Trending Assets

Top investors this month

Trending Assets

Top investors this month

Peruvian Possibilities in 2024

Nathan Rothschild, a 19th-century British financier and member of the Rothschild banking family, is credited with saying that "the time to buy is when there's blood in the streets."

Whether or not Rothschild actually uttered the famous line, it reveals an important truth about betting against market psychology. When prices fall and markets tremble, a bold contrarian investment could reap high profits.

The first time I heard this quote it came from the mouth of Canadian Mining Hall of Fame Inductee, Ross Beaty, during a speech he gave at VRIC. I didn't realize back then that it supposedly originated long ago from Rothschild, who made a fortune buying in the panic that followed the Battle of Waterloo against Napoleon.

The worse things seem in the market, the better the opportunities are for profit. As Warren Buffett warned, "You pay a very high price in the stock market for a cheery consensus." In other words, if everyone agrees with your investment decision, it's probably not a good one.

There are risks to contrarian investing. While the most famous contrarian investors put big money on the line, swam against the current of common opinion and came out on top, they also did some serious research to ensure the crowd was indeed wrong. So, when a stock takes a nosedive, this doesn't prompt a contrarian investor to put in an immediate buy order, but to find out what has driven the stock down and whether the drop in price is justified.

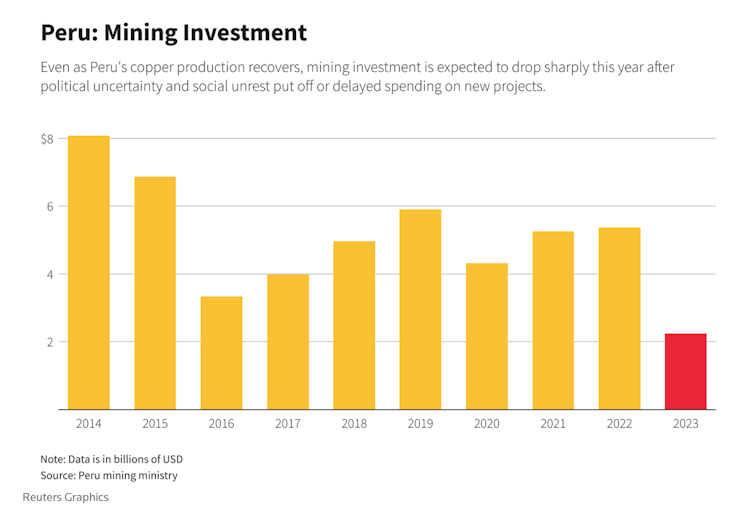

I don't own any of the tickers mentioned in the tweet below, but this John Black interview is one of my favourite clips worth two minutes of your time. The junior mining sector has suffered greatly from a lack of investment over the past two years, but companies in Peru have been hit particularly hard.

In 2008, Black managed a copper junior in Peru with a significant discovery, copper price was high and projections were 'through the roof'. Within a period of a few months, the share price dropped from $5 a share to just $0.38. Black and his Chief Geologist, Kevin Heather, bought all the way down and were cautioned not to 'try & catch a falling knife'. Within 18 months, the company sold for $9 a share.

"The market snaps back very quickly."

I consider the four points marked on the map below to be notable, likely suggesting an impressive geological trend in the Ancash region of Peru:

The blue thumbtack marks Camino Corp's ($COR.V) Maria Cecilia project.

Exploration drilling at Maria Cecilia is expected to start at the beginning of the second quarter of 2024, after drilling is completed at Los Chapitos.

My original post on the company here:

The yellow star is the approximate location of legendary geologist Dave Lowell's Pierina discovery, which sold to Barrick for a 2200% in just twelve months.

The circle just north of Pierina marks $HSLV.CN's recently acquired San Luis project.

David Fincham, President and CEO commented: “We are delighted to be bringing the high-grade San Luis gold-silver project into our portfolio, and are very impressed by the size and grade of the historical resource contained within the Ayelen and Ines vein structures. We believe this deposit may be one of the highest-grade gold-silver deposits of its size that is yet to be mined in the world. Additionally, there may be exceptional growth and discovery potential on this large, but only partially prospected and explored property. There are numerous compelling exploration targets based on previous field mapping and rock chip sampling, and we believe that the district has potential to yield much more. This acquisition has the potential to be transformative for Highlander Silver and aligned with our vision of building a portfolio focused on world-class silver gold projects to the benefit of all our stakeholders.”

On October 28th, Highlander closed a $3 million private placement with strategic investors Augusta Group & the Lundin Family.

Lastly, the circle marked to the south of Pierina denotes Chakana Copper's ($PERU.V) Soledad project.

You can catch Crux's most recent interview with Chakana's President & CEO David Kelley here:

Chakana is expected to close their recently upsized private placement shortly. Gold Fields has now upped their stake in the company to the maximum 19.9% (above that requires a take-over bid according to Canadian securities laws).

WHY PERU NOW?

The blockades that disrupted copper shipments and mine supplies late in 2022 and in early 2023 have been cleared, with thousands of police officers mobilized.

Authorities have said they’re working hard to unlock projects that have been stuck for years. They were looking to have permitting in place for nine key projects by the end of 2023 and are moving forward with the streamlining of red-tape.

For those that consider themselves contrarians willing to buy when there's 'blood on the streets', Peru offers incredible potential in the year ahead, as the government seeks to end chaos and restore investor confidence.

Junior exploration companies are considered a high-risk investment, so please DYODD and allocate accordingly. The three companies mentioned above are currently in my portfolio and I am happy to answer any questions that I can.

$COR.V $PERU.V $HSLV.CN

Wishing you all the best in the year ahead!

Reuters

Peru seeks mining investment revival with pledge to end 'chaos, disorder'

Peru is looking to put the "chaos" of months-long protests earlier this year behind it to revitalize flagging mining investment in the world's no. 2 copper producing nation, even as executives demand more stablity to boost spending.

Already have an account?