Trending Assets

Top investors this month

Trending Assets

Top investors this month

Better Buy: SoFi or Kinsale Capital?

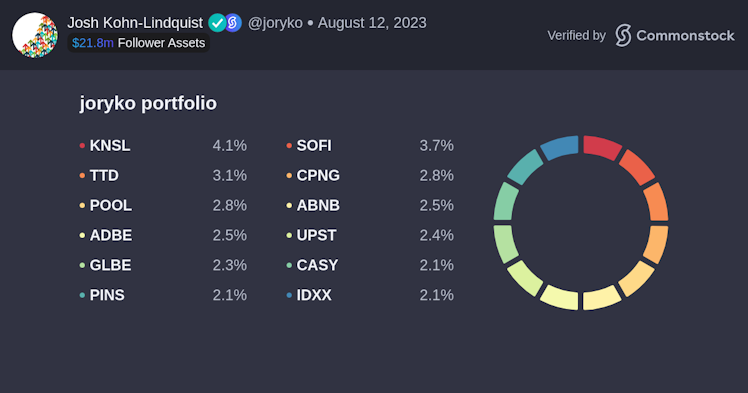

With $SOFI up 88% and $KNSL up 41% year to date, the two financial stocks are now my largest holdings.

Whereas I have stopped adding to some core holdings like $NVDA and $UPST that have risen quickly, I still think SoFi and Kinsale are interesting at today's prices.

So who is the better buy?

Here's my favorite thing about each company at the moment:

- SoFi - Aside from its bank's deposit base allowing for cheaper funding for loans, SoFi's lending segment offers interesting interest rate protection. Here's what I mean. If rates continue rising, its personal loans unit benefits as credit card consolidation becomes evermore attractive. If rates fall, student loans and home loans benefit from increased refinancing activity. With the student loan moratorium set to end soon in the U.S., SoFi is well-positioned to realize its goal of profitability by year's end.

- Kinsale - Amid a boom cycle, the company grew gross written premiums by 58% in Q2. Despite my thinking, "this can't last much longer," CEO Michael Kehoe stated, "And to the extent that inflation is impacting casualty reserve adequacy for the industry, it may be bullish for continued strong rate increases and growth for the near term perhaps through 2024 or beyond." Anything close to last quarter's growth and a combined ratio of 77% for another year or so would quickly outgrow its P/E ratio of 38. Ultimately management expects long-term premium growth to settle in around the low-teens percentages.

All in all, I really like both, but Kinsale's growth may be "safer" thanks to its stellar profitability.

I would love to hear what you all think about these two businesses -- thanks for reading. 🙏

Which stock is the better buy through 2043?

60%SoFi

40%Kinsale

10 VotesPoll ended on: 8/15/2023

Already have an account?