Trending Assets

Top investors this month

Trending Assets

Top investors this month

China's Belt & Road Initiative series (Part 3: domestic investment is unattractive & we're trying to delay a real estate crash)

Many will note that real estate, construction, and industrial production make up over half of the Chinese economy. With the massive real estate and infrastructure development boom that has been going on in China since it reopened itself to the world in 1978, all of those industries have thrived.

Sure, the outsourcing of manufacturing to China did help with China's economic development. However, Chinese leaders needed to find ways to make themselves less dependent on the West for economic development. Plus, everyone knew that at some point, Western companies will have to pull back their manufacturing operations in China and bring those manufacturing jobs back to the West.

China may be known for its high-speed rail projects, fancy skyscrapers, and tons of apartment buildings. The supply chain aspect in China is so great that firms are having a harder time letting go of their manufacturing operations in China because it's difficult to replicate it in other nations like Vietnam and India.

As much as we'd think that the more domestic infrastructure and real estate projects are being made, the more the economy grows. However, without those endeavors being profitable, no one would want to undertake those endeavors. In 2012, the return on investment for new domestic infrastructure fell below zero. Rather than continue to build more infrastructure, Chinese businesses and the government needed to find new markets to sell their products and services. That's one major reason why the country decided to embark on the Belt & Road Initiative.

Another aspect of China's economy that inspired the Belt & Road Initiative is that China's economy relies heavily on real estate for economic growth. China's reliance on the real estate sector is so big that if they stopped growing the real estate sector, GDP growth for the entire nation will slow immensely or even decline. Real estate is so intertwined with other industries that it's China's Achilles heel.

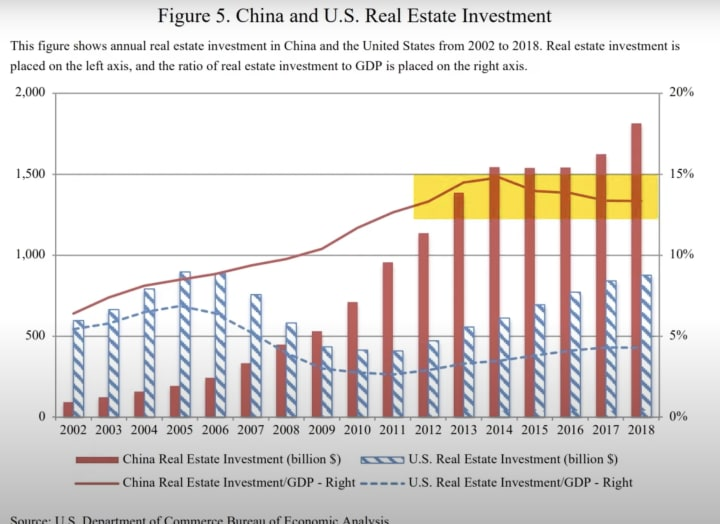

EPB Research made a phenomenal video about the China housing bubble, and this bubble coincides with the mass investment in infrastructure and the unhealthy aspects of China's economy. In the chart below, one will find that Chinese real estate investment contributes 15% to China's GDP.

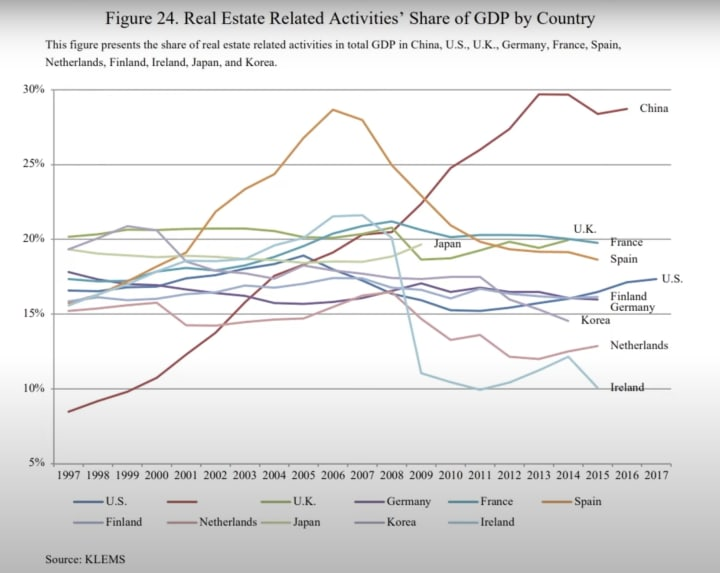

When compared to other countries, China's real estate-related activities account for nearly 30% of the GDP. And that figure could go a lot higher if more of the industrial sector participated in China's domestic real estate market.

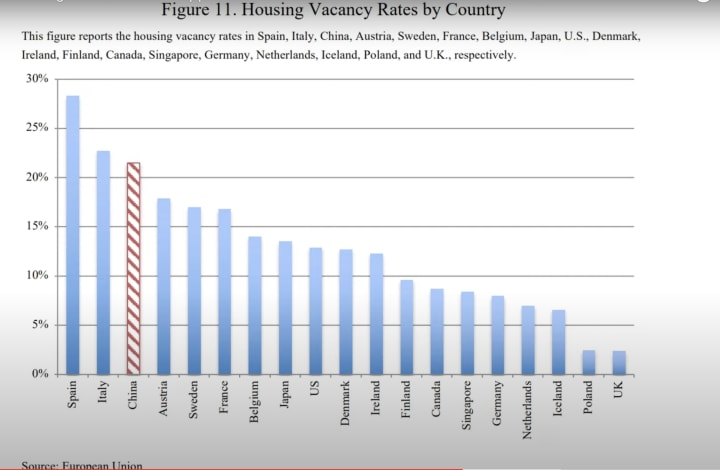

The only other country that endured similar heights as China when it came to real estate-related activities contributing nearly 30% of GDP in Spain.

For decades, China has kept up the growth of its real estate-related activities as a share of GDP. When bad times came, China's government would provide more stimulus to businesses that are involved with real estate. The continuation of such policies has made it more difficult for China's economy to root out the bad debts in its system. As China's government continues supporting this trend, the country will continue to import inflation and export deflation.

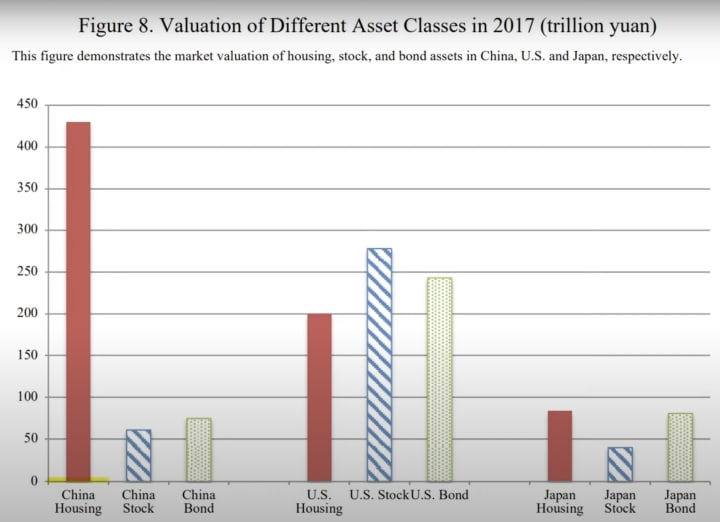

When comparing China's housing real estate valuation to other asset classes, it's the biggest.

Outside of the bad debts issue, let's look at the demographics and vacancy rates of China's real estate sector.

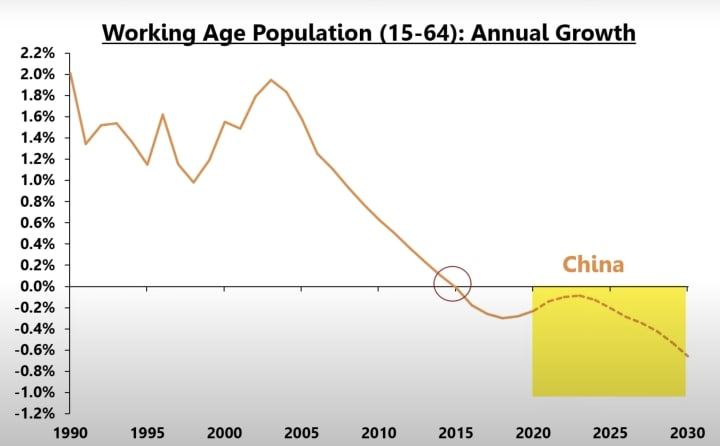

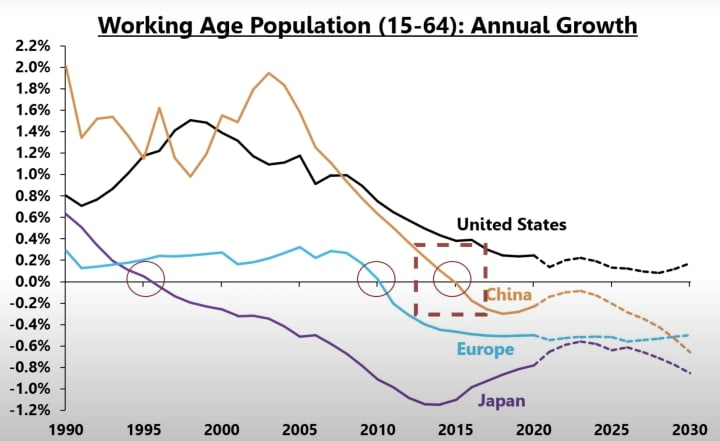

Here's China's working-age population growth. Knowing the growth rate of the working-age population helps to understand the growth in demand for goods and services because the working-age population is known for consuming the most out of any demographic segment. As you can see, it's been on the decline since 2015.

And here's China's working-age population growth rate being compared to other nations:

With a declining working-age population, it's understandable why vacancy rates in China are much higher compared to the rest of the world. The only countries that have higher housing vacancy rates than China are Spain and Italy.

After looking through the demographics and economic data and comparing it to the valuation of China's housing industry, it's clear that China's real estate sector is severely overvalued and that it's due to come down at some point.

With China's economy having more excess than any other modern economy in the world, investors are hesitant to invest in China. Compared to other countries, China's property market is the largest bubble out there (excluding crypto). Rather than undergo a massive deleveraging, which purges the bad debts in the system and creates massive economic pain, the Chinese government would rather do everything in its power to delay that pain and find other ways to promote real estate-related industries. The longer that China's economy delays the deleveraging process, the more severe the deleveraging process will be and the economic effects will last even longer.

Takeaways:

- China's infrastructure and real estate investment opportunities are unprofitable and because of this, China's government needed to open up new markets for its businesses in order to continue growing the country's economy.

- We dove deep into China's real estate bubble and why the sector is positioned for a steep correction

- The BRI helps China's real estate-related industries reduce their dependence on the domestic real estate market for business opportunities and reduces the systemic risk that the domestic real estate sector poses on the entire Chinese economy

YouTube

Understanding China's Housing Bubble

This video covers why China's housing market is not slowing down and potential "solutions" that China may use.EPB Secular & Cyclical Framework: https://epbre...

Some quick thoughts as i was reading through. There's no denying that they have been pre-emptive in their real estate efforts (I'm being generous here lol). Still, looking at the first figure/diagram, I think we add the total spent in dollar terms over the 16-year period in China is about 55% - 60% higher. Of course, as a % of GDP, it is much higher; however, the occupancy rate as real estate is backfilled with the growth of the Chinese economy may end up offsetting some of the worries of a complete spill-over effect when/if the bubble pops.

I guess it is vital the economy grows alongside the middle class, and they occupy more of this empty real estate, then it will be fine; however, its a super bold bet and most likely a correction will occur. I admire their forward-looking confidence but I 100% agree with your statement that international investors probably look at that and most will be turned off.

Already have an account?