Trending Assets

Top investors this month

Trending Assets

Top investors this month

Buying the Dip on $ABBV

Surprise, surprise! For those of you who have been following my recent buys know that $ABBV has been at the top of my list for some time and I have been adding to it over the past few months. $ABBV is still the top holding in my Scorecard, and it will remain my Buy the Dip recommendation.

I think perspective on circle of competence is important in any stock review/analysis, so here is a brief summary on why I feel I am somewhat credible in this review:

My entire family (minus myself) is in the medical field. My wife is a nurse, my dad is a pharmacist, and my brothers/aunts/uncles/cousins are in the medical field as doctors, pharmacists, dentists, PA's and PT's. The medical field was the only industry I had exposure to growing up and conversations around the field continue as I am immersed in a circle of medical professionals. My background in chemical/biomedical engineering and manufacturing in an IP intensive industry provides me the lens to evaluate the manufacturing and technology side of the business.

With that, we are on to the pitch!

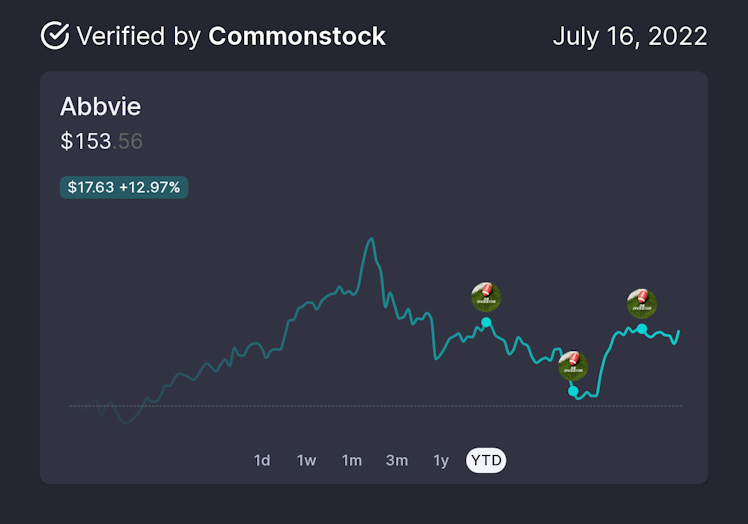

I did have to check the stock chart to make sure it is still in the "dip". $ABBV is still down around $153 per share, with a YTD high of $175.

You can read my most recent post on $ABBV here, where I talk about my process and how it is currently scoring in my Scorecard.

In this post, I want to focus on some other aspects of the business, which I believe will make it a strong holding over the next year and much longer into the future. The three things I want to focus on here are AbbVie's IP, Portfolio Diversification, FCF & Dividend that make it a strong buy.

Intellectual Property

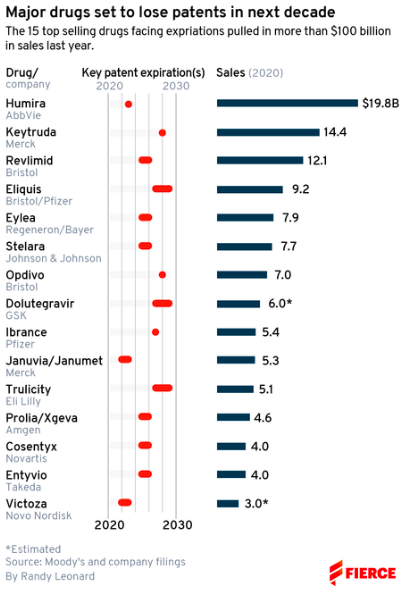

The primary benefit and moat that pharmaceutical developers and manufacturers maintain is their IP (Intellectual Property). Protecting their IP through patents ensures full control of their technology and prevents replication by competitors. AbbVie currently holds the patent for the best selling drug on the market, Humira. Humira sales alone totaled over $19 billion in 2020.

Even though Humira has been a juggernaut for AbbVie, its patent expires in 2023. AbbVie has exploited some legal loopholes to add additional patent protections for their number one drug. However, some biosimilars are set to launch in 2023. There is a summary of recent action here, for more information.

From AbbVie's Q1 report, Humira sales are already declining, so the affect of patent expiration may already be priced in. In Q1, Humira accounted for $4.736B out of the company's total net revenue of $13.538B (35%). One interesting note is even though Humira sales are declining globally, US sales increased 2.2% in the quarter.

Outside of Humira, AbbVie is experiencing major growth in some of its other ulcerative colitis drugs, including revenue increases of more than 50% in both Skyrizi and Rinvoq.

Finally, AbbVie's R&D spend in Q1 was 10.9% of net revenues, about $1.5B, which is proof of an eye towards the future and continued innovations.

Portfolio Diversification

There are a number of societal factors that bode well for AbbVie in the coming years. The advancement of science and medicine has allowed for the detection of numerous illnesses that have created opportunities for revolutionary treatments to be developed by AbbVie.

AbbVie is diversified across immunology, oncology, neuroscience, eye care, virology, Women's care, gastroenterology and aesthetics.

The below graphic shows AbbVie's breadth of therapeutics and global reach.

Cash Printing Machine

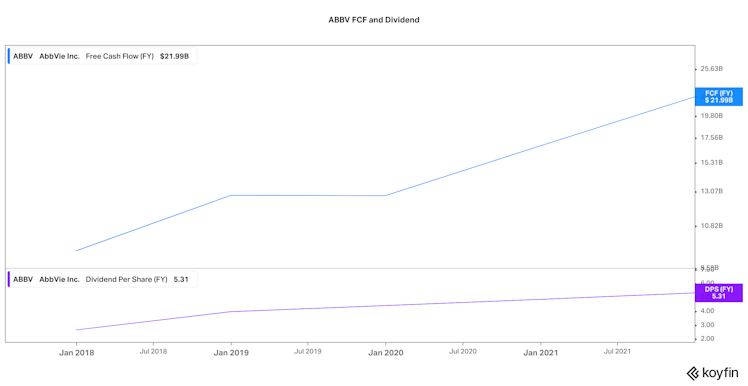

Finally, we will take a look at the immediate financial impact that AbbVie has on your portfolio. AbbVie pays a current annual dividend of $5.31 per share. That is money directly in your pocket.

You can see in the chart below, that the Free Cash Flow and Dividend Per Share have been steadily increasing over the last 5 years.

Dividend Payout to Free Cash Flow is an important metric for me, as it is an indication of how much room a company has to continue to increase its dividend. $ABBV is currently sitting at 43% dividend to FCF ratio. This means that AbbVie could effectively double their dividend and still have it covered by Free Cash Flow. I like the sound of that.

Conclusion

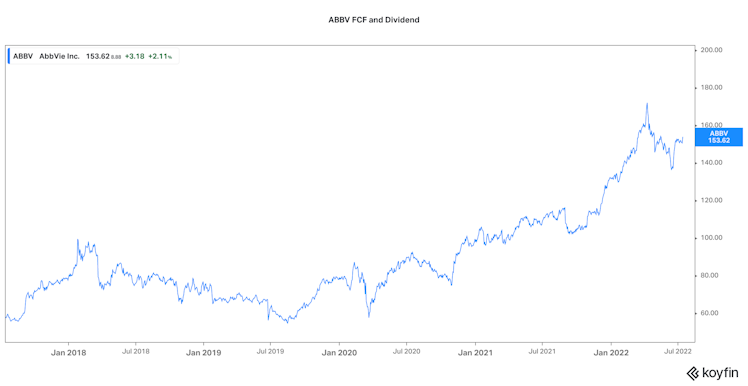

Even though AbbVie is currently in a slight dip in share price, it has nearly tripled in the last 5 years.

Obviously, I cannot predict or expect to see the continued growth, but I think AbbVie is set up to continue to steadily grow as a result of their patent runway, diversified portfolio, continued R&D, and growing revenues.

As long as AbbVie can navigate the short term headwinds of the Humira patent situation and continue to innovate, I think it will be a strong short and long term addition to my portfolio. I will be continuing to add to my position and intend to hold for a very, very long time.

AbbVie News Center

AbbVie News Center - News

Already have an account?