Trending Assets

Top investors this month

Trending Assets

Top investors this month

Here's a dose of optimism for Office REIT investors

I want to start off this memo by giving perspective. It might sound poetic but there are lessons that we can all learn from it:

I remember a time when retail REITs were seen as the least desirable REITs.

That time was during the retail apocalypse.

After that ended, investors chased after the bargains in the retail REITs sector.

Currently, office REITs are undergoing something similar.

Back during the retail apocalypse, investors were concerned about many things. The thing they were concerned with is that retailers are all going online in order to adapt to consumers' changing behaviors. Investors in retail REITs worry that retailers will want to cancel their leases and only sell products online because of this.

Another concern investors had was that Amazon will dominate retail and push all other retailers into a state of constant struggle. There was lots of blood in the retail sector of the stock market during that time, with brand name stocks like Walmart, Target, Home Depot, Costco, Best Buy, etc. all trading at dirt cheap valuations.

In the end, Amazon didn't push these brand-name retailers into bankruptcy. Sure, the smaller names like Sears and JC Penny either went bankrupt or are about to go bankrupt, but the big retail names like Costco and Walmart kept growing both fundamentally and in their stock prices.

Today, a similar situation is happening. This time, investors aren't concerned with one big tech company putting the rest of the industry into bankruptcy.

Instead, investors are concerned with the fact that the pandemic has made work from home a new normal. Even if we're out of the pandemic today, many workers like working from home because of the convenience and lower costs that come with that lifestyle. Business, in general, became more efficient as office work could all be done from home. No spending on rent or office amenities. Just an employee's salary and their hardware for work and that's all.

Workers themselves are liking working from home and are becoming resistant to their employers' demands of returning to the office. In the Bay Area, workers don't like having to travel through BART to get to Oakland or SF because of concerns over safety. In Silicon Valley, workers don't like having to deal with traffic. If employers succumb to the demands of their workers, then demand for office space could nearly disappear.

However, there's one thing that's a certainty in the post-pandemic world: hybrid work is the new normal. While remote work is definitely a new part of the post-pandemic world, I believe that the office will still play a vital role in the post-pandemic world, as it did in the pre-pandemic world.

From an employer's perspective, employers fear that by not bringing employees to the office, it will be harder to promote collaboration, train new workers, and maintain a culture that promotes unity and profitability over the long run. When comparing my virtual internship experiences to my friends' virtual internship experiences during the summer of 2021, training was something that we all struggled with. Tech issues were the main problems we had in training. As for collaboration, we all had mixed experiences. I was lucky to have great communication with my team and we were all able to collaborate smoothly on tasks. Meanwhile, my friends had issues with collaboration because their team members had different expectations that they weren't able to fulfill, tech issues were plaguing the experience, etc.

As for the cultural impact on remote work, many underestimate the importance of culture in a company. During the pre-pandemic days, culture was something that business professors emphasized when analyzing why companies have become successful. When Airbnb started doing layoffs, the biggest thing that the founders feared was the impact on the company's culture. By having employees all come in a shared environment, it was easier for companies to promote the culture they wanted their employees to foster. With remote work, pushing a certain culture onto someone is more difficult because there's no human-to-human interaction outside the digital world.

To attract employees to the office, companies are making their offices more attractive for employees to return to. As Nareit notes:

"REITs are seeing tenants looking to upgrade their space and create an environment that employees will want to come back to."

During the pandemic, workers had the liberty to decorate their home offices to make them inspiring. Some workers have found work from home to be better because their home office was seen as more inspiring to them than their office. Companies are upgrading their offices thinking that by making them more inspiring to work in, they can attract workers back to the office.

If workers aren't willing to go back to the office despite all the improvements that companies have invested in making their offices more appealing, it creates a dynamic that incentivizes employers to force workers back to the office. With the money already spent on beautifying the office, employers want to maximize the money they've spent by having their workers work in that new environment that they created for them.

Looking on the bright side, as more companies make investments in upgrading their offices, office landlords will continue to see tenants wanting to stay longer in their buildings. And if these tenants choose to leave, at least the landlord can use the office upgrades to attract another tenant.

The biggest piece of contrarian thought on office REITs is an article made by Cushman & Wakefield, the largest commercial real estate services firm. In their article, they note down many silver linings that happened in the office market during the pandemic. They include:

- More flexibility with leases (which came with higher rental rates)

- Reduction in office density (the term is de-densification)

- Rising demand for co-working spaces

- Decentralization in the way firms open up offices

- Decentralized offices showed more resilience during the pandemic than centralized office properties

Firstly, the fact that office leases had higher rental rates, at a time when demand for offices was well below normal times, is surprising. There's more than meets the eye when it comes to the higher rental rates. For context, everything that contributes to the higher rental rates provides more flexibility in the lease contract that support the tenants. Here are a couple excerpts to note:

"Due to the market uncertainty in the current economic landscape, firms signing leases desire increased flexibility, which can lead to benefits for office REITs who are willing to accommodate."

"For instance, some firms may want to sign shorter leases, which typically command a higher rental rate as compared to longer leases for the same amount of floor space. Office REITs will then be able to increase the rent earlier when these firms renew during the next market upcycle."

"Other companies could seek pre-termination clauses which allow them to surrender part of their space before the lease expires. Lease agreements which include such clauses also usually have higher rental rates versus those leases without."

In general, cap rates for office real estate are growing as landlords become more flexible with their leases.

Regarding the pre-termination clauses that office landlords are offering to tenants, Cushman & Wakefield noted that these clauses aren't offered to everyone. Here's the excerpt:

"With the K-shaped economic recovery under way, office REITs can exercise discretion on which firms they grant these pre-termination clauses to. By only bestowing the coveted clause on firms in sectors within the upper half of the K-shaped recovery, office REITs will be able to reap higher rental rates while significantly decreasing the probability that these firms will exercise the pre-termination clause. It should also be noted that firms would have to pay an additional fee to exercise the clause, reducing the risk to office REITs."

The reason why office landlords would only offer the pre-termination clauses to firms that are recovering from the pandemic downturn is that those firms will be able to better afford the higher rental rates that come with having the pre-termination contract. Firms that are struggling to recover from the pandemic downturn wouldn't be able to afford higher rental rates, hence why they are stuck with less flexibility on their leases.

Furthermore, since there will be a fee, which I assume is massive, that comes with exercising the pre-termination clause, firms that are in the upper half of the K-shaped recovery are more likely to be able to afford that fee. Firms that are struggling wouldn't be able to afford that fee on top of the higher rental rates.

Overall, office REITs are finding ways to reap more rent out of their stronger clients.

Another thing to note in the article is that social distancing requirements have prompted firms to reduce the density of their office spaces. Firms can't be cheap on the amount of office space they lease when they have to follow social distancing requirements. Even if the pandemic has passed, firms are still de-densifying the office to ensure that they are prepared for the next pandemic.

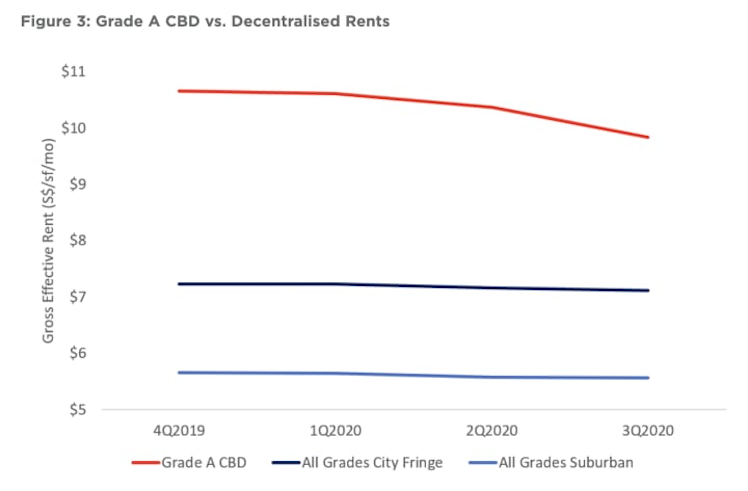

Office REIT investors should take note of the locations where their companies' properties are located. Cushman & Wakefield found that properties located outside of centralized business districts (CBDs) tend to have higher cap rates than properties located in centralized business districts.

By the way, properties located outside of CBDs are called decentralized offices.

According to Cushman & Wakefield, rental rates for decentralized offices remained stable while rents in CBDs plunged by 7.7% on average. Having more decentralized offices in an office REIT's portfolio gives investors more downside protection and more value together.

There are issues with employers signing leases for decentralized spaces. First, there isn't enough office space in those areas. Historically, demand for office space in those areas has been low and the pandemic has created an environment where rental rates for decentralized offices could surge. Also, companies are less willing to sign new leases when they can save money by running their operations remotely.

Since employers are yearning to get their workers into the office for the many reasons I mentioned earlier in the article, the question is: who will help bridge the supply and demand gap for decentralized offices?

The answer to that question is co-working space companies. Whether it's WeWork or its competitors, these firms are best positioned to help bridge the supply and demand gap for decentralized offices. As Cushman & Wakefield note:

"Co-working operators will also open new locations in these areas to serve smaller firms who do not have the resources to open their own secondary offices. This will increase the demand for decentralised office spaces and presents an opportunity for office REITs to fill a gap in their portfolios."

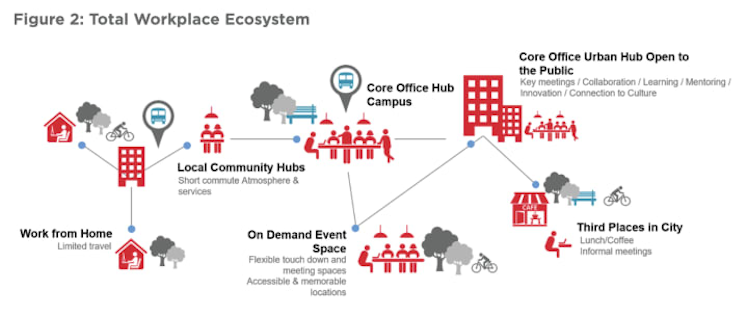

With employees spread out throughout numerous parts of a country, let alone a region, it wouldn't be wise to rent out an entire floor of a small office building when it would be more efficient to rent out a coworking space for them. As Cushman & Wakefield note, the future of work is a total ecosystem.

The core office urban hub or the core office hub campus that was once the place where everyone would commute to, will no longer be the place where people will be commuting. Instead, employees will be utilizing the numerous workplace options that they have.

When it comes to bringing employees to the office, the local community hub or the on-demand event space will be utilized more often. Employees get to commute less and employers have an easier time bringing employees to the office.

Conclusion

The future for the office real estate industry is bright. But to capitalize on that bright future, office landlords should adapt to the changing dynamics of the world.

Even as employers struggle to bring employees back to the office, remember that offices will continue to play a vital role in the operations of a business for the foreseeable future. At the same time, the changing dynamics of how firms do offices have given coworking businesses like WeWork an opportunity that's bigger than what it would've reaped in the pre-pandemic days.

The bearish sentiments for investors are rational, but after reading this memo, I hope that I've opened your minds and inspired you to start bargain hunting for those office REITs. Heck, maybe I've inspired you to consider investing in WeWork or another coworking space company.

Already have an account?