Trending Assets

Top investors this month

Trending Assets

Top investors this month

Why do UNH, CVS, etc. fall sharply? Don't rush to bargain-hunting?

Although there was an intraday FOMC interest rate meeting on June 14th, the market's previous expectation of "skipping the rate hike in June, but there was hawkish wording" was almost the same, so the Qifubiaozhun on the disk was not as big as imagined.

However, there is a collective drop in the sector (in sharp contrast to the glory of the chip industry), that is, medical insurance, the main reason is $UNH The CEO of $GS Medicare costs this year will be the upper limit of, or even exceed, expectations, according to an investor conference.

The implication is that the expenditure of medical insurance companies will increase and the profit margin will be hit.

Companies related to this have fallen sharply, including $CI $ELV $HUM $ALCH Pharmacies including medical insurance $CVS.

In this regard, the CEO of UNH said that after COVID-19, more and more people have medical needs including surgery, resulting in extra costs.

The proportion of premium expenditure for medical expenses is expected to reach or slightly exceed the upper limit of 82.6% of the annual outlook given by United Health

That is, because of COVID-19.

This matter is very interesting. We need to think from many angles, whether it is like what he said.

First, does COVID-19 have sequelae? How big is the impact? My own feeling after having it is that it does have an impact on physical fitness, but it is difficult to estimate how big it is. However, for the elderly or those with poor resistance and basic diseases, it is estimated that more medical services will not run away, otherwise the price of medical insurance in 22 years will not rise so much.

Western media generally do not report the impact of COVID-19 sequelae. On the one hand, this affects the economy and people's mentality, on the other hand, it conflicts with their propaganda. After all, minzhuziyou is above everything else. European and American governments and many people want to dilute its influence. If this is the case, UNH can only swallow this bitter fruit silently and reimburse the people honestly.

Second, is the cost of more medical services one-off? This is the most important factor for investors to consider. More people need medical services? The number of times you need medical services has increased? Can directly affect the cost of UNH. If the impact of COVID-19 on people's health exists for a long time, does it mean that the cost of medical services will increase for a long time?

That is, the actuaries of these insurance companies need to revise the model.

Then, unless the cost of medical insurance increases, the long-term profit margin of medical insurance companies will be affected.

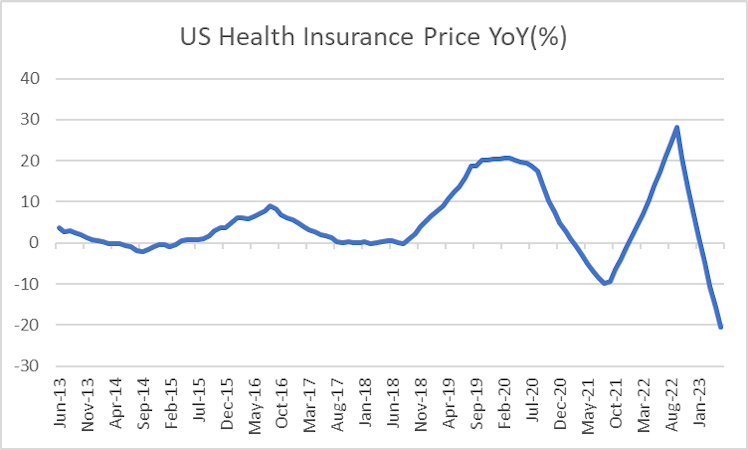

The following is the change of medical insurance price in the CPI sub-item of the United States. It can be seen that it has gone up wildly in 22 years and is vomiting back in 23 years.

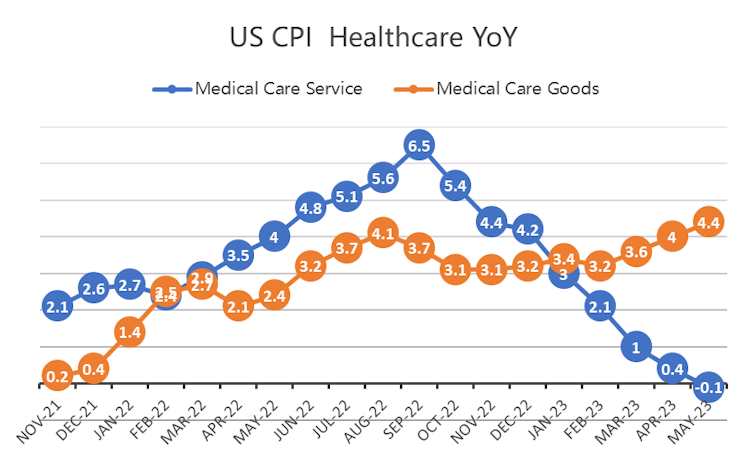

However, the price changes of medical commodities have been showing a normal growth trend, and medical services may not increase so fast due to the bargaining power of insurance companies.

But at present, the cost of medical insurance can't keep up with the price growth of medical services and medical goods, which is definitely not good news for medical insurance companies.

Therefore, if the medical insurance company can successfully raise the price without affecting users' purchase of insurance, then it can really tide over this difficulty.

In the secondary market, these big medical insurance companies often have heavy positions in institutions (just like domestic insurance companies, there is no hot money willing to play games). Therefore, this large selling on June 14th is an institutional behavior, and obviously many institutions also smell danger.

However, institutional positions do not change when they are said to change. When they reduce their positions in this industry, they also need to find similar substitutes, otherwise they will passively increase the proportion of other positions and increase their risk exposure.

So what kind of company can replace the medical insurance company?

Since your CEO said that medical services (including surgery) have become more, is it directly beneficial for such companies that provide medical services directly? Companies with a large-scale network of outpatient day surgery centers (ASC) have an opportunity. For example $SGRY $THC $HCA

They were all yesterday's winners.

Already have an account?