Trending Assets

Top investors this month

Trending Assets

Top investors this month

Palantir: The Defense Contractor for the 21st Century $PLTR

As touchy of subjects as national defense and war are, one must grapple with them when considering an investment in $PLTR.

Sometimes, it's best not to overthink it.

- Palantir's largest customer is the largest customer with the deepest pockets in the world: the U.S. government.

- With war increasingly economic, cyber, informational vs. kinetic, state of the art encryption, security, big data, software and AI solutions are required to retain an advantage. Palantir is the world class provider of these solutions, bringing government-grade security to industry, and industry-grade know-how to government.

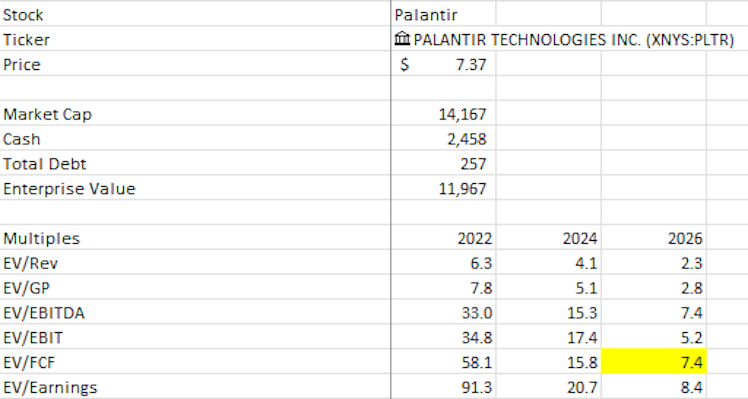

Take the competitive advantages enjoyed by government IT, engineering and consulting contractor Booz Allen Hamilton and lay a SaaS business model on top of it and you have Palantir, on sale today for 7x 2026 FCF.

Thesis

Global leader in AI software sales. Monopoly-like software market share with western governments. Long runway for growth competing in combined $119 billion and growing TAM for commercial (~$56 billion) and government (~$63 billion) software (Palantir S-1) against $2 billion in 2022 revenue.

Moat

"Most software companies are either uninterested in producing or unable to produce products that address the fundamental needs of a large institution. The investment required is too high. The potential payoff is too uncertain." - Alex Karp, Palantir CEO, 2022 Annual Letter

While most software companies build and market one size fits all products which lend themselves to commodification, Palantir sometimes works with customers for months or years developing custom solutions to provide real value before generating any revenue, engendering customer trust and long-term lock-in.

Product and Business Model

Palantir began in 2003 providing a software platform for government use, and has since expanded into the commercial market. The company has built two principal software platforms: Gotham and Foundry.

In the company's words (from the S-1):

"Gotham was constructed for analysts at government defense and intelligence agencies. It enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants, and helps U.S. and allied military personnel find what they are looking for.

The challenges faced by commercial institutions when it came to working with data were fundamentally similar. Companies routinely struggle to manage let alone make sense of the data involved in large projects. Foundry was built for them. The platform transforms the ways in which organizations interact with information by creating a central operating system for their data."

Customers pay Palantir to use their software platforms, and pricing is based on the value the company estimates their software platforms will produce for their customers.

Business Performance and Unit Economics

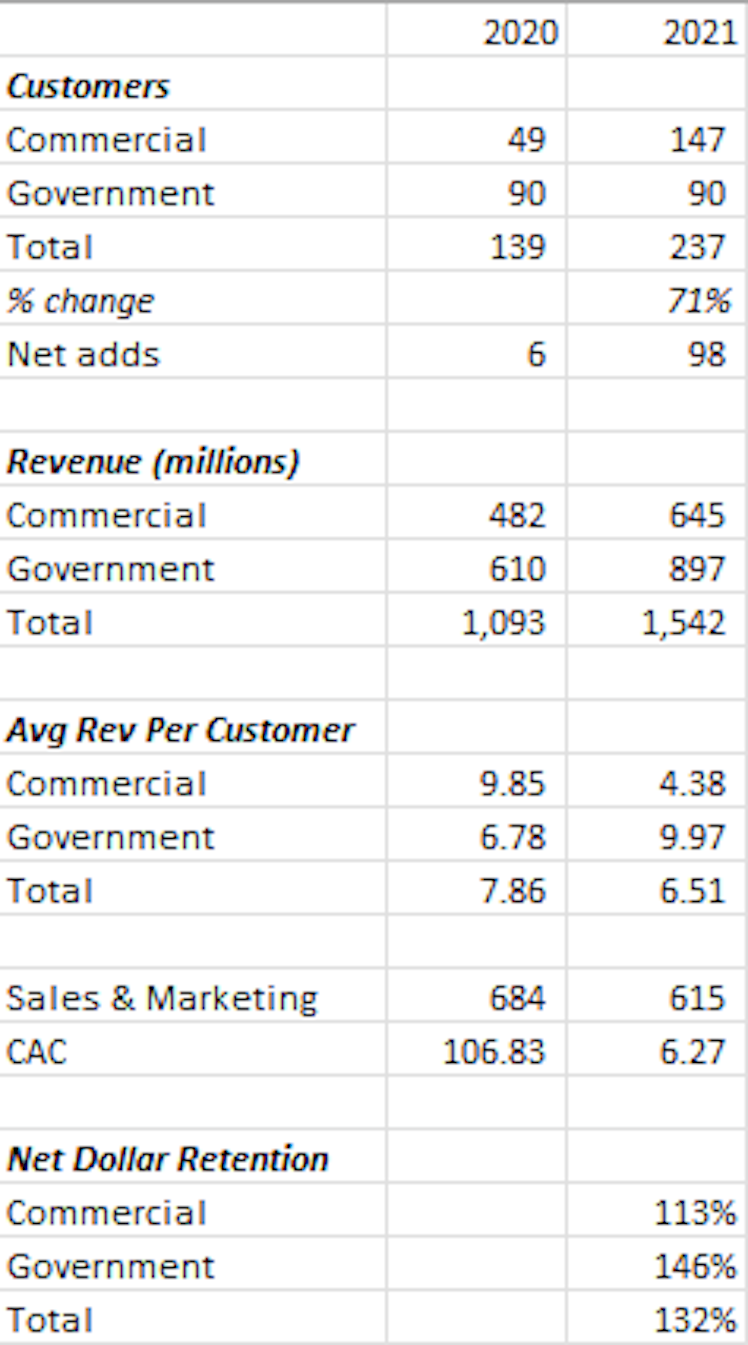

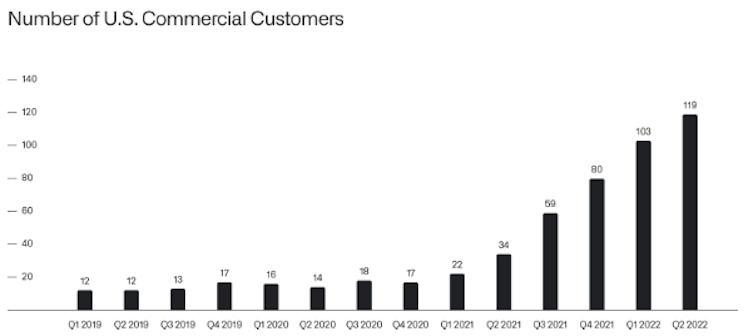

Currently, Palantir is growing both through expanding down market in the commercial sector as well as increasing Average Revenue Per Customer (ARPC) in the government sector.

In 2021, Palantir tripled its number of commercial customers from 49 to 147 while government customers remained flat at 90.

Correspondingly, ARPC in the commercial sector fell from ~$10 million to ~$4 million, while in the government sector ARPC increased from ~$7 million to ~$10 million.

After heightened, one-time SBC costs attributable to the company's 2020 direct listing, sales & marketing expense dropped from 2020 to 2021 even as revenue grew 41%.

With total ARPC of $6.51 million, CAC (2021 S&M expense / customer net adds) of $6.21 million and net dollar retention of 132%, Palantir boasts outstanding unit economics.

Betting on Themselves

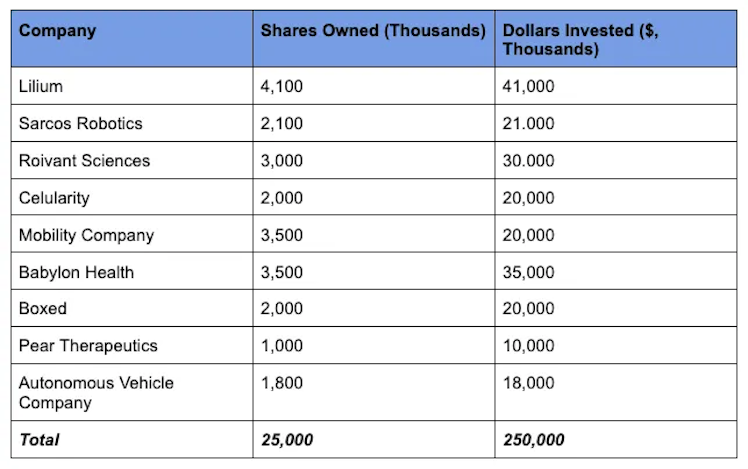

Palantir has adopted a unique strategy of taking equity stakes in their commercial customers, aligning incentives and allowing them to succeed alongside their customers not only in terms of their business but also their investments. See below a table of equity investments and this recently announced partnership with Lilium.

source: mtcapital.substack.com

Valuation

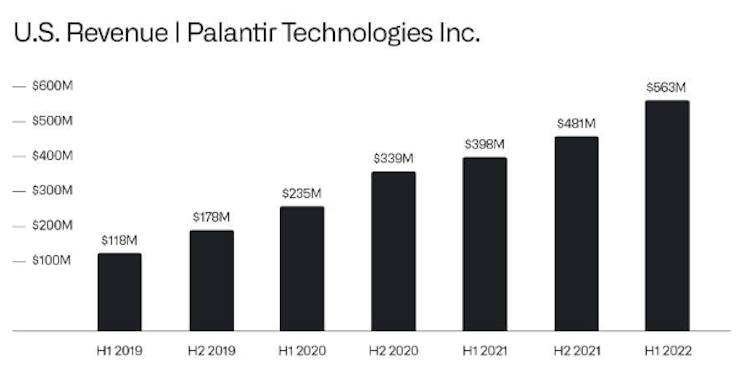

Despite the tech and growth meltdown in the equity market, Palantir's business has kept on humming in 2022.

After a 79% drawdown from its January 2021 highs, the stock now sits at an attractively valued 6x 2022 revenues with 80% gross margins.

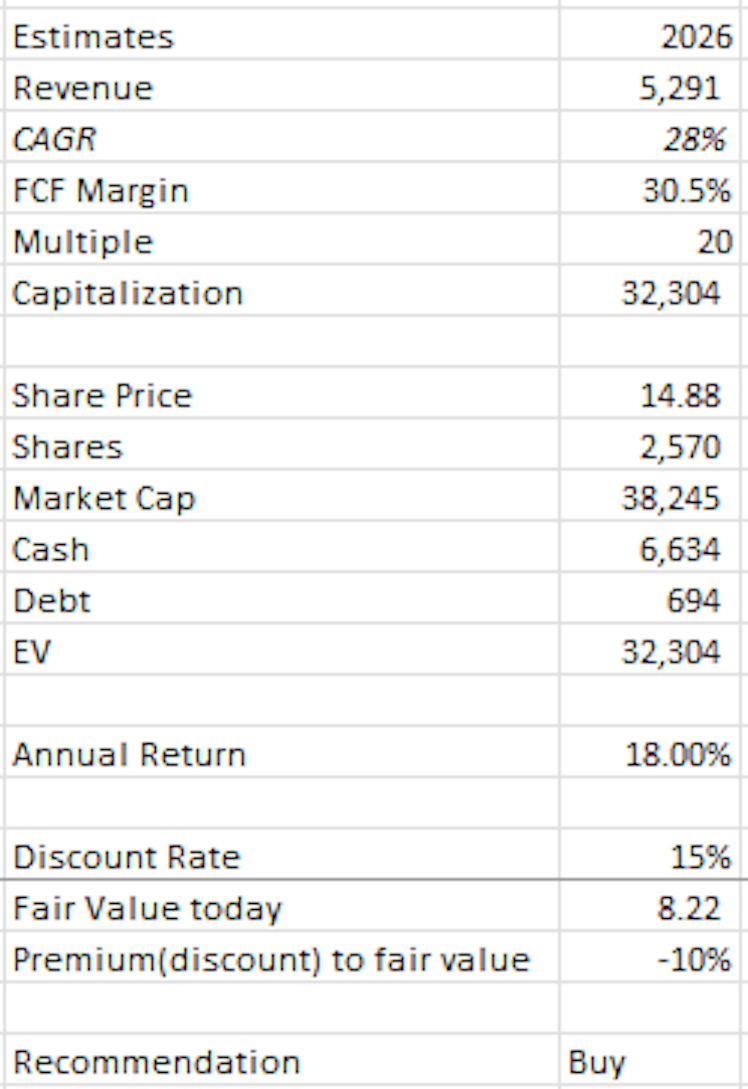

A revenue growth and margin expansion story over the next 5 years, I project an 18% annual return in the stock from now until 2026, based on 20x 2026 FCF estimates, 6% annual share dilution and a 15% discount rate.

CEO Alex Karp is a controversial figure.

I encourage you to read his 2022 annual letter and more recent Q2 2022 shareholder letter to get a sense of his values and to evaluate if they align with your own.

Palantir

Letter to Shareholders

A Letter from the Chief Executive Officer | Q2 2022

Already have an account?