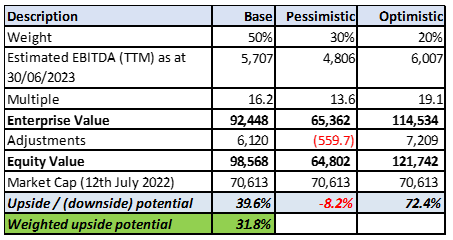

Financial performance of $BKNG is remarkable and has been consistently growing revenues and EBITDA with the exception of 2020 (pandemic impact). As it can be observed from the below graph, the business is growing profitably and with impressive free cash flow conversion. Such results demonstrate that Booking has operating leverage and an ability to maintain its take rate/pricing (Revenue/Gross Booking volume) as the hotel industry is fragmented while the OTA market is concentrated on 3 key players ($BKNG, $EXPE & $ABNB).

Source: Koyfin, Seeking Alpha, StockOpine analysis

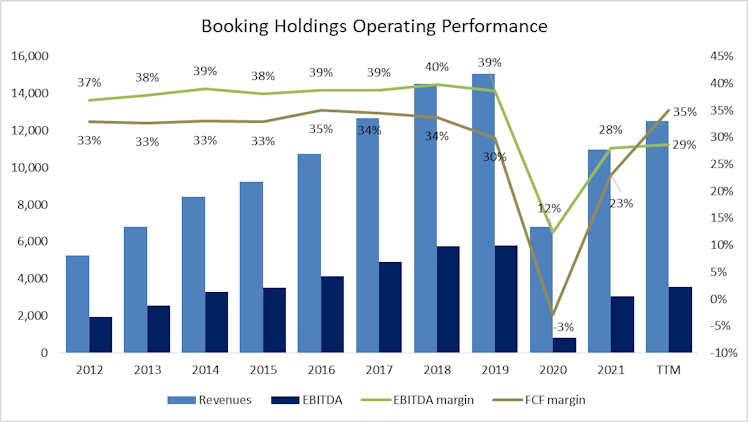

On the other hand, Expedia which by revenue is considered the 2nd largest OTA (Revenue of leading OTAs worldwide 2021 | Statista ) operates with much lower profit and free cash flow margins. Additionally, during the pandemic it revealed more vulnerability to economic shocks compared to $BKNG as its FCF margin fell to a negative 89% and its EBITDA margin to -24 (see graph below).

Source: Koyfin, Seeking Alpha, StockOpine analysis

We do not claim that $BKNG is more robust to $ABNB since $ABNB faced a smoother reduction in gross booking volume compared to $BKNG during the pandemic. Despite this, both companies are recovering recording their highest GBV in Q1’22 ($BKNG - $27.3B and $ABNB - $17.2B).

Although the management composition was not a factor in choosing Booking, the fact that Glenn Fogel has been with the Company since 2000 and serves as the CEO and President of Booking Holdings Plc since 2017 and as CEO of Booking. com since June 2019 says something about his ability to execute.

3.2 Bookings, nights booked and outlook

Gross Bookings and Nights booked grew since 2008 (with the exception of 2020) which implies that the revenue and EBITDA growth observed are clean from any significant one-off events.

Source: Booking Holdings website

As noted above, GBV in Q1’22 of $27.3B exceeded Q1’19 ($25.4B) by 7%, whereas Nights booked of 198m fell below Q1’19 (217m) by 9%.

Additionally, in the recent Cowen conference (2nd of June 2022) Glenn Fogel indicated that the summer bookings are 15% ahead compared to 2019, whereas if the geography is restricted to US & Europe that translates to 30%. No guidance was given for post summer period due to the uncertainty and unpredictability of the industry (imagine what happened in the last 2.5 years!).

4. WHAT IS THE MOAT OF BOOKING?

4.1 The high barriers of entry due to network effects give an advantage of existing players over new entrants. For example, Booking is attracting more and more consumers since its supply of hotels, vacation rentals etc. is larger than what a single hotel chain has to offer. As a result, hotels list their properties on Booking to capitalize on its customer base.

Per Booking website and latest 10-Q filing, there are 28+ million listings (hotels, apartments, homes etc.) in +220 countries and 2.4 million properties whereas per Statista (Largest hotel chains by properties) the top 10 hotel chains, when combined, own only c. 46k properties (as of September 2021).

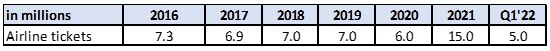

4.2 Optionality: Beyond booking a hotel, vacation rental or alternative accommodation it also offers flights booking, rent-a-car, booking a visit to an attraction / activity, restaurant reservation etc. The progress seen in flights is impressive, as in Q1’22 5m tickets were sold, that is 2.5x what was sold in Q1’19 (as indicated by David Goulden during Cowen conference).

Source: 10K reports, StockOpine analysis

The company is also taking measures to progress in alternative accommodation and to better position the firm in US market (where it lacks) by introducing reasonable liability insurance, improving payment system and by talking to hosts.

- IS THE POST-COVID TRAVEL RECOVERY HAPPENING OR SHOULD WE WAIT?

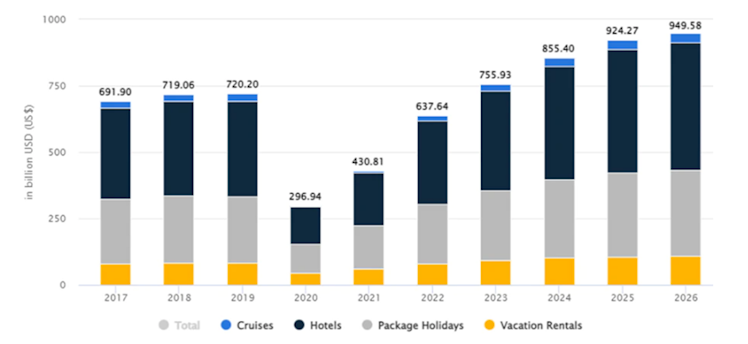

The Travel & Tourism market is projected to reach US$637.6bn in 2022 and generate an annual growth rate (CAGR) of 17.1% for 2021-2026, resulting to a projected market volume of US$949.6bn by 2026.

Source: Statista (published on Jun 2, 2022)

With inflation reaching another 40-year high (9.1%) on July 13th, 2022 and the expectation of further rate hikes, the recession fears grow and if materialize, they could distort the above estimates.

Despite such fears, we extracted information from 2 different sources which effectively show the willingness of people to travel irrespective of price hikes, delays or flight cancellations.

Summer Travel Survey 2022 - More than 42% of American adults will travel more this summer than last summer.

US Travel Demand Remains Strong Despite Inflation | TravelPulse - The research, based on data from OAG's Flightview flight-tracking app, found that 27 percent more people are traveling this summer compared to 2021.

To conclude, there are imminent risks under the current environment but we also agree with Glenn Fogel who recently said “People will always want to travel. They always have it. World War 2 ends and a couple years later, Americans all over Europe. It's going to happen. Pandemics – and people want to travel."

Thank you for reading this memo and make sure to follow us on Commonstock and subscribe to our newsletter in substack!

Disclaimer: Not a financial/investment advice. The team does not guarantee the accuracy or completeness of the information provided in the memo. All statements express personal opinions based on own financial and business analysis. Any estimates or forward looking statements made are inherently unreliable. No statement of opinion is an offer or solicitation to buy or sell the financial instruments mentioned.

Neither the team nor any of its affiliates accept any liability whatsoever for any direct or indirect loss however arising, from any use of the information contained herein.

stockopine.substack.com

StockOpine’s Newsletter | Substack

We invest the time, so you can save hours!

Providing high-quality fundamental research and stock ideas. Click to read StockOpine’s Newsletter, a Substack publication with thousands of subscribers.

Already have an account?