Trending Assets

Top investors this month

Trending Assets

Top investors this month

$INTC, Rising From The Grave?

Intel $INTC is up to bat again for Q3 earnings, and I have mixed feelings about it.

On the one hand, they beat their own estimates. In their Q2 earnings, they guided for $15-16b in revenue and EPS of $0.35 and came up in Q3 with $15.2b and EPS of $0.35 and EPS of $0.59. Off to a decent start despite still being down a massive 15% Y/Y for revenue.

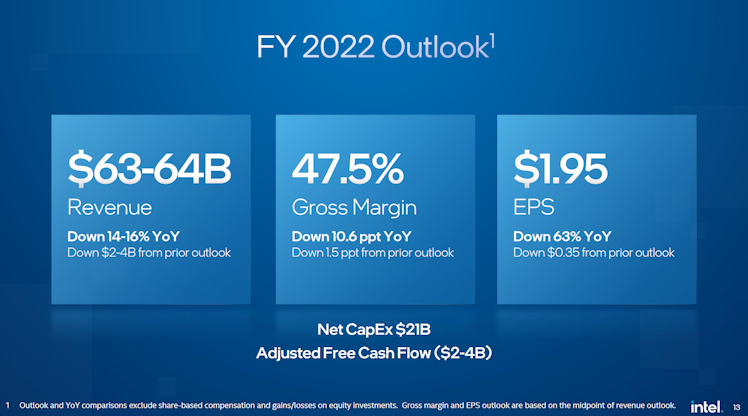

The big problem is guidance. They guided lower... Again. Slashing revenue estimates and lowering ADJ Free Cash Flow by another billion is scary.

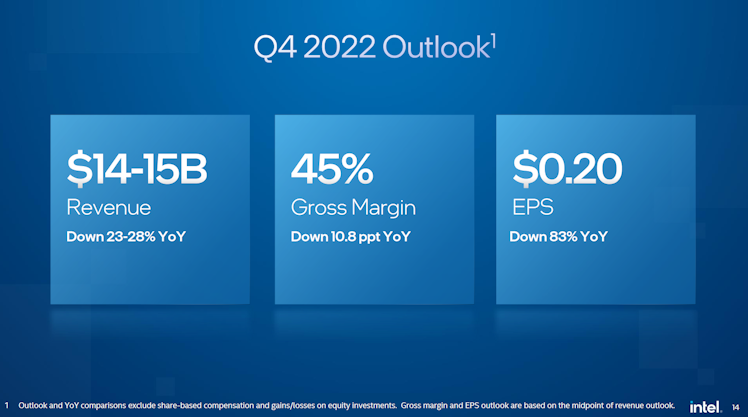

And man that Q4 Outlook EPS is down over 80% Y/Y. That seems like a really big deal. Revenue also diving further. Maybe this is just a big fake-out that sets up Intel to crush Q4 earnings but I am beginning to doubt it.

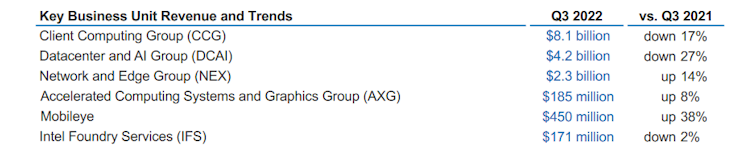

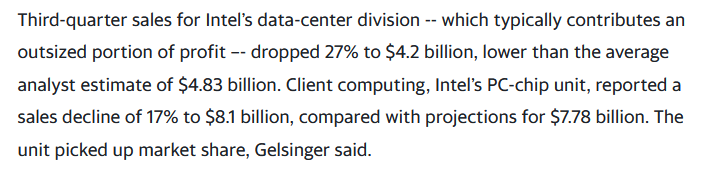

Looking at the breakdown of business segments is also not a great look. Everything is down except the smallest business segments.

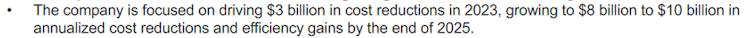

I was somewhat surprised to see this given the stock is up 6% after hours and it seems it is on the news of Intel planning up to $10b in cost reductions over the next 3 years.

To be honest this comes off as Gelsinger desperately trying to salvage anything about this quarter. While it will certainly help I think Intel should have entered cost-cutting mode BEFORE they decided to start spending money like a drunken sailor trying to reclaim market share.

This also means Intel is the newest tech company to announce layoffs but somewhat ominously in this earnings report they neglected to give concrete numbers. This tells me it is probably going to be big maybe even 10-12% of their workforce in an attempt to cut costs. Most of these will be sales jobs so the effect on operations is unclear. We will have to wait till November 1st to hear more.

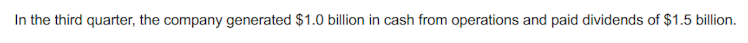

But I think by far the most concerning line was this:

Turns out when you start spending tons of money your reliable stable dividend tends to get in the way. Guess Intel is dipping into its cash pile and issuing debt to pay its investors. At least $META doesn't have this problem.

I am of the opinion that Intel should cut the dividend in half in order to sustainably continue to pay investors and not pile on debt. If they manage to pull this transformation off while holding onto the dividend I will be beyond impressed. If they don't I imagine we get an AT&T situation where Intel will spin off more parts of its business in an attempt to raise cash.

I think the best way to describe these earnings is with this line from a CNBC article:

Very Mixed. Some Good, Some Bad.

Already have an account?