Trending Assets

Top investors this month

Trending Assets

Top investors this month

China's Belt & Road Initiative series (Part 4: Silk Road 2.0)

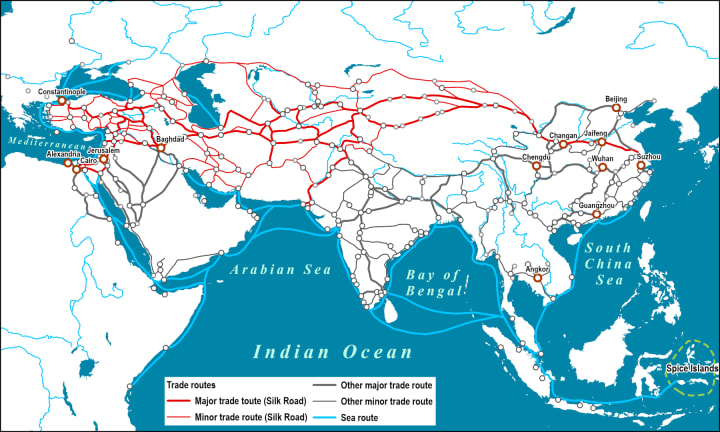

The closest that China has achieved to have a major influence on the world was during ancient times with the Silk Road. Many don't know that the original Silk Road was used for 1,500 years.

Despite the numerous changes in rule throughout China's history, the Silk Road continued to be used by merchants globally. Historians say that the Silk Road's peak was during the time when the Mongolians ruled China under Genghis Khan. After the Europeans developed better naval technologies, the usage of the Silk Road declined as it became both cheaper and faster to transport goods through maritime routes.

Besides allowing various parts of the world to interact and spread ideas, the Silk Road also helped spread diseases. From Justinian's Plague in 541 to the Bubonic Plague in 1346, the Silk Road helped create the first few pandemics in history.

The inspiration behind the first Silk Road was China's attempts to expand westward during the Han Dynasty. Since Central Asia was at the center of the first wave of globalization, it was important for China to capitalize on the opportunity and even connect the booming parts of the world to its own land.

It's likely that the Belt & Road Initiative is China's way of recreating the Silk Road. And unlike the original Silk Road, the Belt & Road Initiative will help China expand the use of its own currency, the Yuan, across the globe and also open up markets for Chinese businesses, whether state-owned or privately owned. As it makes deals with other nations, China encourages its BRI recipients to take low-interest loans in yuan and pay back their debts in yuan. For all the highways and bridges that it builds, it can inspire those nations to charge its users toll fees, and those toll fees can be paid in yuan. Especially in Africa where BRI projects have expanded into the funding of mines and other natural resource projects, the sale of natural resource transactions can be denominated in yuan rather than dollars.

With the recent talks between Saudi Arabia and China, I wouldn't be surprised if the Saudis start selling their energy in yuan instead of dollars to China and then expand the usage of selling oil in yuan to BRI recipient nations.

According to the Council on Foreign Relations,

"Xi’s vision included creating a vast network of railways, energy pipelines, highways, and streamlined border crossings, both westward—through the mountainous former Soviet republics—and southward, to Pakistan, India, and the rest of Southeast Asia."

Like the Silk Road, the Belt & Road Initiative is China's way of expanding westward. Unlike the Silk Road, which was made to connect China to the first wave of globalization in Central Asia, the Belt & Road Initiative has nothing to do with globalization. China's economy benefited immensely from a new phase of globalization in the 1980s as Western firms outsource manufacturing to factories in China. As for connecting one's economy to sources of economic boom, globally, all nations are booming whether they're developed or still developing.

So why is China embarking on an ambitious infrastructure project?

It's many reasons. One reason, as I mentioned in-depth earlier in the series, this project helps China's economy grow while simultaneously delaying the inevitable pain that comes with having too much bad debt in its economic system. And there are other reasons too.

In this map of the Belt & Road Initiative, we can see that if ever NATO does create a blockade in the Pacific against China, China can transport oil from the Middle East through Pakistan and other items elsewhere without having to go through maritime routes.

Now consider the island chain strategy that the US has been employing to contain China and ensure that it doesn't become the hegemon of the pacific:

Within the First Island Chain, Taiwan sits at the center. If China were to break the First Island Chain, it would have to invade Taiwan. In the case of China invading Taiwan, the US and its NATO and Pacific allies would blockade China while helping Taiwan simultaneously.

Pacific war experts may think that a blockade on China will help to prevent China from receiving any imports, as we can see in the Belt & Road Initiative map from earlier, China can take a shortcut and transport their imports through Pakistan or along other routes that are a part of the Belt & Road Initiative.

And by the way, the US military can't disrupt these logistics routes:

"Promoting economic development in the western province of Xinjiang, where separatist violence has been on the upswing, is a major priority, as is securing long-term energy supplies from Central Asia and the Middle East, especially via routes the U.S. military cannot disrupt."

Also, if China were to receive Russia-style sanctions as a consequence for invading Taiwan, not only have bankers consulted with China's government on how to protect their assets from the sanctions, but they also have positioned themselves to become closer with non-US allied nations to do business. There's a strong chance that many of these Belt & Road Initiative recipients will disobey US sanctions on China and will continue to do business with China. Even if China and nations supporting China get kicked out of the SWIFT system, China has its own SWIFT system. Belt & Road Initiative nations will adopt China's SWIFT system and all nations involved in this new system can operate seamlessly despite US sanctions.

Outside of creating a logistics network to shield China from the effects of Russia-style sanctions, China's Belt & Road Initiative allows China to become less reliant on the US for exports. Here's a quote that describes how the Belt & Road Initiative achieves this goal:

"Xi has promoted a vision of a more assertive China, while slowing growth and rocky trade relations with the United States have pressured the country’s leadership to open new markets for its goods."

A common characteristic among Belt & Road Initiative recipients is that their demographics are attractive compared to that of the developed world. There's a small aging population problem, the gender imbalance issue is minimal, and families there are known to have more children on average than families in developed nations like the US and Germany.

Side note: if you're curious about the unattractive demographic aspects of the US, watch this video

In the short term, those new export markets aren't as meaningful and as valuable as the US or European markets. In the future, because of their attractive demographics, those export markets will become more valuable than the US and European markets.

When comparing the demographics of those new export markets to China's domestic market, it's understandable why China is keen to enter these new markets.

Takeaways:

- China was influential in the economies of many ancient civilizations because of the Silk Road. It hopes to replicate this level of influence by embarking on a massive infrastructure imperialism endeavor.

- While designing the Silk Road 2.0, China's central planners have taken into account the possible logistics problems that NATO and its Pacific allies will create if ever China does decide to invade Taiwan.

- Most importantly, the BRI is China's gateway to opening new markets for its privately owned as well as state-owned enterprises. It creates employment opportunities for Chinese citizens but it doesn't create the same benefit for local residents and local firms.

- The demographics of BRI recipient nations are more attractive than the demographics of developed nations. Even if BRI recipients are poor or middle-income in the present day, in the future, these nations will host better economic opportunities than developed nations. The BRI allows China to ride the growth of those nations.

youtu.be

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.

Love this analysis, I have learned more about China after these 4 parts. Great stuff, man, keep it coming

Already have an account?