Trending Assets

Top investors this month

Trending Assets

Top investors this month

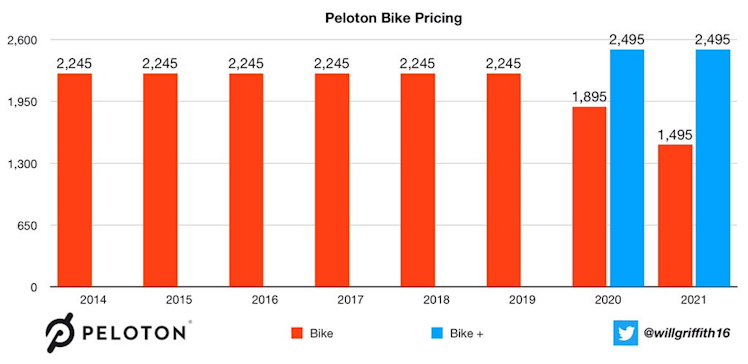

Peloton Pricing Power

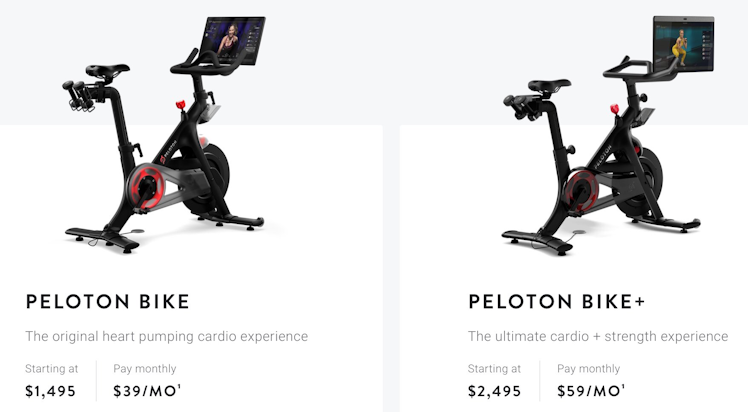

Big news out of $PTON earnings was the price cut of the original bike by $400 to $1,495. Shares were down sharply as a result.

Bulls believe this squeezes competition & will help drive high margin sub growth.

Bears believe the price cut represents weakness in demand and the business is in trouble.

What has gotten lost in the Bull/Bear debate is that Peloton has a higher level Bike+ option that is priced 11% HIGHER than the historic bike was ever priced at.

I’d argue this is still a premium brand despite price cuts in the older model.

Peloton is following the Apple ( $AAPL ) playbook of discounting older models following new releases.

iPhone 12 (2020 Model) Release Example:

- iPhone 11 (2019 Model) 14% price cut from original price

- iPhone XR (2018 Model) 33% price cut from original price

So Peloton is effectively selling a 2014 model bike for only a 33% discount to its starting price.

I don’t know about you, but that sounds like pricing power to me.

That would be the equivalent of buying an iPhone 6 (2014 model) today for $425 dollars.

Peloton now has a lower-cost bike at $1.5k, enabling it to complete in the low/mid range market while driving high margin sub growth.

The lower cost option also gives Peloton strong products for consumers in int’l markets who might be less inclined to embrace >$2k bikes.

What does everyone think about the price decreases Peloton introduced? Why are you bearish or bullish?

Already have an account?