Trending Assets

Top investors this month

Trending Assets

Top investors this month

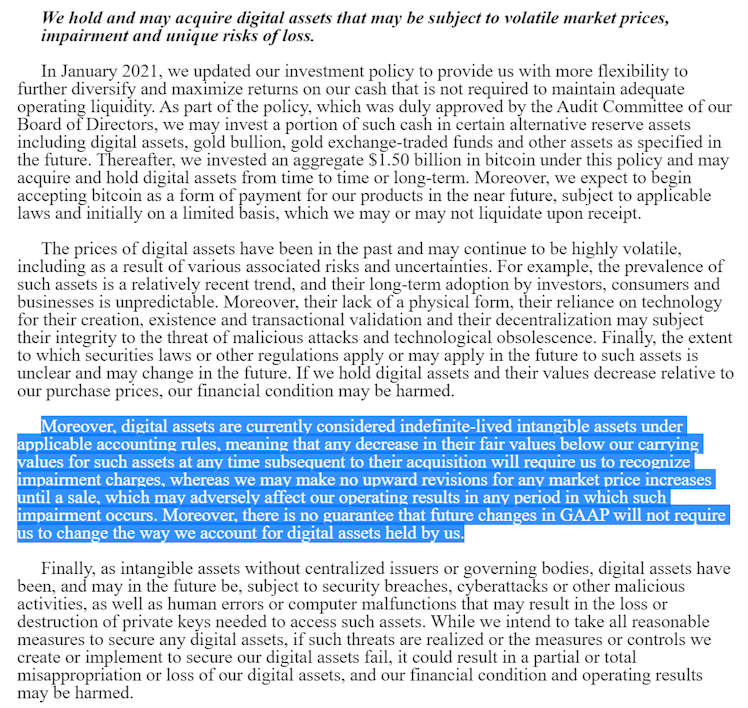

A friend pointed out to me Tesla's "Risks" section now that they have announced their purchase of bitcoin. Posting this as an informational on bitcoin as treated in corporate accounting or to start a discussion.

This is my understanding, welcome corrections and other thoughts.

- If the value of Bitcoin held falls below the purchase value then Tesla has to recognize an impairment expense which will reduce Net Income on the Income Statement.

- Impairment expenses are generally not tax deductible without a taxable event (i.e. a sale), similar to how the unrealized gain or loss of other security investments are treated.

- This is unfavorable as impairment expenses will lower Net Income, artificially deflating TSLA earnings with no tax advantages. In the opposite scenario where BTC appreciates, financial statements are unaffected (because you do not adjust for increases in such intangible assets)

The implication I see is that Tesla multiples (e.g. P/E, P/B) will inflate if Bitcoin falls below their purchase price, as their earnings and book value will look artificially lower as they have to recognize unrealized losses in BTC. This is probably not super impactful as Tesla multiples are already sky high.

According to Amy Park, a Deloitte Audit partner previously w/ the Financial Accounting Standards Board ('FASB'), FASB met last Fall but voted unanimously not to add a project to address this standard. It is likely this will be addressed eventually but generally speaking accounting tends to be very thorough when changing standards.

Happy to be corrected if anyone has a better understanding of indefinite-lived intangible assets and Tesla's intentions or practical implications with holding BTC. I learned a lot from this Microstrategy segment on Bitcoin finance considerations: https://www.microstrategy.com/en/bitcoin/videos/bitcoin-finance-considerations

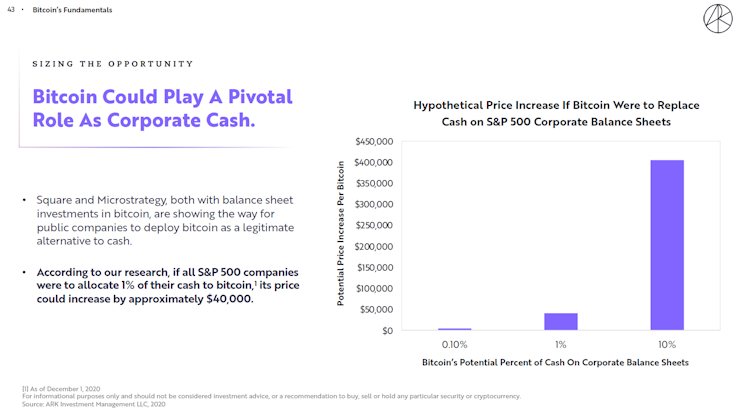

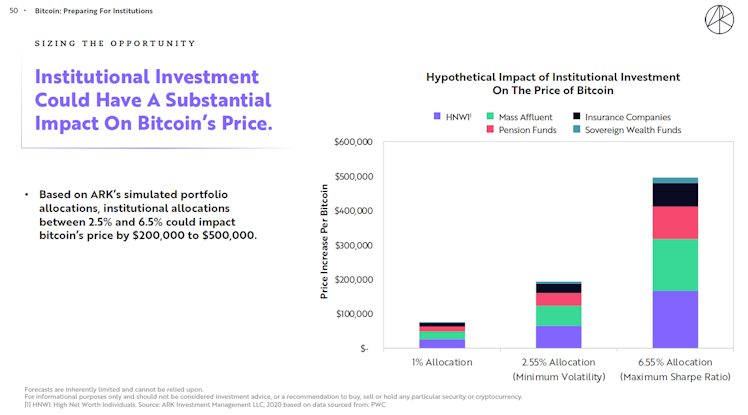

As a tangent, I'll also leave these two slides from Ark Investment Management's "Big Ideas 2021" as food for thought as to where the price of BTC might go given the announcements of more cash allocating into BTC.

edit: I don't have a crypto position but am considering adding one or re-allocating my position in gold into crypto.

MicroStrategy

Bitcoin Finance Considerations with Deloitte

An overview of key finance, accounting, tax, and audit considerations for corporations integrating Bitcoin into a treasury reserve strategy.

Already have an account?