Trending Assets

Top investors this month

Trending Assets

Top investors this month

Camino: High-Risk Hero or Zero?

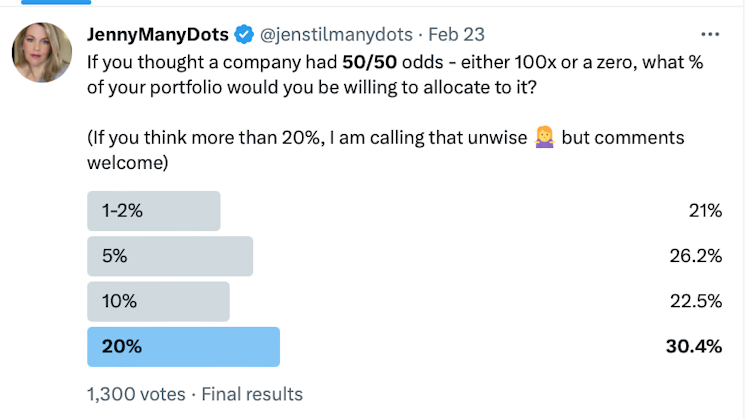

Sometimes the 280 character limit on Twitter just can't convey enough. I regret not working the age factor into my February 23rd poll, as an investor's age should factor into one's risk tolerance. Regardless, I received some interesting commentary in the replies. A few folks said "if there was 50% chance of a stock heading to zero, it's foolish to invest" while others quoted the Kelly Criterion (see my previous post: https://commonstock.com/post/e56e3254-8981-42ff-a138-ed4ef5b63ffb), a probability theory to maximize one's returns. As you can see from the results however, 30.4% suggested a larger allocation to a play that had the possibility of such a high reward (some were extreme in the replies and even said up to 50%).

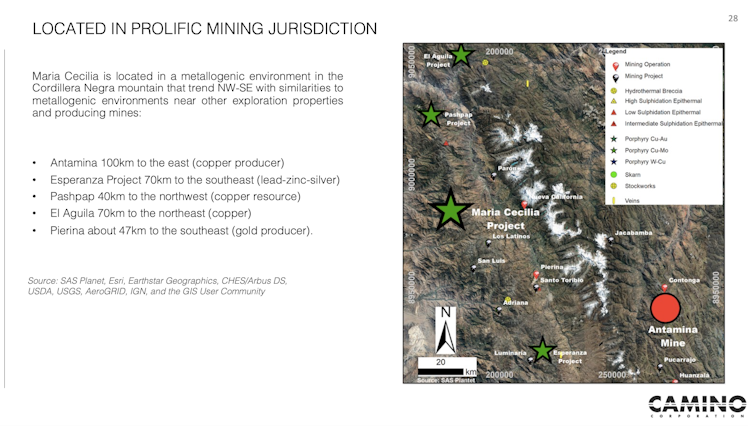

As I frequently state in my posts regarding junior mining companies, they are among the riskiest investments and I usually allocate only 1-2% of my portfolio to a company, rarely exceeding my personal rule of a 5% maximum. I recently came across a Peruvian copper explorer that has me very tempted to break my rule, while strongly considering the fact that Peru is not a safe jurisdiction as it's in a state of political turmoil.

Camino: The Anomaly

I often watch the site CEO.CA to monitor for anomalies on Canadian exchanges. Occasionally an "under the radar" play will see unusually large volume and that can be an indicator of interesting developments on the horizon.

On November 23, Camino Minerals Corporation traded 12,673,873 shares on the TSX-v; the average volume is ~278,000 shares. The opening share price was $0.025 and it closed at $0.05. I decided to perform some DD on the company, and everything I have come across since that day convinced me this is one I believe might be worth my maximum allocation, if not more.

*Please DYODD and never invest more than you can afford to lose - this is most definitely a high risk investment, and as my title states, $COR.V could be a "hero or a ZERO".

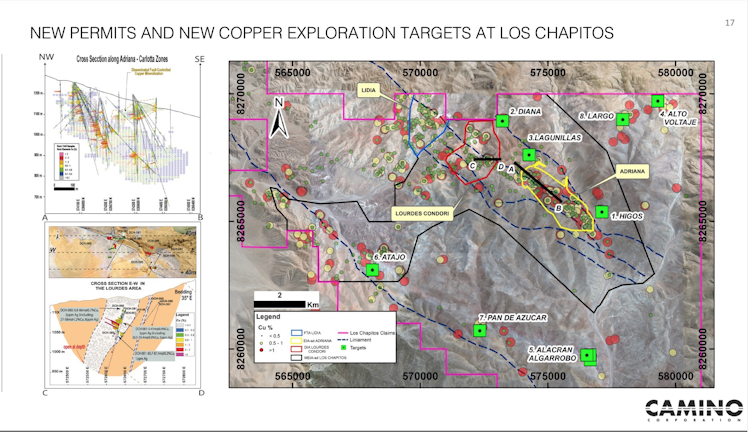

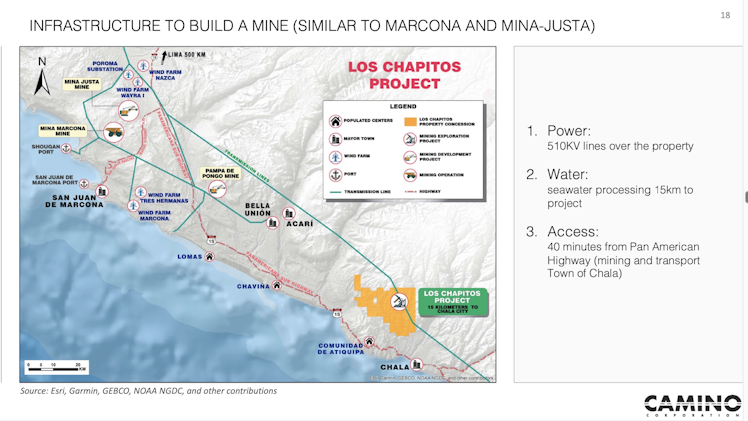

"The upside potential for these IOCG systems is up to 500 million mt, with the best comparison being Mina Justa in Peru, which is about a 400 million mt IOCG deposit and is located about 100km north of Los Chapitos."

Minta Justa's market cap is $1.6 BILLION. Camino, with three prospective copper projects is currently sitting at $13 million.

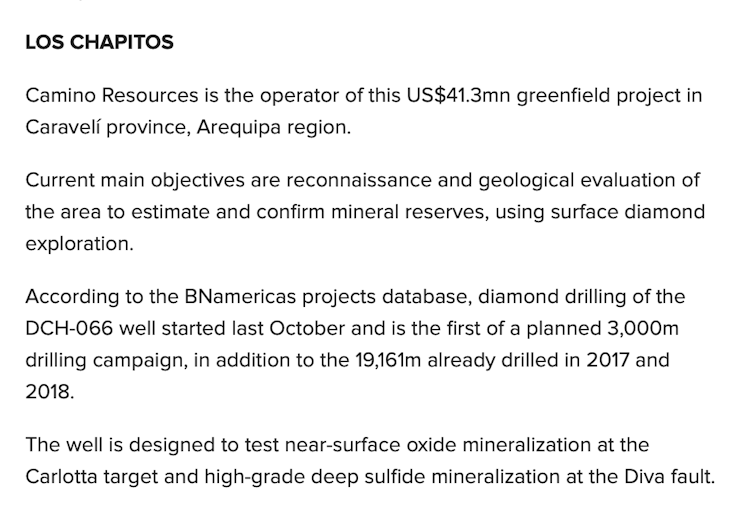

BNAmericas calling Los Chapitos a top 5 Peru copper exploration project:

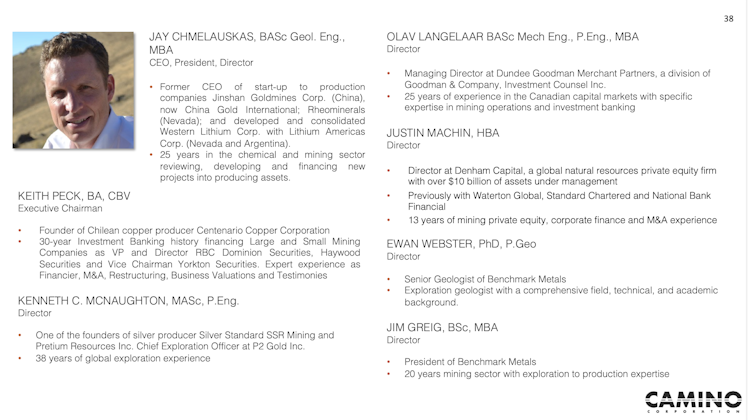

As always, a key factor I consider when investing in junior miners is management's track record. It's worth noting that Camino's President & CEO Jay Chmelauskas co-founded Lithium Americas $LAC with the legendary late Edward Flood.

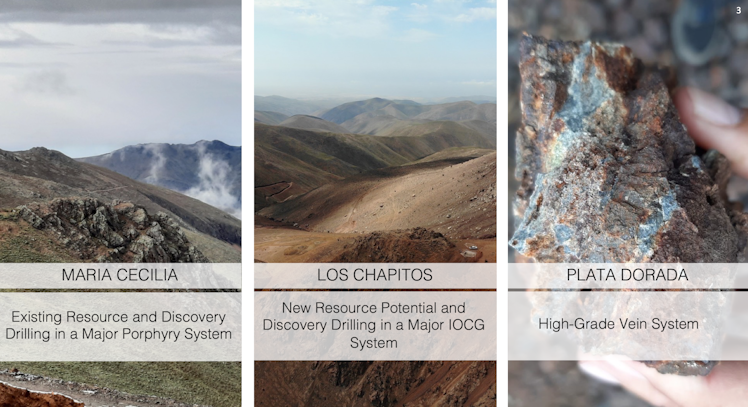

We re-capitalized Camino to restart exploration at our Los Chapitos copper discovery and to develop a platform to build a copper company. We have identified up to four areas of copper, including copper/gold mineralization at Los Chapitos, which is a large land package of 220km2 that we will continue to explore through 2021. As well as developing the Los Chapitos project, we are assessing other business development opportunities to grow the company. Our second copper project, Plata Dorada, is a high-grade copper and silver project located 158 km east of Cuzco. We have a track record of identifying early-stage projects to form the basis of successful, long term operating mining and chemical businesses, and we are looking to repeat this success in the copper sector at Camino.

Camino's Executive Chairman Keith Peck is notably successful as well:

Keith Peck is Chairman of the Board of Orezone Gold Corporation. He is Chairman and Chief Executive Officer of Lincoln Peck Financial Inc., a financial advisory firm focused on the resource sector. He has over 27 years of investment banking experience including Vice-President and Director of RBC Dominion Securities Inc., Haywood Securities Inc. and Vice-Chairman of Yorkton Securities Inc. Mr. Peck has a broad business background that includes billions of dollars of financings in public and private markets, mergers and acquisitions, corporate restructurings, business valuations and financial testimony. Mr. Peck was a founder of Centenario Copper Corporation, a Chilean copper company which was acquired by Quadra Mining Ltd. in 2009. He has a BA in Economics from Princeton University and is a Chartered Business Valuator (CBV)

On February 1st, Camino announced they had entered into a non-binding LOI to partner with Japan's Nittetsu Mining Co. As Camino's Twitter account shows, Nittetsu is currently on the ground at Los Chapitos in Peru performing their DD. Should they enter into a binding agreement by the deadline at the end of April, this could be a significant catalyst.

Vancouver, February 1, 2023 – Camino Corp. (TSXV: COR) (OTC: CAMZF) (WKN: A116E1) (“Camino” or the “Company”) is pleased to announce that on January 31, 2023, it has entered into a non-binding Letter of Intent to partner with Nittetsu Mining Co., Ltd. (“Nittetsu”) at its Los Chapitos copper exploration project (“Los Chapitos” or the “Project”) in Peru. Nittetsu operates the Atacama Kozan copper mine located in northern Chile that was developed from an Iron Oxide Copper Gold (“IOCG”) deposit style similar to Camino’s Los Chapitos Copper Project. Nittetsu can earn a 35% interest in the Project by making payments and expenditures totalling CAD $10,100,000 over three years. Proceeds will be applied towards exploration, infill drilling, and metallurgical and engineering studies. Camino will remain the operator of the Project.

“Nittetsu is the operator of the Atacama Kozan mine located in the prolific Iron Oxide Copper Gold belt in Chile, next to one of the world’s largest IOCG copper mines, Candelaria,” said Jay Chmelauskas, CEO of Camino. “Our Japanese partners have extensive mining and geological exploration expertise in a renowned IOCG belt to bring to our southern Peru location. There has been growing interest in southern Peru as an under-explored IOCG mining district and Nittetsu has recognized our Los Chapitos Project as one of the most advanced exploration projects in this coastal cordillera region.”

Nittetsu will have exclusivity to complete due diligence and enter into a Definitive Agreement by the end of April 2023. Unless mutually extended, the Letter of Intent will terminate at the end of April 2023.

Here's a link to a Twitter spaces conversation with CEO Technician, in the last 10-15 minutes I cover my thesis on Camino.

As always, I am happy to answer any questions that I can. Please DYODD and strongly consider the high risk nature of this investment. I'm certainly hoping for the hero, but I know very well how easily that zero could appear. Personally, this is one where I'm willing to risk it for the biscuit...

X (formerly Twitter)

CEO Technician (@CEOTechnician) on X

Recording of Twitter Space with @jenstilmanydots https://t.co/CyUvorkM5P #commodities #gold #lithium #metals #mining $COR.V $PMET.V

Already have an account?