Trending Assets

Top investors this month

Trending Assets

Top investors this month

$ABBV Earnings - Worth Buying the Dip?

I wrote about $ABBV back in July for the Buy the Dip competition. AbbVie reported their 3rd Quarter results on Friday, so I thought it would be a good time to check back in!

In earnings, I look for a few things:

- Is revenue growing?

- Are net earnings growing?

- Are results in line with what management is communicating?

Revenue Growth

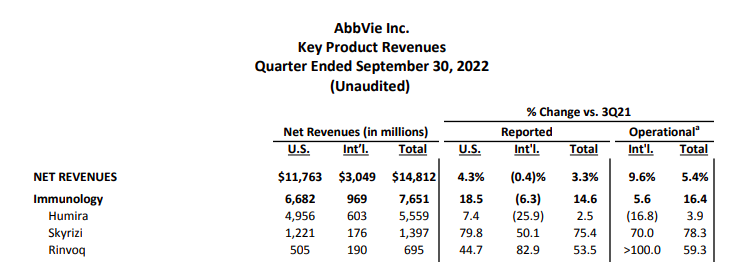

AbbVie reported an increase in revenue, both over the quarter vs 3Q21 and over the year vs 9M21. Revenues increased 3.3% QoQ and 3.9% YoY.

The majority of revenue growth is continuing to be driven by the Immunology product line with products Humira, Skyrizi and Rinvoq. More than 50% of AbbVie revenue comes from this unit, and it continues to grow at nearly a 15% clip QoQ.

Earnings Growth

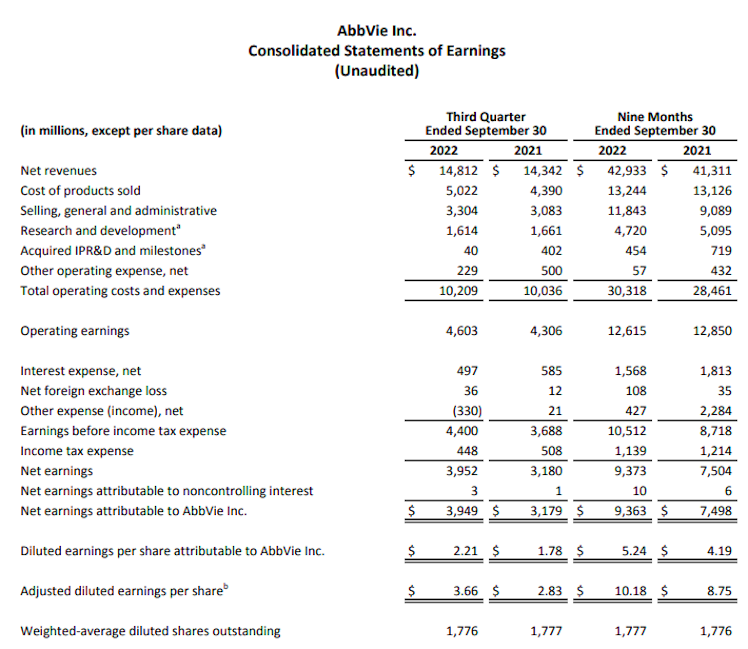

AbbVie reported an increase in earnings, both over the quarter vs 3Q21 and over the year vs 9M21. Revenues increased 24.3% QoQ and 24.8% YoY.

We reviewed above that revenues are growing, so it is also critical to see if expenses are being managed and a company is maximizing that revenue and translating it to earnings growth that can be delivered to shareholders.

A few things that stick out to me:

- Margins on revenues vs cost of items sold (66%)

- R&D spend still at ~10% of revenues which shows continued dedication to new product development

- Total Operating Expenses increased 1.7% vs the revenue growth of 3.3% from above. That is nice to see!

Management Expectations

Management confirmed and tightened its annual EPS guidance from $13.76 - $13.96 to $13.84 - $13.88. As an investor, I like to see that management is hitting, and confirming their targets.

Additionally, AbbVie announced a 5% dividend increase from $1.41 to $1.48 beginning on the pay date of February 15, 2023 (Ex-Div date of 1/13/2023).

Summary

Overall, AbbVie appears to be continuing to operate like a cash printing machine. Seeing top products continue to grow, revenue growth outpacing operational cost growth, and confirming EPS estimates are solid confirmations as an investor.

I would have liked to see a slightly larger dividend increase, but I can't complain about an increase.

What are your thoughts on $ABBV? How do other shareholders feel about these results?

Already have an account?