Trending Assets

Top investors this month

Trending Assets

Top investors this month

First Blush: $SLDP Q2 2022 Earnings

Business Highlights:

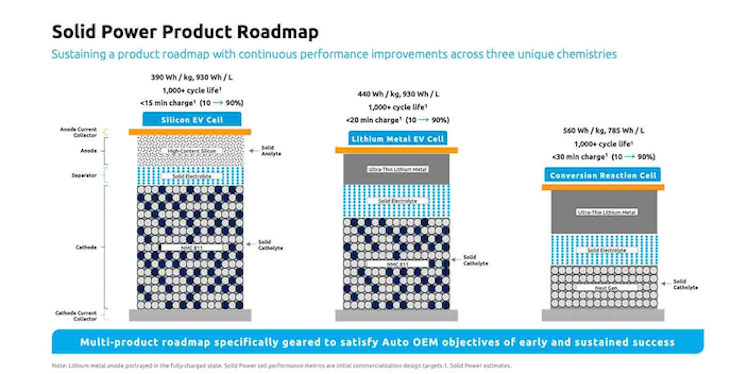

- Cell development remains on track, with initial 20 Ah silicon anode cells (“Silicon EV cells”) expected to be shipped during the third quarter to [Ford and BMW].

- EV cell pilot line installation completed in June, with optimization activities ongoing. Production of EV-scale cells for internal testing still expected during the third quarter.

- Construction of electrolyte production facility progressing, with initial production expected in the first quarter of 2023.

- First half 2022 revenue reaches $4.8 million, nearing the high end of full-year revenue guidance.

- Investments in operations, production equipment and technology development continue on accelerated timeline.

Additional Management Commentary:

- Supply chain challenges opening up the new electrolyte facility are not expected to impact partner delivery milestones, as a result of existing electrolyte production capacity being sufficient to meet near-term product requirements.

- "Longer term we expect the [pilot] EV cell line to provide us the capability to complete B sample validations phases for both of our automotive partners, which is a significant milestone in terms of qualifying EV cells for vehicle integration." - Doug Campbell, CEO

- "We ended the quarter with total liquidity just over $534 million consisting of cash, marketable securities and long-term investments. We are executing right in line with our accelerated operational and development plans, keeping us in a position where we believe we have the resources we need to achieve our long term goals." - Kevin Paprzycki, CFO

My Take:

Q2 was a nearly perfect quarter for Solid Power, with management continuing to under-promise and over-deliver on partner delivery and development milestones. This relentless execution led to the company already meeting the high end of yearly revenue guidance only halfway through the year, which reflects accelerated partner deliveries and implementation for their government contract(s).

I think it's both insightful and necessary to compare Solid Power's progress to their only public competitor in the EV solid-state battery space, QuantumScape. $QS has consistently missed product milestone dates, recently had their Chief Manufacturing Officer resign, and admits that they will need to dilute or issue debt to make it to production, if they actually do end up making it there.

Meanwhile, Solid Power has done nothing but meet or exceed milestone dates, burn only $17.3 million of their $534 million cash in Q2 (showing the resilience of their asset-light business model), and remain on track to get to production in 2024 despite the numerous macro headwinds and supply chain challenges.

I'm loving the opportunity to scoop up $SLDP shares at the current valuation of only $1.3 billion MC, which is criminally low for a bleeding-edge disruptor in a nascent yet massive (TAM estimated at $300+ billion in 2035) market opportunity. With a litany of short and long-term catalysts on the horizon and a 10+ year history of execution, Solid Power is one of my highest conviction picks.

Already have an account?