Trending Assets

Top investors this month

Trending Assets

Top investors this month

Invitae - Cost Declines of Sequencing A Human Genome Will Surprise

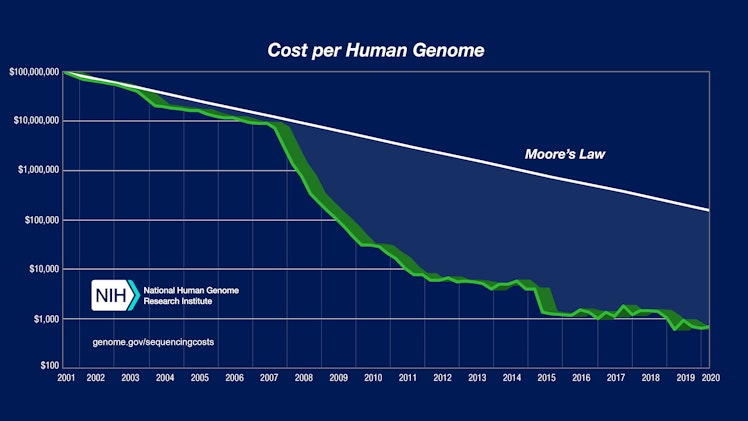

In 2003 the Human Genome project finished sequencing the first human genome at a cost of $2.7 billion dollars. Today, it costs less than $1,000:

As prices continue to drop, being able to sequence the entire population's genome has become a possibility. This would be a watershed moment in health care, enabling early detection and diagnosis of diseases such as cancer, which would lead to significantly increased survival rates, new cures, treatments, and huge healthcare cost savings.

As of today however, costs are still prohibitive. While you can get a 23andMe test for $199, it tests for only three variants in two genes (BRCA1 and BRCA2), which is woefully inadequate, because there are more than 1,000 variants in these genes that can elevate individuals’ cancer risks.

In other words, a report from 23andMe showing that you don’t have a BRCA mutation doesn’t necessarily mean you’re in the clear.

This highlights the need for experts to be part of the process, as getting a more complete test generates orders of magnitude more data, which requires a clinician to interpret and advise on action steps.

For genomics testing to reach its full potential, it needs to be integrated with the healthcare system; the business model will need to include doctors, not be entirely self-serve.

But integrating genomics tests into the healthcare system is hard; insurance coverage is limited, clinics that offer genetic testing are few and far between, and interpreting the data from these tests isn't easy.

Invitae is focused on building a solution to address these remaining concerns. And they are so excited about the global genetic testing market, they offer competitive pricing to 23andMe, but with the service 23andMe lacks. Invitae offers a "clinical-grade" cancer test for only $250 in which an independent physician reviews your health history in order to put the test results in context.

Offering this much quality at this low of a price this early in the genetics game is not a sustainable business model. For this to work, two big things need to happen:

1) The cost of sequencing a human genome needs to continue to fall

2) The usefulness of genomic information in diagnosing and treating diseases such as cancer needs to continue to materialize.

Other competitors in the space (Quest Diagnostics $DGX , LabCorp $LH, Blueprint Genetics, OPKO Health $OPK , Myriad Genetics $MYGN , Natera $NTRA and NeoGenomics ) are all betting that sequencing costs will fall more linearly.

Invitae is going out on a limb by predicting that sequencing costs will fall in-step with Wright's Law, rather than Moore's Law.

Wright's Law states that for every cumulative doubling of units produced, costs will fall by a constant percentage. Read: cost declines will look more exponential rather than linear.

What this means is that there is a chicken and egg problem: demand needs to be high enough to reach the scale necessary for prices to be low enough to stimulate demand.

Invitae is boldly stepping up to the plate to take on the risk of dropping prices to "unsustainable levels", because they are betting they can crack the egg-chicken problem. I mean chicken and egg problem. You get what I mean. They think they can make the market before going bankrupt. Game on.

If they crack the code first, it will likely be a winner-take-most market, because only Invitae will have the scale necessary to keep the prices low, and it will be even harder for any challengers to follow because Invitae will already be servicing a majority of the market.

And the fun doesn't stop there. Once you have one player cracking the scale problem, they are essentially sitting on a huge oil deposit of genetic health data, which can be anonymized and converted into a machine learning goldmine.

The likelihood of wishlist items like "a cure for cancer" goes up when we have the data sets necessary to train machine learning algorithms to make connections to our health that normal humans could never make.

The global genetic testing market is expected to grow at a double-digit rate and reach $16.9 billion by 2025. Personally I think it could be much bigger than that, although, I also don't think the full potential of this space will be reached within 5 years. I bought more Invitae shares $NVTA yesterday and I am long for at least the next decade.

The way I see it, Invitae will either hit it big, or the business modal won't work and they'll go out of business. This is not something to put your whole portfolio behind. But personally I made the decision to start a position and will be adding more as I continue to follow the space.

Please put any thoughts or questions in the comments. I would love to follow this company with a community of people. Changing the world doesn't have to be lonely.

Nathan

www.invitae.com

Staying healthy | Find out which genetic test is best for you | Invitae

Order a Cancer, Cardio, or Genetic Health Screen to learn more about your health. After receiving your results, chat with one of our certified genetic experts.

Already have an account?